SwissMail

@t_SwissMail

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

SwissMail

Look Familiar?

Look Familiar? Look Familiar? People love to compare 2023 spring to 2019 spring a lot so here we have it Look Familiar? People love to compare 2023 spring to 2019 spring a lot so here we have it Look Familiar? People love to compare 2023 spring to 2019 spring a lot so here we have it 2019 stopped at the mid-bull correction low which for us now is ~30k Look Familiar? People love to compare 2023 spring to 2019 spring a lot so here we have it 2019 stopped at the mid-bull correction low which for us now is ~30k Look Familiar? People love to compare 2023 spring to 2019 spring a lot so here we have it 2019 stopped at the mid-bull correction low which for us now is ~30k We also see double fractals on each wave going from higher high at the start to lower highe here signaling potential top Look Familiar? People love to compare 2023 spring to 2019 spring a lot so here we have it 2019 stopped at the mid-bull correction low which for us now is ~30k We also see double fractals on each wave going from higher high at the start to lower highe here signaling potential top s3.tradingview.com/s...shots/k/KhoUkbZA.png Look Familiar? People love to compare 2023 spring to 2019 spring a lot so here we have it 2019 stopped at the mid-bull correction low which for us now is ~30k We also see double fractals on each wave going from higher high at the start to lower highe here signaling potential top s3.tradingview.com/s...shots/k/KhoUkbZA.png Look Familiar? People love to compare 2023 spring to 2019 spring a lot so here we have it 2019 stopped at the mid-bull correction low which for us now is ~30k We also see double fractals on each wave going from higher high at the start to lower highe here signaling potential top s3.tradingview.com/s...shots/k/KhoUkbZA.png For 34k enjoyers i have bad news here Look Familiar? People love to compare 2023 spring to 2019 spring a lot so here we have it 2019 stopped at the mid-bull correction low which for us now is ~30k We also see double fractals on each wave going from higher high at the start to lower highe here signaling potential top s3.tradingview.com/s...shots/k/KhoUkbZA.png For 34k enjoyers i have bad news here similar to how we bears got caught on waiting for the 2nd extreme around 12k (the second high) bull can get caught waiting on the 2nd extreme here as well (but in reverse :) ) Look Familiar? People love to compare 2023 spring to 2019 spring a lot so here we have it 2019 stopped at the mid-bull correction low which for us now is ~30k We also see double fractals on each wave going from higher high at the start to lower highe here signaling potential top s3.tradingview.com/s...shots/k/KhoUkbZA.png For 34k enjoyers i have bad news here similar to how we bears got caught on waiting for the 2nd extreme around 12k (the second high) bull can get caught waiting on the 2nd extreme here as well (but in reverse :) ) s3.tradingview.com/s...shots/h/hKdFEZpA.png Look Familiar? People love to compare 2023 spring to 2019 spring a lot so here we have it 2019 stopped at the mid-bull correction low which for us now is ~30k We also see double fractals on each wave going from higher high at the start to lower highe here signaling potential top s3.tradingview.com/s...shots/k/KhoUkbZA.png For 34k enjoyers i have bad news here similar to how we bears got caught on waiting for the 2nd extreme around 12k (the second high) bull can get caught waiting on the 2nd extreme here as well (but in reverse :) ) s3.tradingview.com/s...shots/h/hKdFEZpA.png Look Familiar? People love to compare 2023 spring to 2019 spring a lot so here we have it 2019 stopped at the mid-bull correction low which for us now is ~30k We also see double fractals on each wave going from higher high at the start to lower highe here signaling potential top s3.tradingview.com/s...shots/k/KhoUkbZA.png For 34k enjoyers i have bad news here similar to how we bears got caught on waiting for the 2nd extreme around 12k (the second high) bull can get caught waiting on the 2nd extreme here as well (but in reverse :) ) s3.tradingview.com/s...shots/h/hKdFEZpA.png Look Familiar? People love to compare 2023 spring to 2019 spring a lot so here we have it 2019 stopped at the mid-bull correction low which for us now is ~30k We also see double fractals on each wave going from higher high at the start to lower highe here signaling potential top s3.tradingview.com/s...shots/k/KhoUkbZA.png For 34k enjoyers i have bad news here similar to how we bears got caught on waiting for the 2nd extreme around 12k (the second high) bull can get caught waiting on the 2nd extreme here as well (but in reverse :) ) s3.tradingview.com/s...shots/h/hKdFEZpA.png not worth the wait imo - start taking profit

