alfoxDayTrader

@t_alfoxDayTrader

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

alfoxDayTrader

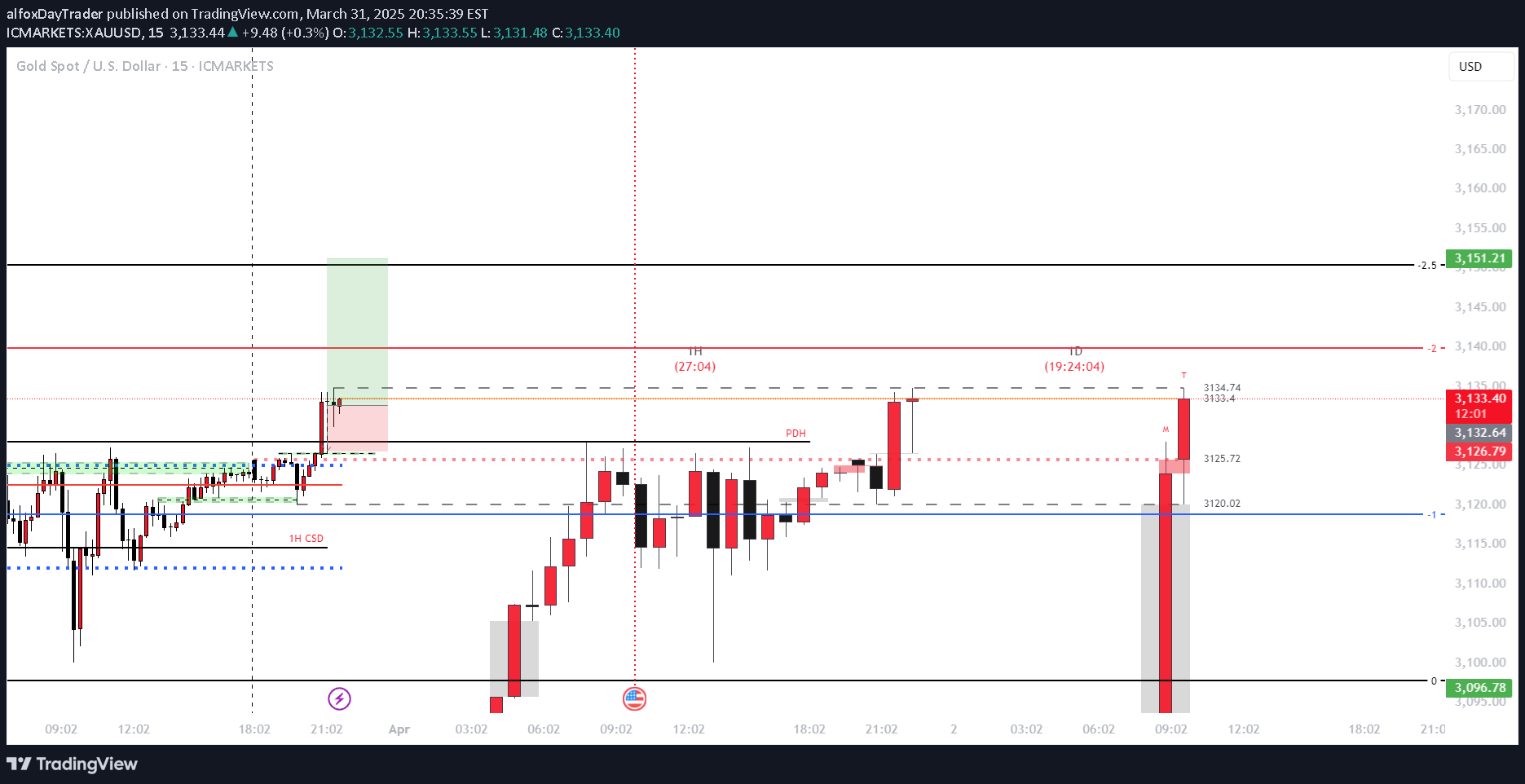

My trading idea for GOLD today

Here's my idea with GOLD today. I can see GOLD to continue going up for today with a weekly model of classic expansion week... So for now i placed a buy stop order and ready for entry... If my idea is correct then i made a target of 1:3R targeting the standard deviation zone...

alfoxDayTrader

My trade for GOLD (XAUUSD) today

Here's my trade for GOLD today. From daily tf where my bias is bullish targeting the PDH and structure tf which is 1H then entry tf which is 5m. Now for my idea, i am expecting for price to go towards the PDH and that's where i got my bias. For my structure clearly we can see that the recent 1H candle respected the recent bullish FVG so now i can see that the bias is aligned with my structure tf. Once i saw that my entry tf is also aligned with my structure tf, i decided to enter with a target of 1:3RTarget of 1:3R reached. All done for today...

