Super_B_XinR

@t_Super_B_XinR

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Super_B_XinR

Whether this develops into a bull trap or a bonafide breakout remains to be seen. Keeping an eye on liquidity dynamics around $100k and Purple Whale order flow. Crypto and risk assets meanwhile stood to benefit from increasing US dollar weakness.

Super_B_XinR

At the time of writing, BTC commands a total market cap of slightly more than $1.9 trillion, while gold’s market cap is almost 10 times greater, around $19 trillion. While there is still a lot of room to grow for BTC, experts opine that it won’t be long before the ‘digital gold’ starts chipping away at gold’s dominance. In a recent client note, analysts at trading firm Bernstein predicted that BTC is on track to replace gold in as little as 10 years. The note stated that BTC is slated to assume gold’s role as a reliable safe-haven asset.

Super_B_XinR

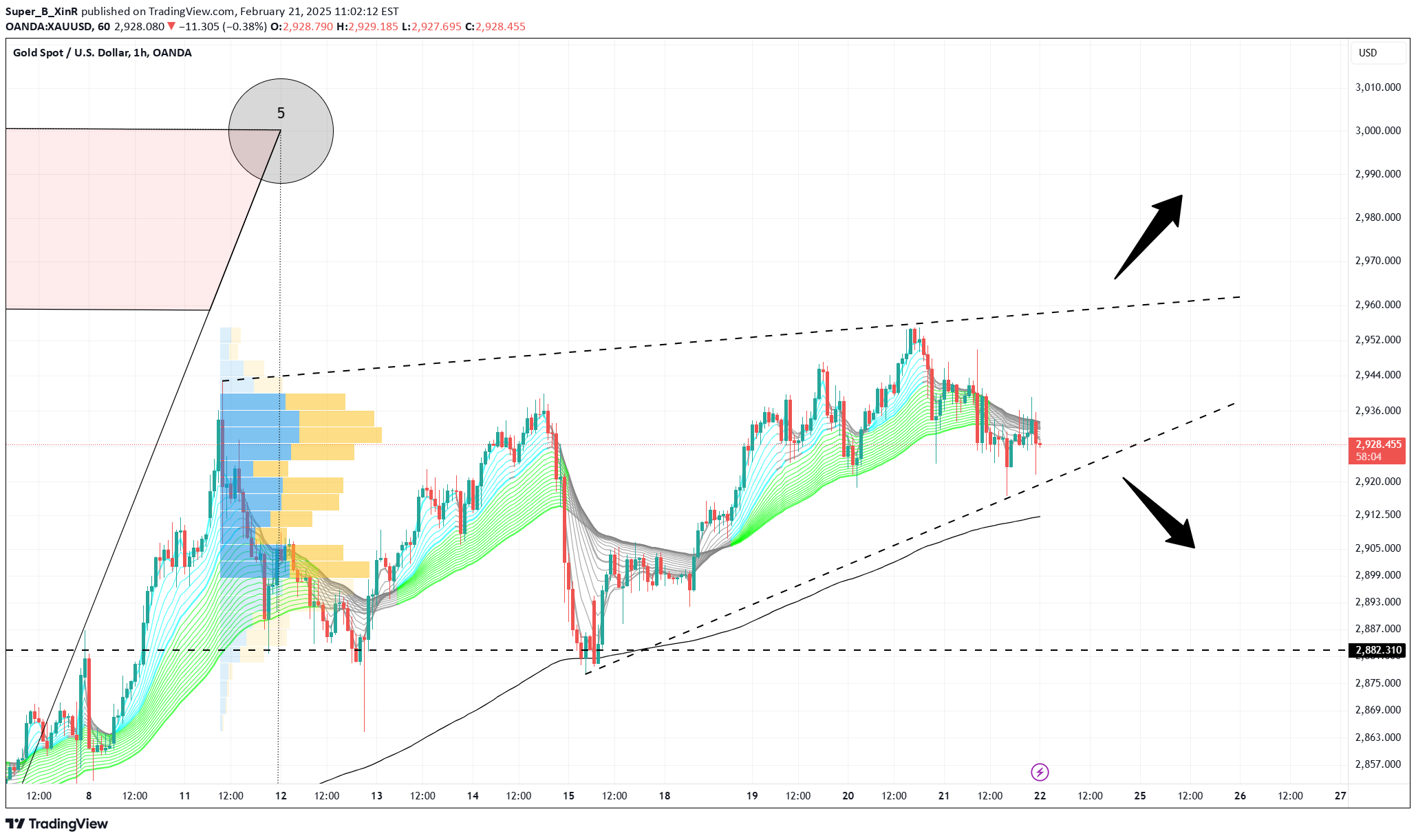

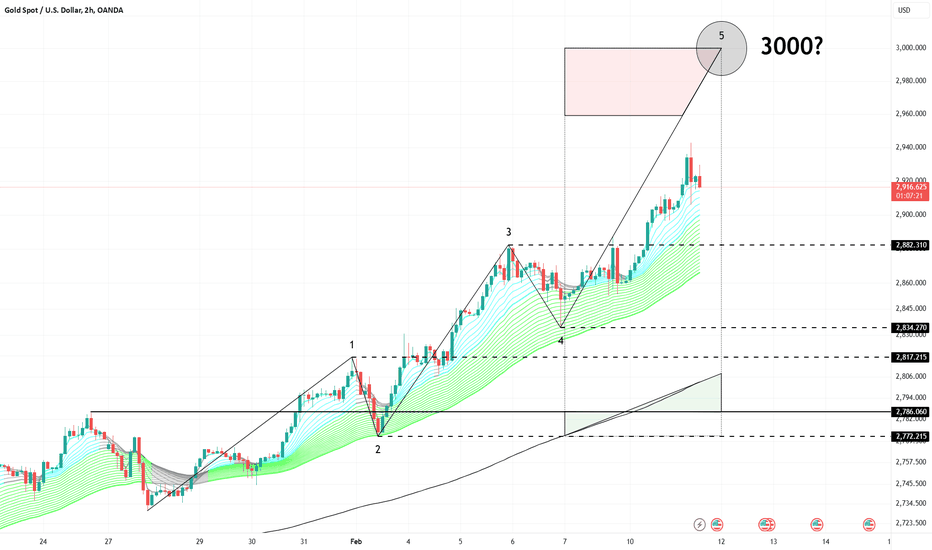

I think the money is piling up to buy but the fundamentals are not looking favorable, on the contrary, the world landscape is changing because Trump is in office, many political and geopolitical conflicts may be coming to an end, and there is reason to believe that this is the last hurrah for Wall Street. Gold prices may be in for a long correction ahead.

Super_B_XinR

The largest crypto slipped to a session low of $91,250 on Thursday, losing about 9% in two days from its Jan. 7 peak above $102,200. BTC has recouped some of its losses and recently traded at $94,390, still down 2.2% over the past seven days.

