Trade_and_Chill-

@t_Trade_and_Chill-

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Bitcoin at a Crossroads: Pause or Next Breakout?

Bitcoin is currently moving through a sideways corrective phase after failing to hold its previous peak. This shift is not driven by a single factor, but rather by a combination of capital flows, market psychology, and profit-taking at the late stage of a short-term rally. From a flow perspective, several institutions and companies that previously showed strong support for Bitcoin have slowed or paused their buying activity, signaling caution after the rapid price appreciation. This has created short-term psychological pressure, especially for short-term traders and the derivatives market. On the other hand, long-term institutional demand has not disappeared. Some large funds and corporations continue to accumulate BTC during pullbacks, indicating that confidence in the long-term bullish thesis remains intact. This is a key reason why Bitcoin is not collapsing, but instead undergoing a controlled correction. On the macro side, the broader crypto market is still influenced by interest rate expectations and global liquidity conditions. As long as expectations for monetary easing remain on the table, Bitcoin continues to be viewed as a long-term alternative asset, even if short-term volatility persists. From a market structure standpoint, recent declines appear to be corrective rather than a trend reversal. Price action is actively flushing out FOMO positions and rebalancing supply and demand before a clearer directional move emerges. At this stage, BTCUSDT is not in a straight-line bull run, but there is also no clear signal that the long-term uptrend is over. This is a market that rewards patience. Both primary scenarios shown on the chart remain valid, and a breakout in either direction would present a strong opportunity. I lean toward the bullish scenario—what’s your view?

Latest Gold Price Update Today

Hello everyone, let’s take a look at today’s gold price. XAU/USD fell more than 4% from its all-time high at 4,555 USD, marking its weakest performance in several months, largely due to thin trading volumes on Monday. However, buyers returned aggressively on Tuesday, with the rebound largely driven by dip-buying activity following the sharp sell-off. At the moment, the pair is attempting to recover from the 4,300 USD area, supported by a more cautious market sentiment on Tuesday as geopolitical tensions continue to escalate. As long as this support level holds, buyers remain in control. On the other hand, if it fails, waiting for opportunities at lower levels would be a safer approach. What’s your view on the current XAUUSD trend?

Altında Sert Düzeltme Sonrası Kritik Dönem

29/12 kapanışında altın fiyatı 201 USD’lik sert bir düşüşle 4.331 USD seviyesine geriledi. 30/12 seansında ise fiyatlar 4.350 USD civarında sınırlı bir toparlanma gösteriyor. Geçtiğimiz hafta sonunda 4.548 USD ile yeni bir zirve kaydeden altın, bu seviyelerde kalıcı olamadı. Yıl sonuna yaklaşılırken piyasada görülen yoğun kâr realizasyonu ve kısa vadeli vadeli işlem pozisyonlarının kapatılması, geri çekilmenin ana nedenleri arasında öne çıkıyor. Şu ana kadar grafiklerdeki dalgalanmalar kontrol altında kalsa da, satış baskısının bugün ve yarın da devam etme ihtimali bulunuyor. Özellikle mevcut fiyat kanalının aşağı yönlü kırılması durumunda, oynaklık belirgin şekilde artabilir. Önümüzdeki günlerde güçlü bir toparlanma yaşanması halinde, bugünkü dip seviye mevcut yükseliş trendi içinde yeni bir tepki dibi olarak değerlendirilebilir. Bu nedenle, önümüzdeki iki işlem günü, altının önümüzdeki haftalardaki yönünü belirlemede kritik rol oynayabilir. Teknik açıdan, Şubat vadeli altın kontratlarında alıcıların bir sonraki hedefi 4.548 USD seviyesindeki güçlü direncin aşılmasıdır. Satıcılar için kısa vadeli ana hedef ise fiyatı 4.200 USD altındaki güçlü teknik desteğin altına çekmektir. Peki sizce XAUUSD bundan sonra nasıl bir yön izleyecek? Görüşlerinizi paylaşmayı unutmayın.

Gold Drops More Than 200 USD

At the close of trading on December 29, gold plunged 201 USD to 4,331 USD. In the following session on December 30, prices edged slightly higher to around 4,350 USD. The precious metal had set a new peak late last week at 4,548 USD, but the rally was quickly reversed. This move is largely attributed to aggressive profit-taking and year-end liquidation by short-term futures traders. So far, although gold has shown some short-term volatility on the chart, the magnitude remains manageable. However, strong selling pressure may persist today and tomorrow, potentially leading to more significant price swings—especially if the current price channel is decisively broken. If gold rebounds sharply in the coming days, today’s low could become the latest reaction low within the broader uptrend. In other words, price action over the next two sessions will be critical in determining gold’s direction in the weeks ahead. From a technical standpoint, the next upside objective for February gold futures bulls is a break above the strong resistance at the record high of 4,548 USD. On the downside, bears are aiming to push prices below the key technical support at 4,200 USD. What’s your view on where XAUUSD is heading next? Share your thoughts in the comments.

