ardatufekci33917

@t_ardatufekci33917

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

ardatufekci33917

ترس، مانع فرزندآوری است: تحلیل روند صعودی و امید به کفسازی!

I know we're at the bottom of the uptrend. And yes... we haven't been able to form a bottom in the daily trend. But I don't want to get liq. , and I'm still bullish. The 4H RSI is on our side. If in an hour we can close like this also a wonderful doji will come up. We can do it.

ardatufekci33917

ardatufekci33917

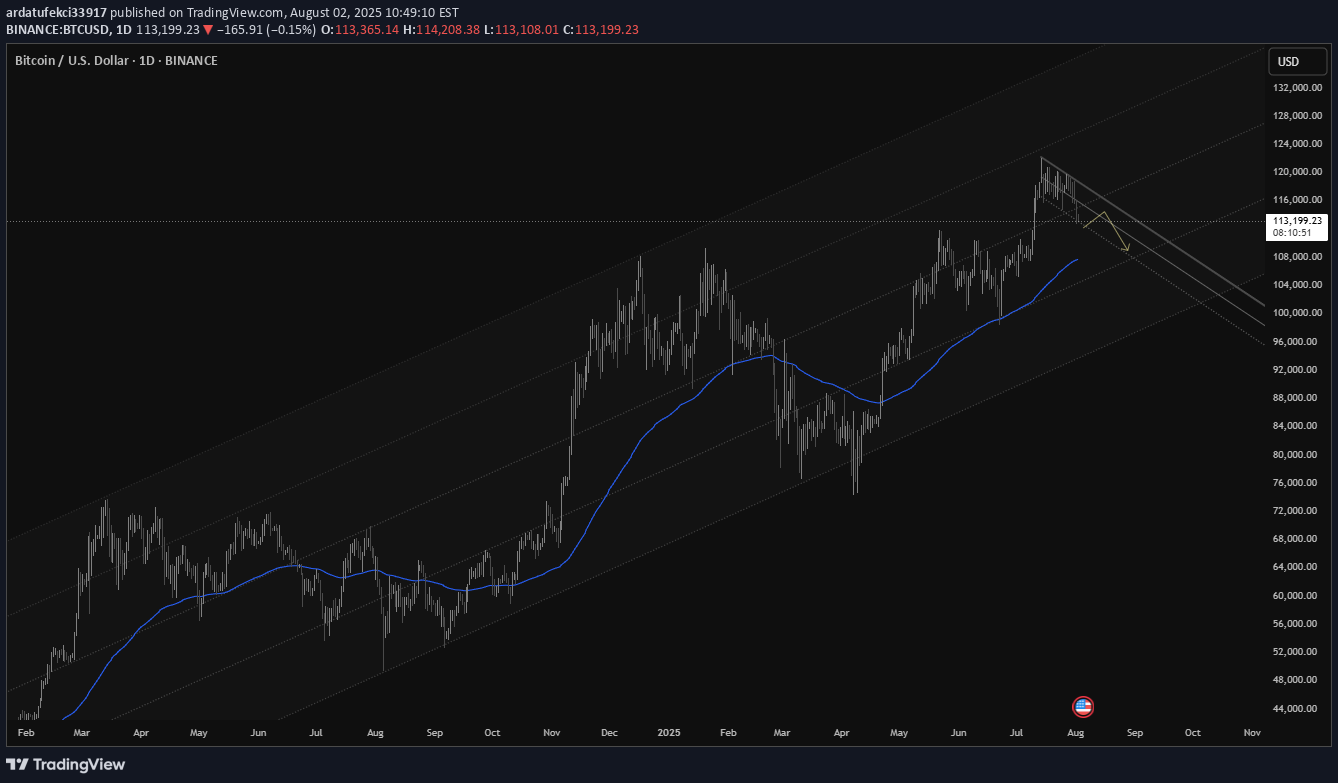

just a look

ı dont have somthing to say in fact this is not an isdea just look.

ardatufekci33917

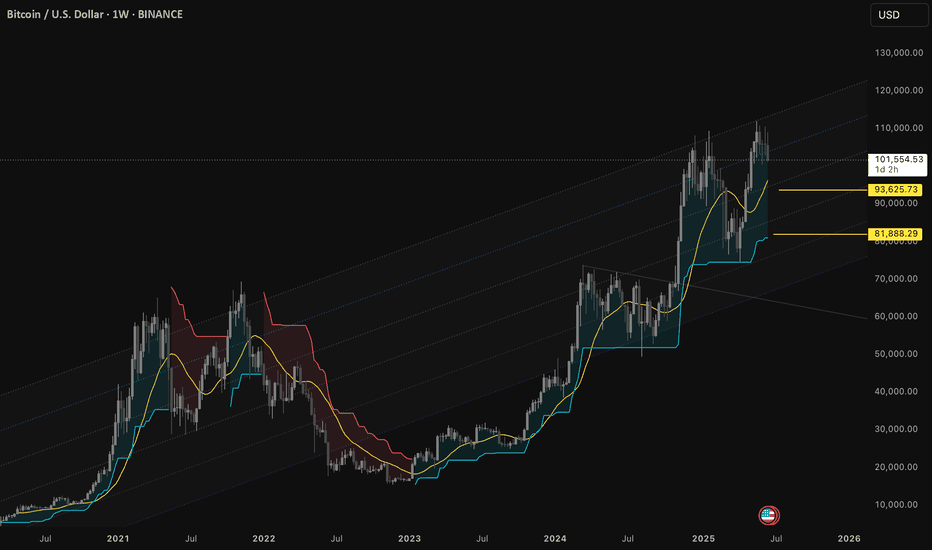

Rev

As it breaks above the top of the logarithmic channel, the indicator is generating a sell signal. Clearly, medium-term investors should remain cautious.

ardatufekci33917

head and shoulders vs wedge but...

I see two patern @4h chart and trendline test. risky area

ardatufekci33917

megaphone pattern

yes as you see, we have a formation looks bearish.

ardatufekci33917

ardatufekci33917

just fantasy

BTC, which has moved away from the moving averages, may first continue its correction process for a healthy rise. While it's a completely fantastic idea, the wedge formation could break first, followed by a diamond formation to determine direction. I thought I'd try something different.

ardatufekci33917

Corection?

Frankly, I'm confused. The 4-hour trend is broken, and there's a possibility of a bad weekly candlestick... A correction down to the lower channel is likely for a while. Of course, 2% fluctuations are possible.

ardatufekci33917

no need risk

It seems that BTC is in decline and taking inspiration from the past, I think the closest place to the averages is the safest place to buy. The safest... then I will look at the charts and evaluate the situation. If it does not look healthy, I will focus on the 2nd target.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.