TurbaRex

@t_TurbaRex

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

TurbaRex

روانشناسی خریداران بازار: راز ماندن سنگین در موقعیتهای QQQ (QLD, TQQQ)

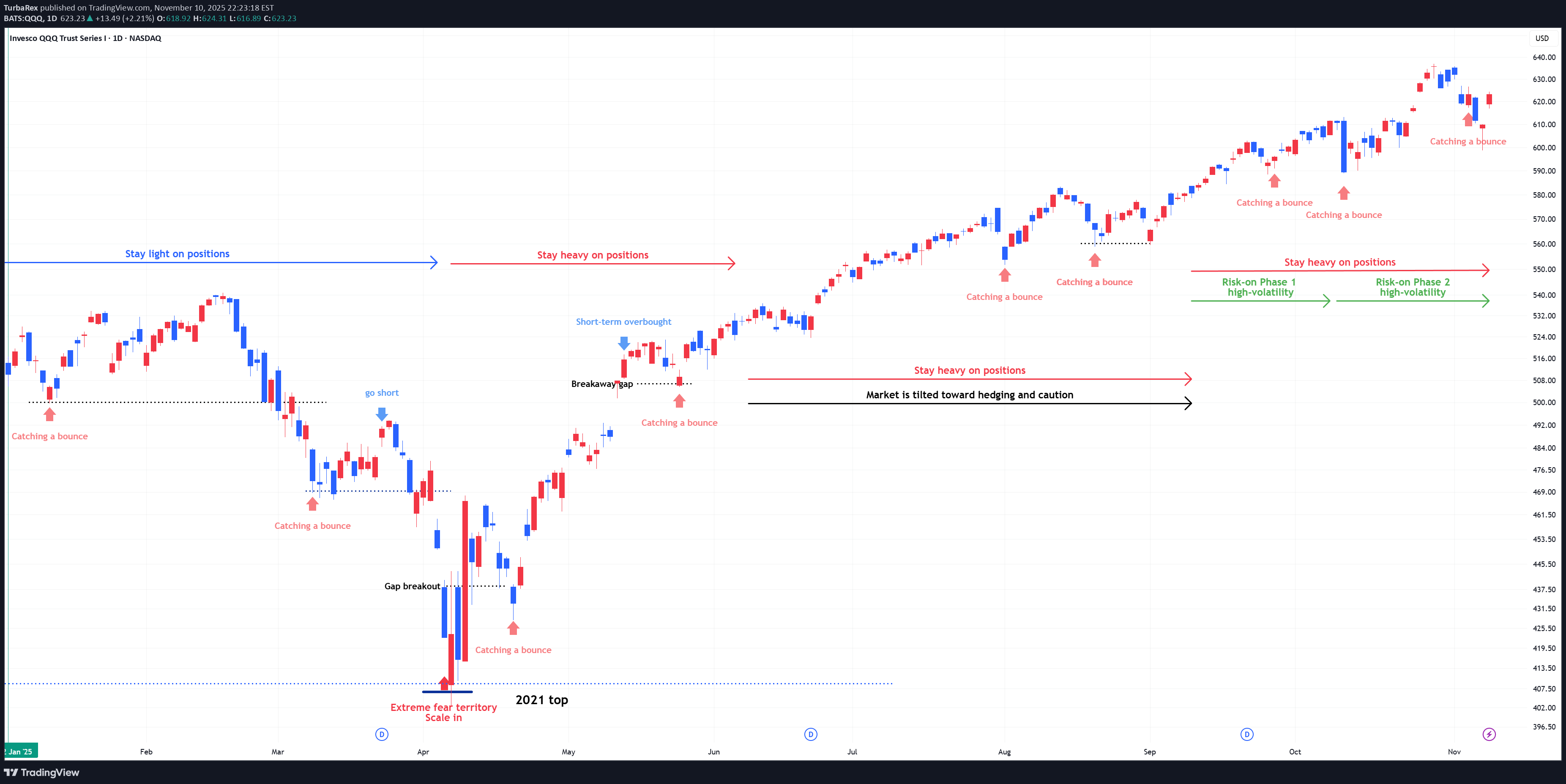

QQQ : Stay heavy on positions (QLD, TQQQ) Risk-on Phase 1, high-volatility zone Risk-on Phase 2, high-volatility zone. Critical Sensitivity Zone In stay light on positions zones, I hold QQQ and reduce exposure. In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ. ** This analysis is based solely on the quantification of crowd psychology. It does not incorporate price action, trading volume, or macroeconomic indicators.

