aryoTraderX

@t_aryoTraderX

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

aryoTraderX

رالی کریسمس در راه است؟ بیت کوین در آستانه جهش بزرگ پس از فروش سنگین!

Price is oversold → bounce likely and we are approaching Christmas rally. Major trend still down, but bullish divergence occurs on the stochastic. Accumulation position around 85k-80k, and please manage risk properly. Take profit around 100K and let's see if the 100k is reclaimed or not. “Be greedy when others are fearful” Warren Buffett

aryoTraderX

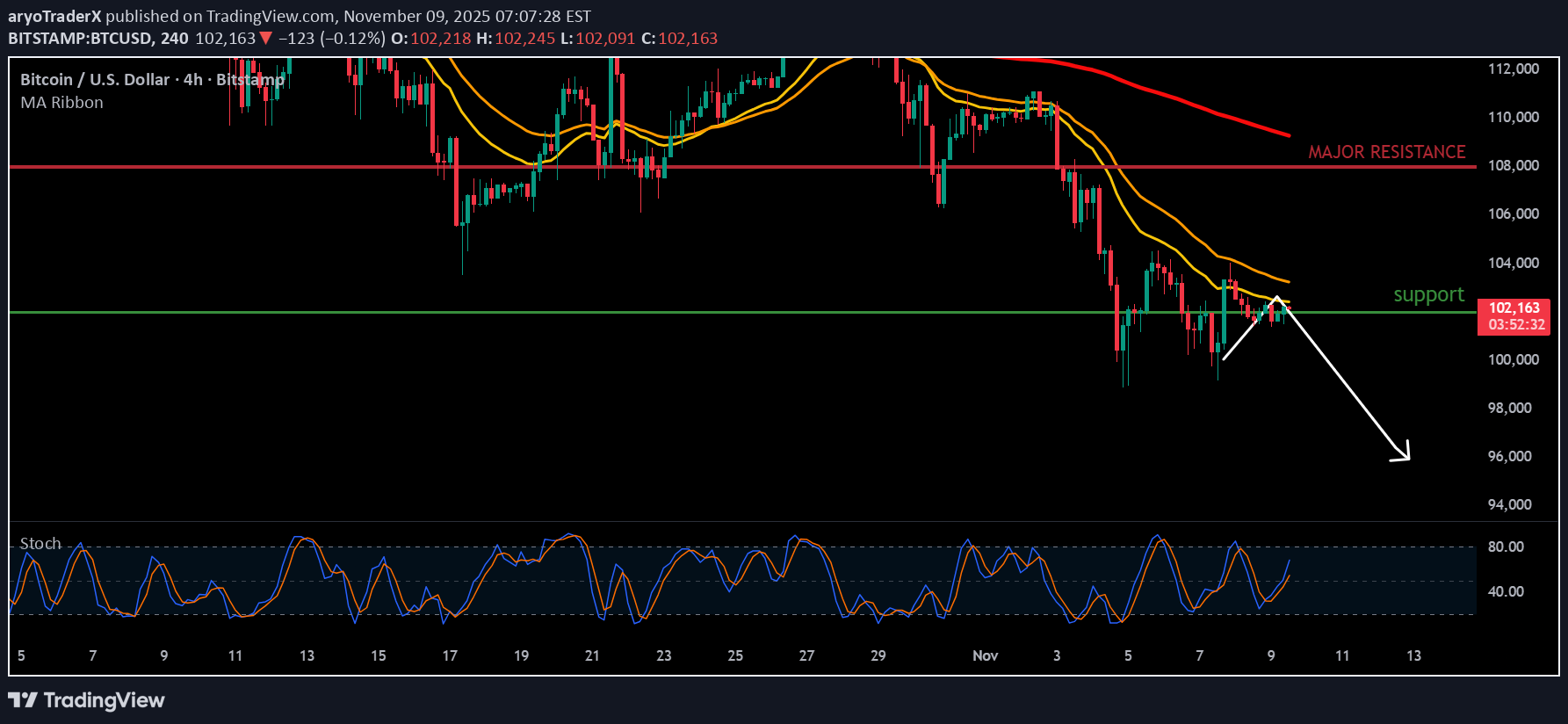

احتمال ریزش سنگین بیت کوین: تحلیل تکنیکال 4 ساعته و هدف ۹۶ هزار دلاری!

BTC 4H chart – bearish setup with MA confirmation. Price is retesting the $102K support (now resistance) while staying below the 50 & 200 MAs, showing strong downside pressure. The MA ribbon remains aligned bearishly, confirming momentum weakness. Below $102K, target sits around $96K. Bias stays bearish unless price reclaims $104K+ above moving averages.

aryoTraderX

Hidden bullisish divergence weekly on GOLD

Technical: Hidden bullish divergence on Gold, signalling continuation of the uptrend after 4 months consolidation. Marco: Favour long positions due to central banks at the end of raising rates, weaker USD, geological tension and safe-haven demand. Entry: try to buy on support or use moving averages on lower time frames.

aryoTraderX

Gold ready to create new all time high!!!

