Smart_Cryptologistist

@t_Smart_Cryptologistist

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Smart_Cryptologistist

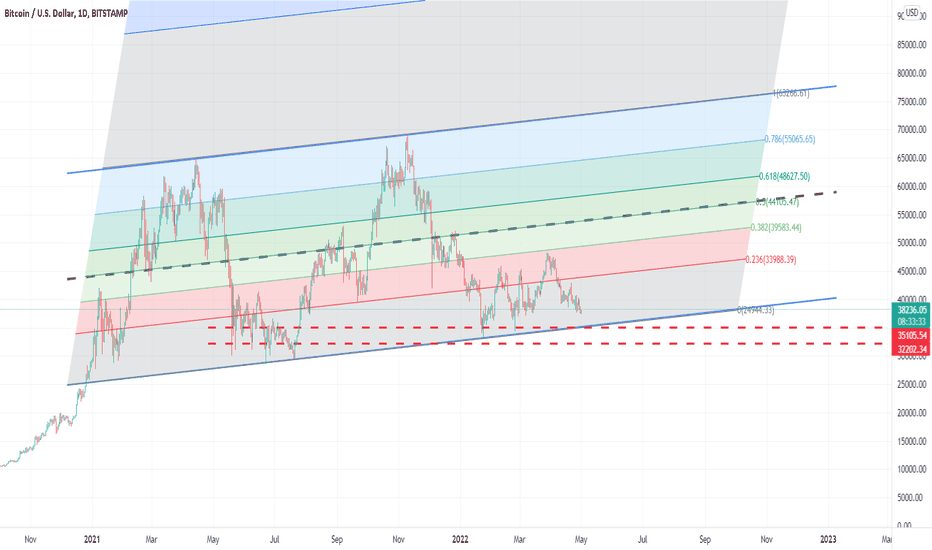

Btc fibo

The biggest support of Btc is 65 64.5 thousand dollars and these levels were tested. Spin up

Smart_Cryptologistist

BTCUSD

BTC has completed the downtrend by dropping to around the 200 weekly average. My expectation is the completion of the decrease of around $22000, which is an average of 200 per week.

Smart_Cryptologistist

Smart_Cryptologistist

BTCUSD

The steps for bitcoin are as follows. The downward trend is signaling.

Smart_Cryptologistist

Smart_Cryptologistist

Smart_Cryptologistist

BTCUSD

Let's see if BTC can reach the 60,000 band by protecting against the Fed's rate hike and all the manipulative pressures.Otherwise, it will regress to the 29 thousand band, which is the support band. I think even the interest rate decisions made against the increasing inflation in the world will not be able to prevent the depreciation of paper money. It will be either today or tomorrow. ;)

Smart_Cryptologistist

BTCUSD

Possible trajectory of BTCUSD. It becomes stable between .52000 and 47 thousand. It lingers a little. Then towards the end of 2022, it continues to increase in 2023..

Smart_Cryptologistist

BTCUSD

It is necessary to overcome the heavy penguins over 40 thousand. The daily closing should be over 40 thousand.

Smart_Cryptologistist

BTCUSD

It is necessary to overcome the heavy penguins over 40 thousand. The daily closing should be over 40 thousand.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.