decklyndubs

@t_decklyndubs

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

decklyndubs

decklyndubs

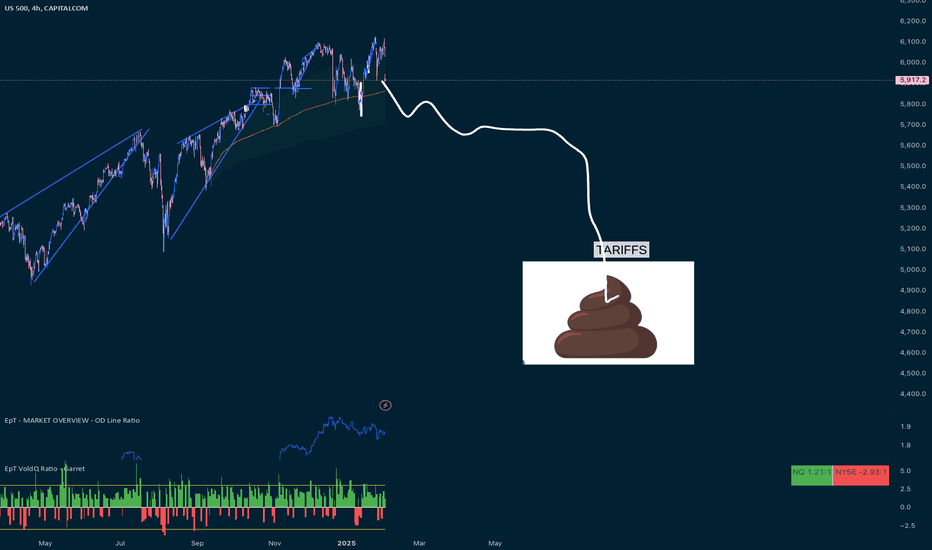

Market Mess Tariff Turd

I'm expecting the market to full-stop halt here on the tariffs and turn into a messy sludge. Dollar Up, Markets will be a mess. Good luck.

decklyndubs

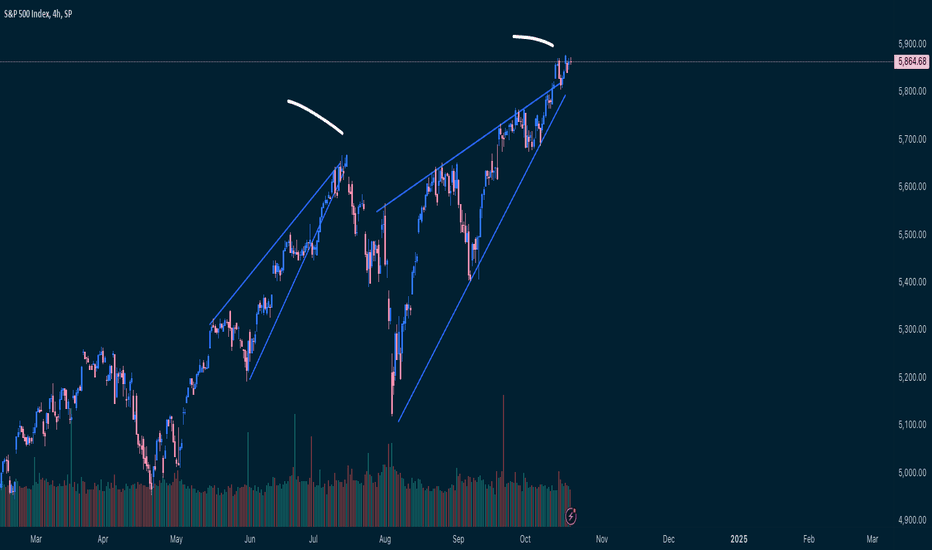

Ascending wedge, blow off into election or rise?

Similar pattern seems to play out where we wedge up, break to the upside, and then (??). Market appears to be betting on a Republican win, we're coming into clearer focus on the election date, which brings uncertainty after apparently boosting most assets. Btc, gold, and Us equities are all very correlated on the Pearson 30d correlation chart. Nobody seems to want to hold a dollar.

decklyndubs

Risk-Off Checks: BTC Down, Equity is Behind?

