averkie_skila

@t_averkie_skila

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

averkie_skila

Cross.

Wow. Ichimoku shows us a classic "bad cross" from the Kijun and Tenkan lines. With a high degree of probability, the asset is awaiting a strong correction.

averkie_skila

Dangerous signs at the end of the year.

Gold is overbought, judging by the temperature gauge at an ultra-high level above 98%. For the third month, the Whalemap indicator has been showing significant activity by whales in terms of sales and short positions. Are you confident that 2026 will be a good year for gold? I'm not.

averkie_skila

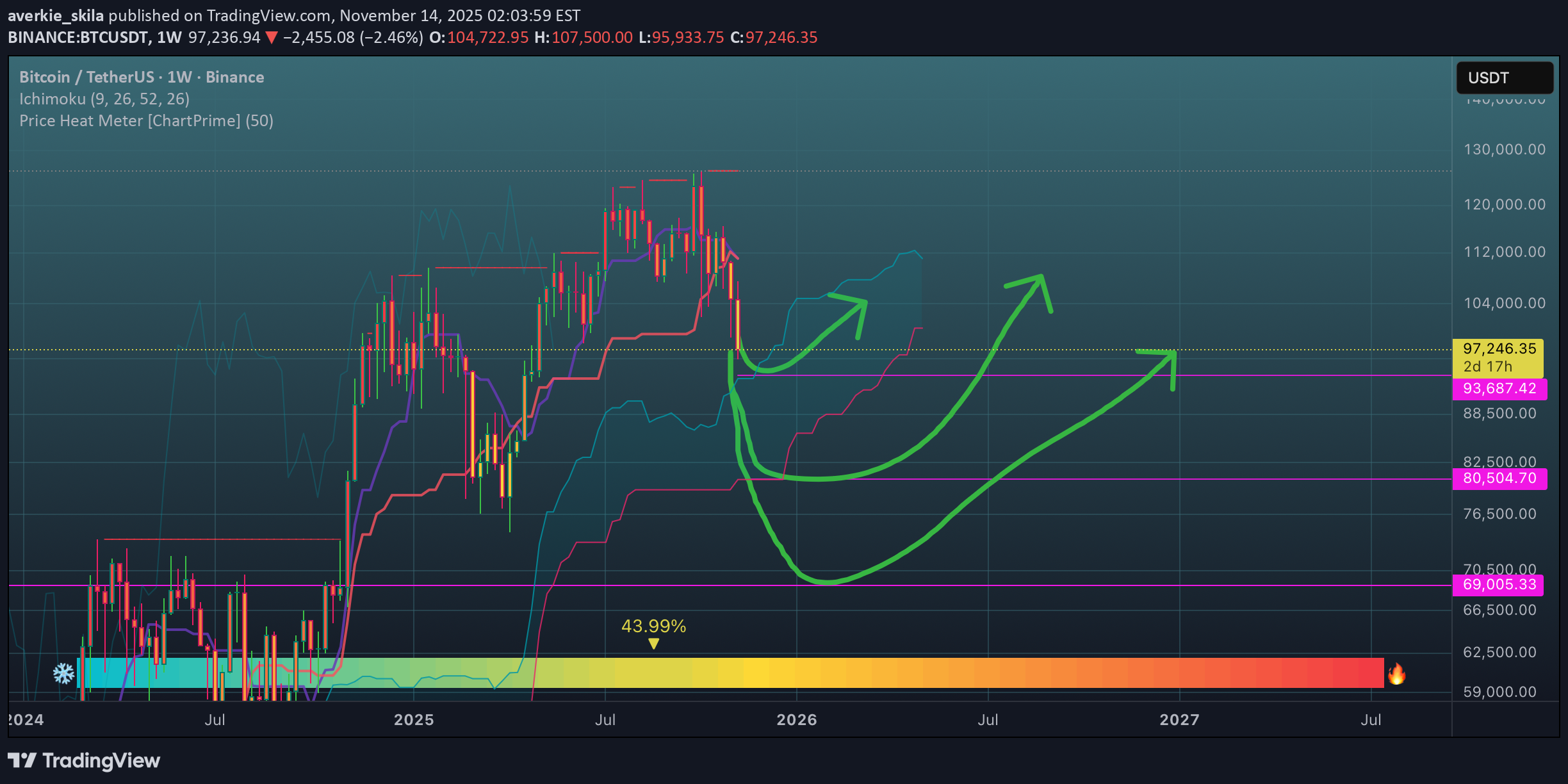

سه سناریوی بازگشت قیمت با ابرهای ایچیموکو: نقاط حمایتی حیاتی!

