arvin94

@t_arvin94

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

arvin94

سناریوی بیت کوین در نمودار روزانه: تحلیل آینده و نکات کلیدی!

Bitcoin's scenario ahead in daily time See more details on the chart

arvin94

پیشبینی حرکت بعدی اتریوم هفته آینده: راز تأثیر نرخ بهره فدرال رزرو!

arvin94

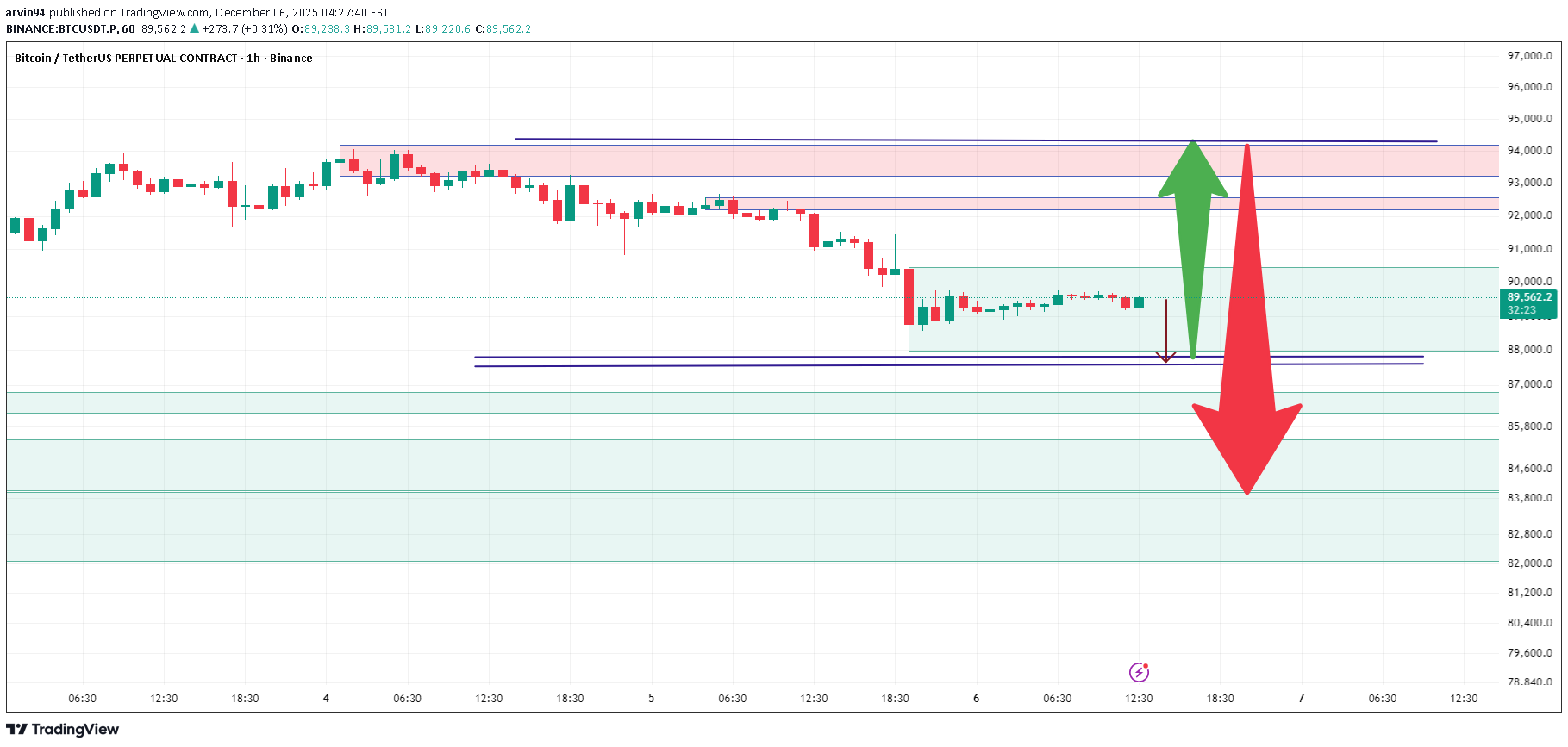

سناریوی حرکت بیت کوین در تایم فریم یک ساعته: آیا منتظر صعود تا ۹۲,۰۰۰ دلار هستیم؟

Bitcoin movement scenario on the 1-hour timeframe. You can find more tips on the chartHowever, the price of Bitcoin is still in a descending channel and there is a possibility of a long-term move to see the price between $84,000 and $92,000.The Federal Reserve (FED) will hold its final policy rate meeting of 2025 on December 9-10, 2025. The decision is expected to be announced on the final day of the meeting. Analysts predict that the decision will be made public on December 10, and the outcome of this decision could almost change the market trend.Those who didn't buy at $88,000, don't take longs now because the risk is high. This is my personal opinion, decide for yourself.

arvin94

آیا این سکوت قبل از طوفان بیت کوین است؟ هشدار مهم برای قیمت بیت کوین!