Based on historic cycles, I've noticed that BTC is the first to show risk off sentiment in the market. This time may be different, but next week what I'm testing for is BTC to start to retreat towards 44k to show a broader weakness in the market. 2021/2022 BTC and crypto showed the market direction _before_ equity started to retreat on the rate hike cycle, so I'm watching for BTC correlation to flip negative vs equity. When that happens, I'll start to try to hang onto shorts against equity indices, especially nasdaq. DJI is also a bit more sane, but after the tech selloff, Nasdaq has become a bit more tradable on the downturns as well.Targets for BTC are either up just under the recent high, or else I'm checking down for 44k. It's at an inflection point in the channel now. For there i'll be looking for a channel test. I wouldn't be surprised to see a 27k BTC if I'm reading things right.We'll see, I can't predict the future, but this is what I'm looking for to gauge the market's wisdom in terms of what's coming.

decklyndubs

BTC Possible Breakdown

BTC is breaking out of a symmetrical triangle, and is tested an observed fib around 60550. If it breaks down, I'm eyeing 56k. If it can find support, 66k would be my target to the upside, but only if it's able to get over ~61500. It looks bearish to me, I'm trying to find a short to hold here, I don't think that this will hold based on the recent macro prints.Comment: I have a short at 60500ish. Look okay to me. Session vwap was poked with some gap fills, the fib is holding as resistance.

decklyndubs

BTC Double Top

Lines up with my other post on DJI. Fundamentals line up with chart. Fibs happen to work as well - I don't usually use them. Economic data reversing the bullish rate cut bets. I believe this is the second peak.

decklyndubs

BTC trend break after jobs data

BTC trend break after jobs data BTC looks poised to test 66, possibly to break it and get to 68. Catalyst is the FOMC words "employment data will give us a reason to cut" then jobs data comes in weak. Rally ensues. Last night down trend was broken, I'm playing a consolidation, looking for the vwap this weekend as a swing which I'll try to scalp inside of. Invalidated under 62kish if the trend line breaks. Watch unemployment on thursday for another possible catalyst.

decklyndubs

Post halving sell the news

Crypto corporations are telling you this is a buy the news event, that's now what I'm playing. Expecting price agreement around 63800 and then a move, very probably to the downside

decklyndubs

Hidden leprechaun divergence and bigmac

Hidden leprechaun divergence and bigmac Hello retail traders! I'm sure you are checking the statistics on all of the concepts that people are presenting to you! You are surely not trading rsi divergences or macd strategies with all of your money without validating them statistically! I have a prediction for you today that the market is turning leprhechaunish. You'll notice that there is a leprechaun divergence in the relative ticklish indicator, which is based on arbitrary number of sessions based on how the original author felt at the time. We know, for sure, that we should trust that this is all sound because some guy said so 100 years ago, and people on youtube that probably don't trade real money say so. You'll also note that the bigmac no longer looks like it does in the ad so lets assume that this is an ominous signal. But no matter, it's the confluence of garbage signals that really matters, as long as you keep making money, we're all good right? And I'm sure you're making at least as much as I am trading these markets! And don't forget to like and subscribe so that at least my youtube channel ad kickbacks can fund my losses and fuel my sense of superiority. I know you already spent a thousand dollars to follow me as a trader that won't show my PnL or give read access to my broker account - I'd rather reap the money from your subscriptions than admit that I am actually not a profitable trader. I have the voice of authority, so just trust me here, and keep paying and watching. I'm a good guy - I'll say "sorry I was wrong" on youtube, but I won't change anything in my strategy because you're trading a course that I made with like 100 hours of trading experience at 22 years of age. I'm driving the ferrari that you bought me with the 5MM in subscription fees I made, while I trade a paper account live every day for you, hoping I get lucky and can post a winning video to loop in the next guy. Meanwhile it makes me so anxious, I can't have sex with my wife, and I sit in bed watching other traders so I have something to repeat that they say so that hopefully you feel like you're at least getting something. Thank god for Depends adult diapers! It's time to long Kimberly Clark, the manufacturer, as I have all of the money now but the diarrhoea will not stop!

decklyndubs

Breakout will be tested, but I suspect failure

I think btc will probably have a few periods of dramatic price action soon - big peaks up - but I suspect we will ultimately see this fail.Can see the area I'm watching as a consolidation zone. I suspect the sellers will drop off, and some rally may fire, but will fail.The chart squiggle predictions drawn show more of an average but I think you'll see at least one huge blast up, probably a few.Anything could happen, and bitcoin is an especially wild beast, so treat this as an idea only.How to trade it:I'll be looking to short peaks in this zone.I'll short each peak, take 75% profit, let the rest run.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.