Sherman_Trades

@t_Sherman_Trades

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Sherman_Trades

Bearish opportunity in ACH

1. We want price to at least head to the order blck meanthreshold 2. We have structure shift in H1 2. We have turtlesoup confirming liquidity grab 4. We are at H1 Orderblocks ALTERNATIVE SCENARIO; We have very clean buyside in 0.024228 and 0.024228 That pose a risk to downside orderflow

Sherman_Trades

Bullish Opportunity in ACH

1. We have price reacting off the parent model 22 2. We have price reacting off the H4 OB Wick 3. We have equal highs and Buyside to attack

Sherman_Trades

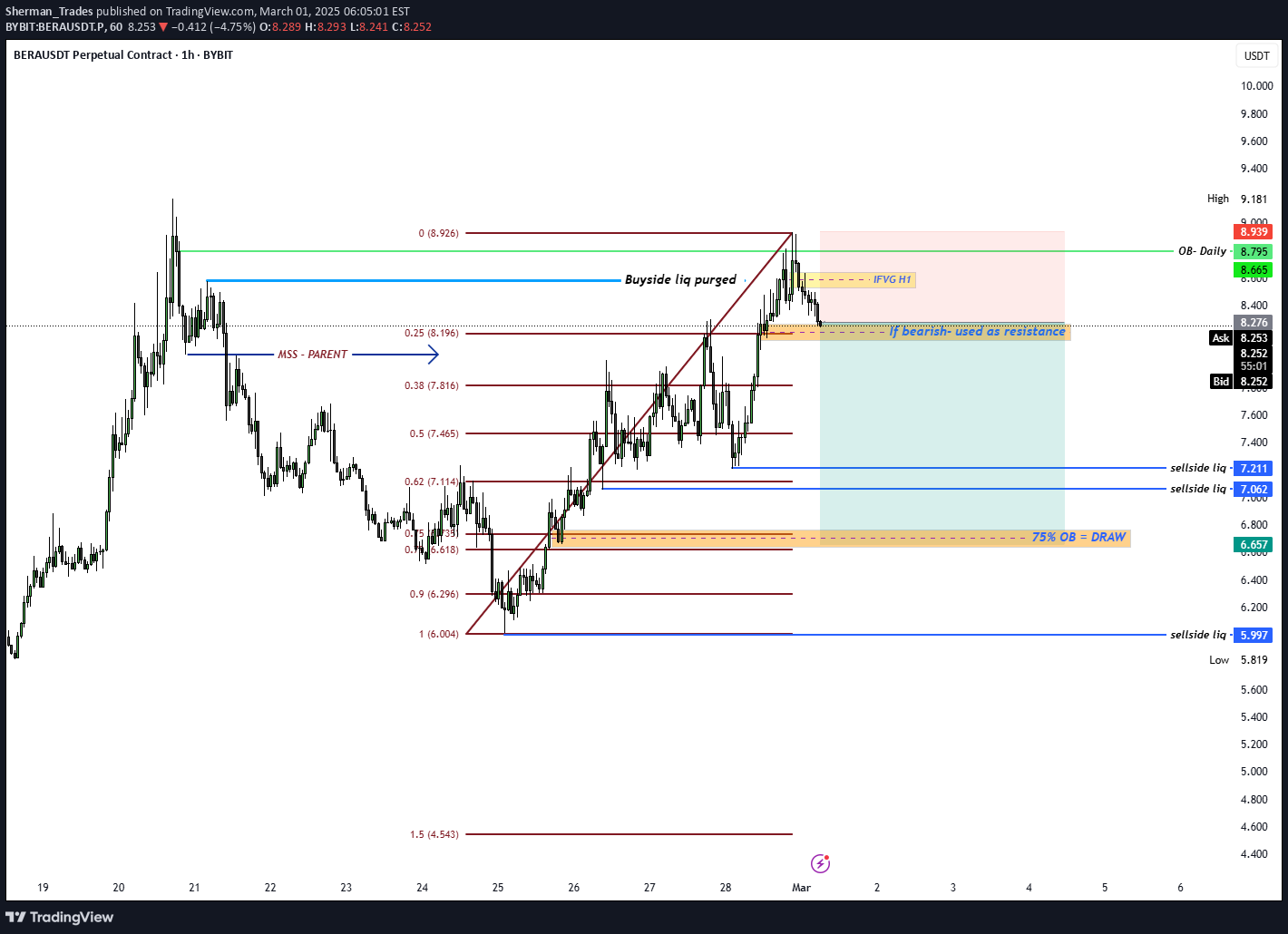

Bearish opportunity in BERA

1. This idea is related to the linked idea posted yesterday (check below) 2. We have a purge on buyside into the daily OB- 3. This is a selloff idea using the parent Model 22 4. We have MSS as well