So, here are three rebound scenarios on the 1-week chart. 1. A favorable rebound from the cloud angle. This often occurs when an uptrend continues. The price tests the cloud angle (Senkou Span A), finds support there, and begins to rise either the following week or in 2-3 weeks. 2. Structure protection. As long as prices are above the cloud and even within the cloud itself, the structure is not completely broken. We have seen rebounds from the lower border of the cloud (Senkou Span B) more than once in this market, which is technically possible as long as the Kijun and Tenkan lines have not crossed this very border. If this border is touched, the price should rebound immediately if it is still an uptrend. 3. Breakout. All I can say here is that there is a 99% chance that it will be stopped at the historical ceiling of 69,000, and further information will be needed.

averkie_skila

نیاز فوری به ریکاوری: آیا اصلاح بزرگ در راه است؟

Damn, the picture looks like a carbon copy TSLA. There may be a few more sideways candles, but the overall picture points to a correction.

averkie_skila

آیا موتور تسلا قلب دارد؟ دکتر با استتوسکوپ چه کشف کرد؟

You know what that is, right? Not every divergence works out. But with larger time frames, the chances are higher.

averkie_skila

اوج گیری فیبوناچی: قیمت تا کجا بالا میرود و اصلاح کی آغاز میشود؟

If so, then this thing won't stop until it reaches the purple level. That's where the correction could really begin. I'm not ready to say when yet, because the angle of attack could be either gradual or exponential, depending on the economy and the political situation.

averkie_skila

Familiar antics.

Very similar to many others, a bullish flag, preparing to break through the price ceiling. Let's see what awaits us in uncharted territory.

averkie_skila

Positive attitude

The listing formed a ceiling level of 7 cents, and it is clear that the bullish flag we are currently seeing and the RSI rebound are designed to break through this ceiling. Beyond that lies uncharted territory.

averkie_skila

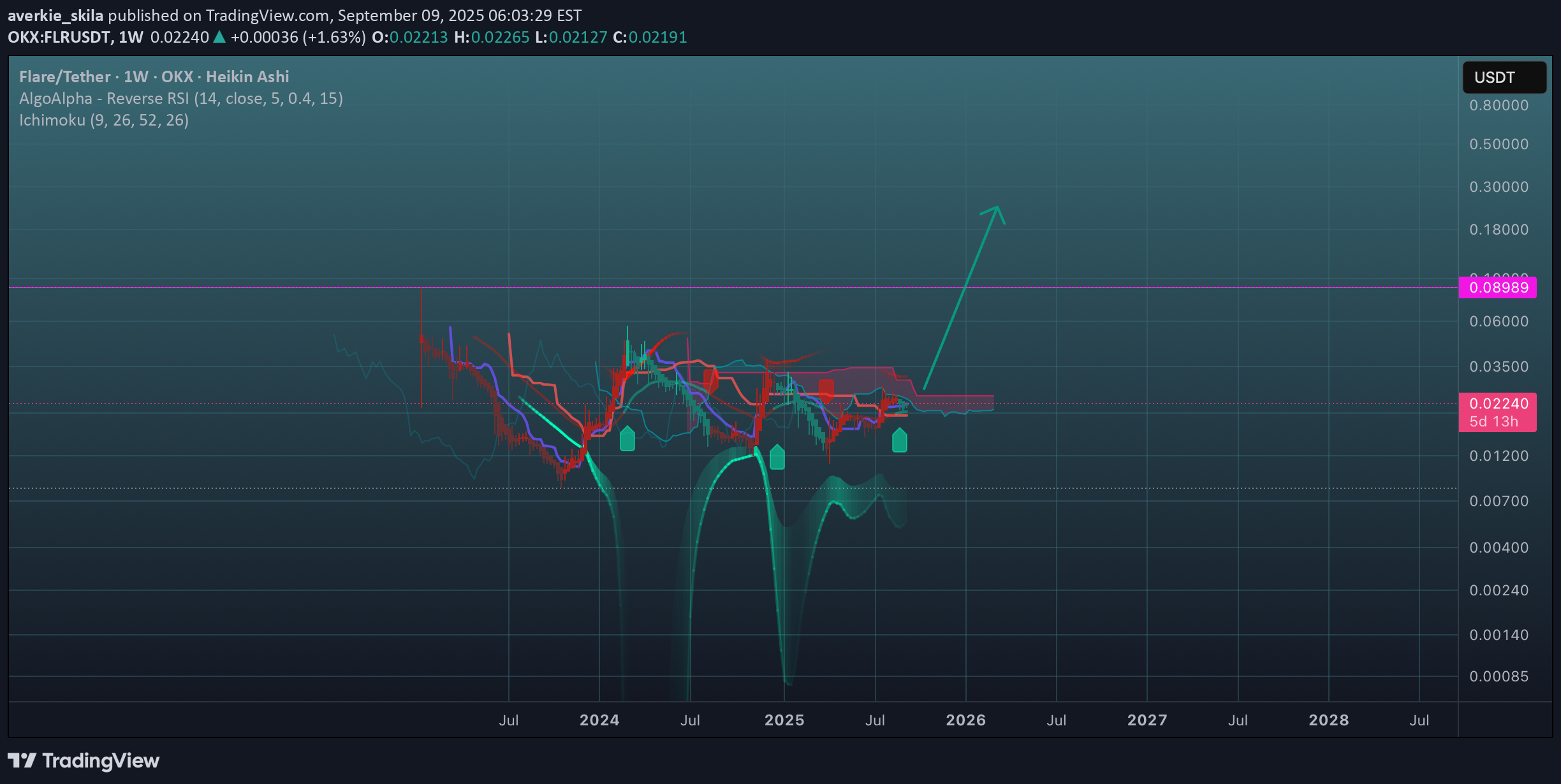

Puzzle pieces form part of a recognizable picture.

