SpartanTrader001

@t_SpartanTrader001

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Context 1: Support: $2.25 Resistance: $4.25 Psychological Levels: $2.00, $3.00, $4.00 Supply Zone: $2.50 to $3.05 Demand Zone: $4.45 to $5.15 Context 2: Technical Structure 1: We are retesting the breakout of an asceding wedge on the 1D timeframe. We had a clean sweep at the $4.25 range before moving downwards. A Head and Shoulders pattern completing on 1H TF. (Strong bearish confluence.) FVG’s: FVG Confluence 1: Unmitigated 1D FVG located below price. Golden Pocket: Located inside 1D FVG below price Context 3: Volume Insight: OBV indicates a high value spike at the $4.00 psych level. Aligning closely with our resistance level. Bullish Scenario #1: We retest the breakout with a sweep of the lows at the 1D FVG around $3.25. Break back out above the ascending wedge and break through resistance with a bounce off our POC for a new ATH. Bullish Scenario #2: We retest the breakout and fail to make a higher high leading to a double top formation and a move down into the unmitigated FVG and GP alignment. Fully mitigate the Daily FVG and continue to test the formation for another breakout to the top. Bearish Scenario #3: We fail to hold all levels of interior support and move to sweep liquidity at ther $2.25 level. Where a Rejection Block sits along with a bunch of built of orders from June 2025 wating to be filled. Sweep the liquidity to move up to test lower wedge resistance and shift the trrend to bearish and continue to go down.

Context 1: Support: $2.50 to $2.75 Resistance: $3.50 Psychological Levels: $3.00 and $2.50 and $2.00 Context 2: Technical Structure 1: XRP now in a Bullish Flag Pattern. Resistance tested 6 times and Support tested only once. FVG’s: FVG Confluence 1: We have an unmitigated 1H FVG located below price. A 4H FVG almost fully mitigated below price as well. Golden Pocket (Bullish#1): There is a GP located at psych level $3.00. This aligns with the lower anchored VWAP 50% of the way through the Flag Formation. Golden Pocket (Bullish#2): There is a major GP located at the bottom of the Bullish Flag Pattern. This aligns with Support at between $2.50 and $2.75. Golden Pocket (Bearish): A mitigated bearish GP located above price may provide the momentum we need to break through multiple FVG’s to the $3.00 psych level leaving a strong confluence for a sweep of liquidity. Context 3: Volume Insight: OBVshows a spike in volume at $3.15. Showing strong confluence to clear lower FVG alignment and sweep liquidity at $2.85 to continue upwards. BullishScenario #1: We flush liquidity and mitigate all unresolved orders from $2.75 to $2.85. With the help of our lowered anchored VWAP and an EMA 200 confluence we see a sharp rise to the top of our Bullish Flag Pattern for breakout at $3.25. With a retest of the breakout leading to push price upward to sweep the $3.50 to $3.65 area. Bearish Scenario #1: After breaking out of the Flag Patter and sweeping the highs around $3.60, we clear a 4H Rejection Block located inside a Daily Rejection Block. We then test the breakout area creating a Head and Shoulders pattern and close out back inside the Flag Pattern BullishScenario #2: After we enter back into the Flag Pattern after sweeping highs, we see a move down to test support a third and final time at the $2.50 psych level. Aligning with the initial bullish move and it’s .618 level along with the bottom of our Flag pattern where we may see a sharp move upwards to create a new support level and ATH.

Context 1: Support: $125.50 Resistance: $185.00 Psychological Levels: $150.00 and $200.00 and $225.00 Context 2: Technical Structure 1: We find ourselves in a Bearish Flag Pattern to finish off an almost 2 year long Head and Shoulders. After CPI news today we saw a bullish push to sweep liquidity at the $190.00 significance level with some force. Support test 3 times and resistance tested twice. FVG’s: FVG Confluence 1: One bearish Daily FVG located above price.. Golden Pocket: Sits inside the bearish Daily FVG and aligns with the $225.00 Psychological level and the apex of our last test of resistance of the Bearish Flag Pattern. Strong confluence. Context 3: Volume Insight: OBVshows a spike in volume from level $145.00 to psych level $150.00 aligning our POC with a major support level at psych level $125.00. Bearish Scenario: There is a Daily RB in our way to $200.00 to $210.00. If we mitigate and close above the RB; we may see a solid push to our initial bearish GP created from the inital move down. We may see a sweep of the GP at the $225 psych level and a bounce rejection from the Daily FVG at the top of our Bearish Flag and a flush of liquidity to follow.