Super_B_XinR

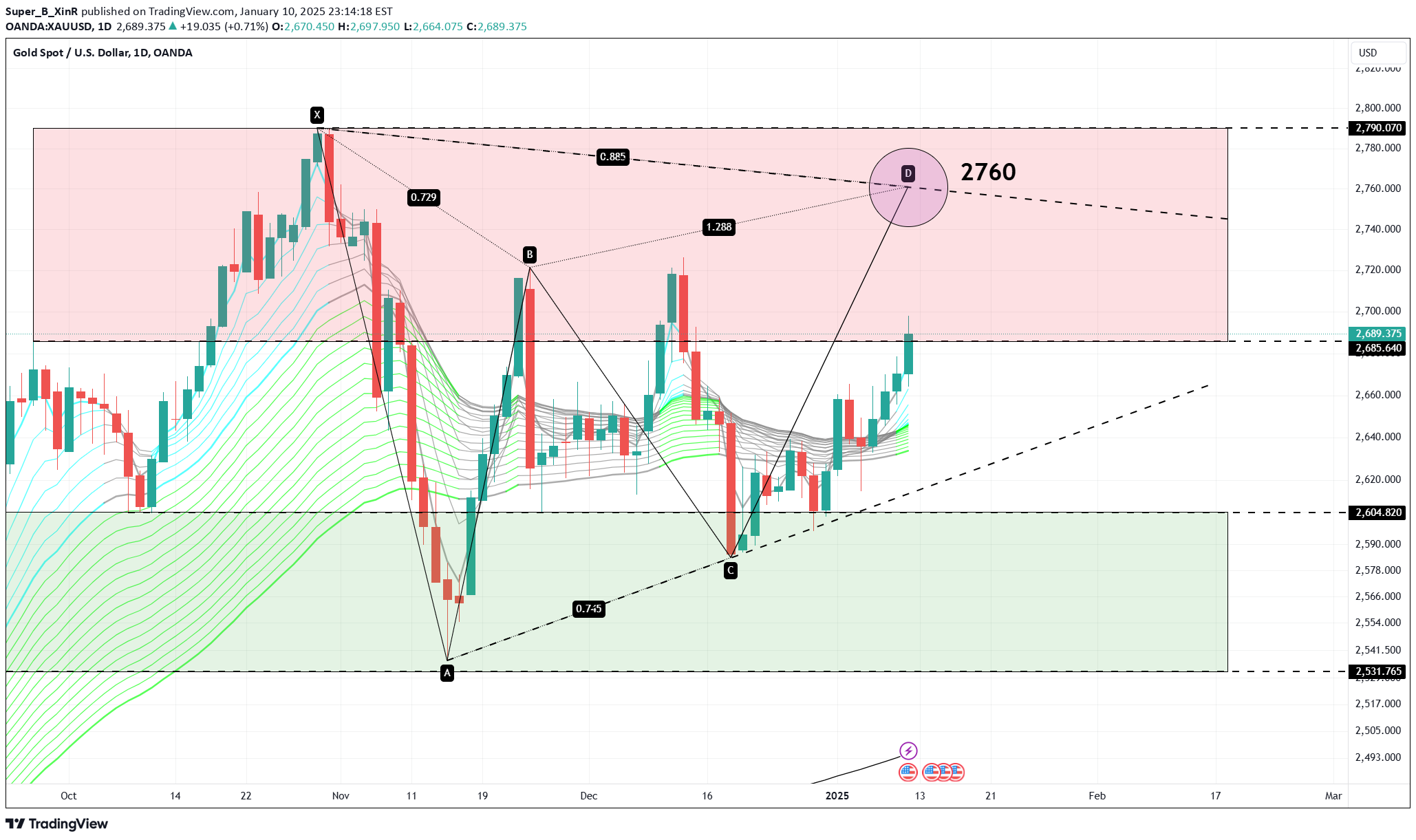

For the week, gold is set for its best performance since mid-November last year. However, the technical setup is still bearish, given resistance at the $2,760/oz level is holding firm. Higher interest rates reduce its appeal as a non-yielding asset

Super_B_XinR

The precious metal has slid against stronger U.S. Treasury yields, with the market looking ahead to 2025 for fresh catalysts. Market pessimism around the prospect of significant U.S. interest-rate cuts in the new year have kept consistent downward pressure on gold prices in late December, reflecting hawkish Federal Reserve commentary and the inflationary nature of many of President-elect Donald Trump's mooted policies. Higher interest rates for longer typically damp the appeal of non-interest bearing bullion.

