Timonrosso

@t_Timonrosso

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Timonrosso

سقوط آزاد بیت کوین: آیا منتظر رسیدن به ۳۲ هزار دلار باشیم؟

Yes I know it's crashed below $90,000. Yes I know the there is the death cross 50MA crossing below 200MA. But the thing is on weekly, there is still a bigger pull back on the cards. Either there are three scenarios. 1. There is an M Formation and breaks below and takes the price to $32,461 2. There is a Head and Shoulders formation breaks below and takes the price to $32,461. 3. Or there is a fakeout and the fat cats get right back in and drive the price to $200,000. Thing is, the price action is not looking good. And as things stand, I am a big Bitcoin Bear. And the second scenarios is more likely, to catch the retailers thinking the price will go up just to drop down back to the neckline and then ya... Then it's like tap dancing on thin ice. 🌍 Fundamental Pressures (The Macro Isn’t Helping) 🔥 1. Risk-Off Environment Returns High rates + sticky inflation = investors dumping risk assets faster than BTC can hold support. ⛏️ 2. Miner Stress Increasing Post-halving costs are up, profits are down, and miners are offloading reserves to survive — adding real selling pressure. 🏦 3. ETF Inflows Cooling Off The “ETF euphoria” has slowed down. With less fresh money entering, Bitcoin loses one of its strongest 2024–2025 drivers. 🌧️ 4. Global Growth Weakening Recession fears, geopolitical tensions, and slowing demand are pushing capital into safe havens — and Bitcoin is not one right now. $32,461 here we come?

Timonrosso

۴ نشانه حیاتی: چه زمانی باید به معامله خود اعتماد کنید و آن را رها کنید؟

Every trader knows the feeling. You’ve done all the homework, lined up every signal, and double-checked your risk. It’s like preparing to jump out of a plane with your parachute strapped on – exhilarating, but just a little nerve-wracking. When you’ve put in the work, planned the trade, and set it in motion, there’s only one thing left to do: Let it go. Trust the process and release the trade. Here are four clear-cut signs it’s time to step back and trust your strategy. SIGN #1: The System Lined Up Perfectly You’ve got a strategy for a reason. You trust it, you’ve backtested it, and it’s made it through countless simulations and reviews. Whether you’re trading Forex, JSE Top 40 or even the Dow Jones Index. When all the indicators in your system align, it’s time to act, not hesitate. Remember, the market rewards action, not perfection. If your system says “go,” then go. No second-guessing. J.T.T.T – Just Take The Trade SIGN #2: Your Entry Orders Are All in Place You’ve placed your entry orders and planned each move with the same precision as a grandmaster in chess. So why keep checking every tick? If you’ve calculated your entry points and set them with intention, then you’ve done your job. This is your chance to let the market do the rest. Obsessing over every micro-move will only drag you into a rabbit hole of doubt. Set it and step away. SIGN #3: It Matches Your Risk & Reward Criteria Your trade has a purpose, and you’ve defined it by setting your risk and reward limits. When your setup meets these criteria, there’s no reason to stick around second-guessing the play. You know your max loss, and you know your target profit. You’ve thought it through rationally, and now it’s time to trust that process. You’re here to be a professional, not a perfectionist. SIGN #4: You’ve Nailed Down Your Trade Size Position sizing is a science in itself, and you’ve already done the math. You’re not risking more than you’re willing to lose, and you’re confident in the upside. If you’ve set your trade size according to your plan, you’ve already protected your capital. The last thing you need is to add or subtract impulsively. Let the size stay as it is and let the market move. Conclusion: Trust and Release Trading is as much about discipline as it is about analysis. If you’ve done the work, checked off every box, and know your limits, the best thing you can do is walk away and let your trade breathe. Micromanaging won’t make you money; it’ll just wear you out. The market is like a river – you can’t force it to flow your way. You can only guide your boat down the path you’ve chosen and let the current do its thing. When you’ve planned the trade, trust yourself enough to leave it alone. So let’s sum up the FOUR signs to let your trade go. SIGN #1: The System Lined Up Perfectly SIGN #2: Your Entry Orders Are All in Place SIGN #3: It Matches Your Risk & Reward Criteria SIGN #4: You’ve Nailed Down Your Trade Size

