Wolfpips123

@t_Wolfpips123

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

قیمت بیت کوین در آستانه شکست؛ منتظر عبور از این مانع کلیدی باشید!

The chart highlights a rising support line guiding recent movement, while a horizontal zone near the top acts as a key barrier. If price continues respecting the upward structure, momentum may build once this upper level is cleared with strength.trades active nowprofits update

بیت کوین در آستانه انفجار: منتظر شکست حمایت یا مقاومت؟

Bitcoin is trading inside a descending channel and has recently formed support near the lower boundary of the structure. Price is currently attempting to recover toward the mid-range zone. A sustained break above the highlighted resistance area may indicate further bullish continuation, while the downside remains limited as long as price stays above the recent support. Market structure will become clearer once BTC chooses a direction beyond these levels.its time to trade active nowany update

تحلیل بیت کوین: آیا کف کانال نزولی بیت کوین شکسته میشود؟ (حرکت کوتاهمدت بعدی)

Bitcoin is moving inside a descending channel, with price testing the lower boundary again. The structure shows repeated swings between the channel levels, indicating short-term range behavior. A reaction from the lower zone could lead to a move toward the mid or upper range if momentum improves.trades activeso any update

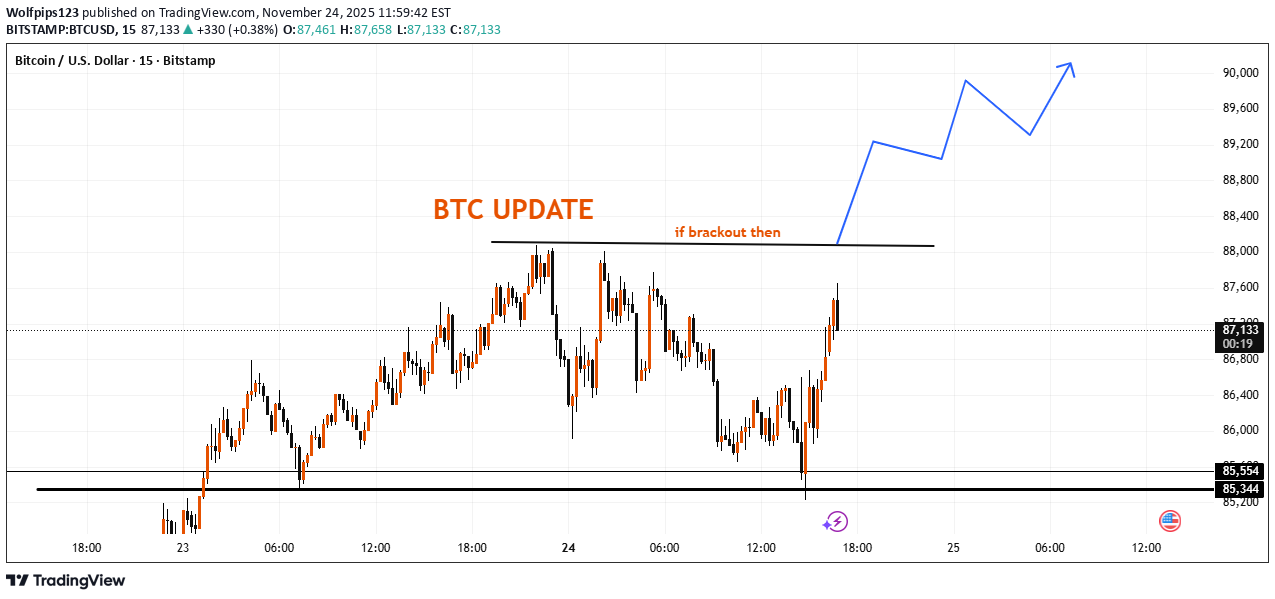

بیت کوین روی لبه پرتگاه: سطوح حیاتی 88,000 و نقشه راه صعودی تا 90,000

This chart highlights an important resistance zone around the 88,000 area. If price manages to move firmly above this level, the market may continue forming a higher-timeframe structure toward the 89,000–90,000 region. The lower zone near 85,300–85,550 remains a notable support area where previous reactions occurred. This outline is based purely on market structure and potential price behavior, not a trading instruction.its time to trade activetarget compleate

