bowtrix

@t_bowtrix

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

bowtrix

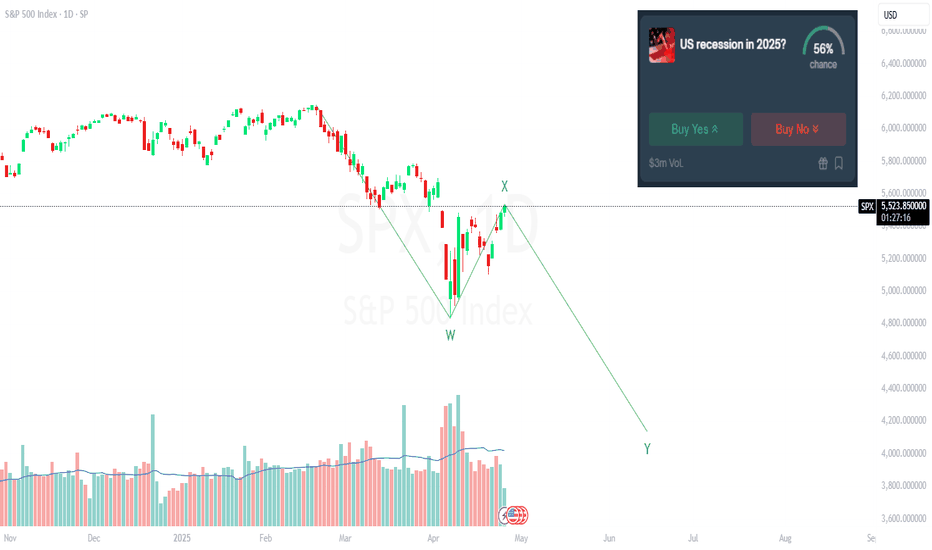

Spy puts

Hello friends. We just bought some 5/16 $550 SPY puts. It's looking like the low for this crash is not anywhere near being in. Retail is still in a buying frenzy because they expect that this will be another V shaped recovery like we're used to. Meanwhile the smart money is selling everything they have and expecting more blood. The fed hasn't come in to save this market, and they aren't going to be able to. Their hands will be tied by artifical inflation caused by tariffs and there won't be an intervention until it's already too late.

bowtrix

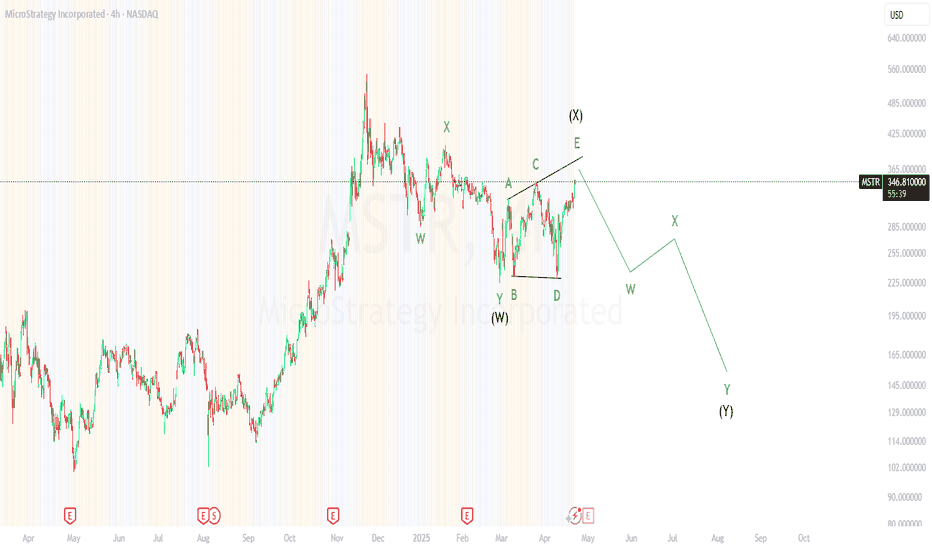

The bubble has been bursted

The wave theory looks especially clean for this stock. Clearly it had a big bubble which is now completed, and it's in a bear market correction at the moment which should lead to lower prices. I am expecting to see a crash all the way to $150 before the year is over! The funny thing is that this isn't even a cheap price either, since it would just be reflecting the NAV value. Falling in half just makes the price fair, since it's already 2x overvalued. 528 thousand bitcoins is worth only 48 billion dollars, while Microstrategy's market cap is is 93 billion dollars. Saylor is going to continue issuing stock to buy more Bitcoins, which will push the price much lower.This is a very high conviction idea. I think we will see slightly higher prices before the crash resumes, and I'm averaging into July 18th $350 strike puts for now.