Timonrosso

شوک داده CPI: استراتژی ساده برای نجات طلا از ضرر احتمالی

So when it's CPI Day. I call it a Medium Probability Trading day. Either I risk less or observe the charts because of the volatile nature CPI has on many main markets like Gold, JSE, US500. ANd today was no different. We first boxed the chop - sideways market This way we don't trade when the market moves in a consolidation period. WHEN TO TRADE WITH MAs Only when the price breaks OUT and the price is below 20MA and below 200MA - We look for shorts. Or when the price breaks OUT and the price is ABOVE 20MA and above 200MA - We look for longs. However, the price remained within the chop until CPI came out. Came out worse than expected, which caused a RALLY with gold in the short term. So you need to consider these anomaly and volatile times when you trade. You might avoid unnecessary losses. Got it? These are just some tips you can take into your account that I have learnt over the last 23 years of trading the markets with the SAME breakout trading system. So let's sum up fundamentals now for those who love economics. When the latest CPI and Core Inflation data hit the markets, traders instantly shifted focus to gold — the ultimate inflation hedge. Let’s break down what unfolded. 🧾 CPI & Core Inflation Data The Consumer Price Index (CPI) came in at 324.8, just below the forecast of 325.01. This slight miss signals that inflation is cooling — a positive sign for markets. Core inflation stayed steady at 3.1% year-on-year, suggesting price pressures remain but are slowly easing. 📊 Market Setup Before the News Before the release, gold prices moved sideways, reflecting trader uncertainty. The phrase “Strike avoided” hinted at calmer market sentiment after earlier risks faded. Everyone was waiting for the data — and volatility was brewing beneath the surface.

