TheUniverse618

@t_TheUniverse618

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

TheUniverse618

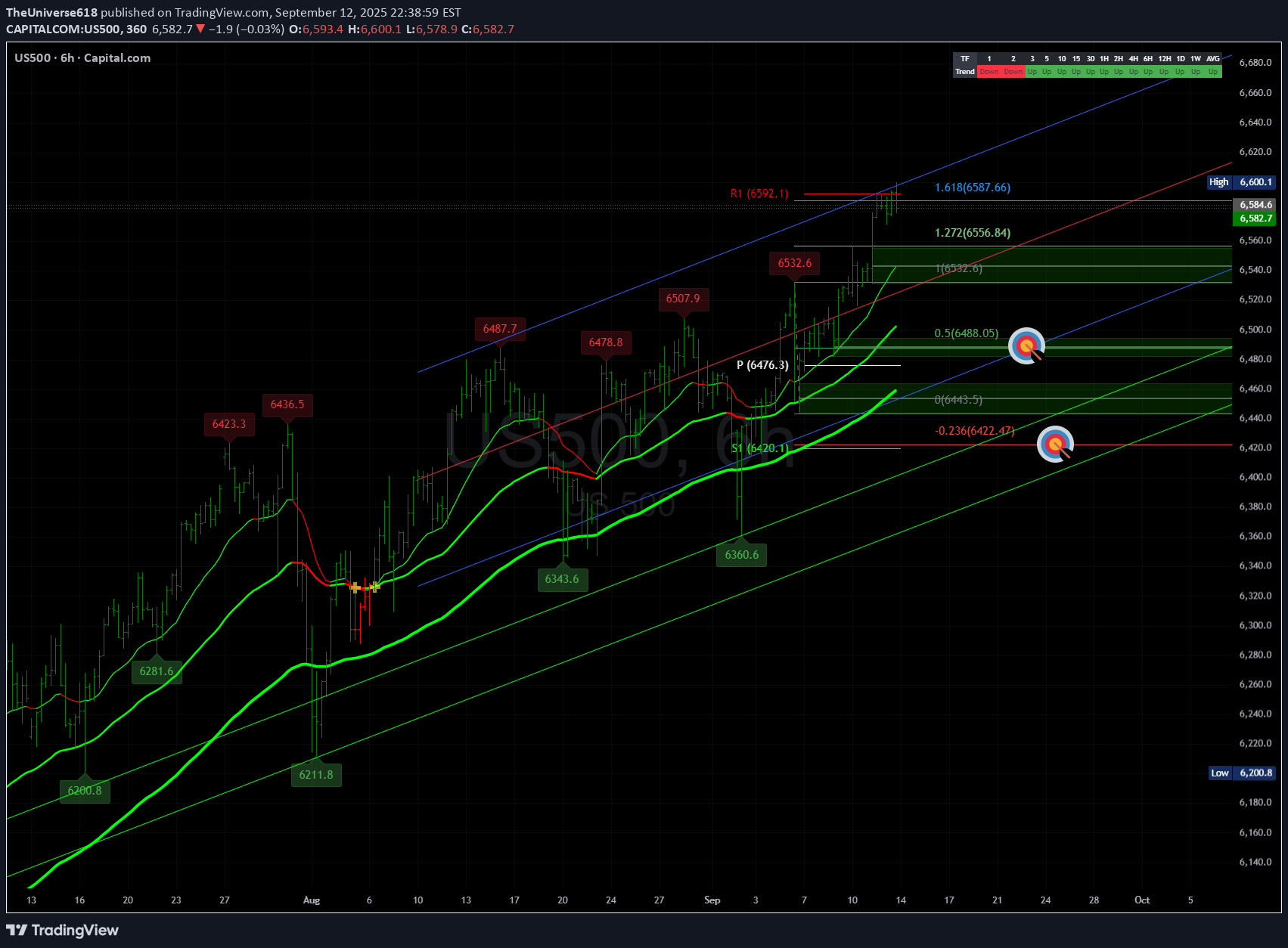

Hello Traders, Well I expected a retrace by now but this market keeps powering higher. Well it finally hit the target many were talking about 6600 . It hit that number the other day on the ES as well. Its the 1.618 fib and the first resistance level and RSI is well overbought. Also we have a rate cut for Wednesday so a drop Monday and Tuesday before the rate cut on Wednesday powers the market and crypto higher makes sense. I don't think we are gonna get that big retrace I kind of expected yet. after we hit these targets we probably head up towards the dreaded 6666. See ya there!

