Zoen_Trieste

@t_Zoen_Trieste

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Zoen_Trieste

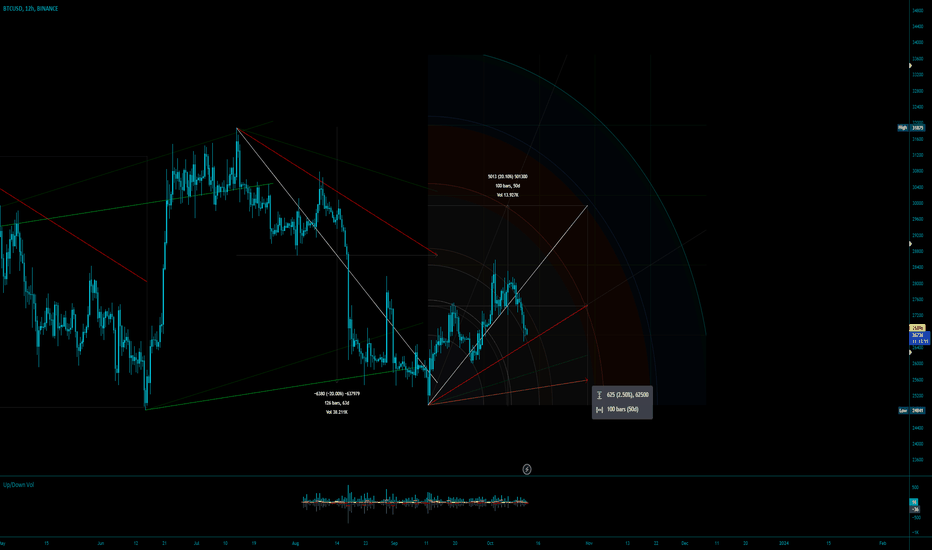

Notes on BTC Market Oct'23

Over the past few months, BTC seems to find a pivot at 20% extensions of the up/down movement. To find sup/res points, what one can try is: take the last significant low/high and draw a rising/declining line at a rate of 12.5 USD per trading day from the chosen high/low. The current example is highlighted on the chart; an info line is provided for easier reference. The given dynamic support area is likely to have some maker bid volume, which usually translates into stop loss volume hurdles, effectively providing setups in both directions depending on which side overwhelms the market at these points of exchange. Keep your eyes on the prize, manage your risk appetite and stay tunedUpdated version with the resistance angle line coming from the most recent pivot high.

Zoen_Trieste

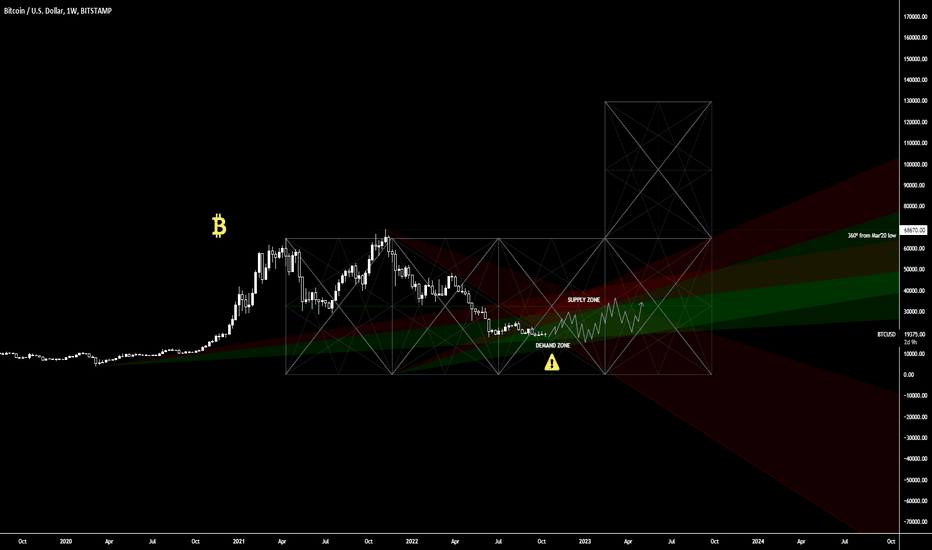

BTCUSD: Range Approximation

This chart suggests that the BTCUSD market is currently in a ranging state. We have tried to identify supply and demand zones in this range environment. The suggested levels are as follows: [* ] High teens for increasing long exposure [* ] Around 28k squaring off long positions [* ] Sit out the area in the middle This kind of price behavior is expected as the market participants are going through range normalization after the price discovery stage. Trade with care and own your risk.

