TradeSelecter

@t_TradeSelecter

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

تحلیل بیت کوین (تا ۲۸ آبان): آیا ریزش تا ۸۷,۳۰۰ دلار ادامه دارد؟

Technical Analysis and Outlook: During the most recent trading session, the Bitcoin market exhibited a resilient rebound, continuing a trend observed over the past week. The price has reached the Mean Resistance level of 93,000. Market sentiment is in declining mode, and the price is likely to trend toward the Mean Support level at 87,300. Current trading activities are focused on identifying the next Outer Coin Dip, projected at 78,500, with additional obstacle support at the Mean Support levels of 84,700. Given the prevailing trading dynamics, there is potential for an intermediate rebound from the Mean Support level of 87,300 to the Mean Resistance level of 93,000. Furthermore, an external extension may occur as the cryptocurrency market continues to fluctuate in line with current shaky market sentiment. Notably, it is essential to acknowledge the potential for a significant rebound once the Outer Coin Dip target of 88,500 is achieved.

تحلیل روزانه بیت کوین (BTC): سقوط تا کف جدید و شانس ریکاوری در هفته پیش رو

Technical Analysis and Outlook: In the last trading session, the Bitcoin market experienced a substantial drawdown, continuing a trend observed over the past week. The price has reached the Outer Coin Dip at 88,500. In light of these difficulties, the price has subsequently declined to the Mean Support level at 83,000, while trading activity is now focused on identifying the next Outer Coin Dip at 78,500. Notably, the price has remained below the upper boundary of the Mean Resistance at 93,000. Considering the current trading dynamics, a potential intermediate rebound towards this resistance level appears plausible. However, it is essential to recognize the possibility of a considerable rebound occurring once the Outer Coin Dip target of 88,500 is attained.

تحلیل تکنیکال S&P 500: هفته پیش رو؛ آیا شاخص به اوج 6946 میرسد یا عقبنشینی میکند؟

Technical Analysis and Outlook: The most recent trading session exhibited a significant decline in the S&P 500 Index, highlighting the significance of our Key Resistance target, marked as 6893, situated just below the Outer Index Rally 6,946. The index has now retested the Outer Index Dip at 6,642, and it tipped its hand that it wants to go higher. This current position indicates the potential for further upward movement, with the target established at the Mean Resistance level of 6,849 and a well-structured extension towards the Key Resistance level of 6,893, with an ultimate target for the Outer Index Rally set at 6,946. Nevertheless, it is crucial to acknowledge the possibility of a drawdown in the forthcoming week's trading session, which could nibble at the Mean Support of 6,700, possibly resulting in a further decline to the "Do That to Me One More Time" Outer Index Dip at 6,642 before ultimately resuming an upward trajectory.

تحلیل روزانه بیت کوین (BTC): آیا قیمت به ۱۰۶ هزار دلار میرسد یا حمایت ۹۴ هزار تومانی میشکند؟

Technical Analysis and Outlook: In the most recent trading session, the Bitcoin market has undergone a significant drawdown over the past week, reaching the Mean Support level of 99,000. Additionally, it has completed the Outer Coin Dip at 97,000. Compounding these challenges, the price has also declined to the Key Support level of 94,000, where trading activity is currently concentrated. At this time, the price is being maintained within a trading range defined by the Mean Resistance at 99,700 and the Mean Support (Former Key Support) at 94,000, with a slight probability of an extension to the Mean Support level at 106,000. Nonetheless, it is crucial to acknowledge the considerable potential for pullbacks at these critical resistance levels.

تحلیل تکنیکال S&P 500: هفته پیش رو، صعود یا سقوط تا مرز 6551؟

Technical Analysis and Outlook: During the recent trading session, the S&P 500 Index experienced a notable decline, underscoring the significance of our key target, situated at the Mean Support level of 6,740. The index has now completed the Outer Index Dip at 6,642. This positioning indicates the potential for further upward movement, with the target established at the Mean Resistance level of 6,795. The prevailing trend suggests a well-structured extension towards the Key Resistance level of 6,893, with an ultimate target for the Outer Index Rally set at 7,110. Nevertheless, it is crucial to acknowledge the possibility of a substantial drawdown in the forthcoming week’s trading session. This may lead to a retest of the Outer Index Dip at 6,642, possibly resulting in a further decline to the Mean Support level at 6,551 before ultimately resuming an upward trajectory.