TheUniverse618

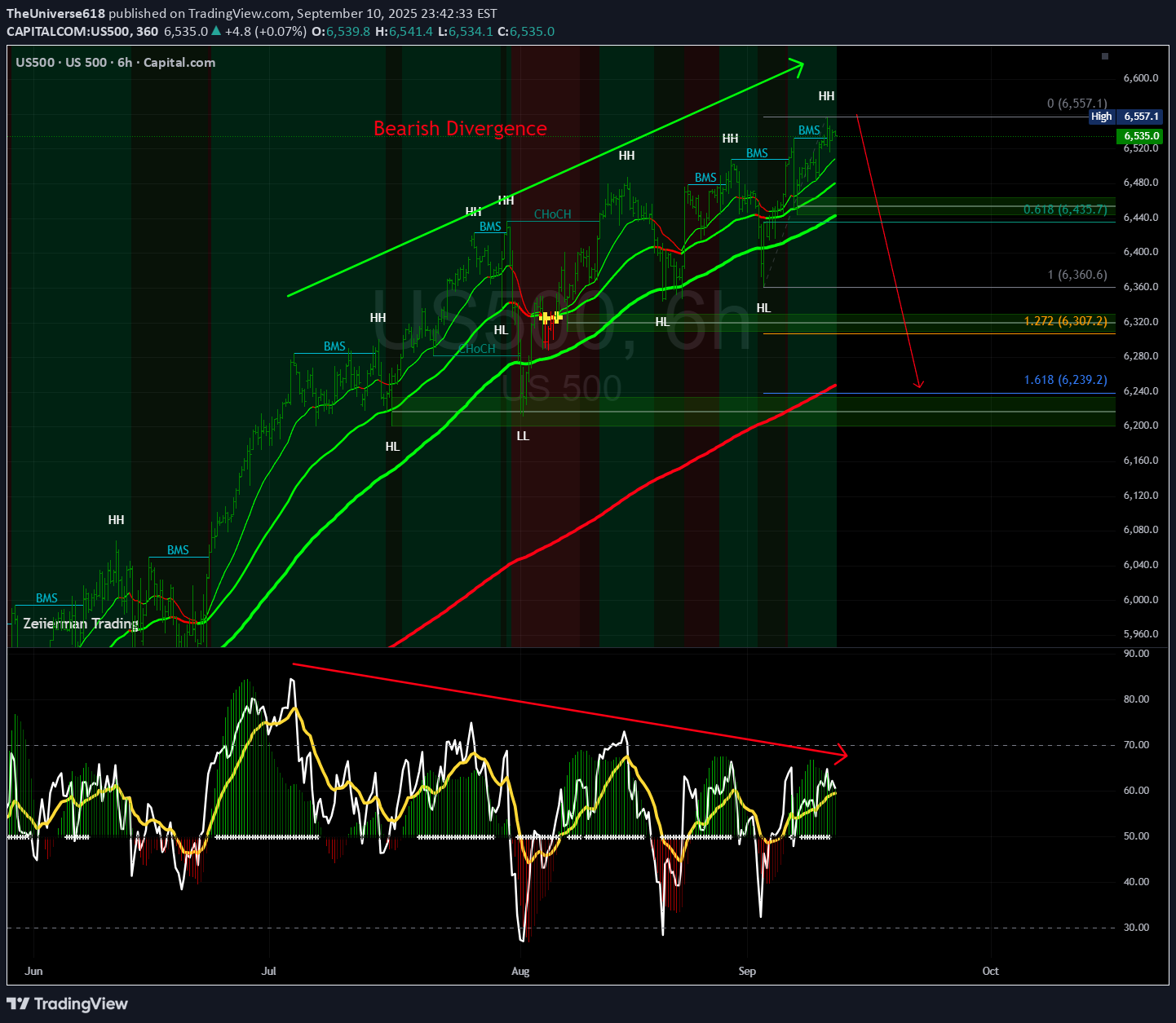

Hello Traders, As shown you can see the two month bearish divergence on the index. My thoughts are it needs resolved soon than later and the inflation data coming up next could be the spark that finally gets it going.... We will find out tomorrow at 8:30 if the data comes in hot the market will not like that.. We could get a selloff in stocks and crypto on no other than 9-11 anniversary. Stay tunes and lets see if I nailed this one or not.Bigger view