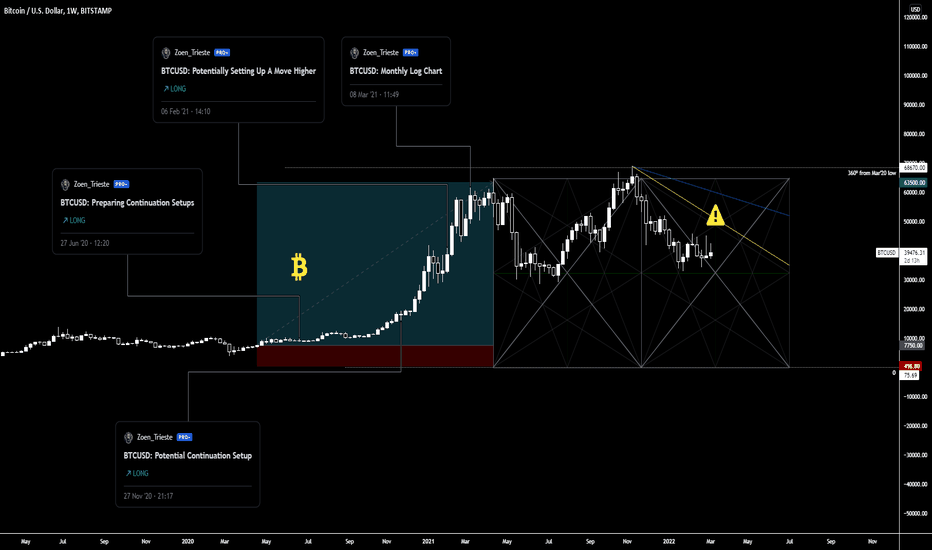

Zoen_Trieste

BTCUSD: Preparing Positional Long Entry

Since our last post, the BTCUSD market went through a corrective phase that brought the price to the mid20k level, the lowest price since the onset of the price discovery phase when the prior ATH was left behind with a bang. It is an exceptionally well-behaved market despite the turmoil that many other DeFi projects incl. stable coins have been going through. It seems reasonable to be looking for opportunities to add to long exposure in this market as the risk/reward is becoming more attractive. Key events/levels to look for clues: 25k bottom retest; 25k bottom retest +break = 7.5k extension lower; 17.5k - 22.5k as a major bottom. BTCUSD is at a very pivotal moment and opportunities always come with risk, do manage the risk accordingly. Staying tuned for further tells.Entry @ $17.59k, stop @ $2.758k, 6R target @ $106.582k. This is a positional trade that is expected to mature in 5 years time. No derivatives used, only spot purchase of bitcoin with subsequent storage in a cold wallet. Given the macro environment, massive volatility and downside is expected which necessitates the use of wider stop. No liquidation is possible as we are trading spot; nevertheless, we should always have a downside limit on price spread whenever entering any market.

Zoen_Trieste

BTCUSD: In Limbo

Here's a BTCUSD chart with prior ideas highlighted. After selling to close all of the BTC holdings @ $63.5k, I have been sitting on the sidelines and looking at what is happening in the market. So far, I do not have the urge to re-enter the market and will look for further downside to time my entry. An exceptional market that should be watched by everyone. Best of luck, fellow traders.

Zoen_Trieste

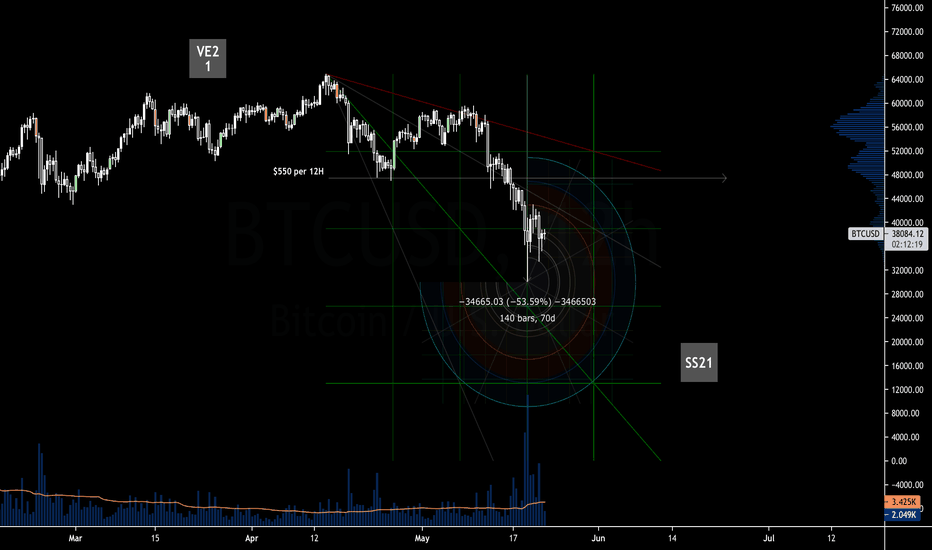

BTCUSD: Got it for 1/2 price?

Not long ago, BTC exchanged hands at levels above $60k, and now we are seeing it being offered half of that price. This massive decline is the perfect moment for the dip buyers to step in, but caution is advised as this range is new, and an extended chop is probable. I will try to update this once in a while. Let us see how it unfolds.update The likelihood of revisiting the 32k area is increasing.

Zoen_Trieste

DOGEUSD: Mapping the Next Bullish Wave

Further to the last idea on this pair, we are now mapping the next potential wave higher. This wave is very coveted and, consequently, has crippled probability; however, the fractal nature of the post-ATH correctional formation evidenced through the repetitive waves is indeed very fascinating and worth our attention. Enjoy!DOGEUSD, 12H Here's an update on this pair. A more compact representation; the timeframe is now 12H. We kept the same price to bar ratio while moving to higher timeframes.DOGEUSD, 72 If bulls are to take this higher, the time is now.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.