TurbaRex

سیگنال خرید بیت کوین: چگونه با روانشناسی جمعیت، موقعیتهای سنگین (3X) بگیریم؟

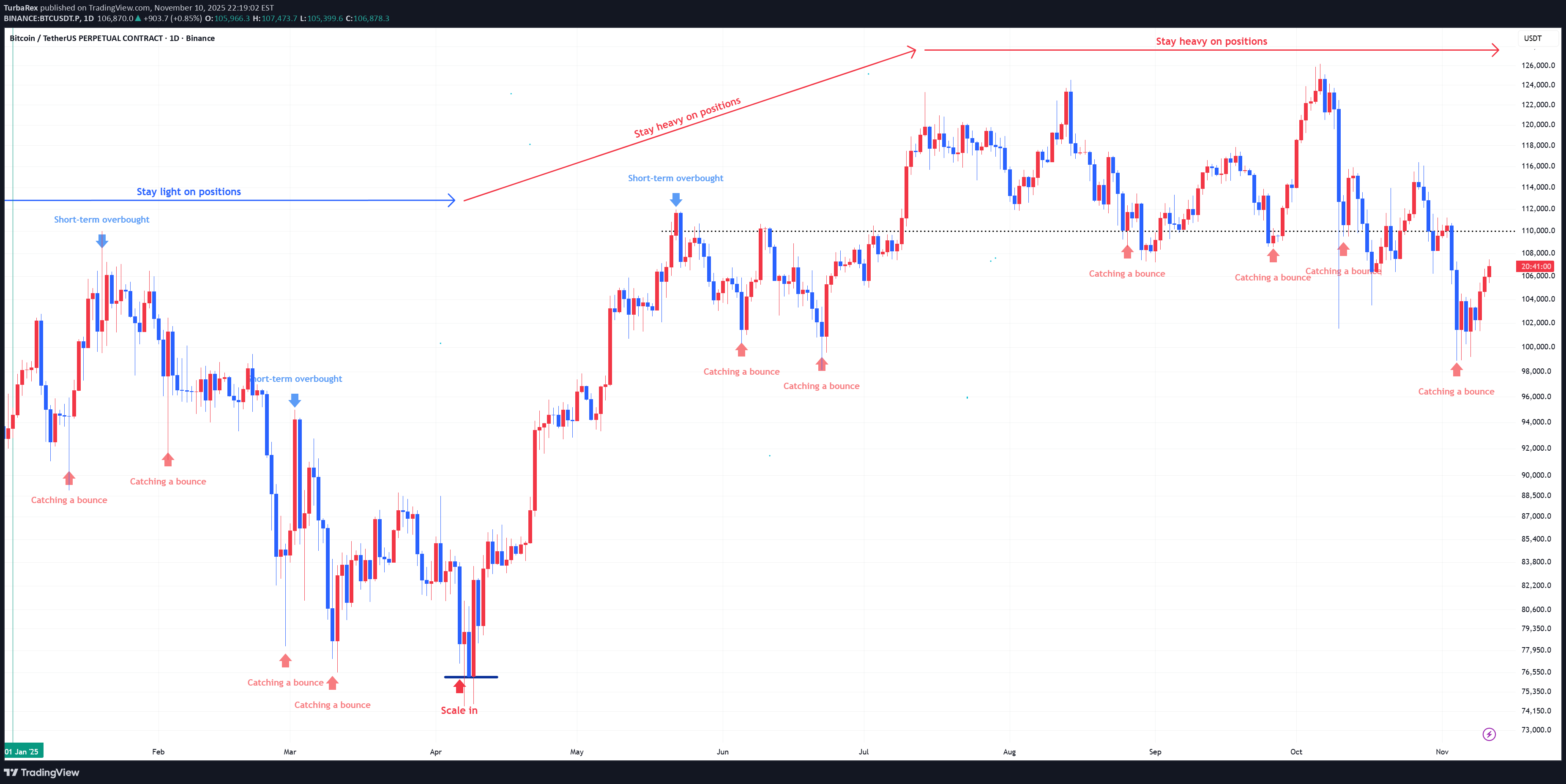

Bitcoin : Stay heavy on positions (3x) A signal for catching a bounce has emerged. Within 1–2 weeks after the bounce signal, leverage is reduced from 3x to 2x. ** This analysis is based solely on the quantification of crowd psychology. It does not incorporate price action, trading volume, or macroeconomic indicators.

TurbaRex

پیشبینی انفجاری بیت کوین: زمان سنگین کردن پوزیشنها با اهرم 3X!

Bitcoin : Stay heavy on positions (3x) A signal for catching a bounce has emerged. Within 1–2 weeks after the bounce signal, leverage is reduced from 3x to 2x. ** This analysis is based solely on the quantification of crowd psychology. It does not incorporate price action, trading volume, or macroeconomic indicators.

TurbaRex

هشدار هیجان بازار: استراتژی خرید سنگین QQQ با QLD و TQQQ (فقط روانشناسی)