TheUniverse618

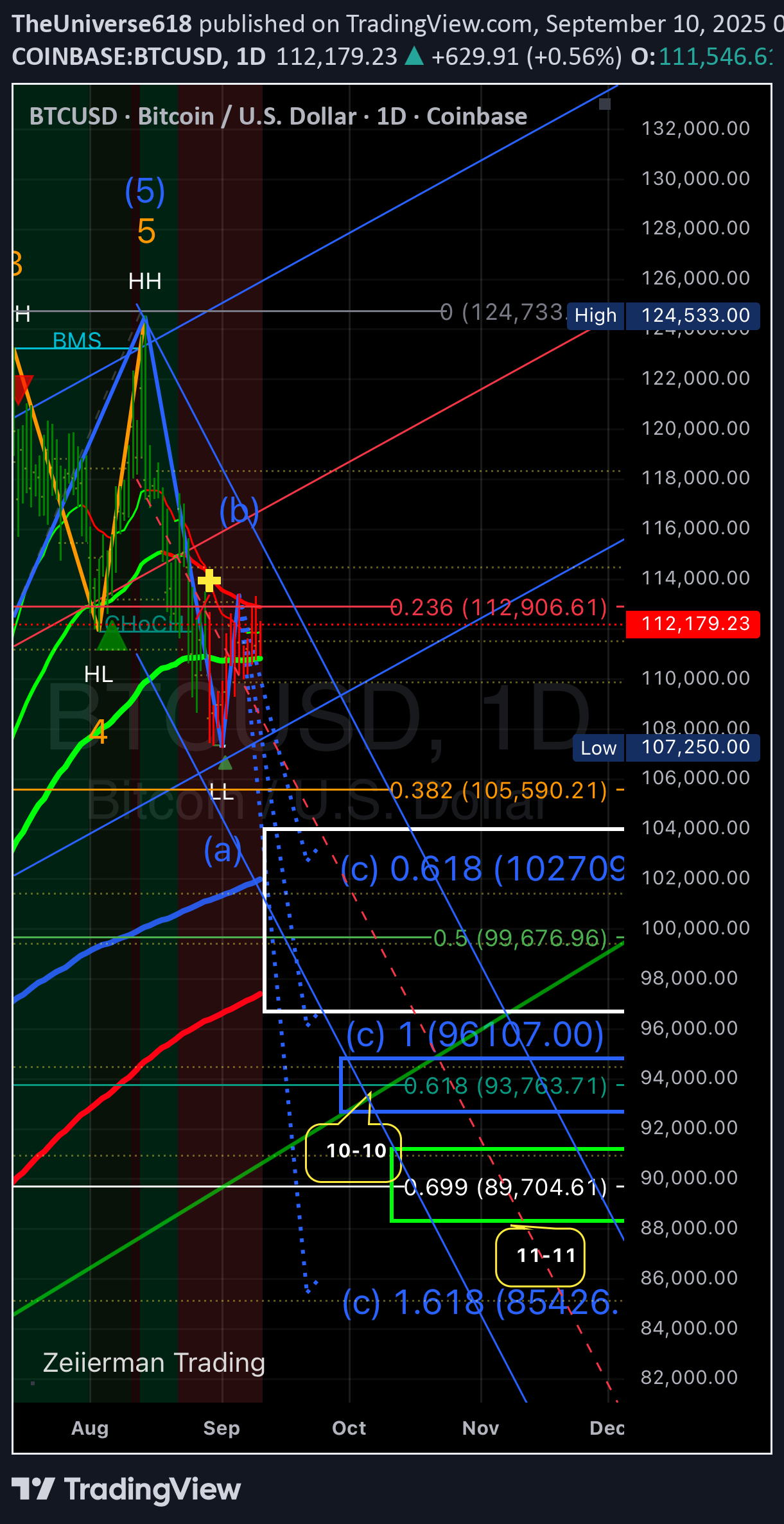

Hello Traders, While many are thinking the party is just about to resume I have found clear bear divergence on BTC and other crypto plus much other TA supporting the move will be down and real soon. Also I believe the move will be down in stocks. Bad inflation data will be the cause starting this morning and accelerating with tomorrow’s follow up. Let’s see how this ages.