SwissMail

Retesting the Trend

Downtrend, ema 100 and previous support getting a nice retest on CPI dayLet the chips fall where they may, today is going to be a fun day

SwissMail

Continue to Eat the Ramen

Bulls playing their last cards with fake economic dataInflation and War here to stay and so is the downtrend especially on cryptohere's some lines and extensions for you

SwissMail

Bulls Rekt - Happy 2023

Bulls keep buying while structure and RSI are failing (see forming bear div)But the biggest divergence is one with reality of FTX collapse versus being just 10% away from pre-ftx lows and still higher than June low on total capitalization chart.

SwissMail

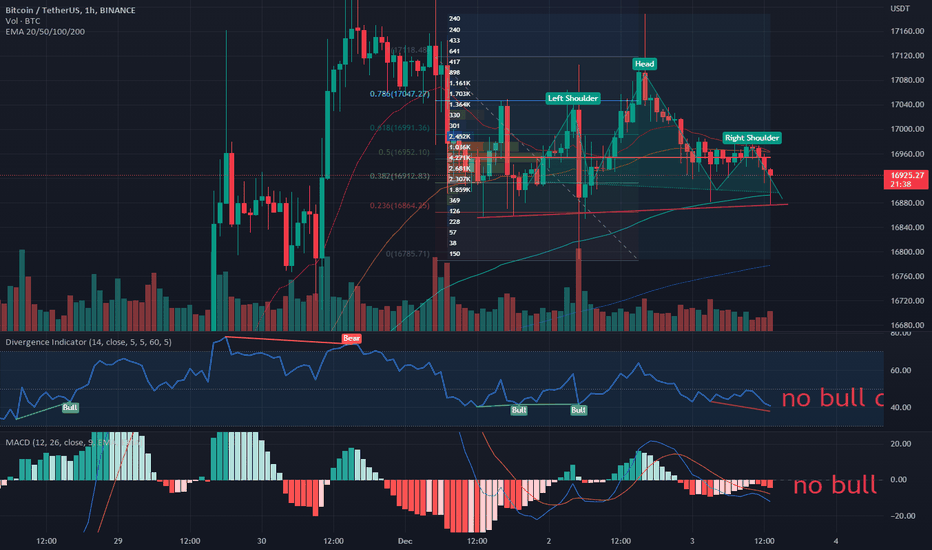

Quick Trade on BTC

I know I posted a bearish medium-term ideaThis is a short term bear on multiple indicators - I want to try to post some of my intraday tradesHere we see several things- emas about to cross down- rsi weakness and inability to form a bull div- macd cross rejection toward bear side- head and shoulders patternAll the same signs also visible on 4h chart4h chartTargetvolume profile delta shows most ppl are shorting here so it could SCAM up for liquidations - be warned

SwissMail

Crypto Pain to resume shortly

Crypto celebrating bottom early what looks like relief (the fastest ever!) wyckoff bottomDisaster averted! crypto is savedBut actually macro has been carrying bulls very nicely away from doom but that is about to change possibly as macro approaches reversalHere's a chart showing the SPX channel top, the dxy trend fib "overextension" and a descending triangle on totals (minus stables)bend the knee peasants