Timonrosso

5 راز موفقیت در ترید: راهنمای جامع برای شروع قدرتمند و مدیریت ریسک هوشمندانه

Trading is the greatest roller coaster you’ll ever ride. Trading has its thrills, challenges, and endless potential for growth. But, before you hit “Buy” or “Sell,” it’s crucial to lay down a solid foundation. Too many traders jump in without preparation, and without knowing the real life variables. When things go great, they feel normal and you feel in charge. When things go bad, you feel it’s the end of the world. So you need to learn to harness each of the 5 essentials to trading success. Essential #1: Build a Solid Foundation of Knowledge You wouldn’t drive a car without knowing the rules of the road, right? Trading is no different. Before placing your first trade, you’ll need to understand the key concepts and market basics that will serve as your roadmap. Key areas to cover include: Market types: Know the difference between stocks, forex, commodities, and cryptocurrencies. Know which is the best stock screener. Also you need to know which markets will work for you and your trading personality. Trading terminology: Terms like “bearish,” “bullish,” “short-selling,” “leverage,” and “margin” might sound like jargon now, but they’ll soon become your everyday vocabulary. Order types: Limit orders, market orders, stop-loss, take-profit. Each of these orders serves a specific purpose. Mastering them is essential for making controlled and effective trades. Essential #2: Select what you want to trade first: The Art of Asset Allocation Trading is thrilling, but let’s face it. No one knows what the market will do tomorrow. That’s why choosing the right mix of assets—and learning the art of asset allocation—is crucial for long-term success. What does asset allocation mean in practice? Diversify your portfolio: Don’t put all your eggs in one basket. Invest and trade across different asset classes to spread out risk. It’s better to trade different portfolios with stocks, Forex, indices and even commodities. Successful trading isn’t about picking one “winning” asset. It’s about managing risk and creating a balanced portfolio that can weather market storms. Diversification is KEY! Essential #3: Risk Management: Strategies to Protect Your Capital If you only remember one thing from this article, let it be this: Risk management is your best friend in trading. Not only do you learn how to be a trader, but also a risk portfolio manager. A smart trader doesn’t only think about potential gains—they think about how to protect their capital when things don’t go as planned. Simple, powerful ways to manage risk include: Set stop-loss orders: Automatically sell a position when it drops to a certain price to minimize losses. Use position sizing: Avoid putting too much of your capital into a single trade. Limit each trade to a small percentage of your total funds—usually no more than 0.5%-2%. Apply the “2% rule”: Never risk more than 2% of your capital on a single trade. This can help prevent one loss from wiping out your progress. Remember, every trader has losses; it’s part of the game. But with a solid risk management strategy, those losses won’t be catastrophic. Essential #4: Charting the Path: Introduction to Technical Analysis Charts are a trader’s treasure map. Learn to interpret them, and you’ll have insights into market trends, price movements, and potential buy/sell signals. Technical analysis allows traders to make data-driven decisions rather than relying on gut feelings. Key tools for technical analysis: Candlestick patterns: These can show trends, reversals, and market sentiment. Patterns like “doji,” “hammer,” and “engulfing” candles can offer powerful insights. Indicators: Tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) help you assess price momentum and potential reversal points. As you might know by now. I like to stick to three indicators: Breakout patterns, 2 Moving Averages and Trend lines. We need to learn to simplify our strategy because we will be following it over our entire trading career. Trendlines: Drawn on charts, trendlines reveal price direction and potential breakout or breakdown levels. Essential #5: The Psychology of Success: Developing a Trader’s Mindset Trading isn’t just about strategies and technical skills; it’s also a mental game. Emotions—fear, greed, EGO, frustration — can interfere with sound decision-making. If you can’t manage your mind, you can’t manage your portfolio. And that’s why it’s essential to develop a mechanical, professional and calm mind when trading. Developing a disciplined mindset is what separates successful traders from those who burn out. Conclusion Let’s sum up the 5 ESSENTIALS to trading success. Essential #1: Knowledge First: Understand trading terminology, market types, and order types. Essential #2: Asset Allocation: Diversify your portfolio based on your risk profile. Essential #3: Risk Management: Protect your capital with stop-losses, position sizing, and the 2% rule. Essential #4: Technical Analysis: Learn chart patterns, indicators, and trendlines to guide decisions. Essential #5: Trader’s Mindset: Control emotions, maintain discipline, and focus on long-term success. Trading isn’t just a skill—it’s an adventure that rewards preparation, patience, and resilience. Keep learning, stay focused, and remember: your success is built one trade at a time.

Timonrosso

معاملهگری واقعی چیست؟ رازهایی که وال استریت نمیخواهد بدانید!

