Trading-Capital

@t_Trading-Capital

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Trading-Capital

Trading-Capital

آیا بازار گاوی طلا به پایان رسید؟ سه دلیل سقوط امروز قیمت طلا

Gold has fallen yet again today. Busting through some major technical support. Gold is falling for 3 main reasons; 1. Trump / XI (USA vs China) meeting is expecting positive negotiations. 2. Mega Cap Tech Earnings: markets love to chase tech higher. 3. FOMC rate cut expectations. We believe gold had a strong chance at retesting the daily 200 MA. Picked up some GLD calls today.

Trading-Capital

آیا کف بازار کریپتو مشخص شد؟ تحلیل چرخهای قیمت بیت کوین

BTC has swept some key areas and looking to form a bottom. Back testing a key break out area. We technically pierced the daily 200 MA a few days ago but never confirmed below the key area. The near term chart looks like we should maintain a positive bounce back to 111,500. We need to be mindful that the last failed double top breakout that occurred in dec 2024 / Jan 2025 - we saw a 30% decline from peak to trough. As long as the crypto market cap remains above the weekly chart neckline - a bull upside target can be calculated. We nibbles on some MSTR shares on Friday. These crypto positions need to be monitored closely.

Trading-Capital

تحقیق SEC از اپلوین: آیا نوبت رابینهود است؟ (سقوط سنگین پس از خبر ناگوار)

APP fell sharply intraday today after announcement came late into the session about an SEC probe into the company. The SEC loves to do this with new S&P500 stocks. Applovin was one of the strongest stocks in the market recently and its finally been knocked back down to earth. You have to wonder if HOOD will be the next SEC probe. Robinhoods controversial NFL prediction markets could a big controversy.

Trading-Capital

We discuss the technical obseravtion in the SPX / SPY. Why was IWM so weak today? What is happening with inflation & why are yields rallying? Are tensions with Russia escalating? Today we closed IWM 241 puts for 150% gain. We took profits on many other short ideas & entered several new trades today. Caution needs to be warranted since the Dollar and oil are rallying.CORE PCE COMES IN HOT 2.6% GDP COMES IN HOT 3.8% INITIAL JOBLESS CLAIMS COME IN BETTER THAN EXPECTED. 218K ALL THIS DATA SUGGEST INFLATIONAR NEAR TERM PRESSURES. BOND MARKET CONFIRMED THAT TODAY.

