bip_14

@t_bip_14

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

BTC Outlook Updated

UPDATED IDEA; Here we go. The Fed has cut for another 25 bps and Powell has given us a not so great outlook into interest rates for the next two years, forecasting only another two cuts of 50 bps total, expecting us to be near 3.1% in 2028. As fellow BTC Traders that is something we don't like to hear. We want 50 bps in ONE, but it makes sense considering Powell wants to keep aiming for 2% Inflation while also supporting the labor market. Anyways folks, while this isn't ideal we can expect the Fed to be turned upside down once Powell isn't chair anymore and Trump sweeps through there. Besides interest rates in the US, we are at an interesting point in time as we have the Russell hit a new ATH, which indicates Risk-On, while we have the BoJ Meeting next week with them most likely hiking rates. I'd be careful in the current macro regime as you have one side of the market scream AI Bubble, Yen Carry Unwind while the others are continuing to push for new upside as interest rates drop and DXY will start cooling. For BTC this means uncertainty and mixed signals. We want and need a market that's risk-on, but a lack or even the pulling of liquidity through the yen carry unwind would sweep us off our feet. In terms of Liquidity the Fed has also announced their $40B. T-Bill purchase program. For BTC where we are headed to is all I can say, everyone and their grandma are screaming for higher prices right now. I could imagine this being the bottom, but if we do lose $76k I see us back in the range of $63k very quick.

GOOGL Outlook

Quick expectations for GOOGL Buying around $276.43 - $296.62, area will most likely hold, if we even get to see it again in the near future. If we come back to $237.01 - $253.84 liquidate all you got and get GOOGL, if the macro economics permit it and we don't break down because of rate hikes or other stuff. Watch for that Santa Rally. Enjoy.

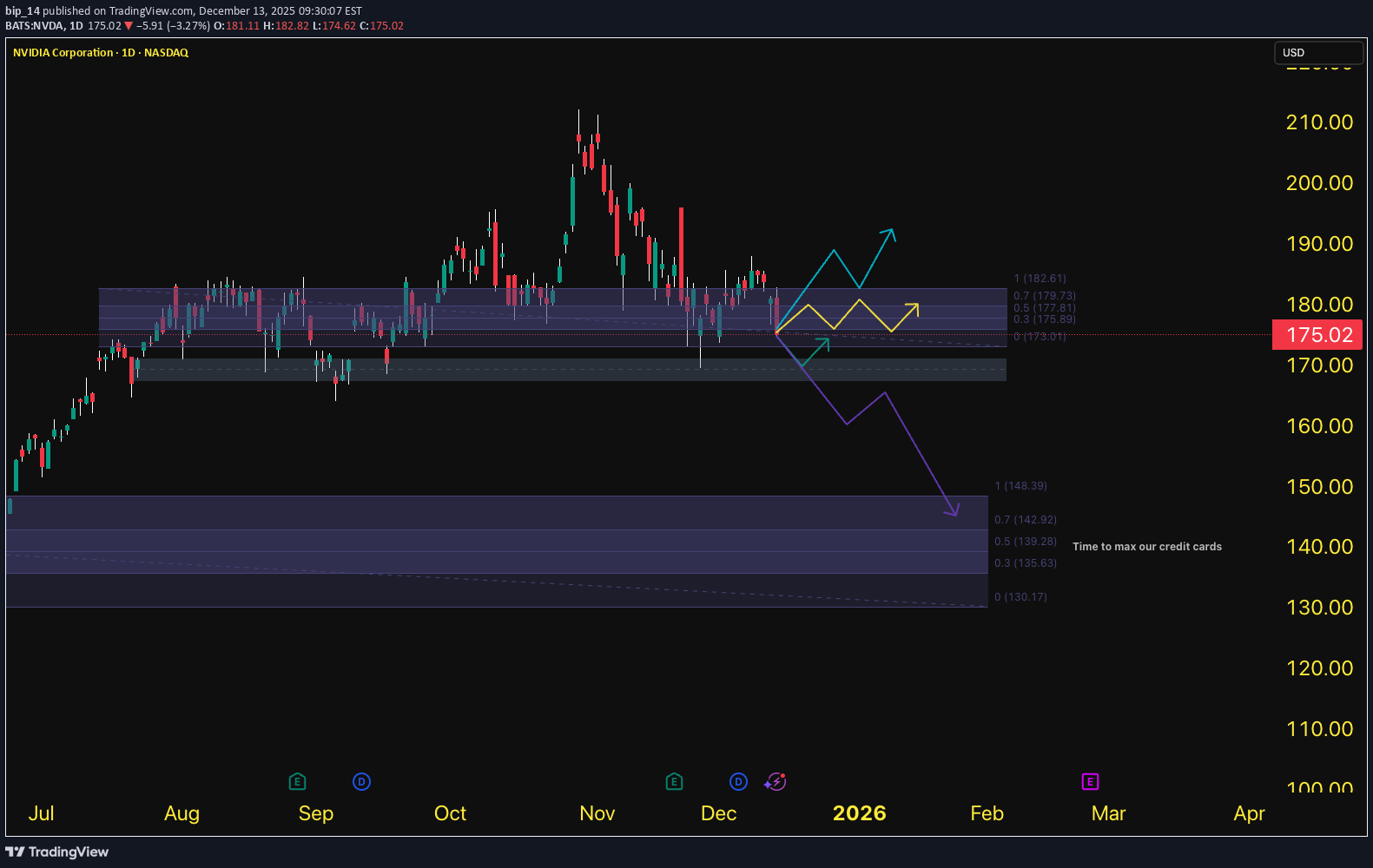

NVDA Outlook

Not going in-depth on any macros here. For that you can check my BTC Outlook. For NVDA my expectation is to play the range for now (yellow line). Looking for entries around $173.01, back to 50% of the range, vwap, etc. If we do break down our last hope is the grey-ish box below to bring us back up. As to why these levels are important or how I get them I don't wanna go into detail here. If the grey box does not hold we'll see $130.17 - $148.39 again. If that happens, I will personally, load up heavy as that's insane discount. Bubble or not, this thing wont pop for another good while. If we manage to break above $182.61 and see acceptance, we can expect another test of the ATH, unless any unforeseen economic events happen. Pay yourself along the way my friends. As always, just my two cents.

BTC Outlook

Here we go. Yesterday the Fed has cut for another 25 bps and Powell has given us a not so great outlook into interest rates for the next two years, forecasting only another two cuts of 50 bps total, expecting us to be near 3.1% in 2028. As fellow BTC Traders that is something we don't like to hear. We want 50 bps in ONE, but it makes sense considering Powell wants to keep aiming for 2% Inflation while also supporting the labor market. Anyways folks, while this isn't ideal we can expect the Fed to be turned upside down once Powell isn't chair anymore and Trump sweeps through there. Besides interest rates in the US, we are at an interesting point in time as we have the Russell hit a new ATH, which indicates Risk-On, while we have the BoJ Meeting next week with them most likely hiking rates. I'd be careful in the current macro regime as you have one side of the market scream AI Bubble, Yen Carry Unwind while the others are continuing to push for new upside as interest rates drop and DXY will start cooling. For BTC this means uncertainty and mixed signals. We want and need a market that's risk-on, but a lack or even the pulling of liquidity through the yen carry unwind would sweep us off our feet. In terms of Liquidity the Fed has also announced their $40B. T-Bill purchase program. For BTC where we are headed to is all I can say, everyone and their grandma are screaming for higher prices right now. I could imagine this being the bottom, but if we do lose $76k I see us back in the range of $63k very quick.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.