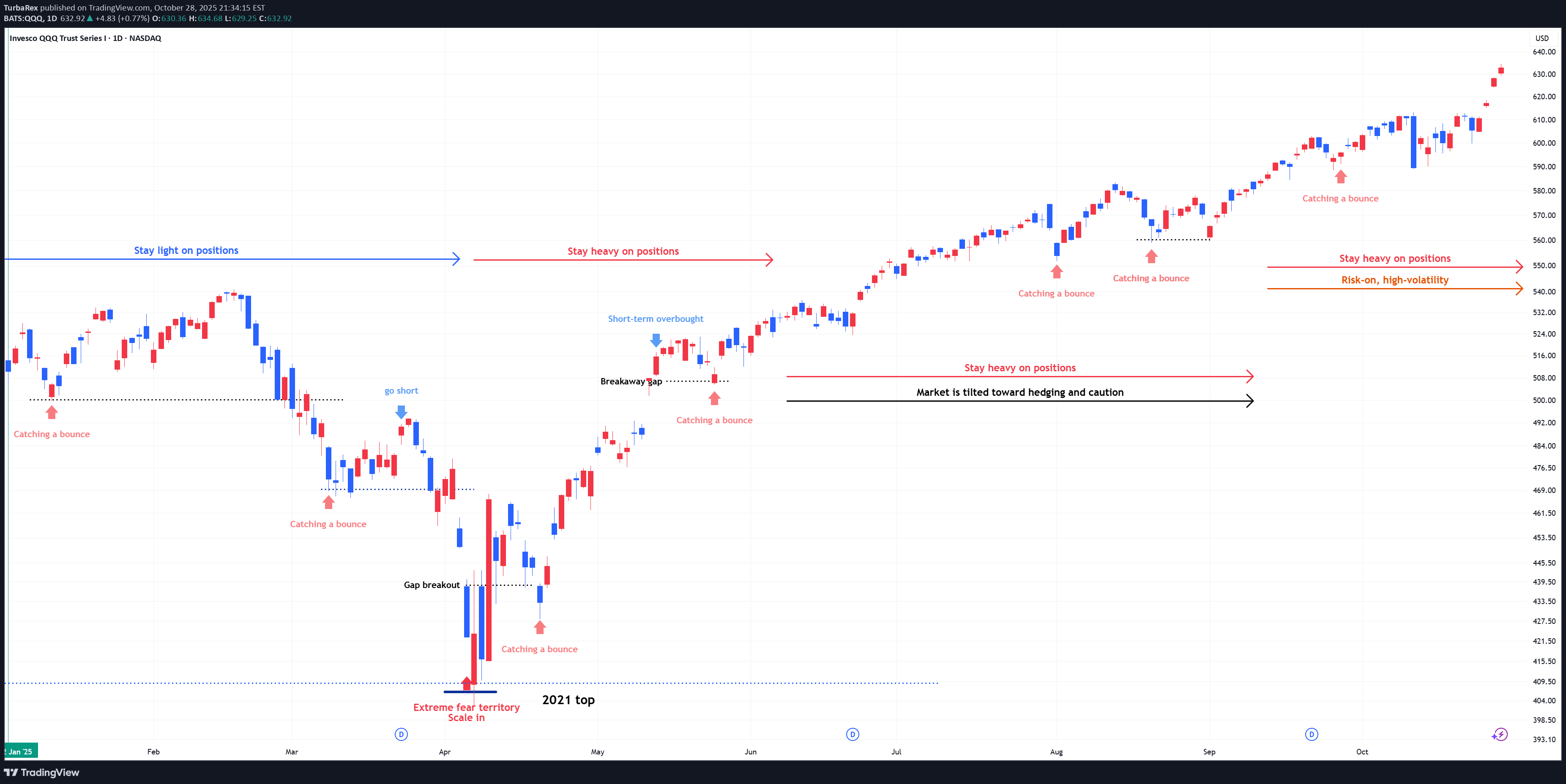

QQQ : Stay heavy on positions (QLD, TQQQ) Entering a risk-on, high-volatility zone. A signal for catching a bounce has emerged. In stay light on positions zones, I hold QQQ and reduce exposure. In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ. ** This analysis is based solely on the quantification of crowd psychology. It does not incorporate price action, trading volume, or macroeconomic indicators.

TurbaRex

بیت کوین: چرا باید سنگین روی پوزیشنهای خود بمانید؟ (بر اساس روانشناسی جمعی)

Bitcoin : Stay heavy on positions (3x) Maintaining the same outlook as before. ** This analysis is based solely on the quantification of crowd psychology. It does not incorporate price action, trading volume, or macroeconomic indicators.