TheUniverse618

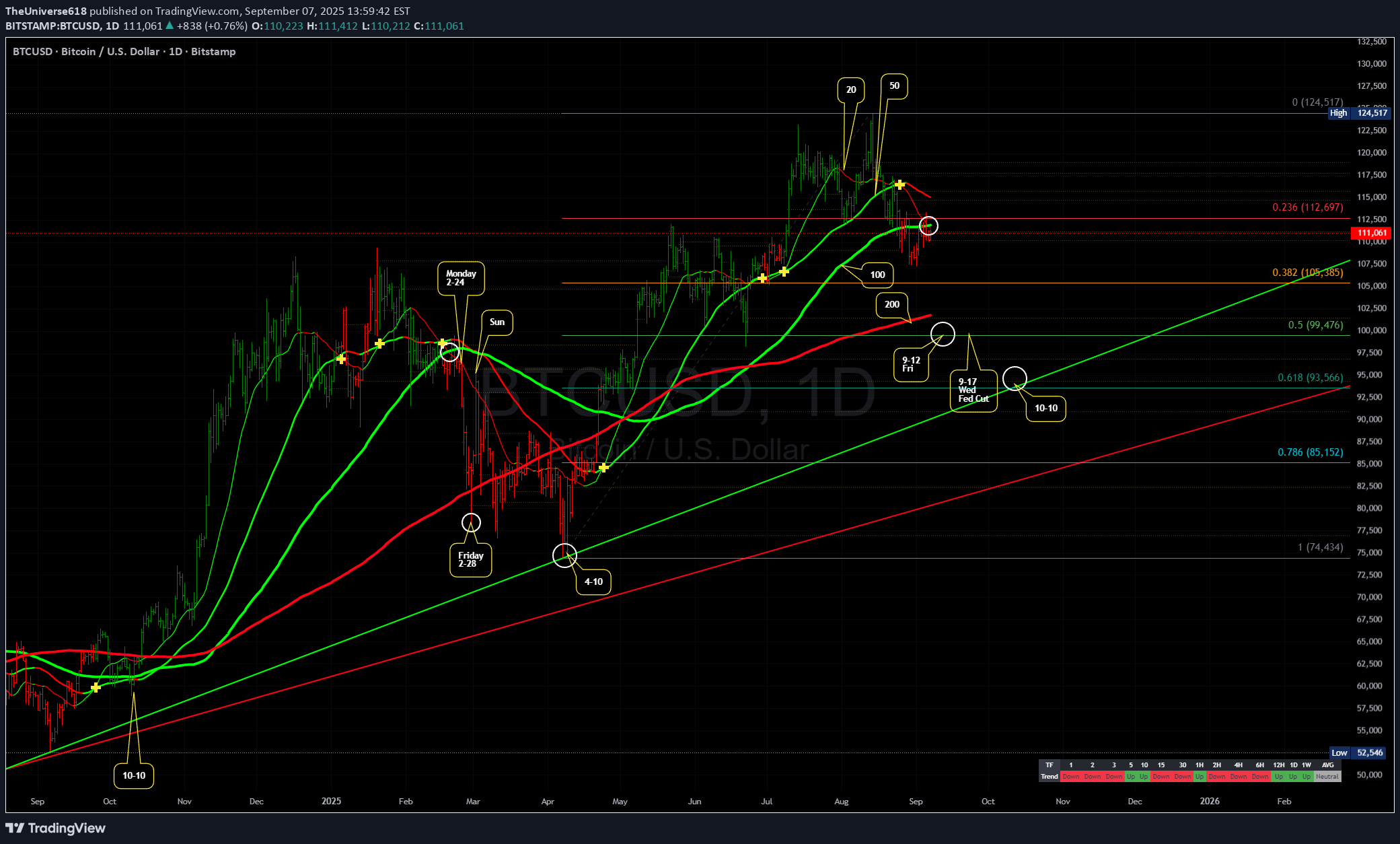

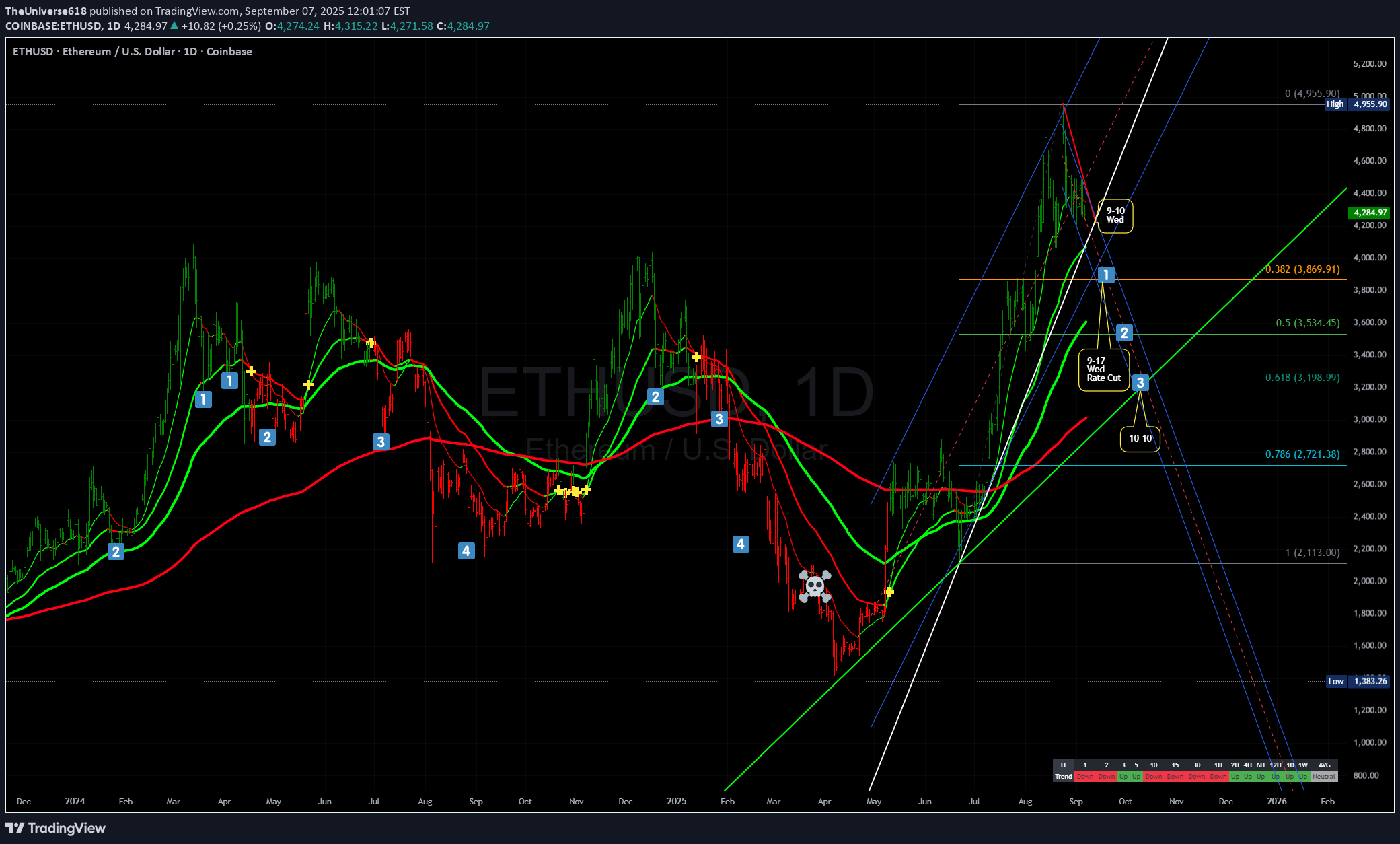

Hello Traders, Looking at TA and other Crypto I believe a down move is at hand..before more than likely more up Oct/Nov into EOY. Here I like some possible targets and timing based on what BTC did earlier this year. the 20SMA just crossed the 100 SMA as circled...same as it did earlier this year before a big downmove shortly there after. Rate cut could certainly change things... but if the ratecut is large .50 and because of a deteriorating job market/economy that could certainly change how risk off assets act with a rate cut... Instead of being bullish it could be bearish. We will have to see how Job numbers come in Tuesday which I think could be the catalyst for everything to move down into the rate cut. We will find out soon

TheUniverse618

Hello Traders.. Well I think we hit a local top.. Could it eak out one more wave up sure.. But I think it needs a decent down move to gather liquidity if its going to stay bullish in the long term. Here I show some price target levels and corresponding drops in the past. What do you think?

