alexpv73

@t_alexpv73

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

alexpv73

Price action in MSTR shows rejection from the 350–320 supply zone, with institutional selling pressure still present. The breakdown opens risk of gap filling below 300, with a weekly bottom as the next reference. Heavy absorption could only resume if the price reclaims 320. # Upside target: 350–320 if reclaimed # Downside target: 280 gap zone, extended to 200–140 support #MSTR #globaltrade #investment #investing #stockmarket #wealth #realestate #markets #economy #finance #money #forex #trading #price #business #currency #blockchain #crypto #cryptocurrency #airdrop #btc #ethereum #ico #altcoin #cryptonews #Bitcoin #ipo

alexpv73

TSLA is consolidating below a major supply zone near 450, showing signs of distribution after the recent rally. Strong supports remain at 350 and 305, with a broader accumulation area between 250–220 tied to institutional orders. Price action suggests buyers remain in control unless 350 breaks. Upside target: 500, with extension to 580 if momentum continues Downside target: 350, then 305 if pressure builds #TSLA #globaltrade #investment #investing #stockmarket #wealth #realestate #markets #economy #finance #money #forex #trading #price #business #currency #blockchain #crypto #cryptocurrency #airdrop #btc #ethereum #ico #altcoin #cryptonews #Bitcoin #ipo

alexpv73

QQQ is consolidating near the upper resistance zone after hitting 5.5B volume. Strong supports are at 570 and 530, with a critical open gap around 490 that could act as a magnet if momentum fades. Institutional flows show distribution near highs, but trend support remains intact. Upside target: 605 if resistance breaks with strength Downside target: 530, with risk of 490 gap fill if weakness persists #QQQ #globaltrade #investment #investing #stockmarket #wealth #realestate #markets #economy #finance #money #forex #trading #price #business #currency #blockchain #crypto #cryptocurrency #airdrop #btc #ethereum #ico #altcoin #cryptonews #Bitcoin #ipo