What is Financial Trading in a nutshell? For the last 20 years I’ve summed up trading as just ONE BIG AUCTION. It sounds like a fast-paced, high-risk, Wall Street movie scene with shouting brokers and skyrocketing graphs. But, here’s the truth: Trading is the most relaxing thing – when done right! It’s a lifestyle, a process, and a mindset. It’s one thing where YOU can take your finances on an exciting adventure — if you do it right. Whether you’re a complete newbie or a seasoned trader, here is a refresher to dive into what trading really is. Trading Is More Than Just an Auction of buying or selling… Let’s clear up one thing first. For the last 20 years I’ve summed up trading as just ONE BIG AUCTION. And yes it is one big market of buying and selling – but that’s only part of it. TRADING is all about solving a puzzle of analyzing probabilities, managing risks, and navigating uncertainty. Every time you enter a trade (buy or sell), you’re making an educated guess on where the market is LIKELY to go next. And you’re placing a bet on human behavior — how millions of people around the world (with their emotions, news reactions, and strategies) will affect the price of an asset. That’s the technical side of trading. Here’s where I want you to integrate trading into your life… Trading Is A Lifestyle It’s not just about making money — it’s about integrating trading into your lifestyle. You need to find the right markets, time, time frame, styles, strategy and approach. Trading is like hitting the gym; it requires discipline, consistency, and a whole lot of sweat equity. And just like you don’t get a six-pack or lose weight after ONE workout. You shouldn’t expect to master trading overnight. It’s a routine you build day by day. A typical trading day might include: Pre-market analysis (Weekly bias): You need to check what’s happening in the world with other markets with both Asian, American, European and even London session. You also need to look at the US Economic Calendar to see what news is arising for the week. Analyse and Execute trades: Once done the pre analysis, you need to do the actual analysis. See what trades are lining up according to your proven strategy. And if anything looks good to go EXECUTE. Review and track your trades: This is where you will reflect on what went right and what went wrong. This is where you’ll track and review your trades that lined up to add to your journal. The key takeaway: Trading isn’t just what you do; it’s who you become. Trading Is a Forever Game When it comes to trading, think long-term. Like, REALLY long-term. Because trading is a forever game. Unlike sports with seasons or video games with levels, trading doesn’t end. The markets will be there tomorrow, next week, and 100 years from now. And as a trader, your mission is to stay in the game for the long haul. That means managing your risk, protecting your capital, and always looking to improve your skills. Trading Is A Business Where YOU Are The Boss The beauty of trading? You’re in control. Trading is a business, and you are the CEO. You call the shots, decide when to enter and exit trades, and ultimately, you take control of your financial destiny. Like any business, trading requires: Planning and strategy: Risk and reward management: Tracking performance and improving: And, just like in any business, you’ll make mistakes. But those mistakes are not failures; they’re lessons. You learn from them, adapt, and get better. That’s what makes trading such an empowering journey. Final Words: Financial trading is more than a job, a hobby, or a side hustle. It’s a process-driven approach to decision-making, a lifestyle to live, a forever game to play, and a business where you’re in charge. If done right, trading can be one of the most rewarding pursuits you’ll ever undertake. Key Takeaways Trading is a process: Follow a set strategy, criteria, and rules for success. Trading is a lifestyle: Incorporate trading into your daily routine and stick with it consistently. Trading is a forever game: It’s not a one-time event; it’s a lifelong pursuit. Trading is a business: You’re the CEO — plan your moves, manage your risk, and take charge of your financial destiny.

Timonrosso

۳ لذت واقعی معاملهگری که هرگز تصور نمیکردید!

Trading. It’s a game. A challenge. A journey. It’s a lifestyle. And yes having a passion to trade is half the battle won. But it’s not just about winning. If you feel thrill when you win a trade. Then you’re enjoying the wrong parts of successful trading. If you’re in a winning streak and feel thrill – Same story. Because you know the losses are inevitable. And you know the drawdown is coming too. So that’s why you need to enjoy the FULL journey… And here’s where you should feel the THRILL for trading. THRILL #1: When you survive the drawdown Like I said earlier, your next drawdown is coming. Your BIGGEST drawdown is coming. So you need to embrace and prepare for these times. I have gone through more drawdowns than you can imagine. And yet my portfolio keeps heading to all time highs. HOW? Well you need to endure the drawdown. You need to keep following your rules and strategy. And when the market environment is more favourable, your portfolio will turn from down to up. And it will continue to go up until you not only recover – but your portfolio breaks to all time highs. And when you survive the drawdown – FEEL THRILL! THRILL #2: Knowing your strategy works (through the good and bad) The markets are like an ocean. Waves come and go, the tide shifts, and sometimes there’s a storm. If you go look at the US Economic Calendar you’ll know the market is about to swivel in ways you can’t even imagine! The thrill doesn’t come from riding one good wave (winner). It should come from taking every trade that lines up perfectly with the strategy. If you followed your rule and criteria to a T – Feel THRILL that you are on the right path to success. Regardless of whether the trade is a winner or a loser. See the bigger picture and what it can do for you! THRILL #3: The Love for the Game and the benefits of trading Remember I said trading is more than just money. Trading helps with everything in your life! It teaches you to be a risk manager. It teaches you how to toughen your mind. It teaches you how to be disciplined, consistent. And it teaches you how you can CREATE your own wealth without depending on a BOSS. The Challenge, the Mental Toughness, and the Growth And the thrill? FINAL WORDS – Celebrate the Right Thrills The thrill of trading isn’t about the quick wins, the big gains, or riding the market waves. It’s about resilience. Mastery. Passion. Patience. And growth. Well fall in love with what trading has offered and taught you, other than the money aspect. It’s not just about making money; it’s about becoming better. Sharper. Wiser. Every trade you take is a lesson. Every loss is a learning opportunity. And every time you wake up excited to face the market, that’s the thrill of passion. Because trading isn’t just a job. It’s a craft. A skill. A calling. If you find yourself waking up early, excited to start your day, knowing full well there’s a challenge waiting for you—you’ve found the thrill. If you find weekends are not ending early enough because you want to trade – that’s a thrill! Let’s sum up some reasons to feel THRILL when trading. THRILL #1: When you survive the drawdown THRILL #2: Knowing your strategy works (through the good and bad) THRILL #3: The Love for the Game and the benefits of trading Do you agree and how has trading changed your life?