As with any other coin from the OTHERS list, I will repeat myself (especially for beginners). Altcoins do not have their own monetary destiny. They are under enormous pressure from Bitcoin and its dominance, Ethereum and its dominance, Tether and its dominance, DXY, SPX, and gold. So many heavyweights are piling into such a small and fragile market. But when a number of conditions come together, anything is possible. FLR looks like it could break through its listing ceiling, and beyond that, it's impossible to say how high it could jump because there is no history above 9 cents. I will continue to watch and hold. The structure looks good.

averkie_skila

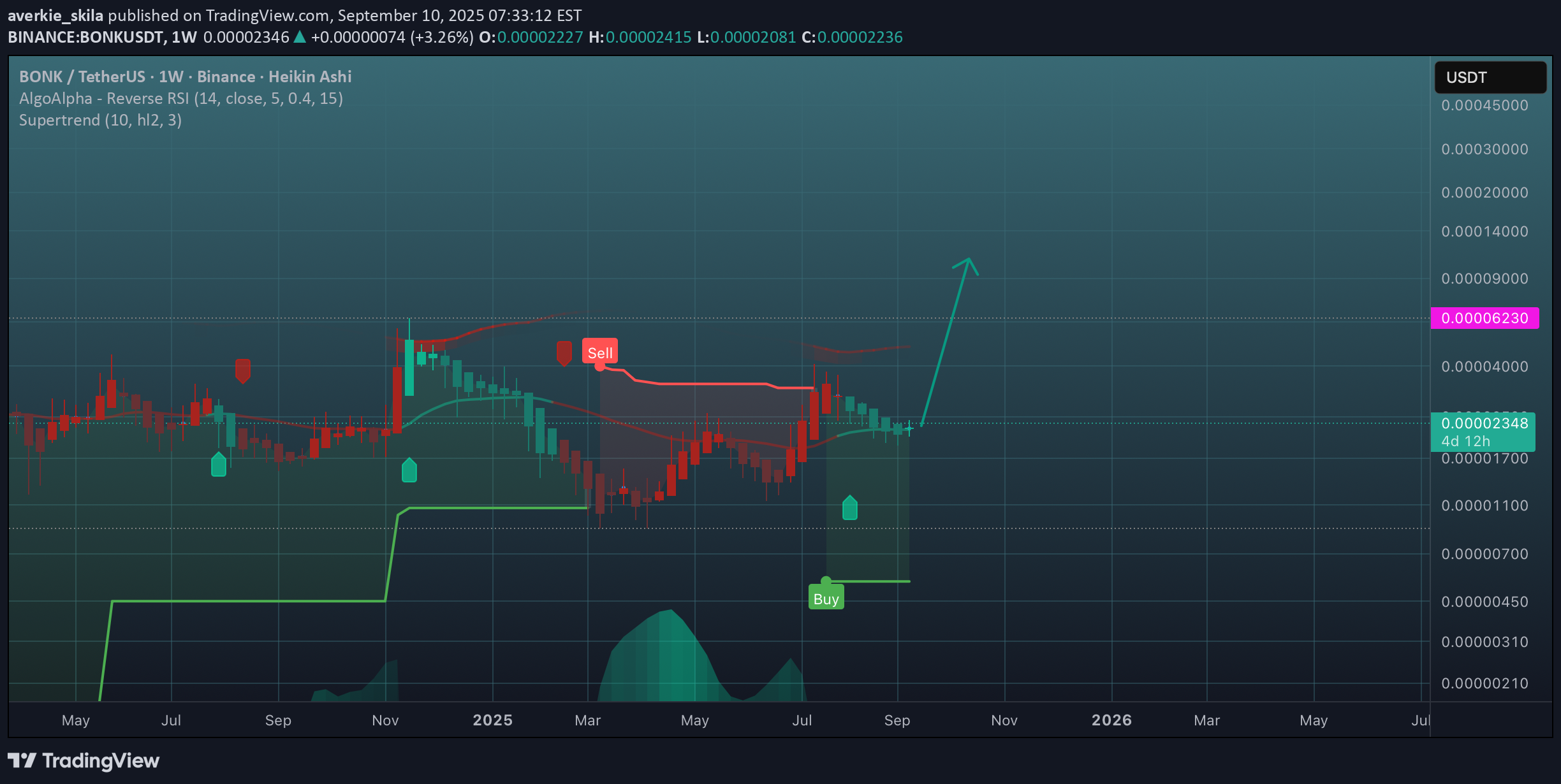

Just a couple of lines.

Depending on what waves of liquidity will be pumped from bitcoin to slagcoins, many things are possible. Faster? Lower price. Slower? More accumulation, stronger level protection. LaRSI may be preparing to storm the 20 line on the weekly chart. Positive. You may agree or disagree, at your discretion.Just don't react to the dates. I just used the tool to show top point of the channel.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.