Sphinx_Trading

@t_Sphinx_Trading

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Sphinx_Trading

Gold Outlook: Bearish Continuation in Play Toward 3,250

Gold Weekly Forecast – July Week 4 Gold closed last week with a strong bearish weekly candle, rejecting from the 3,440 supply zone and closing below the key Fair Value Gap at 3,360. This confirms downside pressure, especially in the context of a strengthening dollar. For this week, we may see a bullish opening early in the week toward 3,370, followed by a deeper bearish move targeting the major low and liquidity pool at 3,250. Bias: Bearish Key Zones: •Resistance / Retest: 3,370 •Target: 3,250 •Supply Rejection: 3,440 Momentum favors further downside unless bulls reclaim key levels. — Weekly forecast by Sphinx Trading What’s your bias on Gold this week? #Gold #XAUUSD #SmartMoney #FairValueGap #BearishBias #SphinxWeekly #LiquiditySweep #GoldForecast

Sphinx_Trading

Gold Outlook: After Breaking 3,260 — Is 3,000 the Magnet?

Gold Weekly Forecast Gold closed last week below the previous weekly lows at 3,260, confirming bearish intent. Price has now left behind multiple imbalances from the bullish leg that started at the 3,000 level. We could first see a retracement to the small imbalance zone around 3,300, followed by a bearish continuation back to the main support/imbalance zone near 3,000. Sideways price action is likely early in the week — but unless bulls reclaim 3,300+, momentum favors a retest of the base. Bias: Bearish Key Zones: •Resistance / Rebalance: 3,300 •Support / Imbalance Target: 3,000 — Weekly forecast by Sphinx Trading Drop your view in the comments. #Gold #XAUUSD #GoldForecast #LiquidityVoids #TechnicalAnalysis #SphinxWeekly #SmartMoney #FVG #3kLevel

Sphinx_Trading

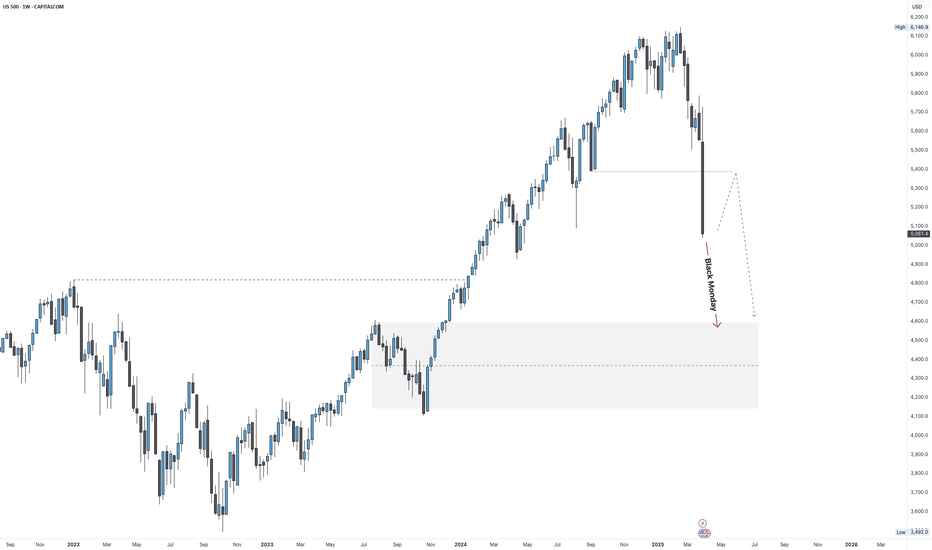

S&P 500 Outlook: Black Monday Risk Points to 4,600

US500 Weekly Forecast – April Week 2 After Trump’s tariff news and the VIX spiking to 29, the S&P 500 (US500) showed signs of cracking. Last week’s candle broke the prior low at 5,092 and closed at 5,061, forming a clear bearish engulfing candle with strong downside momentum. This confirms a structural breakdown, and the first major monthly demand zone sits at 4,600 — a likely target if fear accelerates. Primary Scenario: • Price could open with a short-term bullish correction toward 5,400 (equilibrium zone of the last leg). • From there, we expect a sharp bearish continuation to 4,600 • Alternative: If Monday opens with panic (Black Monday scenario), price may dump straight into 4,600, creating a huge imbalance between 4,600–5,400. • That imbalance could act as a magnet for a later retrace — and then another sell-off from higher again. Bias: Bearish — watching for retest after potential panic move Key Levels: • Support: 4,600 (major monthly demand) • Resistance / Rebalance Zone: 5,400 (equilibrium) • Breakout Confirmation: Weekly close under 5,092 already done This setup reflects both technical structure and the real fear in the market. If Black Monday unfolds, we may get a deep move followed by one of the cleanest bearish retests of the year. — Weekly forecast by Sphinx Trading Let me know your bias in the comments. #SPX #US500 #S&P500 #BlackMonday #MarketCrash #MacroView #SphinxWeekly #VIX #TrumpTariffs #Equities #LiquidityVoid

Sphinx_Trading

Gold Outlook: Bearish Drop to 2,960 Before Bulls Return?