bowtrix

Trump & Dump Pattern

Hello friends. $Trump is heavily manipulated by Donald Trump, like recently when he mentioned the coin and pumped it up on that. He has lots of coins that he wants to distribute. Since he controls the country and the narrative, this is very easy to do. All he needs is to find people willing to buy the coins by releasing some big news. As you can see on the chart, it currently looks like an accumulation area with a clear level of liquidity to sweep through at $12.45 before crashing. Did you notice how crypto didn't plunge along with the equity market on Friday? It was a huge break in the correlation and it shows that some serious manipulation is going on for this entire market. My expectation is that this weekend there will be some massive news such as that Trump has used the government to purchase Bitcoins or a similar headline. Onchain data shows that smart money has been accumulating millions of dollars worth of Trump here over the past 2 days and the price is already starting to rise from the lows. They definitely know something. Think about the timing of a final exit pump across the board for cryptos right into this plunge on equities. It makes perfect sense to sweep liquidity at $95,000 in that market as well and give everyone one last chance to sell their coins before Bitcoin plunges to $50,000.

bowtrix

Gold is reaching the bubble's picotop

The gold market has been really crazy. Do you know that currently, gold is worth an equal amount to the entire M2 money supply of US dollars? When adjusted for CPI, its considered by some measures to be more expensive than any other time in history. Google search trends worldwide for the term "Buy gold" are now at record levels. Everyone is buying gold because they think that tariffs, inflation, war, and a potential recession are good for it. They are all completely wrong. Every time the stock market has crashed, gold crashed too, although sometimes like this time it lags behind slightly. The trading strategy now is to wait for a sharp drop and short heavily with puts when the momentum is staring to turn on the bears favor. I think a final liquidity sweep is still likely in this distribution here before a very serious multi-decade correction gets going fully.

bowtrix

bowtrix

Liberation day

April 2nd, referred to as "Liberation Day" by President Trump, is the day he plans to announce new tariffs on imports from various countries, aiming to reduce reliance on foreign goods. The specific details of these tariffs are still unclear, but they are expected to impact a wide range of products. Gold has been on a face-ripping vertical rally up into this news on expectations that this will be big news, but it's pre-announced which means it's a clear sell the news event. I am going to buy 0DTE puts on gold at the market open on April 2nd and sell them before the close.

