asilturk

@t_asilturk

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

asilturk

LRC Pozitif Ayrisabilir

Loopring (LRC) is one of the most established and technically advanced Layer-2 scaling solutions on the Ethereum blockchain. Its main goal is to speed up decentralized exchanges (DEX) and reduce transaction costs (gas fees) to almost zero. As of now, its price is 0.057 cents, it has 1.37 billion shares in circulation, the volume is over 20 million dollars, the formation DUK needs to be worked on, we can partially say that the recovery and correction has been completed in technical terms, serial movements above 2% may occur in the platform concentration value.

asilturk

CTK Kisada Sert Yukselisler Gelebilir

We can say that the general outlook for CTK is positive on a weekly basis. We see that for CTK, which is relatively less affected by the movements from the BTC downward channel band, there is an increase in momentum and movements towards the RSI buying zones, and the increases occur gradually in the weekly period. I wish you lots of accidents.

asilturk

OM Diriliyor Olabilir

OM (MANTRA) Coin combines traditional finance and decentralized finance, $RWAs It is a critical part of the MANTRA ecosystem, which aims to prioritize $ tokenization and support it with a strong governance model. Currently, the price is 0.078 cents and the volume is over $65M. It cannot be said that it is very healthy from a technical point of view, but money inflows and volumetric increases will bring new price targets. We can say that these are good levels for the medium and long term. I remember it was hacked in February 2025 and it crashed at 19 dollars and is traded below 1 cent. We can say that there is a good transaction volume for coins in such a price range. I wish you good luck.