SwissMail

Fresh Copium

Bottom's in Boyz!!Eh Solde?Wen Lambo?Yes we're in tightening macro conditionsdoesn't mean it's a free ride for bearsIf we're indeed in the recession, lows won't come until another year from nowPutin said he's not holding grain from Ukraine on Fridaymight see some supply easePapa Powell gonna keep us safuthe chart shows similar profile on the fed drop 05/22 to the china drop 05/21 not including the general bear trend we're in from the top in November 2021an identical 618 retracement aligned with the trend could land us in 36k territory by end of july (just in time for 2nd quarter GDP reading - signaling potential top)FED put up a positive GDP rumor so we can pump to sell the newsthe conclusion of this trade is possibly coming up,there is a good chance we have just topped out prematurely on the weakest bear rally of crypto history with alts/eth taking the majority of liquidity and preventing a clear 28k-34k breakoutthats why for the conclusion of this trade I will be using a combined market cap chart for the structure as followsgreen cross = lambo moonred cross = rally is over :(we held the red line perfectly (check i didn't move it :D)and appear too be breaking out of green as btc sets up for ema golden cross on dailyim still holding out for a massive squeeze on btc supported by golden cross and btc.d bounce from the 40% levels (as usual)but...i have to acknowledge that many bear rally targets have been achieved (esp on top alts and primarily on SPY) and unless we keep pushing into the squeeze *soon* we might lose the momentumhere are my new stops in blue for the hopium addicts like myself with the full readiness that 70% chance this rally ends very soon (but the 30% chance of pump is too great a reward to give up on)

SwissMail

Wyckoff 3.0

- Based on altcoin dominances indicating risk-on activities I believe we're not in a bear market- So we're just retracing but why is the chart so bearish?- Wyckoff 3.0 - everybody is too smartass these days buying the dip - look at open interest and funding rates- Make this dip look extra bearish by: breaking ema's, key fibs and major trendlines to get them to finally sell- We're approaching this time - just bearish enough that everyone is selling but still within reach of recapturing the major uptrend by breaking out the massive descending wedge- Momentum indicators also pointing toward this happening within the next 10 days but the trends would suggest sooner imo before it is too far gone to repaint a bullish picture for this cycleWhat's next? a 20% move up on corn and dominance recovery (all that money stashed up in alts will help squeeze many bears)What's the likelyhood? I'm going with 70% and managing exposure accordingly - if it fails the next dip will be substantialAaaaan we have a breakout!!Well shit...that fakeout had me...at this point holding spot positions and looking for the next setup

SwissMail

CRO going to MARS featuring Matt Damon

If you're not watching CRO right now you must be living under a rock, let me summarize: - highest earning APY on any currency (if you own cro) - highest cashback return credit card (if you own cro) - lowest exchange fees (if you own cro) - access to highest yield farms on cronos (if you own cro) - access to eth supercharger (get 2% your holding in eth in a month - IF YOU OWN CRO)Okay you say - "But Swiss....this is all pricd in the recent pump "Recent pump was nothing...and driven mainly by 2 other things - token burned 70% limiting supply - coinbase listing - Cronos network is new and TVL (total value locked) on it is growing steadily in a straight line as we speak (up almost 2x from 4 days ago) - Assuming crypto.com doesnt grow, let 10mln users start spending 50k per year using cro credit card (creating buy pressure on cro to get cashback) - Question: how many Billion is that? (10000000*50000*0.03/1000000000) - Hint: 15Billion (very close to current market cap ;) )What about they hype? - Okay Matt Damon... - Staples stadium renamed to Crypto.com arena on Christmas not enough? - Rumor has it: Exchange in US is coming Q4 this year"But Swiss...cro is dumping right noe I must sell!" - Okay Davinci...have a look at the chart - Do you like fibs? - holding above 0.5 fib retracement is bearish? - cro is a "spending" coin and today is cyber monday (put 2 and 2 together ;) )Wen pump? - look at triangle :profit:Attribute the shift of price below the triangle as the effect of broader macro market situation right now and pretend we're in the triangle :)

SwissMail

Forming Distribution Channel Grinding to ATH

We are entering distribution area where a lot of previous top buyers may want to exitNot expecting a pump straight through ATH since its a heavy selling area (thick horizontal line at 57)Instead, could be nice to have a channel going up slowly chewing away at that area before a final pumpRight now might go straight for channel top pre market open or paint IHS to trap bear liquidity to make it easierIf it happens I will be swing trading within this channel, moving increasing focus on altsbtc might have shown near-top just now but crypto has not finished the rally yet, i'll be waiting for the liquidity to move to eth and some alts next

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.