Gold Holds Firm as Markets Reassess Momentum

XAUUSD is trading around 4,500 USD per ounce, easing slightly from recent highs after an extended rally. The current price action reflects a short-term technical consolidation, as traders lock in profits following the establishment of new record levels. The recent surge in gold has been driven by a combination of key macroeconomic factors. Geopolitical tensions remain elevated, particularly in the Middle East, while developments surrounding energy sanctions and trade flows in the Americas have increased risk aversion. These conditions continue to channel capital into gold as a preferred safe-haven asset. At the same time, expectations of looser monetary policy remain a critical pillar of support. Recent U.S. economic data point to slowing growth, moderating inflation, and a softer labor market, reinforcing the view that the Federal Reserve could begin an interest-rate cutting cycle next year. This environment reduces the opportunity cost of holding gold. From a technical standpoint, gold has broken above multiple consolidation zones and is now holding above a strong high-price base, suggesting that selling pressure remains limited. As long as key support levels are respected, the current pullback is viewed as constructive rather than trend-changing. In the near term, gold may continue to move sideways while the market awaits fresh catalysts. However, with persistent geopolitical risks and expectations of lower interest rates, the medium-term outlook remains constructive, leaving the door open for another upside extension once buying momentum returns.

Gold Continues to Maintain Its Bullish Streak Into Year-End

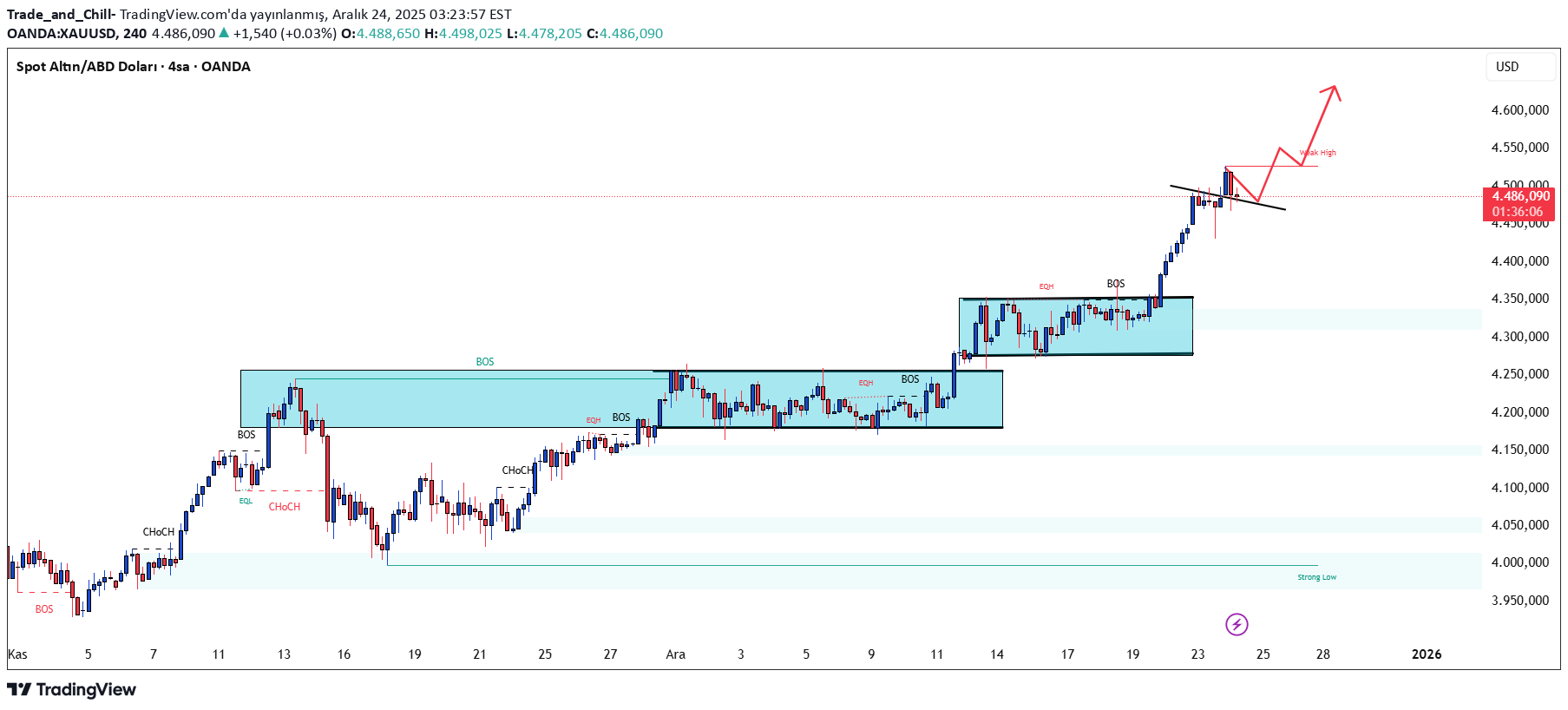

Hello everyone, Today, XAUUSD is taking a pause during the Christmas holiday period, currently trading around 4,479 USD. Although slightly lower than the previous session, gold continues to hold a strong high-price base after a powerful rally, driven by rising safe-haven flows, escalating geopolitical tensions, and expectations that the Fed may cut interest rates in 2026. On the chart, price has broken out of the previous sideways range and formed a clear bullish structure. At the moment, gold is consolidating within the 4,450–4,525 range, with 4,520–4,525 acting as the nearest resistance (weak high)—a zone where liquidity may be drawn before the market commits to its next direction. From a scenario perspective, as long as price holds above key support, any pullbacks are considered healthy, and the uptrend remains dominant. A decisive break above 4,525 could open the door toward 4,600 USD and beyond, especially if supportive factors such as low interest rates and ongoing geopolitical risks persist. The preferred strategy at this stage remains buy-biased, focusing on patience, confirmation-based entries, trading in line with the trend, and avoiding FOMO. What’s your view on the current XAUUSD trend? Feel free to leave a comment. Wishing you a peaceful and joyful Christmas!

Küresel Belirsizlik Ortamında Altın Güçleniyor