TheUniverse618

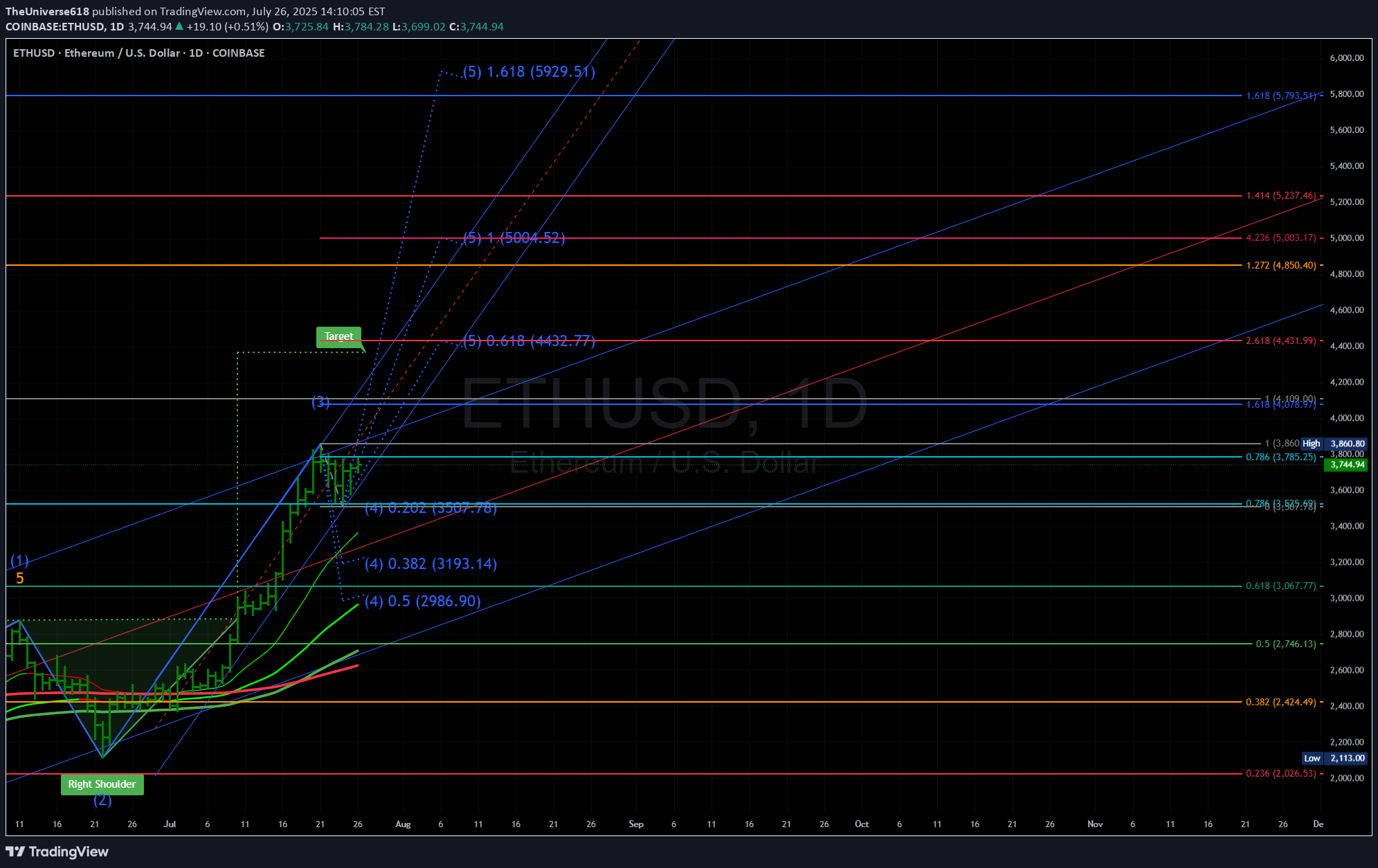

Hello Traders, Using Fibs, Elliot Waves, Trend Regression Channels, and an Inverse H&S Patterns I show some possible ETH price targets and dates. Lets see how this plays outAnother Timeframe and Pattern

