for_forexit

@t_for_forexit

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

for_forexit

بیت کوین در آستانه سقوط؟ تحلیل شکسته شدن مثلث و اهداف قیمتی جدید!

As seen in the chart, the price broke the symmetrical triangle structure. 97000 tp1 93500 tp2. The daily orderblock channel was pushed too much, we could not see a clear attitude, it seems that some more upward selling pressure will continue in the short term.

for_forexit

روزهای سرنوشتساز طلا: آیا ریزش ادامه دارد؟

There is a risk of continuing technical declines in the precious metal. If the first stop is closed below the 3900 (fib 38.2) level from the daily, things may get complicated. I think it is too early to look for a return. Unless there is a close above 4060, painful days may be waiting for us on the gold side. It is better to be careful..

for_forexit

بیت کوین بالای ۱۰۶,۱۰۰ تثبیت میشود؟ تحلیل تکنیکال و اهداف صعودی پیش رو

Bitcoin If H4 closes below 106.100, stop, target 110.700. The price slowed down both at the support line and the support channel. If we take into account the positive news from the fundamental side, I am closer to the price rising. The stop is already short, I think it is worth trying for myself..

for_forexit

سقوط طلا ادامه دارد؟ آیا این بازار دیگر جایی برای نفس کشیدن ندارد؟

Hello friends ❤️ I expect the declines to continue on the gold side. The price is currently in the 5th wave and this wave may extend up to 3820 after 3895-3863. Both the positive news from the China-USA talks and Powell's hawkish statements at the meeting yesterday may have left the Gold side with nothing to hold on to. If you subscribe to the channel to instantly access the analysis videos where I comment on major products every morning, you will be able to access more products regarding analysis and you will be a driving force for me. Thank you in advance, I wish everyone a fruitful day 🙏🏼❤️

for_forexit

بیت کوین: آیا هنوز فرصت صعود تا ۱۱۹,۹۰۰ وجود دارد؟

We see an inverted head and shoulders pattern that has been broken. It ended its pull back movement in the support resistance transformation channel and created and broke a flag structure in this movement. I think the price may rise to 119.900 levels. In case of a close below 113,500, we should not insist. I wish everyone good luck.

for_forexit

طلا به منطقه بحرانی بازگشت؛ حرکت بعدی چیست؟ (حمایت 3945 یا مقاومت 1800؟)

If the price breaks the orange support line and support channel, it may start to move upwards towards the 180s, even if it receives a support reaction from the lower 3945s. Tensions on the geopolitical side show that the environment is actually ready for a new rise, but on the other hand, the inflation data coming today has created tension on #gold. Let's see what a few 4-hour candles will show us today.. #xauusd

for_forexit

آیا طلا در آستانه انفجار قیمتی است؟ (شکست مثلث و رسیدن به هدف ۴۱۶۱)

There is a squeeze on the gold side. If the triangle structure breaks up, both the triangle target and the previous resistance, 4161, can be targeted with a candle closing... If it starts to stay below 4100, you should not insist. Take ownership of risk management.