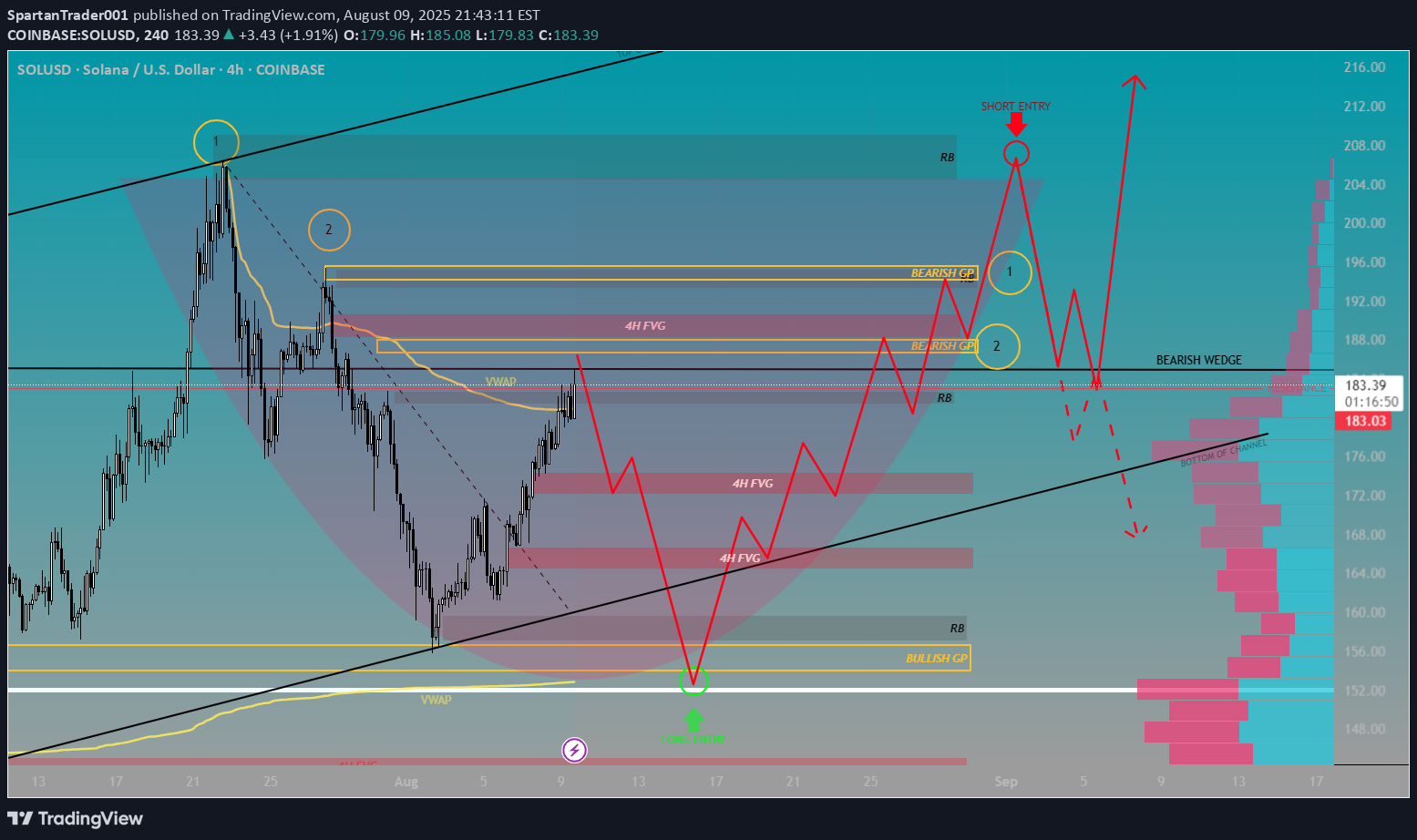

Context 1: Support: $125.50 Resistance: $185.00 Psychological Levels: $150.00 and $190.00 Context 2: Technical Structure 1: We are in a bearish wedge that has formed the beginning of a bearish channel that has tested support 3 times and tested resistance 4 times. FVG’s: FVG Confluence 1: One bearish 4H FVG located bove price. 3 bullish 4H FVG located below price. Golden Pocket: Sits right below 4H FVG and aligns with the $190.00 Psychological level. Strong confluence. Context 3: Volume Insight: Volume Indicator shows a spike in volume from psych level $150.00 and $155.00. Aligning with the POC and a Rejection Block located right above the 0.65 fibbonacci level. Bullish Scenario: With multiple confluence at the $150.00 psych level, price sweeps the previous low as it bounces off the lower anchored VWAP. This will lead to a completion of a Cup and Handle formation producing enough momentum for a breakout of the Bearish Wedge. Bearish Scenario: Above the $200.00 psych level remains a Rejection Block. Sweeping this area may lead to enough liquidation to push us back within the Bearish Wedge and allow for a breakout towards the POC.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.