TurbaRex

توصیه معاملاتی QQQ: چه زمانی سنگین روی موقعیتها (QLD, TQQQ) بمانیم؟

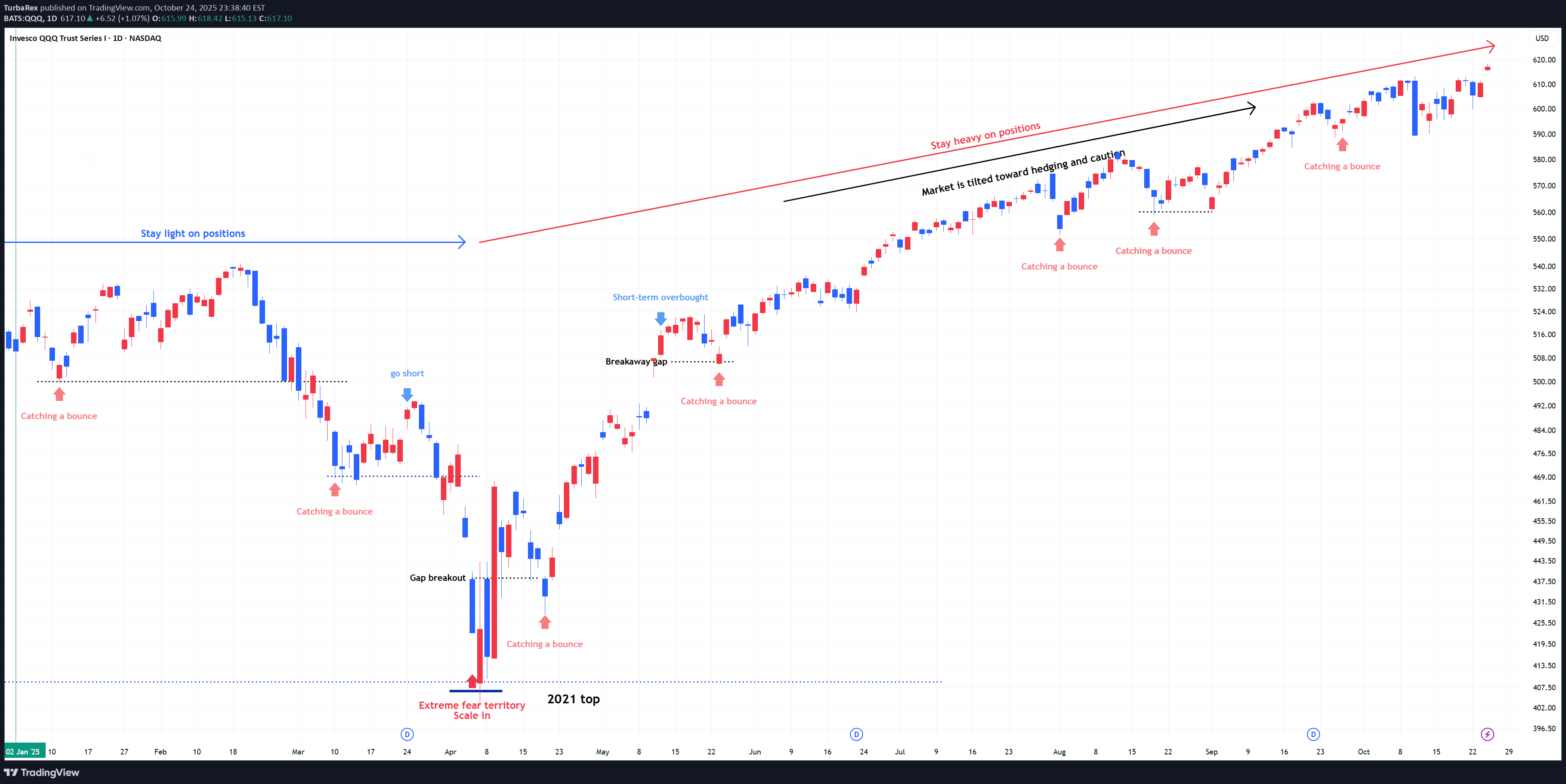

QQQ : Stay heavy on positions (QLD, TQQQ) Entering a risk-on, high-volatility zone. In stay light on positions zones, I hold QQQ and reduce exposure. In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ. ** This analysis is based solely on the quantification of crowd psychology. It does not incorporate price action, trading volume, or macroeconomic indicators.

TurbaRex

روانشناسی جمعی بیت کوین: چرا باید سنگین روی پوزیشنهای خود بمانید؟

Bitcoin : Stay heavy on positions (3x) Maintaining the same outlook as before. ** This analysis is based solely on the quantification of crowd psychology. It does not incorporate price action, trading volume, or macroeconomic indicators.

TurbaRex

افزایش سنگین سرمایه در QQQ: راز روانشناسی بازار برای سودآوری در مناطق پرنوسان

QQQ : Stay heavy on positions (QLD, TQQQ) Entering a risk-on, high-volatility zone. In stay light on positions zones, I hold QQQ and reduce exposure. In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ. ** This analysis is based solely on the quantification of crowd psychology. It does not incorporate price action, trading volume, or macroeconomic indicators.

TurbaRex

بیت کوین: راز حفظ موقعیتهای سنگین (فقط روانشناسی جمعی)

Bitcoin : Stay heavy on positions (3x) Maintaining the same outlook as before. ** This analysis is based solely on the quantification of crowd psychology. It does not incorporate price action, trading volume, or macroeconomic indicators.

TurbaRex

استراتژی معاملاتی QQQ: چطور با روانشناسی بازار، سنگینترین موقعیتها را بگیریم؟

QQQ : Stay heavy on positions (QLD, TQQQ) Entering a risk-on, high-volatility zone. In stay light on positions zones, I hold QQQ and reduce exposure. In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ. ** This analysis is based solely on the quantification of crowd psychology. It does not incorporate price action, trading volume, or macroeconomic indicators.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.