for_forexit

طلا سقوط میکند؟ آیا زمان خرید فرا رسیده یا باید منتظر کاهش بیشتر باشیم؟

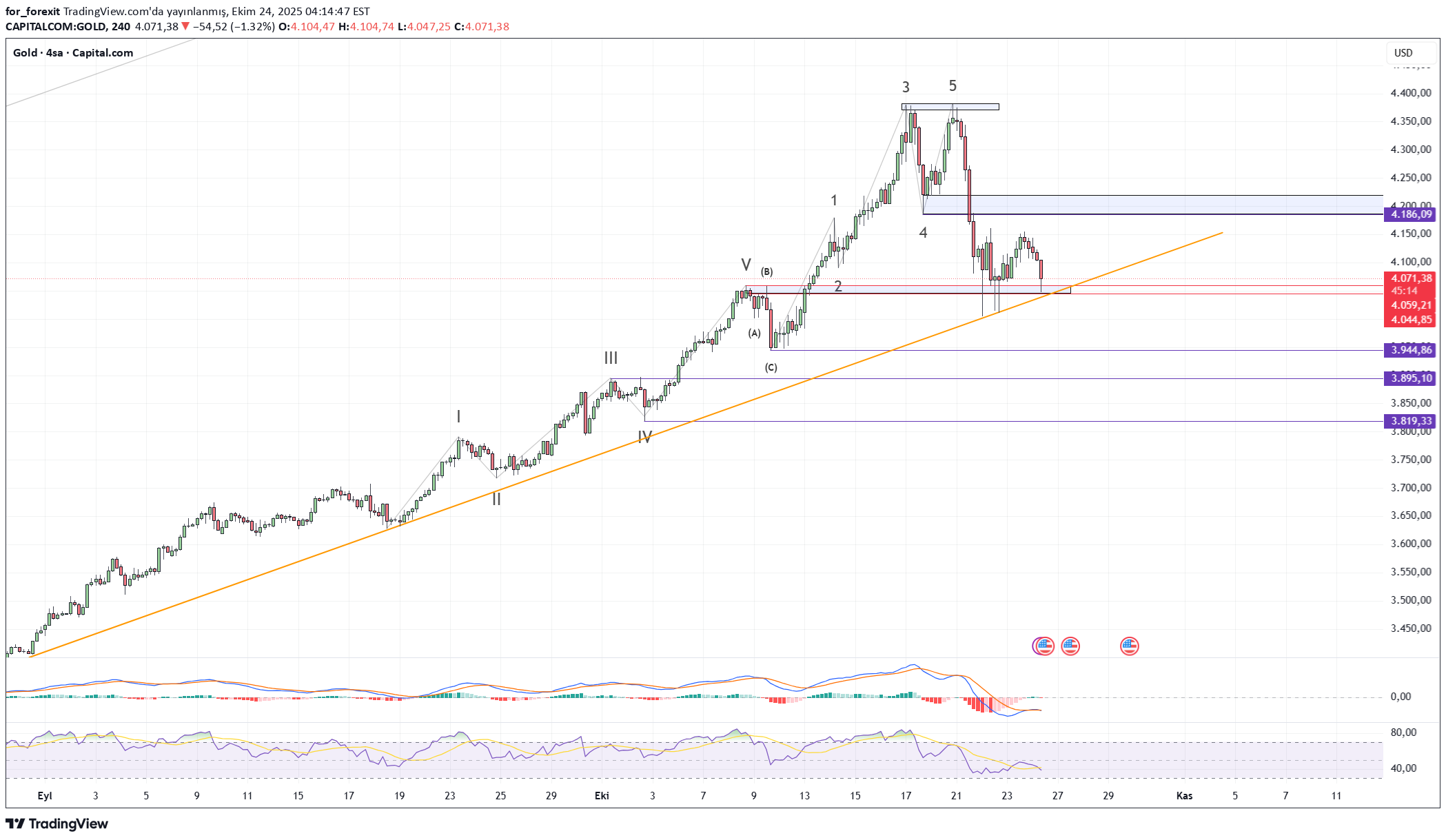

I think there is a risk of the precious metal retreating to 3945 levels if the 4059-4044 region is broken. It is better not to rush to buy. Everyone is waiting for their return, naturally, it is a separate question mark in my mind whether they will feed them so easily. If it pushes after 3945, I will start buying from 3888 regions. Take care of your risk management, the movements on the gold side are quite large. It's better to be careful. You can follow my YouTube channel from my profile and turn on notifications to see the possibilities of what may happen in the market with my 5-minute daily analysis videos that I publish every morning around 9:30. Thanks in advance for your support.

for_forexit

نقطه حیاتی طلا: آیا قیمت به 4060 سقوط میکند یا تا 4300 صعود؟

The Gold side is in a very important region. If the price breaks the current band (4186), it may fall towards 4060 if it closes an hourly candle. If there is a reaction, it may climb to 4300 levels. This is a critical area.

for_forexit

آیا موج پنجم طلا آغاز شد؟ تحلیل الیوت و اهداف قیمتی صعود

Gold (XAUUSD) is gaining momentum again after completing its 4th wave correction. The structure on the chart indicates the beginning of the 5th wave according to the classic Elliott count. Technical targets are 4.331 and 4.414 regions respectively. While momentum indicators are signaling a recovery, the RSI is still close to the neutral zone. If there is volume confirmation at these levels, it is possible that the rise will continue.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.