Timonrosso

چرا بازارهای مالی همیشه در حال تغییرند؟ ۵ دلیل شگفتانگیز و غیرقابل انکار!

Change is the only constant in the financial markets. And that’s why it’s important to stay humble and grounded because everyday is a UNIQUE day to the markets and the pre market movers. No matter how much experience you have, you can’t get too comfortable with the way things are. Because we know they won’t stay that way for long. The markets are like a living, breathing entity—constantly shifting, evolving, and transforming. And now I want to explain why I believe the markets are ALWAYS changing. REASON #1: The Fresh Faces of Trading Continuous flow of new and old traders. Every day, new traders enter the game while seasoned veterans continue to play. This constant influx of fresh perspectives creates a dynamic market environment. New traders bring innovative strategies, emotions, and decision-making processes into the market, while the veterans tweak their systems to keep up with ever-evolving trends. And so the demand and supply is constantly shifting in new ways – which changes the markets style, moves and algorithms. End of the day, the market is one big AUCTION as I have told my members for the last 15 years. They’re influenced by the people who trade in them. REASON #2: The Never-Ending Stream of New Information New information – shining on the market Here’s the thing: the financial markets thrive on information. New data points, news reports, earnings releases, and economic indicators flow in non-stop, impacting prices and trends at every turn. Sometimes there is good days with amazing news coming out. Other days there is catastrophic news. And then you get the mundane boring days with no reaction. If a central bank announces an unexpected interest rate cut, or if a company releases disappointing earnings, the market is going to react swiftly. Even geopolitical events and natural disasters play their part in shaping the direction of markets. So no matter how much analysis you’ve done, be prepared for the fact that new info can change the game in an instant. REASON #3: Micro, Macro, and Inner Fundamentals New micro, macro and inner fundamentals The fundamentals that underpin market movements are far from static. On the micro level, individual companies are constantly evolving. New product launches Mergers and acquisitions News and earning reports Prospects Leadership changes can all affect a stock’s price. Zoom out a little, and you’ve got macro fundamentals. These show the big-picture factors like: Interest rates inflation, and unemployment rates, All of which influence the broader economy. REASON #4: Global Economies and World Events World info from the economies The financial markets are more interconnected than ever. What happens in one part of the world now ripples through the rest of the global economy in minutes, not weeks. A change in China’s trade policy can directly impact European markets. An unexpected election result in America could influence the South African or UK equities. REASON #5: The Endless Actions of Traders Constant actions of traders around the world Then, of course, we have the daily actions of traders around the world. Every time a buy or sell order is placed, the market shifts. I like to think of it as the Stock Market’s Butterfly-Effect. These actions are a direct result of human behavior—our emotions, analysis, strategies, and even fear and greed. When traders believe in a trend, they pile on, creating momentum. But when panic strikes, markets can spiral down in a blink of an eye. Since traders are constantly reacting to new information, the market flows like an ever-shifting river. Conclusion The financial markets are in a constant state of flux. They will forever change and we need to learn how to evolve, adapt or die trying. But there is one thing that is inevitable. The markets will KEEP moving and trending. And for that, we will always be profiting in the medium to long term. Let’s sum up why the markets will always change… REASON #1: The Fresh Faces of Trading Continuous flow of new and old traders. REASON #2: The Never-Ending Stream of New Information New information – shining on the market REASON #3: Micro, Macro, and Inner Fundamentals New micro, macro and inner fundamentals REASON #4: Global Economies and World Events World info from the economies REASON #5: The Endless Actions of Traders Constant actions of traders around the world

