Trainwreck

@t_Trainwreck

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Trainwreck

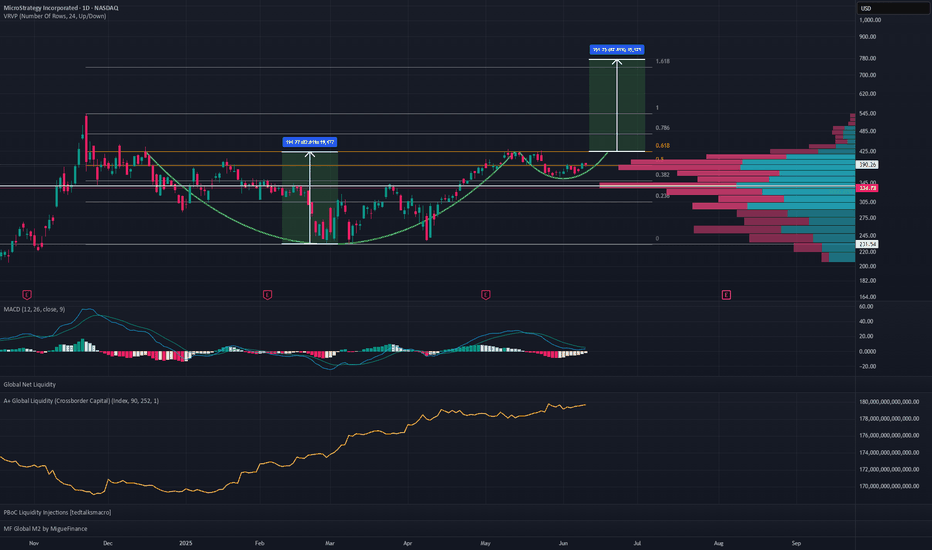

MSTR Long Idea

IF Bitcoin breaks new ATH next few weeks, MSTR cup and handle impossible to ignore with a target of 1.618 fibonacci extension as target 1...... Moonboi thoughts.

Trainwreck

Bitcoin Santa Rally

My view for year-end rally in Bitcoin is based on seasonal and global liquidity (GLI) My projection for the Treasury General Account (TGA) is an increase from $740B today to a peak of $880B on 12/17 (which will be negative for Bitcoin and assets) and then a decrease (positive liquidity) of $200+ Billion down to a low of $630B on 1/10. This will be the window to buy a dip IMO. These figures do not take into account any additional reduction from the debt ceiling being reinstated on 1/1... which could add additional liquidity not accounted for as it is an unknown. That said, the debt ceiling debate is less of a factor now that we had a red sweep in the elections and the republicans control the votes, thus unlikely to be much of a "debate"... Simple but my view.One more thing... the pullback could already be in so I am not providing an entry point. This is more of a comment on a Santa rally being realized or not.Narrator: the pullback was NOT in and the target is now hit

Trainwreck

Bitcoin Volatility Coming

September rate cut is now consensus.. what is lost on most is that rate cuts are not bullish outside the blowoff top that comes from retail thinking they are. 2008 GFC rate cut cycle: in July 2007 the Fed cut rates for the first time after a hiking cycle similar to the one we are in currently. The S&P dropped 7%, then went on to make a new ATH 105 days later (blow off top) and immediately started a 60% move down. Fed funds rate was 0.18% 525 days later and the GFC bottomed after 616 days from the original rate cut. Twas not bullish. Bitcoin price direction squiggles: Green = bearish Gold = bullish Tapping the trend line in a black swan at the Fibonacci golden ratio zone (50 to 618) makes a lot of sense, the only question is will we be above $74K at time of the first cut or will we still be in this range. No matter what major volatility is coming between Sept-Jan. This might seem like a short but no matter what happens the price of Bitcoin will be going up forever and trying to time the lows is pointless when you can just buy at any time and on a long enough time horizon you will be up based on this trend line and fiat expanding forever. Buy the dips or buy the rips... as long as it is a buy who cares?