asilturk

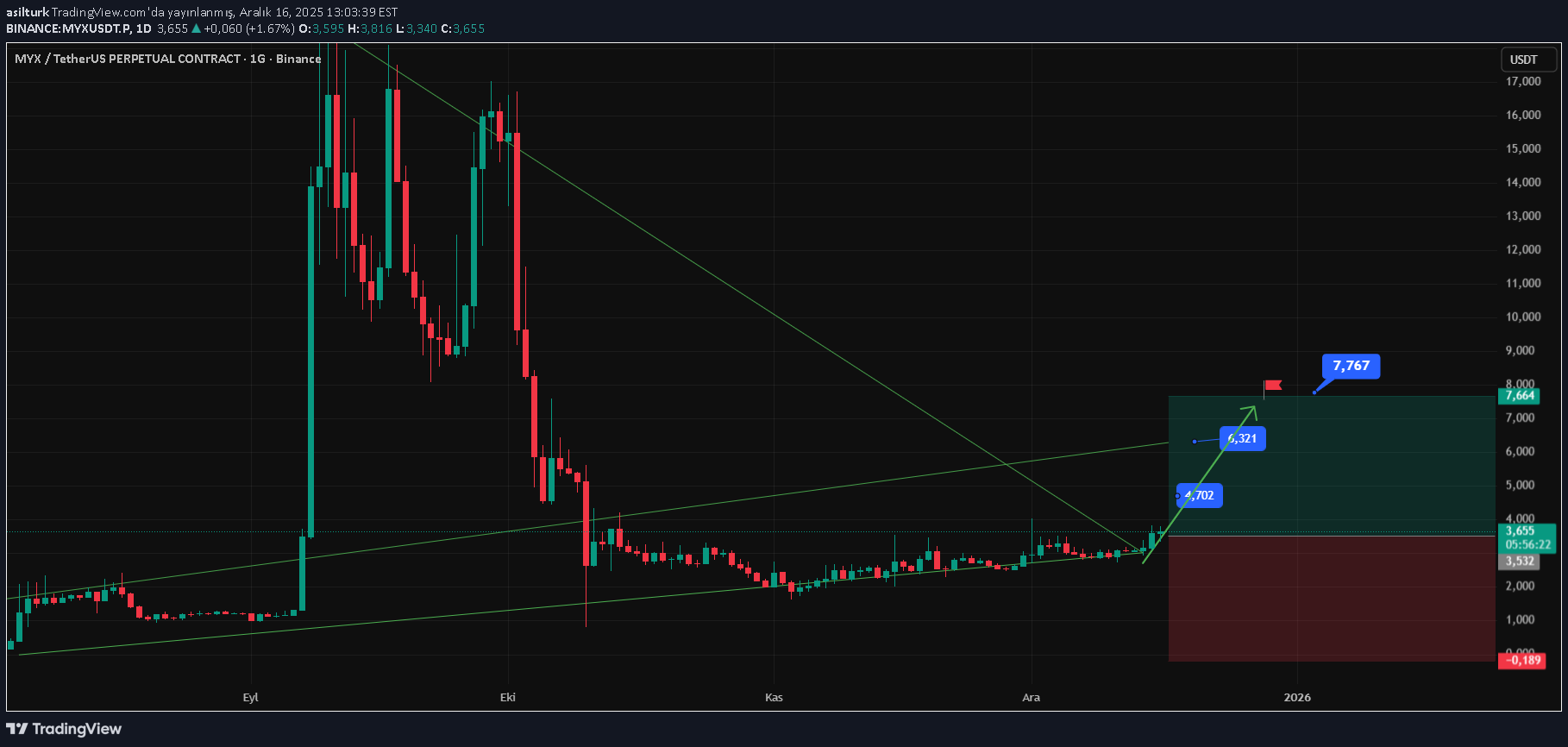

MYX Sert Hareketler Gelebilir

MYX The coin is known as an asset that grows especially rapidly in the market and is the scene of speculative transactions: Currently, its price is 3.67$, market value is 3.69Billion$, actual circulation is 1 billion units, dominance weight is 0.0315%, it is one of the coins that should definitely be taken into consideration. It was listed on Binance in the second quarter of 2025. It was listed on Binance in the second quarter of 2025. Then, it tested 18$ in the next month and gradually recovered from 1$ levels. 2-2.66-2.93-3.33- continues to move in the rising channel band. We can say that the company's market value is in high risk status due to its enormous extreme volatility, but it is one of the coins that shows resistance when falling BTC. When we look technically, we see a volumetric recovery, but it is not enough. On a weekly basis, the trend is still not over, but we can say that it is very open to harsh movements. Sharp movements in both directions may test new price targets and may show short movements to $4-4.40-5 levels sequentially. Must be careful... I wish you good luck.

asilturk

FORM Sert Yukselisler Gelebilir

Another crypto that we will add to the portfolio today is FORM (four&bnx), market value is 220 Million $, platform concentration value is over 24, extreme volatility and total maximum circulation is 580 Million units and the largest shares are in 5 wallets in total... It needs to be careful. I wish you good luck.

asilturk

ORDI Tehlikeli Sularda Yuzuyor

ORDI Coin is the first token created using BRC-20, an experimental token standard that operates on the Bitcoin blok chain. It takes its name from the Ordinals Protocol, the technology on which this token standard is based. As of now, its price is $4.81, market value is $100 Million, technically the outlook is positive, there may be sharp increases in the short term. However, the concentration value is over 7, which means that 7% can be controlled. I wish you good luck.