alexpv73

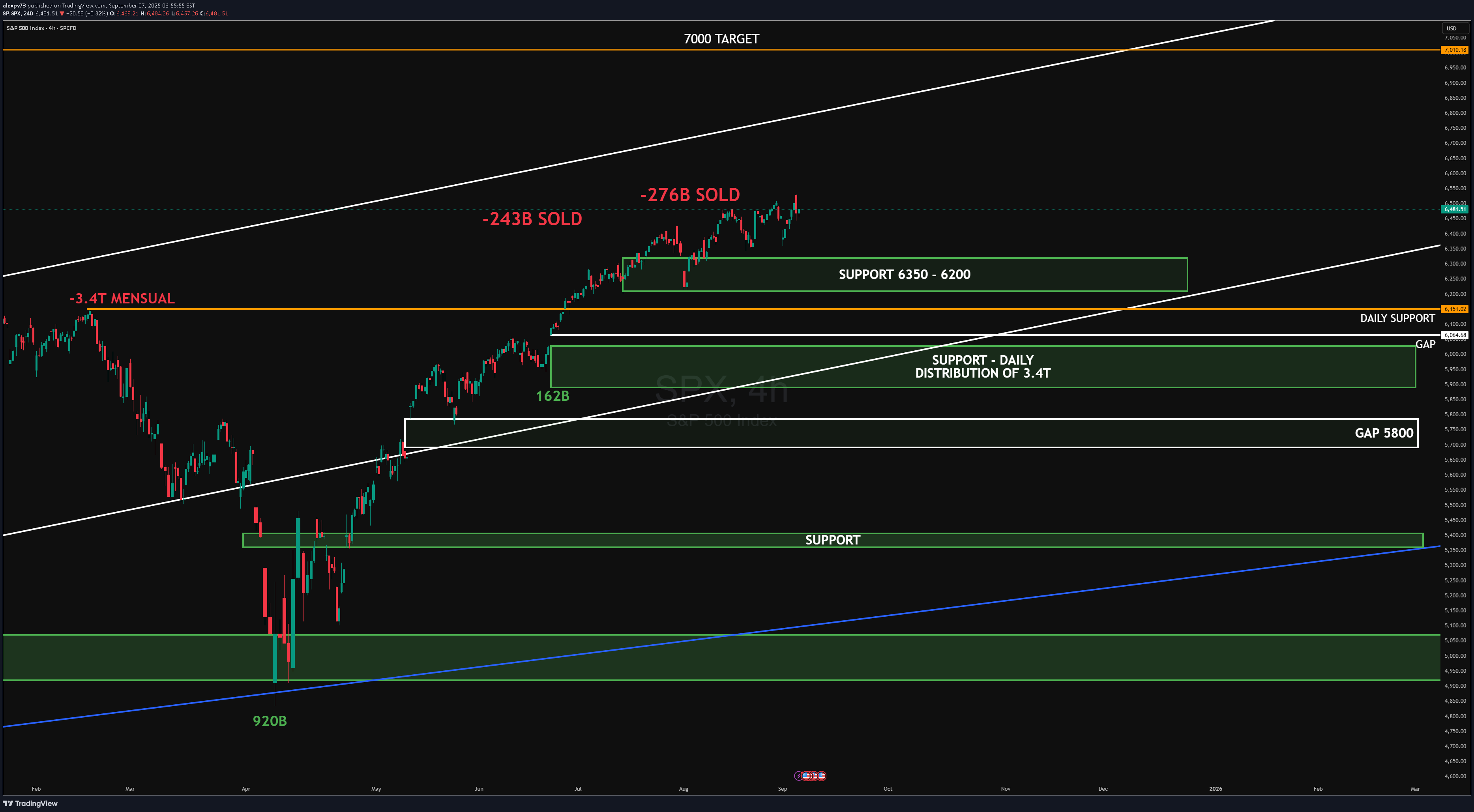

SPX rejected at the 6600 area after heavy institutional distribution (-352B). Price is consolidating above key support zones at 6500–6450 and 6350–6200. Stronger demand sits at 6100, where the 3.4T daily absorption was previously noted. Below that, unfilled gaps remain at 5800 and 5350. Upside target: 7000 if supports hold and momentum returns. Downside target: 5800 gap fill if 6350 breaks. #SPX #globaltrade #investment #investing #stockmarket #wealth #realestate #markets #economy #finance #money #forex #trading #price #business #currency #blockchain #crypto #cryptocurrency #airdrop #btc #ethereum #ico #altcoin #cryptonews #Bitcoin #ipo

alexpv73

SPX on the 4H chart is facing rejection near recent highs after notable sell volume (-243B and -276B). Institutional absorption is visible, but upside momentum remains intact as long as the 6350–6200 support holds. Below that, the 3.4T daily distribution zone and the 5800 gap are key downside targets. On the upside, the projected path points toward the 7000 area. target: 7000 target: 5800 #SPX #globaltrade #investment #investing #stockmarket #wealth #realestate #markets #economy #finance #money #forex #trading #price #business #currency #blockchain #crypto #cryptocurrency #airdrop #btc #ethereum #ico #altcoin #cryptonews #Bitcoin #ipo

alexpv73

BTC is holding above 110K support after sharp rejection near 120K–115K, where heavy distribution took place (810K sold). Institutional absorption seems active around 110K, but a break below would expose 105K and 95K as deeper supports. Upside targets remain 115K and 120K if buyers regain momentum. Target upside: 115K–120K Target downside: 105K–95K #BTCUSD #globaltrade #investment #investing #stockmarket #wealth #realestate #markets #economy #finance #money #forex #trading #price #business #currency #blockchain #crypto #cryptocurrency #airdrop #btc #ethereum #ico #altcoin #cryptonews #Bitcoin #ipo

alexpv73

The S&P 500 Index (SPX) faced strong rejection at the upper resistance zone near 6,400, where -243B was sold, signaling aggressive institutional distribution. This area aligns with the broader -3.4T monthly level, confirming it as a significant ceiling. Multiple support levels lie below. The first key zone near 6,200 is being tested. If broken, deeper liquidity pockets are visible around 6,000 and 5,700, where 162B was previously absorbed. Further down, the high-volume August 2023 level near 5,000 remains a macro support with 920B of institutional activity. Upside target (if reclaimed): 6,400 Downside target (if breakdown continues): 5,700 → 5,000 #SPX #globaltrade #investment #investing #stockmarket #wealth #realestate #markets #economy #finance #money #forex #trading #price #business #currency #blockchain #crypto #cryptocurrency #airdrop #btc #ethereum #ico #altcoin #cryptonews #Bitcoin #ipo

alexpv73

BTCUSD just met strong supply at 120 K, showing clear distribution from large sellers, yet price still respects the primary rising trendline. Below, absorption blocks cluster at 110 K–105 K where bids keep stepping in. Targets: • Upside — 125 K if the trendline holds and 120 K is reclaimed. • Downside — 110 K on a break of trend support. #BTCUSD #globaltrade #investment #investing #stockmarket #wealth #realestate #markets #economy #finance #money #forex #trading #price #business #currency #blockchain #crypto #cryptocurrency #airdrop #btc #ethereum #ico #altcoin #cryptonews #Bitcoin #ipo

alexpv73

AMZN price action update: Price is consolidating below the 240 resistance after a steady climb. Buyers are defending the 230 level, showing signs of absorption just above the ascending trendline. The 233.50 breakout level could trigger momentum towards the 240 resistance. If breached, institutional targets extend toward 250. Current consolidation suggests the Market Maker is trapping liquidity below 230 while buying time for a directional move. Upside target: 250 Downside target: 220 if 230 fails #AMZN #globaltrade #investment #investing #stockmarket #wealth #realestate #markets #economy #finance #money #forex #trading #price #business #currency #blockchain #crypto #cryptocurrency #airdrop #btc #ethereum #ico #altcoin #cryptonews #Bitcoin #ipo