Trainwreck

Trainwreck

#Bitcoin Pullback Welcome

It is time to ask yourself if you are a trader or a HODL'er of #Bitcoin I know I get more engagement with bullish posts but BTC is up 200% over a very short period (13.5 months) and I did post entries as low as $17,000.. and called buying dips all the way to 42K Bitcoin could easily continue up to new ATH right now... but a pullback here is VERY likely based on a plethora of indicators and TA: - Fibonacci Golden Zone (0.50-0.618 hit) - Halving cycle PA (price always dumps around the halving date) - The distance from moving averages crossing - Macro environment - Liquidity constraint levels coming (Reverse Repo to be drained to zero and BTFP supposedly ends for banks free money printer in March) So if you just DCA spot Bitcoin and sleep like a baby at night.. good for you! HODL and ignore this post. Long term going to the moon. However, If you are here trying to buy low and sell high, this is an area to take profit, not hope for 300% gains. All of that said, I am not shorting Bitcoin... this is a pullback post. I think all markets will struggle up to end of Q1 with a massive dump around March when RRP is fully drained. We shall see.;

Trainwreck

Bitcoin Correction Ending? BTFD Perhaps

Bitcoin is slowly bleeding under short-term and long-term moving averages while looking like it is about to break the bullish market structure. IMO this is a simple healthy correction after an 85% move up off the low year to date. While everyone is saying Bitcoin is dead and sentiment goes into the toilet on crypto Twitter I look for entry positions based on level-to-level and timeline. PRICE ACTION: This long idea is set for price bouncing off the mid-term moving average (50 Week MA) with a capitulation candle and immediate reaction to reject prices at the lower level. I would be just as excited to get the same reaction further down into the Fibonacci golden zone. TIMELINE: Regarding timeline, I would be looking at week of September 11 for $21,500 to $23,000 level and will follow the long-term tend line for rising price entry levels. IE following week the lowest price moves up $500. I would chase this a bit all the way to the safest entry in October, where the up-trending line meets the down-trending line, right at the golden zone. INDICATORS: The main indicators I am looking at right now are global liquidity (in orange bottom pane) which is holding a pivotal position of QE helicopter money, CMF which is trending to flip bullish again next week, and OBV which is also starting to show some strength again. BEYOND TA: All of this said... we are 23-26 weeks from the 4th Bitcoin halving (depending on consistency of hash rate) and what that means to me is that dips are for buying unless $20k breaks with conviction due to a black swan even, which is not high on my percentage chance base case at this point.

Trainwreck

Bitcoin Long Potential

A ton of MACRO factors to consider but strictly price action for Bitcoin, you cannot ignore the 200 day moving average, Bollinger Band tightest since 2013, and key levels needing retest for entries. That said, I am looking to get long and hoping to catch some dips here but would end up chasing if price goes bananas from here. On the MACRO front, global liquidity is flat while US domestic liquidity has been doing amazing with the RRP drain VS the liquidity drain via US Treasury.

Trainwreck

#Bitcoin wait & see

Moment of truth for Bitcoin to react to the 200 day moving average - what I would like to see is a healthy retrace to key level and shorter term MA's before challenging the 200 MA for real. My base case is the low is NOT in yet for 2023 and there will be a black swan lower but until that news event, Bitcoin is building steam and has already made it much further than I expected and have called for on this pump. The trend is defiantly up right now so if it breaks the 200MA all lower bets are certainly off but the good news is the levels are extremely clear and stops are easy to place to avoid liquidity stop hunts. I will long the break of 200MA I will long the retrace and defend I will short the break of MA's and key level I will continue to degen leverage trade shitcoins dependent on Bitcoin telling the crypto market when to jump and how high

Trainwreck

Bitcoin Long VS Dollar pullback

Easy idea... Long against the DXY pullback... should we not get it then i'm out before stops but thinking 28-30k and or 200 day MA easy targets if it can get above trend lines. DXY could easily make another pop to around 114.40 IMO but that would be the top for me... that is my line in the sand to remain in long positions: BTC MARA ARBK BTCM ZIMWell that was an amazing call haha $1000 pump in last 24 hours BUT DXY pumping this morning and BTC pulling back. looking at LTF for getting out and looks like the 4hr could turn into a nice bull flag unless we lose the MA sitting around $19950-$20000 so lose that and I would be getting out of this one in profit.

Trainwreck

No WWIII Long Idea

Simple long idea.. if WWIII starts this idea will be void haha Dips into the weekly 200 MA and daily levels outlined are buying opportunities as far as I am concerned. My thoughts on the FED Pivot are well outlined if you are interested and the chart with targets goes hand/hand.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.