Signal_Centre1

@t_Signal_Centre1

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal_Centre1

Bitcoin Intraday Sell: Bearish Momentum Persists

Bitcoin – Sell Limit Entry: 111650 Target: 107260 Stop Loss: 113650 Type: Intraday Trade Idea: Continued downward momentum from 117415 resulted in net daily losses yesterday, marking three consecutive negative sessions. Although the overnight dip has been bought into, there is scope for further bullish pressure this morning. Bespoke support is located at 104645, but there is no clear indication the downward move has ended. Preferred strategy is to sell into rallies, targeting a move back toward 107260 with stops above 113650. Resistance Levels: 111650 / 114424 / 117420 Support Levels : 107260 / 105000 / 104645 Next Volatile Events: No events in the next 24 hours Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Signal_Centre1

US500 Intraday Buy: Dips Attracting Buyers Near Key Support

US500 – Buy Limit Entry: 6396 Target: 6516 Stop Loss: 6356 Type: Intraday Trade Idea: Levels close to the 78.6% pullback level of 6395 found buyers, suggesting demand remains intact. Setbacks should be limited to yesterday’s low, with overnight losses contained. The primary trend remains bullish, and the 20 1-day EMA at 6384 underpins price action. Preferred trade is to buy into dips for a potential rebound. Resistance Levels: 6421 / 6467 / 6490 Support Levels: 6393 / 6369 / 6348 Next Volatile Events: 20/08/2025 19:00 — FOMC Minutes (US) 21/08/2025 01:00 — Jackson Hole Symposium (US) Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Signal_Centre1

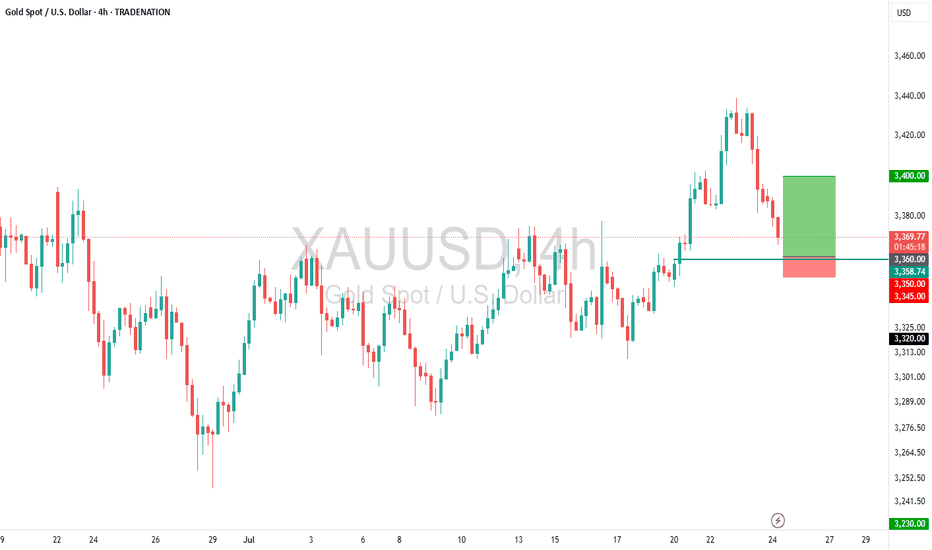

Gold (XAUUSD) – Buy the Dip Toward Key Support

Trade Idea Type: Buy Limit Entry: 3360.00 Target: 3400.00 Stop Loss: 3350.00 Duration: Intraday Expires: 25/07/2025 06:00 Technical Overview The primary trend remains bullish, supported by recent price structure and sentiment. Price is correcting lower, and is approaching Fibonacci retracement support at 3360.00. A Buy Limit at 3360.00 aligns with bespoke support and offers a low-risk entry opportunity. The target at 3400.00 is modest but achievable within the current intraday cycle Upcoming Events to Watch 24/07/2025 at 14:45 – S&P Global Manufacturing & Services PMIs (US) could add volatility and act as a catalyst for a reversal from support. Key Technical Levels Resistance: 3400.00 / 3420.00 / 3435.00 Support: 3360.00 / 3340.00 / 3320.00 Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Signal_Centre1