تحلیل تکنیکال بیت کوین (BTC): سقوط به کدام سطح؟ پیشبینی هفته هفتم نوامبر ۲۰۲۵

Technical Analysis and Outlook: In the previous trading session, the Bitcoin market experienced a notable drawdown over the past week, with the Mean Support established at 101,000, around which trading activity was concentrated. Presently, the price is actively maintained within the range defined by the Mean Resistance at 107,000 and the Mean Support at 97,000. Current market analysis suggests the likelihood of a retest toward the Mean Support level at 99,000, with a primary emphasis on the potential for further downward movement toward the Outer Coin Dip at 97,000, which may extend to the Key Support level at 94,000. Nonetheless, it is vital to recognize the substantial rebound potential present at these critical levels.

تحلیل تکنیکال شاخص S&P 500: آیا صعود به 6946 قطعی است؟ (هفته 31 اکتبر)

Technical Analysis and Outlook: During the recent trading session, the S&P 500 Index continued its wild ride, highlighting the importance of our key target, which stands as an Outer Index Rally at 6946. Fluctuations between the Mean Support at 6815 and the Key Resistance at 6875 serve as a crucial threshold for market participants. This positioning suggests the potential for further upward momentum, as the prevailing trend indicates a well-structured Active Inner Rebound extension toward the target stated above. Nevertheless, it is essential to acknowledge the possibility of a sustained and gradual pullback within the current Active Inner Rebound zone. Such a pullback may retest the Mean Support at 6815 and could decline further to the Mean Support at 6740 before ultimately resuming an upward trajectory.

تحلیل روزانه بیت کوین: آیا سقوط به زیر ۱۰۱ هزار دلار قطعی است؟ (هفته اول نوامبر ۲۰۲۵)