Timonrosso

رمز موفقیت در ترید: تمرکز، اراده و عزم پولادین!

Here is a quote I want you to write down and hold close to your heart. Trading is a Game of Focus, Sheer Will, and Unstoppable Determination Trading is not for the faint-hearted. It’s a game of focus, sheer will, and the kind of determination that doesn’t back down when the market throws punches. If you’ve been in the trading world long enough, you know it’s not about making a quick buck. It’s about holding your ground when the waves get rough and staying in the game even when the winds are blowing against you. Let’s break this down… Focus Is Your Superpower To succeed, you need to zero in on your strategy and trust the process, no matter how loud the noise around you gets. Focus is what separates a good trader from a great one. It’s about staying laser-focused on your plan. Do not get rattled when the market throws a curveball. If you’re jumping from one strategy to another or chasing every shiny new stock, you’re spreading your energy too thin. And in trading, scattered focus equals scattered results. How to Strengthen Your Focus: Create a daily routine and stick to it. Consistency fuels discipline. Set specific trading goals for each session. Block out distractions. Social media can wait. Review your trades regularly to keep your mind sharp. Sheer Will Gets You Through the Tough Times Let’s not sugarcoat it: There will be rough patches. Trading will test you. Your willpower will be stretched like a rubber band, and sometimes it might snap. But those who make it are the ones who refuse to quit. There’s a misconception that the best traders are the ones who never lose. Wrong. The best traders are the ones who keep getting back up. You will lose trades. It’s part of the game. But if you have the will to persist, those losses become your greatest teachers. Ways to Build Your Willpower: Start small. Set short-term, achievable goals to build momentum. Learn from each mistake. Losses are part of the learning curve. Celebrate your progress, even if it’s slow. Stay connected with other traders to keep motivated. Determination is Your Guiding Force What makes a trader stick to their plan even when everything seems to be going wrong? Determination. It’s that relentless drive to keep going no matter what. It’s about having a clear vision of where you’re headed and refusing to let setbacks derail you. Determination means playing the long game. It’s easy to get discouraged after a few losses or slow weeks, but successful traders know that big wins take time. You’ve got to be in it for the long haul. Strengthening Your Determination: Write down your trading goals and review them daily. Make sure you have checked the US Economic calendar with your trading strat. Remind yourself of why you started trading in the first place. Don’t let a losing streak shake your confidence—adjust, don’t abandon. Stay flexible but committed to your strategy. Conclusion: Keep Grinding, Keep Growing Trading is a game of focus, sheer will, and relentless determination. It’s not easy, but if you can master these qualities, you’ll find yourself ahead of the pack. Success in trading doesn’t come from luck or overnight gains. It comes from grinding it out, day after day, with a sharp mind and an unbreakable spirit. Remember, the markets will test you. They’ll try to break your focus, test your will, and challenge your determination. But if you stay committed, keep your focus razor-sharp, and push through the tough times, you’ll come out stronger, smarter, and more successful. So, what are you waiting for? Tighten up your focus, flex that willpower, and get ready to tackle the markets with unstoppable determination.

