TradeWithAtemak

@t_TradeWithAtemak

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

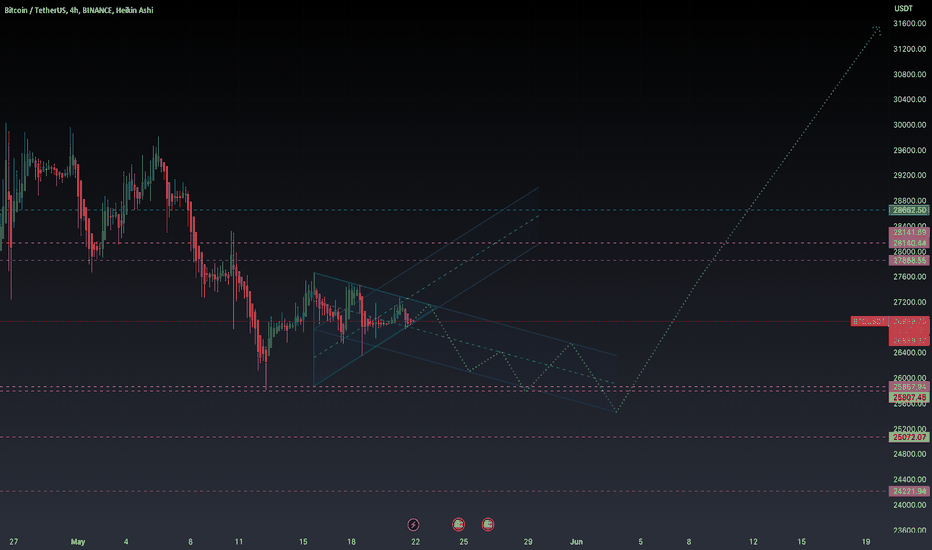

Bitcoin's Navigating a Potential Bounce at 27400

Bitcoin's Navigating a Potential Bounce at 27400 My previous posts were showing the scenarios of a fall to 29500 then 28500 then 25000. So we are on the 25K side, and I told we will need a further analyse to know what to expect. so here is a speculative first analysis: From my humble perspective, I'd say bears took the command since last week, I can see that from my weekly chart finally. So I doubt we will see price reaching or ranging around 30K yet. Much like a diver who propels skyward before their exhilarating plunge, Bitcoin's trajectory seems to echo this pattern. Anticipate an upward bounce toward the resistance level of 27,400, akin to the diver's swift climb. After reaching 27,400, we may see a fall to a range of 20,000 to 22,000. Time will tell. Don't take my work for granted, do your own analysis, analyze again then take your own decision to trade or not.

BTC: Tired bulls against raging bears

BTC: Tired bulls against raging bears The 30K psychological range was strong, since price orbited for days around it, as you've seen. But Bitcoin's price has recently started to decline, primarily due to the impact of the violet line on the ascending price candles. This impact can be seen as a signal to the bulls that they have hit a resistance level and should exercise caution. While it is not always the case, many times when the violet line touches the price, it triggers a reversal. In my previous post, I estimated this "impact" to occur around 31,200. However, it actually happened at a lower price two hours ago, as indicated on the chart. Based on current conditions, I don't anticipate the price reaching or surpassing 31,500 in the near future. Consequently, I am currently adopting a short position in my approach, but I am waiting for the price to fall below the WHITE "stairs" line twice to confirm this short scenario. There was a fakeout crossing of the red and blue lines, which should have occurred but didn't. This indicates that the bears have enough strength locally, particularly within the 1-hour period. My short-term forecast remains the same as in my previous post: the price is likely to drop to 29,500 and linger there momentarily before further descending to the range of 28,000-28,500. Around the 28,000 mark, we will need to conduct another analysis to determine if the price is inclined to go as low as 25,000 or even lower, or if it will rebound instead. Please do not rely solely on my words. Conduct your own thorough analysis, re-analyze the data, and make your own decisions. Trading is a challenging endeavor that requires careful consideration. Best regards, Atémak

BTCUSD up 31.2K then down

BTCUSD up 31.2K then down In this analysis, I've identified a significant moving average (MA) crossover, indicated by the red and blue lines crossing. Historically, such crossovers often lead to price increases. Additionally, I've included a violet line which I believe acts as a catalyst for a downward movement. Once the violet line touches a candle, I anticipate the end of the upward move and the beginning of a substantial price decline. I hadn't previously considered this scenario as I was focused on other indicators and patterns. Based on my analysis, I foresee the following scenario over the comind days: Initially, the price will rise following the crossover of the red and blue lines. The price will continue to climb until the violet line interacts with a candle. Subsequently, a significant price drop is expected, targeting approximately 29500 initially, followed by around 28500. After reaching around 28K, there will be some uncertainty, necessitating a new analysis as the price may potentially drop back to 25K. Although I maintain a bullish stance, I believe a correction is imminent, as mentioned in my previous post. Currently, there appears to be a buying opportunity until the take profit (TP) level of 31200. it's not finished yet for the bulls on a high perspective. I don't think we will see an enormous price drop (below 25K), since we are still in a bullish phase anyway, which needs a correction. Remember, trading can be challenging, so conduct your own analysis and do not solely rely on my words. Stay cautious and take care. Atémak

Bitcoin's Psychological 30K: Uncertainty and Potential

Bitcoin's Psychological 30K: Uncertainty and Potential Bitcoin has reached the psychological barrier of 30K, likely triggering a temporary pullback to around 28K. At 28K, uncertainty arises: a strong climb to 32K is expected if bullish momentum persists, while falling below 28K could test the 25,800 support level. On the Weekly, the scenario is still bullish though, but starts to weak a bit. PS: I'm happy to see that the price didn't fall under the 25K support, and climbed as stated in my previous posts. But for now, I would say there is a little slowdown in the bull movement. I hope it is just local and temporary. We need extra candles to be more sure of the bullish strength, if it will last or not (even if there was the sudden surge which reached 30K). My bullish goal is 49K, but it's really far from now.

Correction Drop to 25k followed by a Bullish Surge

Correction Drop to 25k followed by a Bullish Surge BTCUSDT may see a brief dip to the 25K support level before potentially surging towards 49K. The bullish move is still active on the weekly chart (from a previous post I've did). So I don't think it will go below the 25K level, since the bullish power is still strong. This is for me a correction before a realy move to the top The 25000-25800 range can be an ideal zone for a BUY.

Next major levels : 30500 (support) & 49000 (resistance)

We are now in a good scenario of getting an uptrend which can potentially reach 49000 USD before august.The opportunity has started since this new easter week.The 29K-30K barrier is now more fragile than ever, and will be broken imminently. And 30500 will become a new support level.It's a long opportunity here. I have 2 cross-overs in my CMA indicator which I'm considering for a Takeprofit closing : 1/ When the green line will crossover the thick purple line, that will be the easiest to reach. (small profit) 2/ When the green line will cross over the blue line. Normally it should reach around 40000/42000+Time will tell :)PS: a typo in the chart, please read ==> "30490 barrier is NOW breachable finally."

BTCUSD : small short trade

I've started a SHORT few mintues ago. I will stop the trade when the green line will cross under the thin aqua colored line.I've developped a personnal indicator which helps me to better view on trend moves.The full SHORT power will start in late Saturday or early Sunday. I don't think we can go that much high than 28600-28800.So we're entering a down cycle.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.