Sniper29x

@t_Sniper29x

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Sniper29x

Technical Analysis of Bitcoin: * Bearish Divergence and Price Decline: * Several weeks ago, a bearish divergence signal emerged, leading to a significant decline in Bitcoin's price from a high of around $48,900 to a low of $38,539. * Stochastic RSI Indicator: * Currently showing signs of a potential reversal. * After reaching oversold territory, it is now curling up and approaching a cross of its moving average. * Historical data suggests such crossovers often precede notable price increases, indicating a possible bullish turnaround. * Relative Strength Index (RSI): * Recently broke above a downtrend line that had been acting as resistance for several weeks. * This breakout on the RSI suggests a potential shift in momentum towards the upside. * Key Resistance Level: * The previous high around $48,900 is a crucial level to monitor. * A successful breach of this resistance could signal further upward movement in the price of Bitcoin. * Halving Pattern: * Historical data indicates a sell-off typically follows Bitcoin's halving events. * A demand zone has been identified between $34,000 and $37,000 in anticipation of such events. In summary, technical indicators suggest a potential bullish reversal for Bitcoin. Traders should remain vigilant and monitor price action around key resistance levels, particularly the $48,900 mark. Additionally, awareness of historical patterns, such as sell-offs following halving events, can provide valuable insights into potential price movements.

Sniper29x

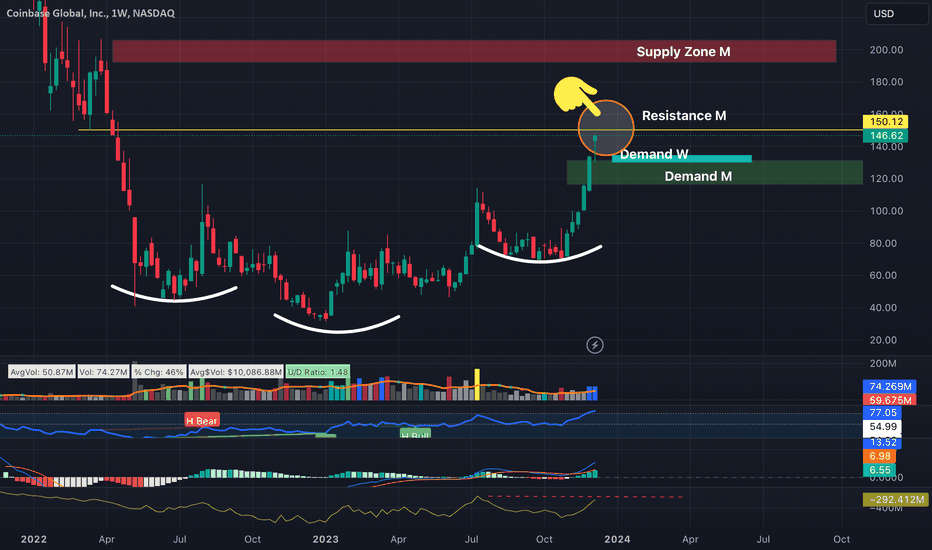

Potential Challenges COIN $150 Resistance Battle: a formidable hurdle at $150, representing both a psychological and technical challenge. In the event of a potential rejection at $150, attention turns to the $115-130 monthly demand zone, a critical support level. A pullback to the $115-130 would provide traders and investors with a strategic point for potential entries. Chart Patterns: The ongoing scenario includes an Inverse Head and Shoulders pattern, hinting at a potential bullish reversal, and a Hammer pattern, signalling resilience with a recovery from the lows. Technical Strengths: Recent indicators, including a rising Accumulation/Distribution Line, a vibrant MACD, and an RSI at 76, suggest current technical strengths favouring the bulls. Recognition of the Inverse Head and Shoulders pattern and Hammer formation adds to the bullish narrative, suggesting potential trend reversals. Breakthrough to $150: A successful breach above $150 opens avenues for further highs, targeting the next supply zone at $191-207, though potential selling pressure looms. WATCH for Coinbase's $150 challenge, watch for potential rejection or breakout. Stay vigilant, manage risks, and seize opportunities for informed decision-making.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.