Super_B_XinR

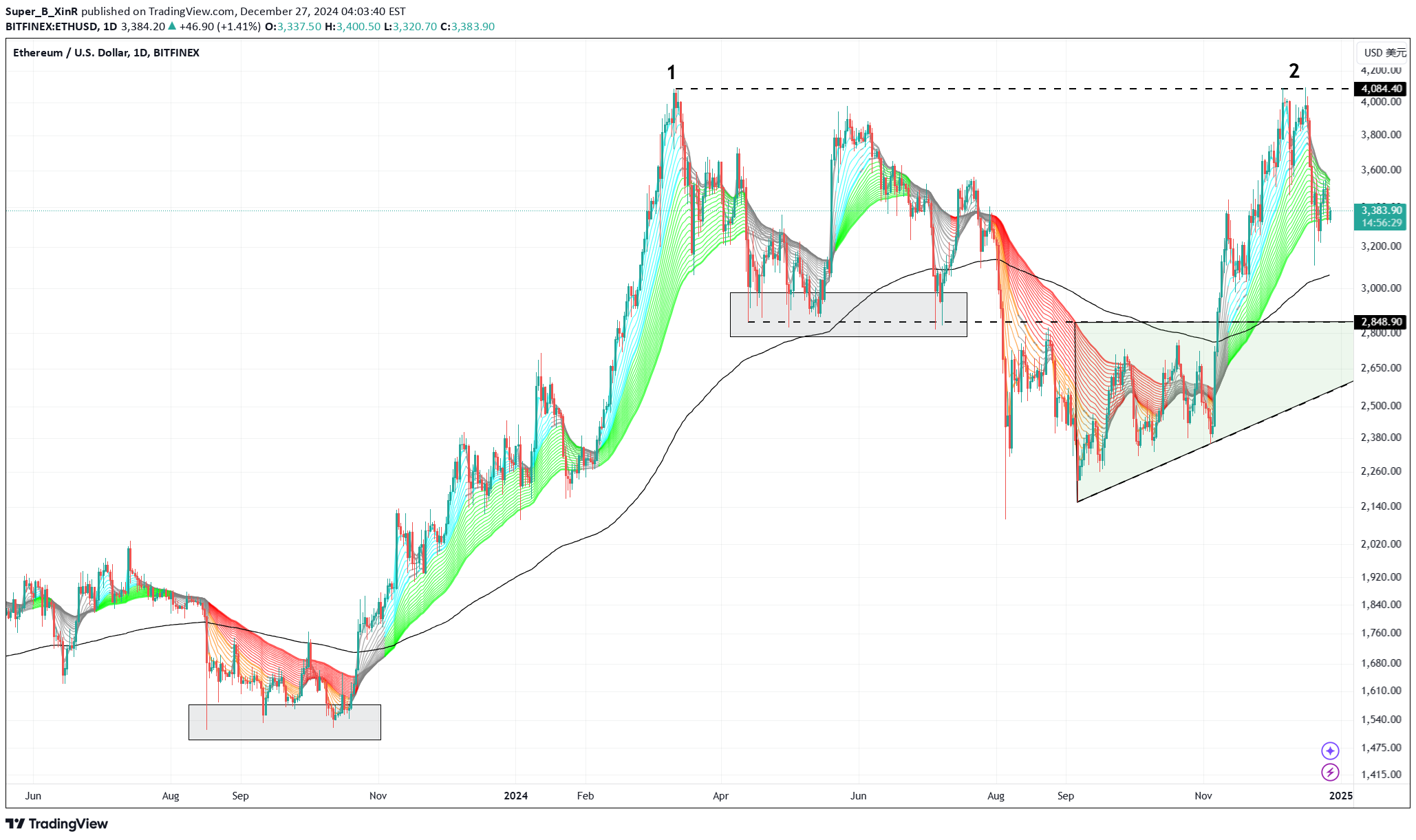

A clear move below the $3,300 support might push the price toward the $3,250 support. Any more losses might send the price toward the $3,220 support level in the near term. The next key support sits at $3,110.

Super_B_XinR

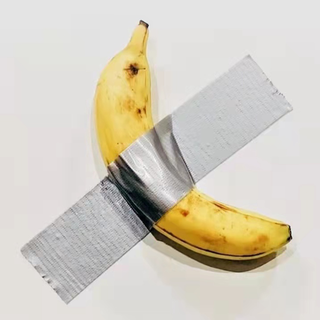

The retreat by traders underscores concerns about market volatility ahead of the election, with Bitcoin prices highly responsive to political dynamics.

Super_B_XinR

Stock markets moved sideways and an uneasy calm settled over currencies and bonds as investors waited for the United States to choose a new leader with polls showing the contest on a knife edge. I think XAUUSD will rebound moderately.

Super_B_XinR

Investors holding positions at high levels are in the most dangerous position. The higher the leverage, the greater the price fluctuations, the more difficult it will be for the investment account to withstand the huge retracements and eventual liquidation.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.