Timonrosso

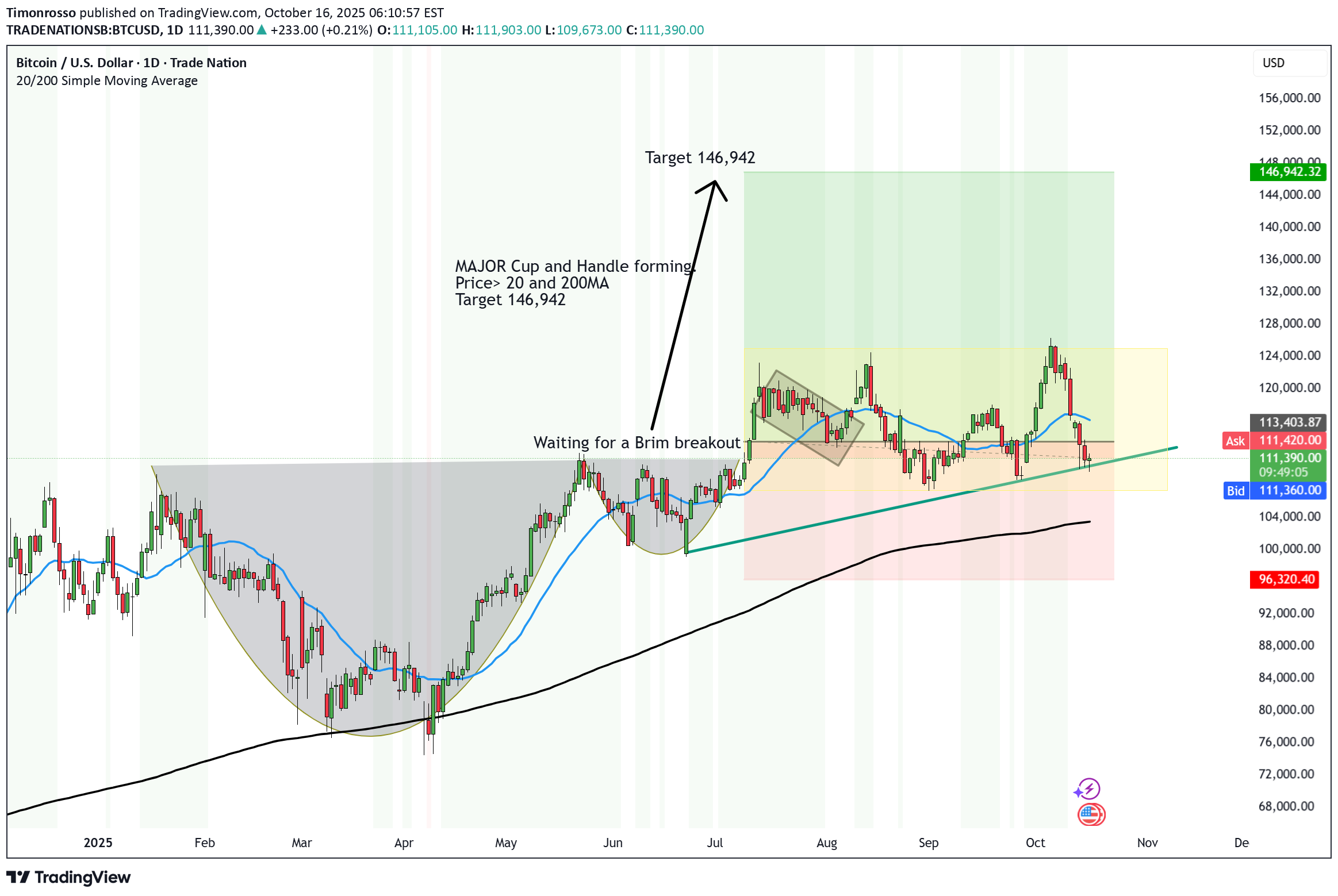

تحلیل بیت کوین: آیا شکست مقاومت (بریکاوت) نزدیک است یا سقوط در راه؟

From our last update with Bitcoin. We’ve been tracking this MAJOR Cup and Handle for weeks. We then had the Bitcoin flash crash wiping out 16 big Bs. But if we look at the grander scheme of things, there is nothing new to the movement of the charts. So we are holding the uptrend for now. And far away from the stop loss level. We’re now waiting for the brim breakout, which could send BTC straight toward the next big level at $146,942. If we get a BREAKDOWN then it will have an M Formation which will bring the price lower before it goes up. If it hits the stop loss then there could be a MAJOR crash coming. But I'll keep you up to date monthly. 🌍 Fundamental Reasons for Upside 🏦 Institutional Inflows: Big money keeps flowing in through ETFs — Wall Street’s not selling, they’re accumulating. 💰 Halving Tailwinds: Supply is tightening while demand stays strong — classic post-halving squeeze setup. 🇺🇸 Fed Pause Hopes: If the Fed holds or cuts rates, risk assets like Bitcoin breathe again. 🪙 Growing Adoption: Countries, corporates, and funds are treating BTC as digital gold more than ever. Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Timonrosso

3 Dangers of Trading DOUBT (Part 2)

Trading isn’t just about charts, indicators, and strategies — It’s a battle of the mind. And lurking in the shadows is one of the most dangerous opponents you’ll face: Doubt. Doubt stops you from taking action. Doubt kills confidence. Doubt leads you to giving up. So let’s go into why doubt is so dangers and how we can destroy this silent saboteur. DOUBT #1: Search for Something “Better” Doubt is where you don’t think something will help you achieve what you want to. And so you’re on the perpetual quest of finding something new and “better”. But you need to realise something. There is NO such thing as the perfect system. Strategy hopping will you to wasting money, time, effort and energy. Instead, you need to embrace the imperfections in trading. You need to perfect your strategy, execution and mind. Keep at it and you will find that you always had the Holy Grail at your grasp. Stick to