US500 – Buy the Dip Near Trend & EMA Support

Trade Idea Type: Buy Limit Entry: 5,870 Target: 6,020 Stop Loss: 5,820 Risk/Reward Ratio: 3:1 Duration: Intraday Expires: 28/05/2025 12:00 Technical Overview Price action continues to respect the primary bullish trend with recent buying off the 78.6% Fibonacci pullback level at 5,868. A bullish engulfing candle on the 4H chart reinforces a short-term momentum shift to the upside. The 20-period 4H EMA (5,864) is rising and should provide dynamic support near the entry level. The setup favors buying dips, aiming for a move to 6,020, while keeping stops tight below key support at 5,820. Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Signal_Centre1

Bitcoin (BTCUSD) – Buy the Dip Near EMA Support

Trade Idea Type: Buy Limit Entry: 108,050 Target: 111,850 Stop Loss: 106,750 Risk/Reward Ratio: ~2.9:1 Duration: Intraday Expires: 28/05/2025 12:00 Technical Overview Bitcoin continues to hover near all-time highs, maintaining a bullish structure of higher highs and higher lows. Current price action suggests temporary pullbacks are healthy within this trend. Yesterday's low and the 50-period 4H EMA (~107,956) should act as strong support. The strategy is to buy dips into this zone, anticipating a bounce toward resistance at 111,850. Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Signal_Centre1

XAUUSD – Buy Limit Setup (Intraday Idea)

Expires: 01/05/2025 06:00 Trade Summary Type: Buy Limit Entry: 3225.00 Target: 3385.00 Stop Loss: 3185.00 Risk/Reward Ratio: ~4:1 Duration: Intraday Technical View The primary trend remains bullish, with recent downside viewed as corrective. Current selloff is nearing exhaustion, as indicated by daily chart signals. A Buy-the-Dip strategy is preferred, aligning with bespoke support at 3225.00. A break above 3350.00 could reaffirm bullish momentum, with measured resistance targets at 3370.00 and 3400.00. Upcoming US Data Risks (High Impact) 13:15: ADP National Employment Report 13:30: Advance Estimate GDP & Employment Cost Index 15:00: Personal Income and Outlays 15:30: EIA Petroleum Status Report Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Signal_Centre1

Bitcoin (BTCUSD) Sell Limit Trade Idea

BTCUSD Bitcoin has formed a double top pattern, confirmed by a breakdown below 89,199, signalling potential for further downside. Additionally, a bearish flag breakdown in recent sessions suggests continuation lower.This morning’s gap down highlights market weakness, but a fill of this gap at $83,543 may offer an ideal entry for short positions.Trade DetailsEntry (Sell Limit): 83,543Stop Loss: 87,992Take Profit: 70,613Risk/Reward Ratio: 2.9:1Key LevelsResistance:R1: $83,543 (Entry Point)R2: $85,819R3: $88,767Support:S1: 76,590S2: 70,531S3: 63,411Technical & Fundamental Factors✅ Double Top Formation – Breakdown below 89,199 confirms bearish momentum.✅ Bearish Flag Breakdown – Indicates continuation of the current downtrend.✅ Gap Lower – Signals further weakness; gap fill at 83,543 offers a selling opportunity.⚠️ Smart Money Not Buying – Commercial participants are selling Bitcoin, suggesting a lack of institutional support.SummaryThis setup offers a high-probability short opportunity at 83,543, targeting a move down to 70,613, with a stop at 87,992. The combination of technical breakdowns and weak institutional demand supports a bearish outlook.Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Signal_Centre1

Bitcoin to push for a new all time high?

Trade ideaBitcoin - 24h expiry - We look to Buy a break of 65600 (stop at 64000) Short term MACD has turned positive.Short term momentum is bullish. We look for gains to be extended today. Price action continues to trade around the all-time highs. A break of the recent high at 65525 should result in a further move higher. Our profit targets will be 69600 and 70600 Resistance: 65525 / 68000 / 70000Support: 64000 / 62000 / 60500

Signal_Centre1

Taf's Gun to the Head

Trade Idea: Short Gold at MarketReasoning: Lookig for a correction from the parabolic bullish movement. Resistance at 1780 seems to have held and we are currently at resistance which was support before. Target is the 1750-1747 zone.Entry:1769.72TP: 1747.46SL: 1778.41RR: 2.56Disclaimer – Signal Centre. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Signal_Centre1

Taf's Gun to the Head

Trade Idea: Sell Bitcoin at MarketReasoning: Fundamentals of the crypto space are in peril after the collapse of FTX and this will show on BTC. Price broke down from a crucial 18200 support level and we seem to have retested it yesteday and now looking for bearish momentum to continue today.Entry:17271.00TP: 15005.00SL: 18251.39RR: 2.31Disclaimer – Signal Centre. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.