Technical analysis by Sphinx_Trading about Symbol SPYX: Sell recommendation (4/6/2025)

Sphinx_Trading

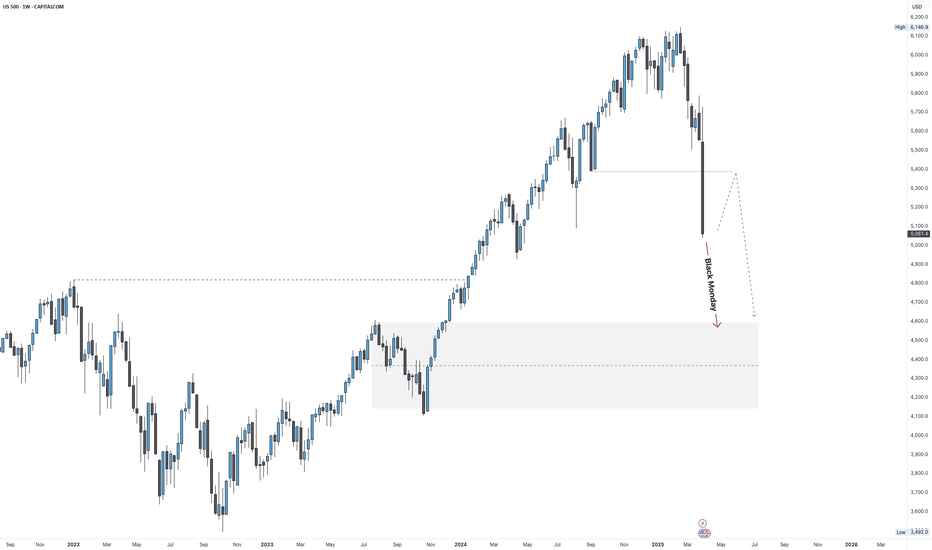

S&P 500 Outlook: Black Monday Risk Points to 4,600

US500 Weekly Forecast – April Week 2 After Trump’s tariff news and the VIX spiking to 29, the S&P 500 (US500) showed signs of cracking. Last week’s candle broke the prior low at 5,092 and closed at 5,061, forming a clear bearish engulfing candle with strong downside momentum. This confirms a structural breakdown, and the first major monthly demand zone sits at 4,600 — a likely target if fear accelerates. Primary Scenario: • Price could open with a short-term bullish correction toward 5,400 (equilibrium zone of the last leg). • From there, we expect a sharp bearish continuation to 4,600 • Alternative: If Monday opens with panic (Black Monday scenario), price may dump straight into 4,600, creating a huge imbalance between 4,600–5,400. • That imbalance could act as a magnet for a later retrace — and then another sell-off from higher again. Bias: Bearish — watching for retest after potential panic move Key Levels: • Support: 4,600 (major monthly demand) • Resistance / Rebalance Zone: 5,400 (equilibrium) • Breakout Confirmation: Weekly close under 5,092 already done This setup reflects both technical structure and the real fear in the market. If Black Monday unfolds, we may get a deep move followed by one of the cleanest bearish retests of the year. — Weekly forecast by Sphinx Trading Let me know your bias in the comments. #SPX #US500 #S&P500 #BlackMonday #MarketCrash #MacroView #SphinxWeekly #VIX #TrumpTariffs #Equities #LiquidityVoid