bowtrix

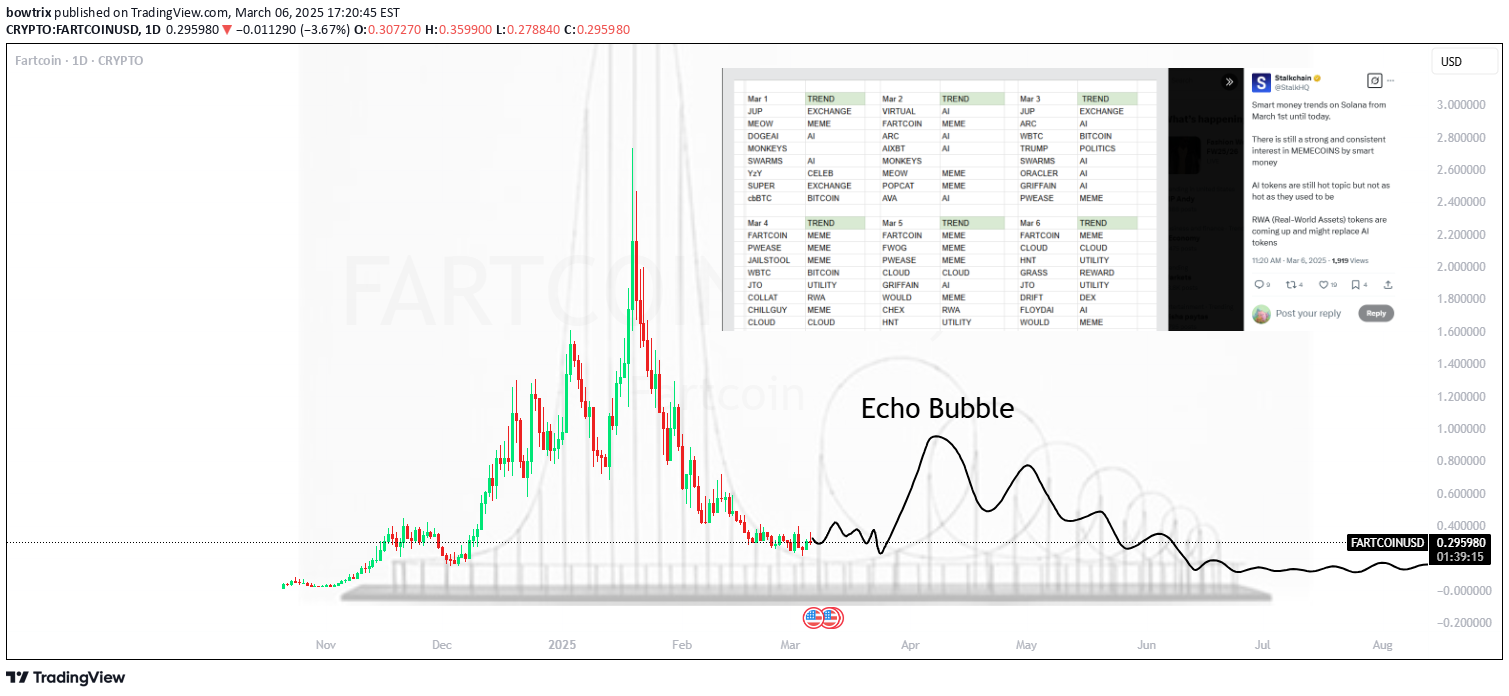

Echo bubble for Fartcoin

Hello friends. I think that following a breakout from this accumulation area, Fartcoin will soon have an echo bubble that may go as high as $1.00 or even a little higher before the excitement starts to fizzle out again and prices begin falling. There are several things making me interested in this idea. 1) Smart money accumulation According to Stalkchain, large and profitable traders have been buying recently and expecting the price to rise. Profitable traders are usually right so that is good news. x.com/StalkHQ/status/1897423425309663594 2) High volume and high mindshare The coin regularly turns over it's entire market cap in volume, and has maintained the largest mindshare out of all the AI crypto coins which is favorable for long term growth and means that the attention of traders has not disappeared from this coin like it has for many others. This coin has been mentioned by a lot of famous people, which means it will continue to take up space in the minds of retail traders who will happily start buying if they see that the price is going up.

bowtrix

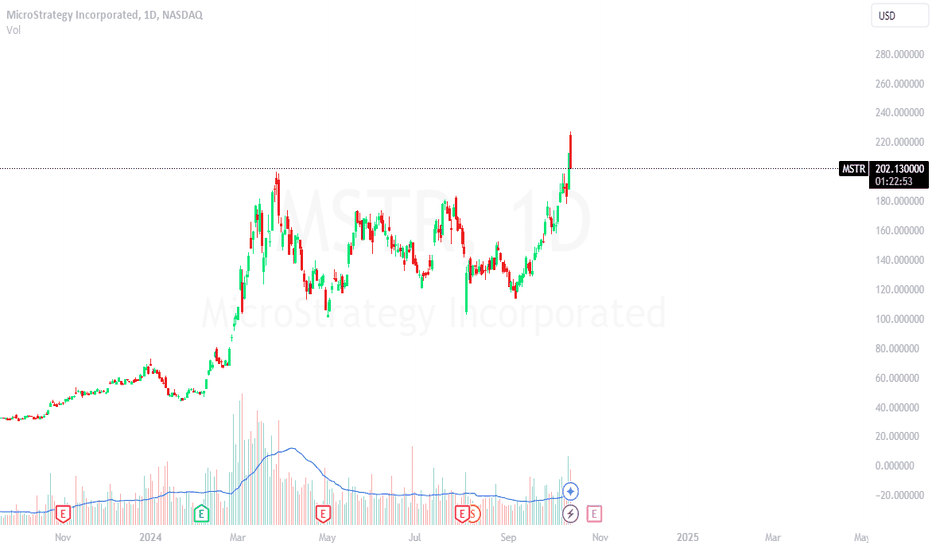

Microstrategy is absurdly overvalued

Hello friends. Microstrategy is presenting us with an amazing shorting opportunity. The stock acts as a sort of closed-ended Bitcoin ETF, and it is now trading at about 250% above its NAV. To reach it's correct price, MSTR needs to fall down by over 70% to around $50. This will occur through further share dilution as the ATM is utilized to issue shares and purchase Bitcoins, as well as through retail traders slowly realizing that they are holding something dramatically overvalued and panic selling. Microstrategy has already increased it's share count by 20% so far this year to purchase more Bitcoins and take advantage of it's overvaluation. Now that it is even more overvalued, the dilution will accelerate and trigger a huge wave of panic for the retail traders.

