SmartSignalss

@t_SmartSignalss

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

SmartSignalss

$NVDA – Earnings Super Bubble?

🚨 Nvidia is reporting earnings tomorrow, and the market is waiting with bated breath. While analysts pile on with hyper-bullish predictions extrapolating the AI super bubble, they seem to ignore one glaring fact: 👉 The last time Nvidia beat earnings, the stock crashed -45% shortly after. Technical view: We’re near resistance at the previous post-earnings high. RSI sits at 63.80, hinting at possible exhaustion. Volume spikes hint at indecision, not confirmation. This could be a make or break moment for NVDA and by extension, the entire Tech sector.

SmartSignalss

$BTC – Breaking Out of the Pattern?

📈 Bitcoin (BTC) is testing the upper resistance zone of a multi-month structure.✅ Break of Structure (BOS) has already occurred, adding fuel to the bullish case.🚀 Just a bit more upside and BTC could escape this consolidation pattern completely.Key levels to watch:Break above ~$110K areaGreen trendline remains strong supportEyes on higher timeframe close to confirm breakoutThis could be a pivot point for Bitcoin’s next leg higher — or a trap if sellers step in hard.

SmartSignalss

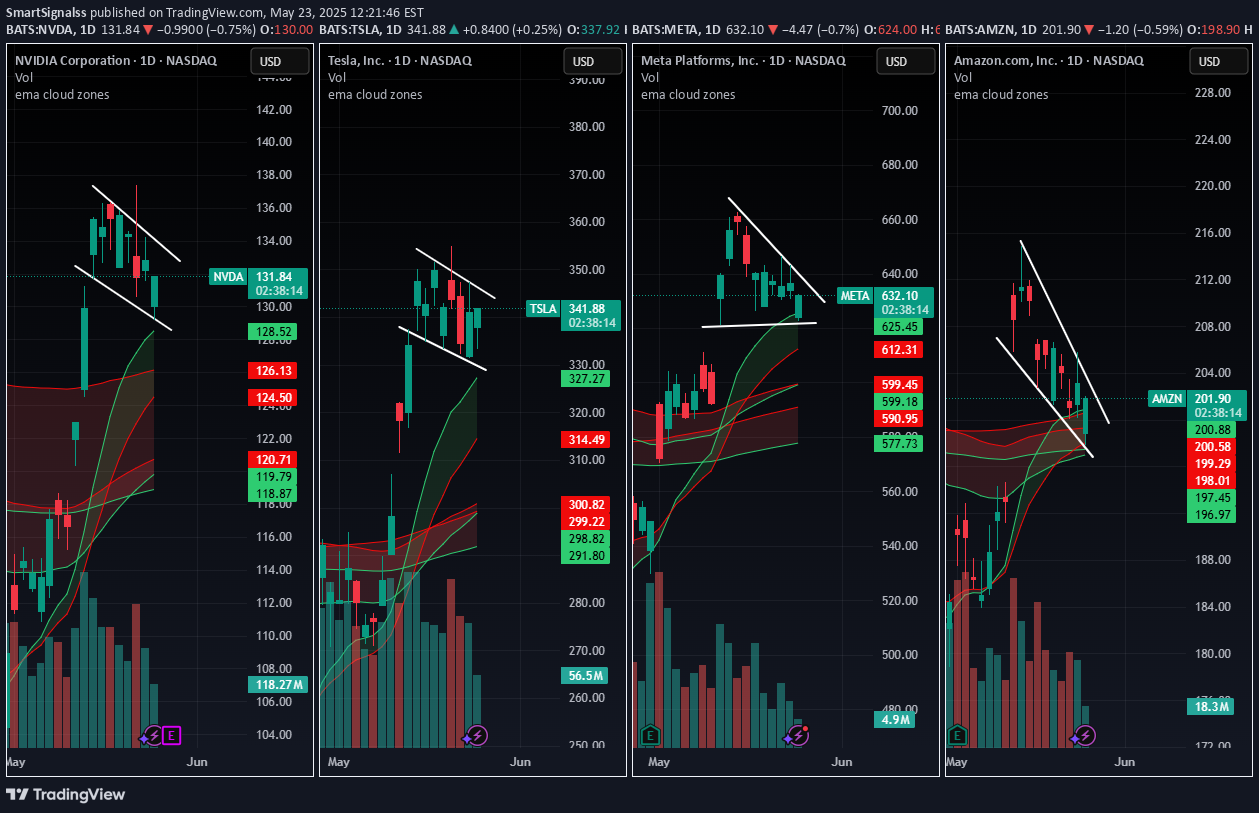

$NVDA $TSLA $META $AMZN – Triangle Squeeze Incoming?

📊 Symmetrical triangle formations are building across these tech giants — and volatility is compressing. 🔍 What to watch: 📈 Breakout above upper trendline = bullish momentum 📉 Breakdown below lower trendline = bearish confirmation 📉 RSI on NVDA is at 73.04 = overbought warning ⚠️ NVDA earnings drop May 28, could be a trigger for resolution These coils don’t last forever. Price is building pressure — and one strong candle could break the dam. Stay sharp, and tighten your stops. This is where risk management matters most. 👇 Which side are you betting on — breakout or breakdown?

SmartSignalss

$NVDA Hits Key Inflection Zone – Breakdown or Breakout?

📍 We’ve arrived. NVDA has reached the key reversal zone where sellers previously took control. This is the third touch, and markets rarely leave these zones without a fight. 🔍 Technical Setup: Price has retraced to prior breakdown level. MACD is trying to cross bullish — momentum building. Sellers should defend here… but the recent AI narrative and Gulf chip deals could fuel a breakout. If sellers fail to show up, we may blow straight through this level toward new highs.

SmartSignalss

Trump Manipulates the Market Again: Tariffs ON/OFF Play

Once again, we’re watching how political narratives are used to shake the markets — and Bitcoin was no exception this time.🔻 Step 1: "TARIFFS ON" AnnouncementMarket instantly reacts with a sharp sell-offBTC drops from 81K to nearly 75KFear spikes, media goes wild📉 That’s your classic short squeeze setup.🔺 Step 2: "TARIFFS OFF" RetractionMassive green candle, BTC rebounds from lowsShorts get liquidatedPrice rips back up in minutes💸 It’s a textbook fake panic followed by a well-timed reversal. Someone knew what was coming. Someone profited. And it wasn’t retail.🔎 What does this mean? This is not just market volatility — this is narrative-based manipulation. If you're trading without paying attention to headlines, you're already behind.🧵Follow the money. Follow the timing. Follow the candles. #Bitcoin #BTCUSD #MarketManipulation #Tariffs #Trump #PoliticsInMarkets #Whales #NarrativeTrading #PriceAction

SmartSignalss

$NVDA | A Double Bottom in the Making?

We’re spotting the early structure of a double bottom pattern forming on NVDA — a classic bullish reversal signal. After a steep decline, price action is showing signs of stabilization, testing support twice, and trying to recover from the lows. But there’s a catch... 📌 No confirmation yet. The neckline still needs to be broken with strong momentum to validate this formation and trigger potential upside. ⚠️ Today’s tariff-related news could be the catalyst. A strong reaction may either confirm the breakout or invalidate the pattern entirely. What to watch: Break above the neckline with volume = potential entry ✅ Failure + breakdown = more pain to come ❌ This is a key technical level. Stay sharp and let price action lead the way.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.