asilturk

asilturk

ZEC Token Genel Degerlendirme ve Sonuc

ZEC Tokeni: 6 Kasım – 15 Kasım 2025 Dönemi Performans ve İleri Analiz Raporu Hazırlanma Tarihi: 15 Aralık 2025 Giris: Bu rapor, 6 Kasım 2025 tarihinde 55 USD fiyattan alınan ve 15 Kasım 2025 tarihinde 700 USD'ye ulaşan ZEC tokeninin olağanüstü performansını analiz etmek ve ZEC/USDT ve ZEC/BTC çiftleri uzerinden uygulanan ileri teknik analiz stratejisini degerlendirmek uzere hazirlanmistir. ------------------------------------------------------ 1. DONEMLIK PERFORMANS VE KARLILIK HESAPLAMALARI ------------------------------------------------------ - Alış Tarihi: 6 Kasım 2025 - Satış/Zirve Tarihi: 15 Kasım 2025 - Alış Fiyatı: 55 USD - Zirve Fiyatı: 700 USD Gecen Sure - 6 Kasım – 15 Kasım: 9 gün Hisse Başına Net Kar 700 USD - 55 USD = 645 USD Yüzdesel Getiri (Kar Yüzdesi) ((700 USD - 55 USD) / 55 USD) * 100 (645 USD / 55 USD) * 100 = ~1172.73% SONUÇ ÖZETİ: - Gecen Süre: Sadece 9 gün - Token Başına Net Kar: 645 USD - Yüzdesel Getiri: %1172.73 (Yaklaşık 11.7 Kat) ------------------------------------------------------ 2. ZEC YUKSELISINE DAIR GERÇEK GELİŞMELER (ÖZET) ------------------------------------------------------ ZEC'in 9 günde %1172 gibi devasa bir yükselişi, kripto piyasasında nadir görülen ve genellikle aşağıdaki gibi kritik, temelleri sağlam gelişmelerle tetiklenen bir olaydır: 1. Gizlilik Teması (Privacy Narrative): Zcash, gizlilik odaklı (zero-knowledge proofs) bir projedir. Piyasanın genel olarak gizlilik coinlerine yönelik yoğun ilgisinin ve adaptasyon haberlerinin patlaması. 2. Kurumsal Adaptasyon: Büyük bir finansal kurumun Zcash'i kullanmaya başlaması veya ZEC'in popüler bir ödeme platformuna entegrasyonu haberi. 3. Düzenleyici Haberler: ABD veya AB gibi büyük pazarlarda Zcash'in yasal olarak kabul edilmesi veya düzenleyici belirsizliğin ortadan kalkması. 4. Ağ Yükseltmeleri: Önemli bir protokol yükseltmesi, ağ verimliliğini veya kullanım alanını katlanarak artırmış olabilir. Bu tür bir yükseliş, fiyata dair temel bilgilerin, teknik sinyallerin tetiklenmesiyle birleştiği bir "Mükemmel Fırtına" anıdır. ------------------------------------------------------ 3. ILETI TEKNIK ANALIZ METODU VE STRATEJISI (HAFTALIK PERIYOT) ------------------------------------------------------ Bu olağanüstü karın ana sebebi, haftalık periyotta uygulanan gelişmiş trend teyit ve momentum yakalama stratejisidir. Kullanılan Yeni Indikatorler: 1. Ichimoku Bulutu (Kumo) 2. VWAP (Volume-Weighted Average Price - Hacim Ağırlıklı Ortalama Fiyat) 3. MACD (Moving Average Convergence Divergence) Stratejinin Basarısı: Dogru Alım Yeri Belirleme Strateji, sadece ZEC/USDT fiyatını değil, aynı zamanda ZEC $'in Bitcoin karşısındaki gücünü gösteren Z ZEC/BTC $ çiftini de analiz ederek pozisyon açma kararını güçlendirmiştir. 1. ZEC/BTC Analizi (Kripto Gücünün Teyidi): - Güçlü Alım Sinyali: Z ZEC/USDT $ fiyatı yükselirken, Z ZEC/BTC $ çiftinde de güçlü bir yükseliş gözlemlenmiştir. Bu, ZEC $'in sadece dolar bazında değil, piyasanın ana varlığı olan Bitcoin karşısında da değer kazandığı anlamına gelir. Bu ikili teyit, trendin çok sağlam olduğunu gösteren kritik bir başarı sinyalidir. 2. Ichimoku Bulutu (Ana Trend): - Ichimoku Kumo (Bulut): Haftalık grafikte fiyatın Ichimoku Bulutu'nun (Kumo) üzerine çıkması ve Bulut'un yeşile dönmesi (yükseliş trendinin teyidi), ana trendin artık boğa piyasası lehine döndüğünü ve uzun vadeli bir pozisyon için ideal alım yerini işaret etmiştir. 3. MACD (Momentum ve Dönüş Sinyali): - MACD Crossover: Haftalık MACD çizgisinin Sinyal çizgisini yukarı kesmesi (boğa geçişi), güçlü bir momentum değişiminin başladığını göstererek alım kararını teyit etmiştir. - Doğru Alım Yeri (55 USD): MACD crossover'ının genellikle fiyatın dip seviyelerden (uzun düşüş trendlerinin sonu) döndüğü anlara denk gelmesi, $55 \text{USD}$ seviyesinin (uzun bir düşüşten sonra) en az riskle en yüksek potansiyeli sunan yer olduğunu göstermiştir. 4. VWAP (Kurumsal İlginin Teyidi): - Fiyat, haftalık VWAP seviyesinin üzerinde kalıcı olarak kapanış yapmaya başladığında, büyük hacimli (kurumsal) alıcıların da piyasaya girdiğini ve fiyatın mevcut seviyelerden "adil" bir şekilde alındığını göstererek alım güvenini artırmıştır. Kriptonun Hangi Fiyatlardan Gelip Hangi Seviyelere Düştüğü: Bu seviyeye ulaşmadan önce, ZEC tokeni genellikle 2017-2018 boğa piyasasında $1500 seviyelerinin üzerine çıkmış, ancak daha sonra ayı piyasalarında 20 ila $50 $ aralığına kadar gerilemiştir. 55$ seviyesinden alım yapmak, uzun süren bir düşüş ve konsolidasyon döneminin (birikim dönemi) sonuna denk gelerek **riski minimize eden** bir strateji olmuştur. ------------------------------------------------------ 4. YATIRIMCIYA NOTLAR (ILERI ANALIZ ODAKLI) ------------------------------------------------------ 1. Ikili Analiz (BTC Pair): Kripto para birimlerinde sadece USD/USDT çiftini değil, BTC çiftini de analiz etmek, yatırımcının piyasa geneline göre varlığın gerçek gücünü anlamasını sağlar. ZEC/BTC yükseliyorsa, ZEC piyasadan daha güçlüdür. 2. Indikator Karşılığı: Momentum göstergeleri (MACD), trend göstergeleri (Ichimoku) ve hacim göstergeleri (VWAP) olmak üzere farklı kategorilerden indikatörleri bir arada kullanmak, yanlış sinyal olasılığını büyük ölçüde düşürür. 3. Kâr Kilitleme: %1172'lik bir getiri, tüm pozisyonu bir anda satmak yerine, fiyatın 700 USD'den geri çekilmeye başladığı anlarda (örneğin MACD'nin tekrar kesişmeye başladığı yerde) kademeli olarak satarak kârın büyük bir kısmını realize etme disiplinini gerektirir. Ve Böylelikle ZEC Tokeni takip listesinden çıkarıyoruz. Yatırım yapan arakadaşlara keyifli harcamalar dilerim.