TheUniverse618

TheUniverse618

TheUniverse618

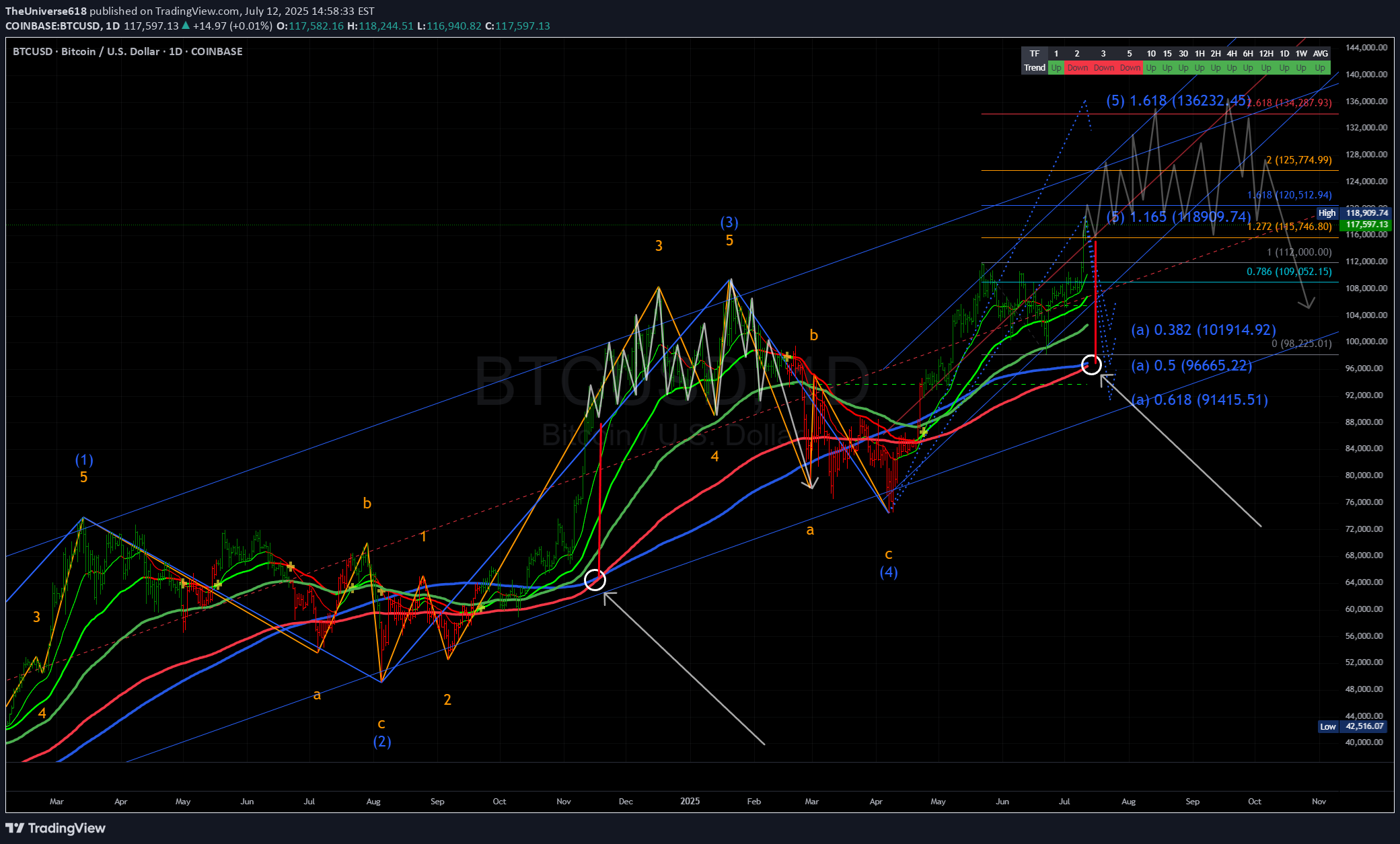

The 200 EMA is about to cross the 200 DMA and I show the last time that happened then I use the fractal from that period to project what BTC could do if something similar. It also lines up with fibs and channels. Let's see what happens