Trading-Capital

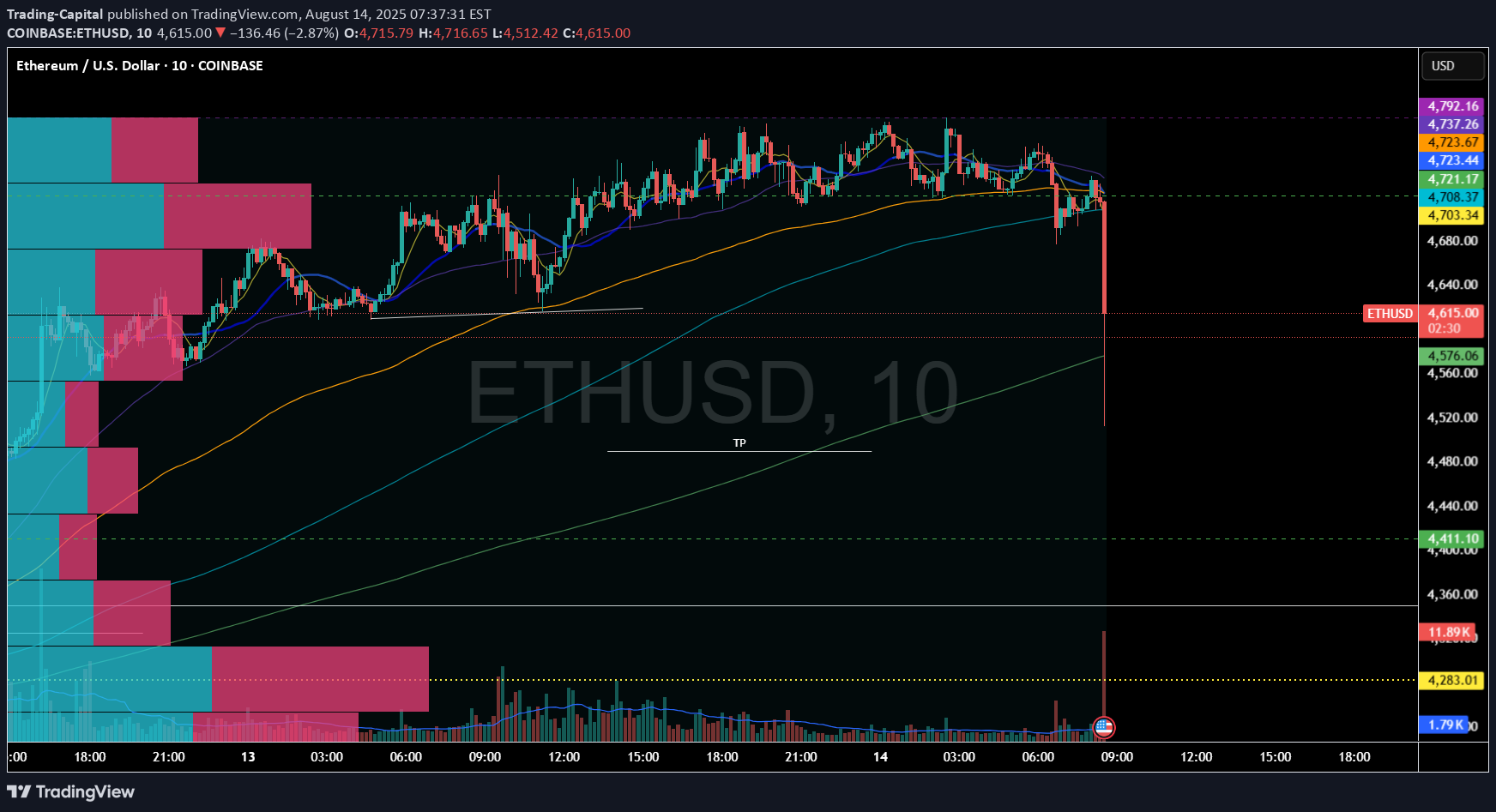

The total crypto market cap is retesting $4 trillion. We are now looking much more bullish on a technical basis across Ethereum & Bitcoin. We may have had a failed breakdown in the Total Crypto market cap, which could provide the additional liquidity for another surge. Recapturing Key Daily 7 & 20 MA's is a very positive sign. Although still being net short BTC & ETH - I now have breakeven stop losses in place. Ethereum chart is looking very explosive like it could have a move to $5500 ETH recently has defended a massive volume shelf which is a very bullish sign. Keep on your radar: BMNR / SBET / MSTR / COIN / MARA

Trading-Capital

SPX has triggered 2 larger bullish patterns. Both patterns result in higher price. Despite the weakness in NVDA the markets have shrugged off the decline. We are trading into new all time highs so price discovery mode is in a effect. When you have no resistance pivots or volume to trade against at new all time highs you really have to be careful if you're shorting the market. Volume trends. extension moves, ATR, deviations should all be included in your analysis to define upside target zones. We continue to remain net long the markets with key shorts in place.

Trading-Capital

Gold has been in a raging bull market and almost up over 100% since its monthly bullish engulfing candle. Gold sniffing out week monetary policy and rallying on the back of easing global monetary policy. Historically from a trading standpoint, Gold is extremely overbought and could be 4-8 weeks away from a considerable pullback of 15-30% . Many Signals such as symmetrical moves, Monthly overbought RSI, Copper / Gold Divergence, GDX resistance is telling us to use caution and trim long profits. It does seem like gold wants $3500 before it has a reversal back down. We are looking for a liquidity sweep of the ATH as a possible short zone. (Not FA advice) Once gold resets some indicators and allows longer term moving average to catch up it will likely keep pushing but we only for see that in mid to late 2026. If we make a new high....we don't see much upside for the next 3-6 months.

Trading-Capital

Today the markets were shattered by weakness in mega cap tech. All major leading companies in the QQQ were severely down. We saw the majority of the S&P 500 sectors green with health care leading the charge. Despite all indices closing negative this was not a full fledge market sell. Commodities were hit across the board. Gold, Nat gas, Oil, Uranium, Silver were all down. It seems the market is de risking into J Powell Jackson Hole meeting on Thursday / Friday. Today we closed out MSFT PLTR short & trimmed MSOS puts for over 105% We were very active on the option and swing trading side of the market.

Trading-Capital

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.