Gold Weekly Forecast – April Week 2 Last week, Gold (XAU/USD) reached a new all-time high at $3,168, before closing the week near $3,035, printing a strong bearish weekly candle. Despite the current risk-off sentiment in global markets — with the VIX spiking to 29 — Gold is not behaving like a safe haven just yet. Instead, the technicals suggest a pullback is necessary. There is a clear imbalance and untested support zone around $2,960, which price has yet to revisit. Primary Scenario: • Gold may open the week with a bullish bounce toward $3,070 • Then reverse with a sharp bearish leg down to $2,960 • From there, we reassess — Gold could react strongly and resume its bullish trend, or continue correcting deeper. Bias: Bearish → Bullish (if $2,960 holds) Key Levels: • Resistance: $3,070 • Support: $2,960 (main zone to watch) This scenario matches both the technical need for a pullback and the macro confusion around gold’s role as a safe haven this week. — Weekly forecast by Sphinx Trading Drop your thoughts in the comments. #Gold #XAUUSD #GoldForecast #TechnicalAnalysis #SphinxWeekly #SafeHaven #VIX #Commodities #MarketOutlook

Sphinx_Trading

XAUUSD: Extreme Demand +400 Pips

- Price has been consolidating within a range for the past week, following the recent bearish move from 2718.0. This range suggests the market is accumulating orders in preparation for the next potential breakout. to be clear I do not know or predict the next big move, but what is clear that before expecting a bullish move we should see at first a small bearish move to take the liquidity below 2605.0 and maybe create a full retest to extreme demand zone at 2580.

Sphinx_Trading

XAUUSD: Short +400 pips

Last week, price accumulated significant liquidity below the 2470 level before reversing to the upside. After sweeping minor liquidity at 2523, a key supply zone has emerged at 2504. Notably, the equilibrium aligns with this supply zone, presenting a potentially strong area for a short position. If a valid short confirmation forms at the 2504 level, we could anticipate a bearish move back towards the 2470 liquidity levels.- Price reached supply area at 2505, now we can wait for a confirmation to short.- Price made a change of character on the lower time frame 5m at higher time frame supply zone. - Now we have a confirmation to short.

Sphinx_Trading

XAUUSD: Bearish +1000 pips

- Price closed last week with the strongest bearish momentum in years after reaching a new high at 2430.0. - As you see in the charts price created trendline liquidity below 2330.0 (sign for bearish move). - Great point of interest created at 2365.0as you see in the charts so it could be a good zone to short after confirmation at LTF. * We may see a big bearish move to 2250.0- Price swept the last lows. created at 2333.0 and closed with a strong bullish candle. - We can predict sweeping the last highs also filling the imbalance / FVG created at 2380.0 levels and that would be our premium zone to enter a short position.

Sphinx_Trading

XAUUSD: Short HISTORICAL high +300 pips

- Price reached 2300.0 new historical high that align with feb extended level. - Price swept the last high closing below it (sign to sell) also we can wait for another confirmation as change of character on LTF.

Sphinx_Trading

BTCUSD: SHORT Setup to 52K +1300 pips

- Price swept 68k high so if price wants to push higher it should sweep the first low's liquidity at least. - Price created SMT with the last bull run at 59k levels so it may drop more lower to sweep the liquidity below 59k also to fill the first imbalance / FVG at 58k as a first target and 52k order block as an extreme target.- Price reached Entry price 65200- Price reached 64k levels and started to pullback to 64.700 resistance. * Closure below 64k levels will lead to 62k Low (Minor liquidity)

Sphinx_Trading

XAUUSD: Bearish pullback to 2100.0

- Price closed last week with weak bearish pressure after reaching 2190.0 areas. Daily Timeframe: - Price left behind big imbalances at 2060/2100 before breaking the all time high an closed last week with a bearish pressure after positive news on US dollar, so price may see bearish pullback move to 2100 (first imbalance) at least. 4h Timeframe: - As you see on 4h charts price built liquidity below 2150.0 also swept the last minor high at 2170 before week closure and closed with a strong bearish move forming another relative equal low. * Pivot 2148: We predict bearish move to 2100 at least only if price closed below 2148

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.