alfoxDayTrader

Assignment for GOLD next week

Base on what happened this week. My idea for GOLD is simple and straight forward next week. After that strong expansion to the downside, i am expecting to see a retracement towards .5 or .62 of fib level before price will continue to go down and mitigate that big weekly imbalance below. Base on the structure of next weeks high impact news, my idea would be a simple consolidation for Monday till Wednesday since we got no high impact news on those given days. Then Thursday and Friday would be the expansion since we got FOMC,CPI and PPI for those 2 remaining days of the week... My entry would still be the same. Top down analysis using my multi timeframe strategy and wait for all timeframes to align and enter in 5m timeframe once it aligns with the overall higher timeframe. Good luck to us all and Happy trading...

alfoxDayTrader

Another great trade for XAUUSD (GOLD) today

After seeing the price action of monday to wednesday, it gave a hint as to what to expect for today. Since i was expecting a consolidation reversal week i knew then that thursday will sweep monday to wednesday and do a reversal for today. Combining it with my multi timeframe analysis from daily to 1H with my entry in the 5m timeframe, i was able to capture this 1:7R trade for today... For tomorrow my expectation would be an expansion friday candle going down targeting the daily +FVG to complete the ERL to IRL scenario...

alfoxDayTrader

Another Good Trade for GOLD (XAUUSD) Today

https://www.tradingview.com/x/yVyDlDrq/ My overall forecast for this week is that Gold will do classic expansion week where monday will go up then tuesday will most likely go up to sweep mondays high then do the reversal so that wednesday and thursday will be expansion going down and target the daily imbalances below. For today i was expecting a bullish push upwards for GOLD before it will reverse so i followed my steps by combining my multi timeframe analysis. From daily for the overall bias to 1H for that confirmation and alignment then 5m for my entry timeframe. Once i saw those 3 timeframes align with combination confirmation that i saw with the price action then i entered the trade. My original target was 1:3R but then i saw the weakness after price came to my 1:2R level so i manually pulled out with a 1:2R gain for today....

alfoxDayTrader

Entry for GOLD (XAUUSD) Today

Here's my trade entry for today with GOLD. With the idea of Bullish i entered after the higher TF showed resistance and pushing price higher. So my multi TF strategy is to check the Daily for overall trend then 1H for that signal of alignement then enter in 5m tf https://www.tradingview.com/x/IWRINhHj/ .I am happy with the 1:2R. So instead of 1:3R i closed manually with a gain of 2R

alfoxDayTrader

Trade for XAUUSD (GOLD) Today

https://www.tradingview.com/x/kynwPGBW/ Okay here's my trade i took with gold earlier. My target was a 1:3R and my idea came from combination of my multi timeframe analysis. From Daily i go down to 1H tf for more info then go down to 5m tf for my final entry. For this week i can see Gold retrace going towards the Daily BISI below and since today is Monday, i am expecting price to go up first and liquidate before it will reverse going down. So once i saw that in 5m tf that price went towards the 200 EMA i monitored price and saw that price was rejected and respected the 200ema in 5m tf which is also aligned to the 1H tf level of change in state of delivery. So to make it clear, price respected 200ema at the same time respected and was rejected by the 1H order block so with this combination of ideas i came up with my final decision to enter a LONG entry. It was a fast and smooth trade...

alfoxDayTrader

TICTOE trading strategy with BTC today

Here's another successful trade i took with BTC today... I just love it when market shows the signals for a good entry... It feels so relaxed and satisfying... https://www.tradingview.com/x/la0IPL8x/

alfoxDayTrader

Analysis for ONEUSDT

Today i share my analysis for ONEUSDT. as you can see in my chart i drew the 4hr bullish OB with matching FVG. as confluence this OB is also a strong support level for higher tf. The plan is for us to wait for price to hit our FVG and or OB and go down to lower tf to see some reactions. once we see in lower tf that price wants to reverse or CHOCH then we prepare our entry for a long position.

alfoxDayTrader

SMC analysis with BTC

SMC analysis with BTC Early grind with BTC today. Bias for today is bearish and i'm riding this baby going down. Price reached the 50% of premium range which means it is now ready to go back to it's higher tf trend which is bearish. My trade just got tagged in so now let's wait and see. hopefully tp will be hit as it is the discount zone in 4 hr tf ...

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.