bowtrix

Retire on shorting Bitcoin

Hello friends. Shorting Bitcoin should yield enough profit to retire if we can get in at the 40k level. This is one of the best trades you will see in the coming years, so the size should not be small!Polymarket quotes the odds that specifically a BlackRock ETF is created this year at around 50%. I think the odds are closer to 80% for *any* Bitcoin spot ETF to be approved this year (counting Greyscale GBTC). And if that happened it would still pump the market quite a bit. When the ETF is announced, Bitcoin will be very likely to pump. We want to get massively short into that movement. That is the peak.We haven't had the ETF announcement quite yet, but I think that this is the time to get short right now. If we do see it, we could go even higher, but if there is even a perceived rejection, which is still on the cards, the red candle will be like -25% in a minute so it's worth being short.

bowtrix

Very hard to pick a side on Bitcoin now. Patience is key.

Hello friends. Right now it's tremendously difficult for me to pick a side on Bitcoin. I have arguments for being bullish, and I have arguments for being bearish. Both of these arguments are quite compelling. Bullish arguments: We have not yet seen the kind of peak euphoria that we might expect from an echo bubble. Nowhere did sentiment overflow with excessive positivity. We have been in a consolidation-looking phase for the past 200 days. If we were going to form an impulse down, shouldn't it have happened by now? It would make sense for the price to be trending down very rapidly in that kind of situation. Instead, it's dead flat, suggesting that we aren't inside of a bearish impulse. TOTAL (Total Crypto Marketcap) has quite a different-looking structure compared to Bitcoin which has risen a lot more this year. I would say TOTAL looks a lot more bullish and primed to give another wave upwards, and in such a case it's hard to argue that Bitcoin would itself be falling during that move. Bearish arguments: Global liquidity is rapidly falling, and Bitcoin is very likely to follow it on the way down. Related, the stock market is effed and is set to collapse. It's quite rare for the stock market to crash and not take Bitcoin along with it. Even though we didn't reach peak euphoria, that is somewhat expected -- this isn't a true bull market, it's just an echo bubble. You can only force so much euphoria into a beaten-down, depressed market. It was never going to feel anything like the sentiment did when Bitcoin was topping at 69k. Most people in crypto are down a lot on their 'investments' even with the recent price gains in 2023, so they can't get all that excited about this just yet. If you look at BLX, everyone is still long-term bullish AF on Bitcoin. So one way or another, the sentiment seems locked perpetually on max bullish for many traders in this crypto market. I can't reconcile these arguments into a strong view one way or the other. I would say that I am SLIGHTLY more bullish than bearish on crypto, but I emphasize slightly. I don't have a real opinion here, and I want to avoid trading anything crypto-related until the market shows me a real opportunity. If the bear case is correct and crypto starts to collapse, we will see signs of that happening, but we likely won't have any good entry points and it may be too late to actually take the trade as I don't usually like chasing trends. Ideally, this will not happen, as I might not make any money from this outcome. I won't lose any either though, so it would be more neutral than anything. If the bull case is correct and crypto rallies hard, this is what will really present a golden opportunity for me. I will get to short Bitcoin from potentially as high as $40,000, which is incredible. With a setup like that, I would feel confident enough in the trade to take a 6 figure position. I would likely execute the trade itself by buying puts on something crypto-related, like Microstrategy, Coinbase, or some bitcoin miners. If price rises like this, it eliminates a lot of my bullish arguments, while keeping the bearish arguments on the table. It also takes away the bullish count. I don't see Bitcoin breaking or even coming close to 69k ever again as even a possibility worth considering, so the risk is extremely low when shorting Bitcoin at around the 40k level, and the reward is extremely high considering I have a long-term target of around 8k for Bitcoin. For my strategy, being patient and waiting for a great opportunity is what makes the most money. That is how I got long on Greyscale Bitcoin Trust back when it was 8 bucks a pop last year and had 16 bucks of NAV (50% discounted)! So, we can all wait and hope the bulls are "right" and that Bitcoin rallies. Because that's the best way to take their money, and win big!Another argument favoring the bulls is that we likely want to see a Bitcoin ETF approval before things peak out. If we see approval, it's definitly the signal to short TF out of Bitcoin following that pump.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.