Is this the calm before the Bitcoin storm? I think if Bitcoin fails to break above $90,500, it will most likely see a major drop in the coming hours. This is my personal opinion.As long as the Bitcoin price does not rise above $90,500 and stabilize, the possibility of a bearish price and a sharp drop in the event of selling pressure remains. This analysis is valid.

arvin94

سناریوهای احتمالی بیتکوین در هفته آینده: آیا منتظر تغییر روند هستیم؟

Possible Bitcoin Scenarios for the Week Ahead More Details on the Chart. Considering the Federal Reserve's interest rate decisions in the next few days, a trend change is possible

arvin94

آینده بیت کوین در 4 ساعت آینده: سناریوهای احتمالی با وجود تنشهای جهانی

Bitcoin's future scenario in the 4-hour timeframe. Despite the economic and war developments between the United States and Venezuela, and renewed threats between Israel and Iran, the situation in financial markets will remain uncertain, at least until after the Christmas holidays.And if Bitcoin loses the crucial $90,000 price, Majd will correct to $86,000-$84,000.

arvin94

تحلیل تکنیکال ETH/USDT: آیا اتریوم مقاومت 3957 دلار را میشکند؟ (پیشبینی 25 اکتبر)

ETH-USDT Technical Analysis Report ## Current Situation Summary **Current Price:** 3928.43 USDT **24-Hour Change:** +54.47 USDT (+1.41%) **Price Range:** 3864.9 - 3957.25 USDT **Volume:** 72,052,749 Contracts --- ## Price Trend Analysis ### **Overall Trend** Ethereum is currently in a **mild uptrend**. The price has gained 1.41% in the past 24 hours and has managed to break through the support level of $3864.9. ### **Key Points** - **Main Resistance:** 3957.25 USDT (24-hour high) - **Strong Support:** 3864.9 USDT (24-hour low) - **Current Price:** Near the middle of the price channel --- ## Volume and Volatility Analysis ### **Trading Volume** The 24-hour trading volume of 72 million contracts indicates **moderate** market activity. This volume is suitable for a price move of 1.41% and indicates a relative balance between buyers and sellers. ### **Volatility Analysis** - **Volatility Range:** 92.35 USDT (2.35% of current price) - **Volatility:** Medium to Low - **Price Stability:** Fairly Favorable --- ## Candlestick Pattern Analysis Based on hourly data from the past 24 hours: ### **Strengths** 1. **Sustained Uptrend:** Price has risen from 3886.76 to 3928.44 2. **Resistance Break:** Successfully crossed the $3920 level 3. **Strong Support:** Positive reaction at $3864.9 ### **Weaknesses** 1. **Resistance at 3957:** Unable to fully break this level 2. **Bearing Volume:** Volume has decreased in recent hours 3. **Hesitation at Highs:** Retracement from daily highs --- ## Forecast and Scenarios ### **Bullish scenario (60% probability)** - **Short-term target:** 3980-4000 USDT - **Condition:** Support 3900 held and break 3957 - **Volume requirement:** Increase in trading volume ### **Neutral scenario (25% probability)** - **Range:** 3880-3950 USDT - **Duration:** 2-3 days - **Characteristics:** Fluctuation in the current channel ### **Bearish scenario (15% probability)** - **Target:** 3820-3850 USDT - **Trigger:** Break of support 3864.9 - **Warning:** Sharp decrease in volume --- ## Trading recommendations ### **For day traders** - **Entry:** On retracement to 3900-3910 - **Exit:** Near 3950-3960 - **Stop Loss:** Below 3880 ### **For Medium-Term Investors** - **Expect:** Until a clear break of 3957 - **Target:** 4050-4100 USDT - **Risk:** Medium ### **Risk Management** - Maximum 2-3% of capital per trade - Use a mandatory stop loss - Monitor trading volume --- ## Conclusion ETH-SWAP-USDT is currently in a **cautious uptrend**. Despite the 1.41% growth, the market is still waiting for a clear break of the $3957 resistance. Moderate volume and controlled volatility indicate a balanced market. Traders should wait for stronger signals to enter large positions.

arvin94

arvin94

سناریوی احتمالی اتریوم: آیا قیمت ETH پس از نوسان بیت کوین به ۳۶۴۰ دلار سقوط میکند؟

Possible Ethereum scenario considering Bitcoin price volatility next week. In my opinion, given the global political and economic events, the renewed US government shutdown, and the market’s lack of confidence in Bitcoin’s price stabilization, Ethereum price will correct to $3,640 after rejecting and breaking $4,000.If it breaks through $3,600 and goes below $3,500, the price could drop to the lower levels, even to $3,200. Note that this is not a definite possibility, but it may happen due to the lack of stabilization of Bitcoin fiat and the continued selling pressure.Set the stop loss at $3,495.

arvin94

سناریوی هفته آینده اتریوم: سقوط تا ۳۲۰۰ دلار و جهش انفجاری!

I think that given the uncertainty of the decisions and economic and political developments in the world, the price of Ethereum will suffer between $3,720 and $3,900, then it will have a price drop to $3,200 and will come back strongly from $32,000 with higher targets. Note: This is not financial advice. The decision will be made by the individual.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.