TheUniverse618

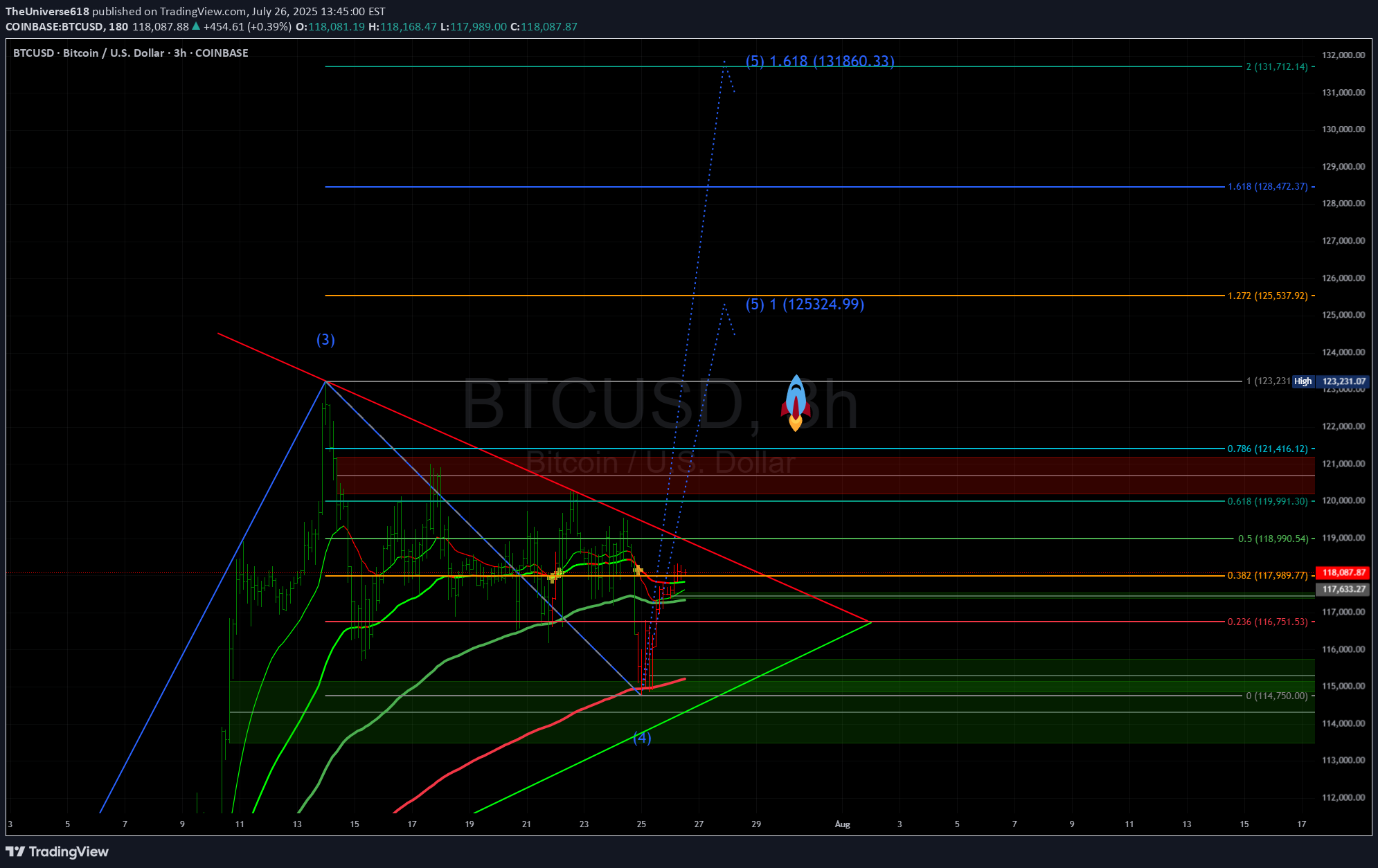

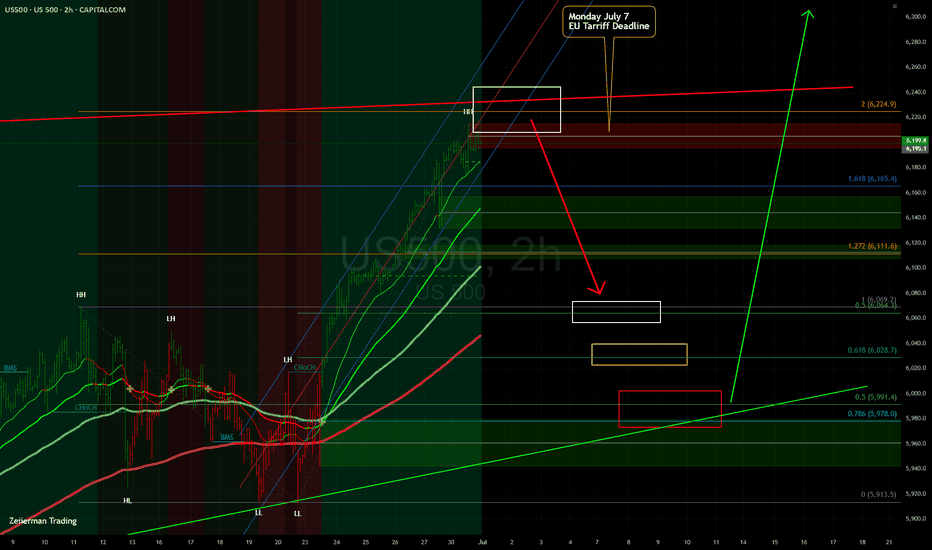

Hello everyone, Well we made it. ATH! Well all things must eventually dip. I see a good possibility into next Monday July 7 Tarif deadline plus we are hitting the ATH's prior tops trendline (Red Line).... I highlight with colored boxes 3 different price targets I think it could dip to before resuming its march higher. Let's see what happens!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.