Buy: $3447.28 Set up: wait for a breakout and hidden bullish divergence on a weekly basis. Sl: $3183.11

aryoTraderX

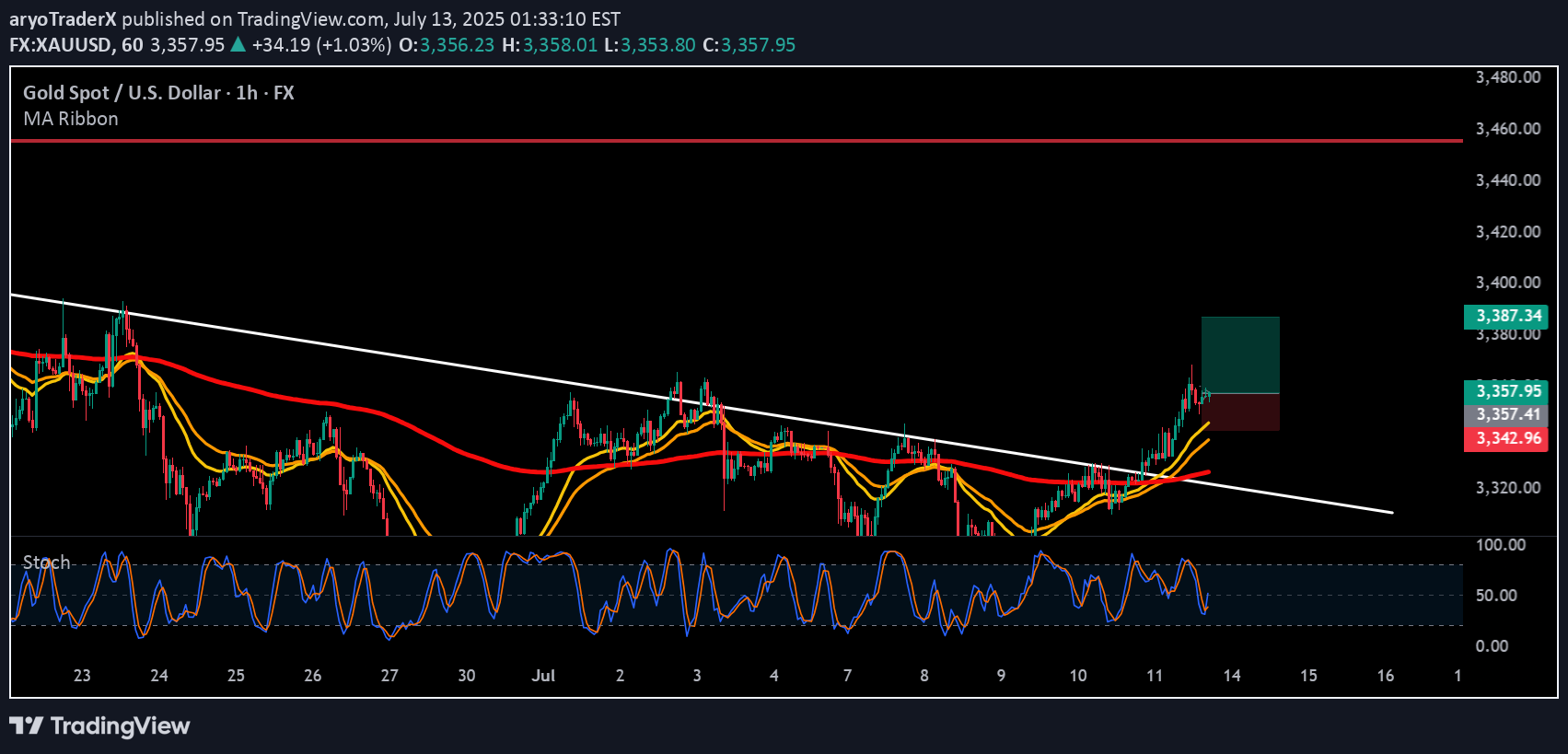

Gold ready to bounce?

Buy: $3337.868 Set up: Support trendline Sl: $3319.513 TP:$3387.427 RR: 1:1

aryoTraderX

ETHEREUM to 4000?

Buy: $3753.31 Set up: Bull flag Sl: $3564.48 TP:$4000 RR: 1:1

aryoTraderX

Temporary pull back on BTC

Sell: $117590 Set up: consolidation set up Sl: $119717 TP:$114400 RR: 1:1

aryoTraderX

Breakout on Gold

Buy : $3358.94 Set up: momentum trade with trend line breakout on 1 H Sl: 150 pips TP1:200 pips TP2:300 pipsstop me out

aryoTraderX

Short XAUUSD

Sell:3328.75Set up: Retest on 0.618 fib and MAs rejectionSl: 3335.62TP: 3304.91

aryoTraderX

Long Gold on trendline support

Buy: $3362.27Set up: Trend line support and bullish divergenceSl: $3325.67TP: 3436.36Limit order triggered

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.