alexpv73

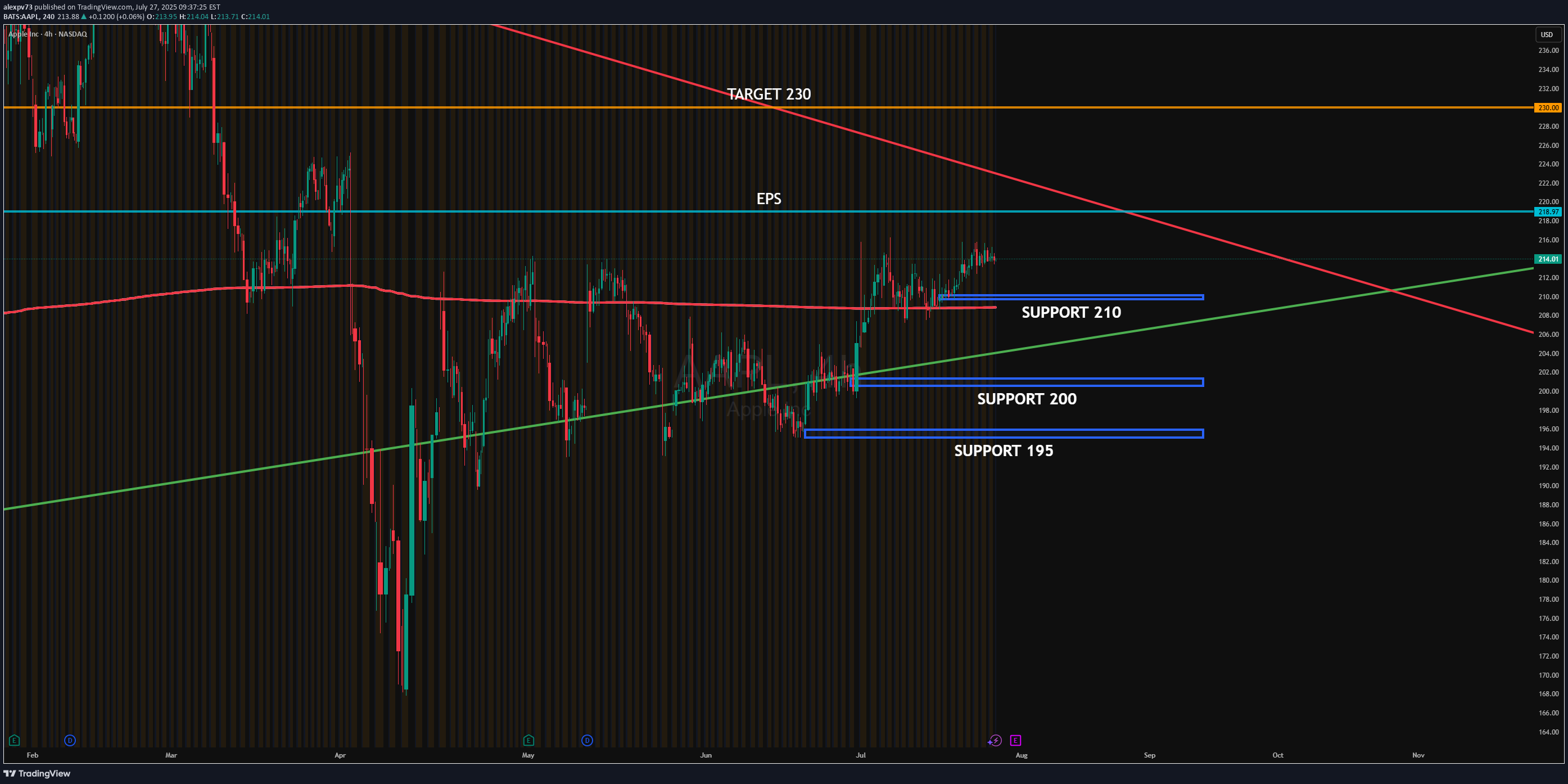

AAPL is consolidating just below the post-EPS resistance zone near 219, while institutions are actively defending support around 210. There's visible absorption at 210 and 205, aligning with high PUT interest, suggesting a strong institutional floor. Distribution is evident in the 220–225 area, where CALLs are being sold to cap upside and benefit from theta decay. Upside target: 230 if price breaks above 225 with volume. Downside target: 200–195 if 210 fails to hold. #AAPL #globaltrade #investment #investing #stockmarket #wealth #realestate #markets #economy #finance #money #forex #trading #price #business #currency #blockchain #crypto #cryptocurrency #airdrop #btc #ethereum #ico #altcoin #cryptonews #Bitcoin #ipo

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.