cldx

@t_cldx

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

cldx

Bitcoin Long Term Halving Cycle

Bitcoin is very Bullish Long Term following all previous halving events which is coming up in March 2024. Anything can and will happen between now and then so do not take this as any type of Short Term analysis. Bitcoin could easily drop 5K between now and then. The "H" markings are the Halving events. Our present PA is copying (loosely) the same PA from the 2013-2016 time period. (Yellow Boxes). This would put price somewhere in the 45K range for the Halving event in March '24 (follow both dashed White Lines for the price target). I think we will fall short of that price because of an overall slow market and economic uncertainty and will be closer to the 40K price. If this cycle plays out like it did before we should hit a new ATH right around Dec '24 (Blue Line) following the 2024 election in Nov. (very important event). This will kick off the bullrun of 2025 and reaching the 250K range around July (Green Rectangle). This price also corresponds with the "Plan B" model which I did an analysis on in a previous chart.Key Dates:March 2024: Halving Event 40-45KNov 2024: ElectionDec 2024: New ATH at 69K (Blue Line) and beginning of the 2025 Bullrun.July-Aug 2025 (Green Box): New High at 250K, this is more than my original target of 180K which I feel is justified by the past 4 years of pent up energy. "Irrational Exuberance" could push it up into the 300K range. "Who let the dogs out".Aug-Nov 2026: Following a 12-14 month bear market will see a bottom in the 60-62K range. There will be strong support here (Red Rectangle) and will create a new trend line for the next cycle (Yellow Dashed Line). If this line changes drastically then the top solid Yellow Line will have to change accordingly to create the new channel and could become the White Solid Line which would suppress the long term price of Bitcoin greatly.Jan 2027 will mark the start of the next cycle (Heavy Red Line).July-Aug-Sept 2029: New ATH $1Million, Marked on the chart.

cldx

Bitcoin Stock-To-Flow

The Bitcoin Stock-To-Flow Indicator has come under alot of attack recently for failing to adhere to the Bitcoin price as originally forecast and has been deemed as an unreliable indicator by many critics. However, what I'm showing you here is a new way to "see" the indicator which might change how everyone views it in the future.Note how close price is at the point where the S-T-F indicator makes a 900% jump to the next level at the yellow circles. This marks an important point in the S-T-F cycle and the price is right at or even on this point when it makes this jump. The next level jump will occur around the April 1, 2024 date which puts Bitcoin at or near the 150K target range. The likelihood that bitcoin will go higher than this price before this date seems unlikely at this point.... But you never know, the upper Red band is at the 250K level and would mark an extreme top for this cycle.The Long Term target is around Feb/March 2028 (scroll chart forward) which puts the Bitcoin price in the 1.5 Million range.

cldx

Bitcoin Drawn To Scale

Happy New Year Everyone!Where we are right now in the grand picture. It's just a small hill compared to the Mt Everest that is to come.

cldx

BTC Mid-Term Price Projection

This sideways market has to break eventually. History says it will break to the upside. Right now, I'm hopeful that July will show a strong recovery and move up into the Resistance area around 45600 before falling back down to the Support level around 40200. At this point market factors could remain suppressed and continue to push BTC into another sideways trend.This analysis shows a new ATH by late October. This would be considered a Very conservative estimate and already places Bitcoin well behind schedule. If this projection fails then this means there is a total breakdown in the underlying structure of Bitcoin in relation to it's historical time frames and price projections.Basically, this becomes a do or die situation for Bitcoin. A breakdown here could result in a long term re-evaluation of Bitcoin.

cldx

cldx

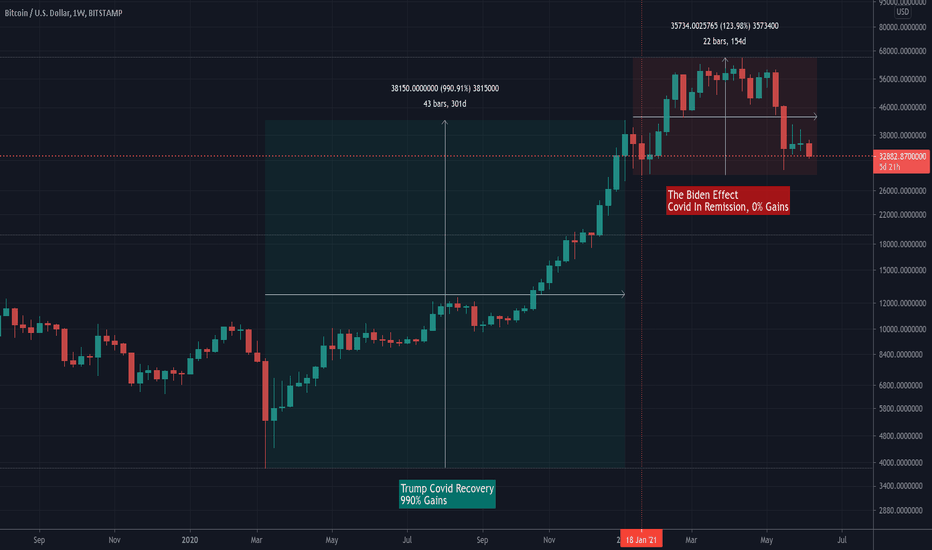

Bitcoin Mid To Long Term Price Projections

Bitcoin will top out right around December 13 at a price around $180,000. This is based on the prior 4 year cycle tops before a long Bear Market correction. (Gold vertical lines)This fits with both the top parabolic curve that is determining the top of the market and also significant trend lines (Blue lines) that are being shown based on the end of year dates.The Blue vertical lines represent an interim cycle that is very consistent throughout each 4 year cycle. In 2 cycles it marks a significant top and in another a bottom region. The cycle that Bitcoin is in right now is copying the 2012-13 cycle almost perfectly.The overall time frame seems to be very different during this cycle following the halving event. In prior cycles price began moving upward almost immediately following the halving but this time the price remained somewhat flat for several weeks before finally moving up. The only thing I can determine is that the halving event was severely altered by the Covid event and the subsequent lockdowns that followed which created rather unusual prices throughout the market.The horizontal Gold boxes are identical in length but are slowly getting more condensed with each cycle. They mark the previous cycle top and the next market cycle bottom with a percentage being shown between each of the tops and bottoms. They span beginning at the market top and terminate at the Blue interim cycle lines. One note of interest is the fact that in each case following the halving event as price moved upward marking a new ATH, price then corrected back down to touch what then becomes the 50% line inside each box. (White circles) Presently price just touched this 50% line and has now reversed direction. (Hit Play and scroll forward) The next 4 year cycle will see a market low around $40,000 and should take place right around the Blue cycle line in July/August 2023 which also coincides with the next halving event. This should result in a rather long and steady increase in price very similar to the 2016-17 cycle. So, get ready to buy Bitcoin in the Summer of '23 and it should top out in early January 2026 right around $1,000,000.I just realized you can scroll around on the chart without hitting Play.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.