Herkese merhaba, Altın fiyatları yükselişini sürdürerek sabah işlemlerinde 4.505 USD seviyesine kadar çıktı ve yeni bir rekor kırdı. Bu yükseliş, İsrail–İran çatışması ile ABD–Venezuela arasındaki artan gerilimler nedeniyle güvenli liman talebinin güçlenmesiyle destekleniyor. Aynı zamanda, ABD’de enflasyonun yavaşlaması ve zayıf istihdam verileri, piyasanın gelecek yıl Fed’den birden fazla faiz indirimi beklemesine yol açıyor. Daha gevşek bir para politikası ortamı, altın için önemli bir destek unsuru olmaya devam ediyor. Teknik açıdan bakıldığında, görünüm hâlâ güçlü. 4.470 USD seviyesi kısa vadede önemli bir destek konumunda. Fiyat bu seviyenin üzerinde kaldığı sürece, kısa vadeli geri çekilmeler sağlıklı düzeltmeler olarak değerlendirilirken, yükseliş trendi yeni zirveler hedeflemeye devam ediyor.

Gold Reaches Fresh Record Highs

Hello my friends, Gold prices continue to surge, reaching a record high around 4,505 USD during this morning’s trading session. The precious metal is being driven higher by rising safe-haven demand as the Israel–Iran conflict and escalating tensions between the United States and Venezuela fuel geopolitical uncertainty. In addition, recently subdued U.S. inflation and weak labor market reports have increased market expectations for at least two 25-basis-point rate cuts from the Federal Reserve next year, a backdrop that is clearly supportive for gold. From a technical perspective, there are no signs of weakness in gold. The nearest support stands around 4,470 USD. As long as prices remain above this level, any short-term pullbacks are considered healthy, and buyers retain the upper hand until a new high is formed.

طلا به قله تاریخی جدید رسید: رمزگشایی از دلایل جهش قیمت و پیشبینی آینده

Hello everyone, let’s take a look at XAUUSD today. Gold continues its strong rally, trading around 4,480 USD, up more than 111 USD compared to the same time yesterday. Notably, this marks a new all-time high, decisively breaking above the previous peak. The sharp rise is driven by surging safe-haven demand at the start of a shortened trading week due to holidays, amid escalating geopolitical tensions. Gold gained further momentum after weekend reports that the United States is pursuing a third oil tanker near Venezuela. According to a U.S. official, President Trump has intensified oil sanctions against the government of Nicolás Maduro. Bloomberg reported that the tanker being pursued was operating under a false flag and is subject to a court seizure order, believed to be the Bella 1, a Panama-flagged vessel sanctioned by the U.S. These actions follow earlier incidents in which the U.S. military boarded the supertanker Centuries and previously the vessel Skipper. The blockade appears to be pressuring Venezuela’s oil storage capacity and could lead to production declines and broader civil instability. From a technical perspective, the next upside target for February gold futures bulls is a break above the strong resistance at 4,500 USD per ounce. Initial support is seen at 4,400 USD, followed by the overnight low at 4,365 USD. I remain bullish on gold—what’s your view?

Gold Maintains Its Uptrend

Hello everyone, what’s your view on today’s global gold price? Gold is rebounding above 4,350 USD early in the session, supported by escalating geopolitical tensions. The Israel–Iran conflict, along with developments involving the U.S. and Venezuela, is driving investors toward gold as a safe-haven asset. At this stage, the bullish trend remains intact. The 4,400 USD level has been reached for the first time and successfully closed in the short term. As no new peak has yet been firmly established, the upside bias continues to dominate. Do you agree with this outlook?

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.