a strategy long enough to learn its nuances and understand its strengths and weaknesses. Remember, the grass isn’t always greener—it’s just different grass. DOUBT #2: Failure to Take the Trade Ever hesitated to take a trade. Whether you’re trading gold, Dow Futures, JSE or Forex! Then you end up watching the “imperfect” trade head straight to your profit target? That’s doubt working its magic. When doubt clouds your judgment, you start second-guessing yourself. You start questioning. “What if it is a loser?” “What if I am in the wrong trading environment” “What if my system stops working from here?” Not taking the trade is one of the most subtle yet dangerous forms of self-sabotage. To combat this, it’s crucial to develop a routine that instills confidence. Preparation is key. When you’ve done your analysis and the trade setup aligns with your plan, just take the trade (J.T.T.T). Trust your process and let the trade play out. You can’t win a game you don’t play. DOUBT #3: Failure to Follow Your Risk and Reward Criteria Every trader knows that managing risk is paramount. Yet doubt can lead even the most seasoned traders astray. When doubt creeps in, it whispers dangerous ideas. “Maybe I should move my stop loss further”. “Maybe I should risk more in this trade” “Maybe I should risk less in this trade” “Maybe I should drop my take profit to lock in a premature profit”. When you deviate from your established risk and reward criteria, you’re going against your one and only proven and profitable strategy. Your risk and reward criteria are there to protect you. They are the guardrails that keep your trading on track. Conclusion Trading doubt is a silent killer. It can creep into your mind, and sow seeds of uncertainty. Let’s sum up issues with Doubt. Stop Searching for Perfection: Embrace the strategy you have and focus on mastering it rather than endlessly searching for a mythical “better” one. Take the Trade: Don’t let doubt freeze you into inaction—execute your plan and trust the process. Stick to Your Risk and Reward Criteria: Discipline in following your rules will protect you from doubt-driven decisions that can derail your success.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.