Sherman_Trades

Bullish Opportunity in KAITO

1. We have price finding strength at the Bullish OB+ 2. We have structures shift (MSS) 3. We have price having a draw as the Breakaway gap 4. We have this pair still in a bullish momentum

Sherman_Trades

Bullish opportunity in Pi Network ROAD TO 3.1415

1. Price dipped after hitting 3.0 but thats not the target(at least not yet).. that why a lower low ahs not been created yet 2. We have MSS supported by a H3 OB+ 3. We have price finding strength above the H3 OB+ Wick since Pi is 3.1415 there is a high probability of it hitting 3.14 price

Sherman_Trades

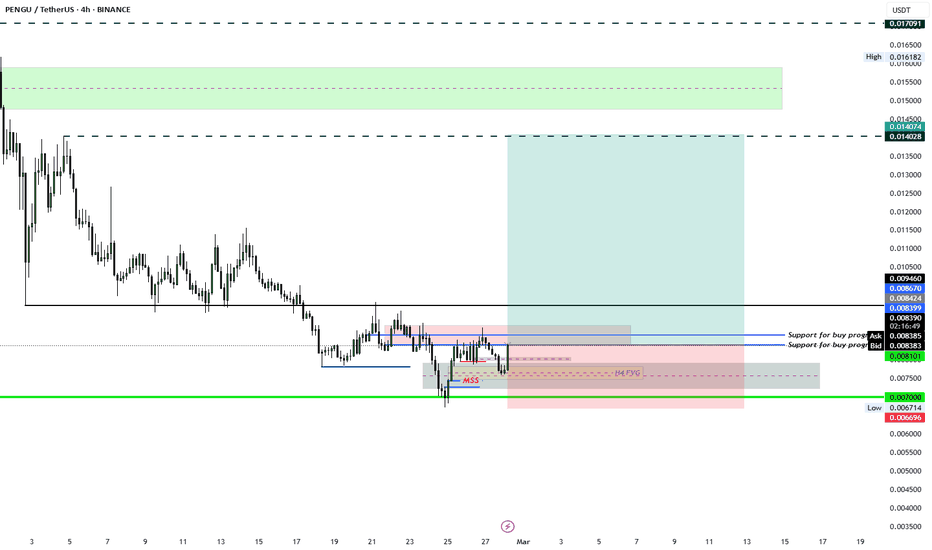

Bullish opportunity in PENGU

1. W have price rejecting off the .7 AREA (In green) 2. We already have MSS in H4 as well 3. We have price confirming by volume and bullish momentum 4. We have draws at the premium area

Sherman_Trades

Bearish opportunity in BERA

1. We have structure shift in M15 2. We have price rejecting off the entry pd array in H1 3. We have draws as the lowest low in this chart 4. All the PD ARRAYS marked on the chart should act as RESISTANCE AS WE ARE IN A SELL PROGRAM NOW Fundamental twist; since it there was a free airdrop sellers might sell off their holdingsI AM SORRY GUYS BUT AFTER BTC HIT 79K I MIGHT WE MIGHT PULLBACK HARD TO 85K + HENCE THIS SETUP WILL DEFINETLY HIT STOPLOSS (maybe) ANYWAY CLOSING THE TRADE MANUALLY! The market might be pulling back! Also its Friday whereby (not always) price pullbacks 30% thereof of the weekly range -- bearish or bullish

Sherman_Trades

Bearish Opportunity in OM

1. We have price at key pd array as the Daily breaker block low 2. We have Inversion FVG H1 that acted as resistance as expected 3. We have structures shift in discount that will flip to new PREMIUM 4. We have draws as the sellside liquidities in H1 note: Significant changes were made in the tokenomics of MANTRA. therefore volatility is expected This pair is highly manipulated in Binance therefore taking this trade there is not recommended,I AM SORRY GUYS BUT AFTER BTC HIT 79K I MIGHT WE MIGHT PULLBACK HARD TO 85K + HENCE THIS SETUP WILL DEFINETLY HIT STOPLOSS (maybe) ANYWAY CLOSING THE TRADE MANUALLY! The market might be pulling back! Also its Friday whereby (not always) price pullbacks 30% thereof of the weekly range -- bearish or bullish

Sherman_Trades

Bearish opportunity in BNX

Price has reached the 75% premium level - I expect a pullback at these levels We have a purge on buyside We have CISD confirming order-flow We have draws as the FVG around 1.055 Price is around the Daily order-block high ALTERNATIVE SCENARIO: If this FVG at 75% Daily Chart fails, I expect price to continue higher up to 1.39 to 1.4 levelsTP 1 reached

Sherman_Trades

Bullish opportunity in SPELL

Price has cleared major sellside We have price reacting off the entry pd array as the large FVG We have price creating a CISD plus CISD OB+ We have draw on liquidity as the wick at 50% fib and 62% fib OB+ a the final draw

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.