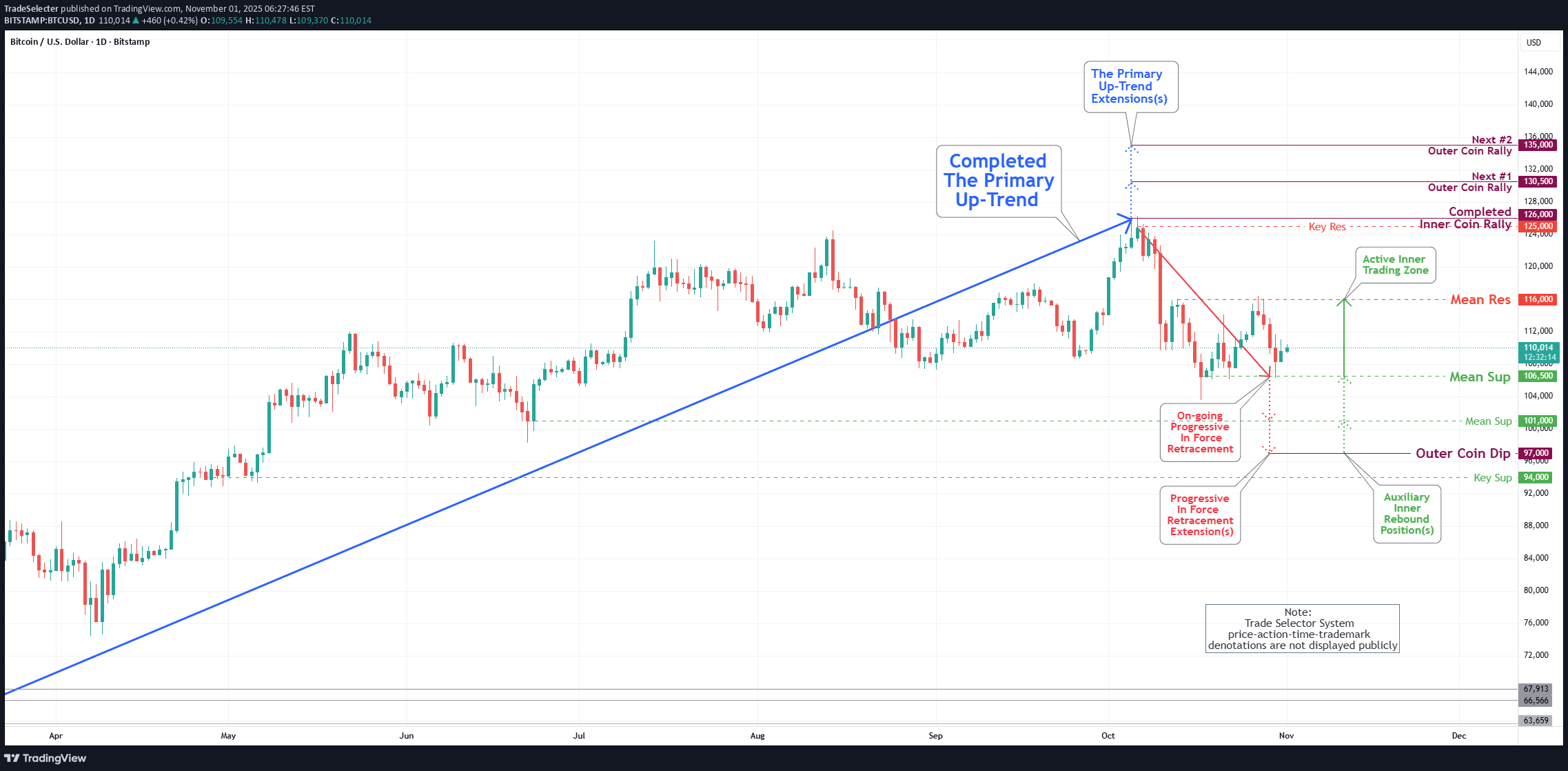

Technical Analysis and Outlook: The trading session from last week was notably eventful. The Bitcoin market experienced significant volatility, fluctuating between the Mean Resistance level of 116,000 and the critical Mean Support level of 106,500. Currently, the price is actively navigating this range. Current market analysis indicates a likelihood of a retest toward the Mean Support level at 106,500, with a primary focus on the potential for further downward movement towards the Mean Support level of 101,000. This trajectory may ultimately lead to our key objective of reaching the Outer Coin Dip at 97,000. It is, however, essential to acknowledge the robust rebound potential at these pivotal levels.

تحلیل تکنیکال روزانه شاخص S&P 500: آیا بازار به قله تاریخی میرسد؟ (هفته ۲۴ اکتبر)

Technical Analysis and Outlook: The most recent trading session exhibited significant volatility in the S&P 500 Index, marked by pronounced price fluctuations between the Mean Resistance at 6671 and the Key Resistance at 6753. This range served as a crucial threshold for market participants, prompting a series of rapid buying and selling that influenced the index's overall wild movement. Ultimately, this price action culminated in a breakout above the completed Outer Index Rally at 6768. At present, the index is situated at the newly established Key Resistance level of 6800, which lies just below the historical high of 6807. This positioning indicates the potential for further upward momentum, as the prevailing trend suggests a well-structured Active Inner Rebound extension toward the Next Outer Index Rally target of 7110. Conversely, it is imperative to acknowledge the possibility of a sustained, steady-to-lower pullback from the Key Resistance level of 6800 to Mean Support 6740 for the Secondary Primary Up-Trend to continue on its path.

تحلیل تکنیکال بیت کوین (هفته ۲۴ اکتبر ۲۰۲۵): آیا BTC از مقاومت ۱۱۳۵۰۰ عبور میکند؟

Technical Analysis and Outlook: In last week's trading session, the Bitcoin market experienced wild gyrations between Mean Support 106500 and the critical Mean Resistance level of 113500, as the price is currently actively fluctuating between the two. Current market analysis indicates an initial recovery towards the Mean Resistance level of 113500, with the potential for further upward movement to the Mean Resistance level of 116000. However, it is crucial to acknowledge the possibility of a reversal at these resistance levels, which could extend to continue the Progressive In Force Retracement trend.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.