تحلیل بیت کوین امروز: سطوح حیاتی برای صعود یا سقوط (زیر 87,500 چه میشود؟)

Bitcoin is currently moving within an ascending structure, approaching a trendline that has acted as a reaction zone in recent candles. If price holds above the 87,500 area, the chart suggests the potential for continued upward momentum toward higher intraday levels. If the market slips below the 86,620 zone, it may indicate a shift toward lower support areas around 85,550–85,340, where the chart previously showed reactions. This update highlights the key zones to watch based on recent movement and overall short-term structure.its time to trade activesay something about btc

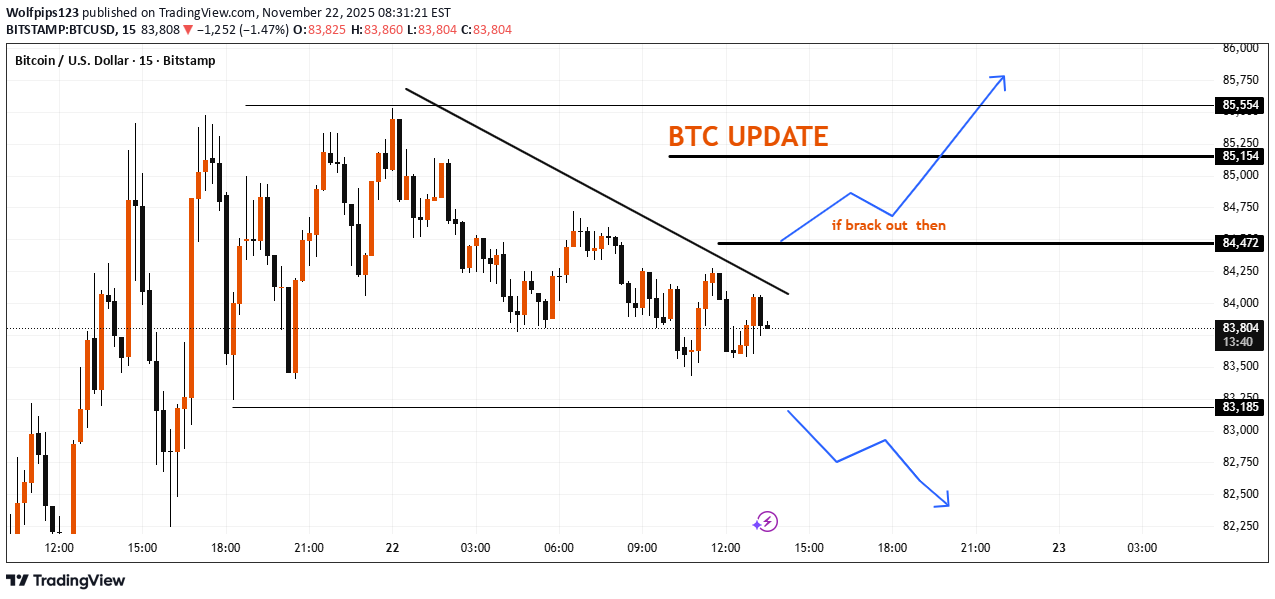

تحلیل ساختار بازار بیت کوین: سطوح حیاتی 84,000 و سناریوهای احتمالی صعود و نزول

Bitcoin is currently trading near the 84,000 zone while respecting a downward trendline on the 15-minute chart. Price is moving inside a short-term compression range. A clean break above the trendline and the 84,472 zone may indicate strength toward the next price areas around 85,154 and 85,554, where potential resistance levels exist. However, if the price fails to hold above the mid-range and moves below 83,185, it may show weakness toward the lower support area. This update highlights key structure levels so traders can observe how price reacts to each zone.its time to trade watch chartso what you diside

سطوح کلیدی بیت کوین: سطوح حمایت و مقاومت مهم و مسیرهای احتمالی قیمت BTC

Description (TradingView-Friendly) Bitcoin is currently trading between two important zones. Price is reacting near the lower support area around 88,406, while the upper boundary near 93,782 remains the major resistance. If the price moves above the upper zone with strong momentum, it could indicate a continuation toward higher levels. If the market fails to reclaim support and moves downward, it may extend the decline toward the lower region highlighted on the chart. This idea is for technical observation only and reflects possible scenarios based on structure and levels visible on the chart.i think all of proftsso now what you doing

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.