asilturk

بیت کوین کش (BCH) به ۱۰۰۰ دلار میرسد؟ پیشبینی صعودی بزرگ!

The BCH (bitcoin cash) we added to the portfolio on November 21st at a price band of $500 is currently moving at a price band of $575. Over the past 21 days, BCH generated a net income of $76.5 per share and the percentage change was 15.50%. We can say that the technical outlook for BCH continues both weekly and monthly trend and continues slowly and steadily based on the volume towards the formation target along with the increases in volume. Since the weekly momentum is strong and it is one of the largest cryptos in the POW group, we can easily say that it is one of the cryptos positively affected by the BTC drop. Sequential targets are indicated in the chart. I believe that the $1000 test will occur in the medium term, although not in the short term. I wish you pleasant spending.

asilturk

BTC Teknik Degerlendirme ve Beklentiler

We shared our prediction in the previous chart that short (sell) positions should be opened at the $ 116,000 level. By completing the BTC sequential decline targets, it continues to remain below $90,000 and the $80,000 level, which we stated as the main support level, is still valid. Even though there is recovery and reaction increases on the weekly chart, I believe that the monthly downward trend will continue for Bitcoin. In general, the declines in Bitcoin are fake and will bring even sharper declines in the coming days. As of last month, the trending cryptos ZEC-ZEN-DASH-DCR-DGB, which are cryptos in the POW group, will continue to rise. Although there are declines in alt coins, Exchange Tokens, which we call Exchange Tokens BNB (Binance), KCS (kucoin), MNT (bybit), HT (houbi) GT (gate.io), FTT (FTX-LUNC-LUNA) etc. I believe that cryptocurrencies such as will diverge positively. As a result, when we evaluate them as a whole, although the decline predictions for BTC are for the short term, this should be considered as the second wave of a real Elliot wave. It would not be true to say anything definite and clear about price targets, but the volumetric declines for Bitcoin will continue due to the downward trend, the $80,000 price band should be followed as the main support level for Bitcoin, it would not make sense to open a short in this process (overreaction and buybacks may occur to close long positions), but the rise in alt coins in the POW group is a harbinger of the rise of alt coins and most importantly, a process we can call rally for alt coins. I believe it will happen in the coming weeks. Bitcoin 88777-85,100-83400-80000 levels can be followed as sequential decline targets. I wish you good luck. Foot note: You can write via WhatsApp.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.