Senorita71

@t_Senorita71

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

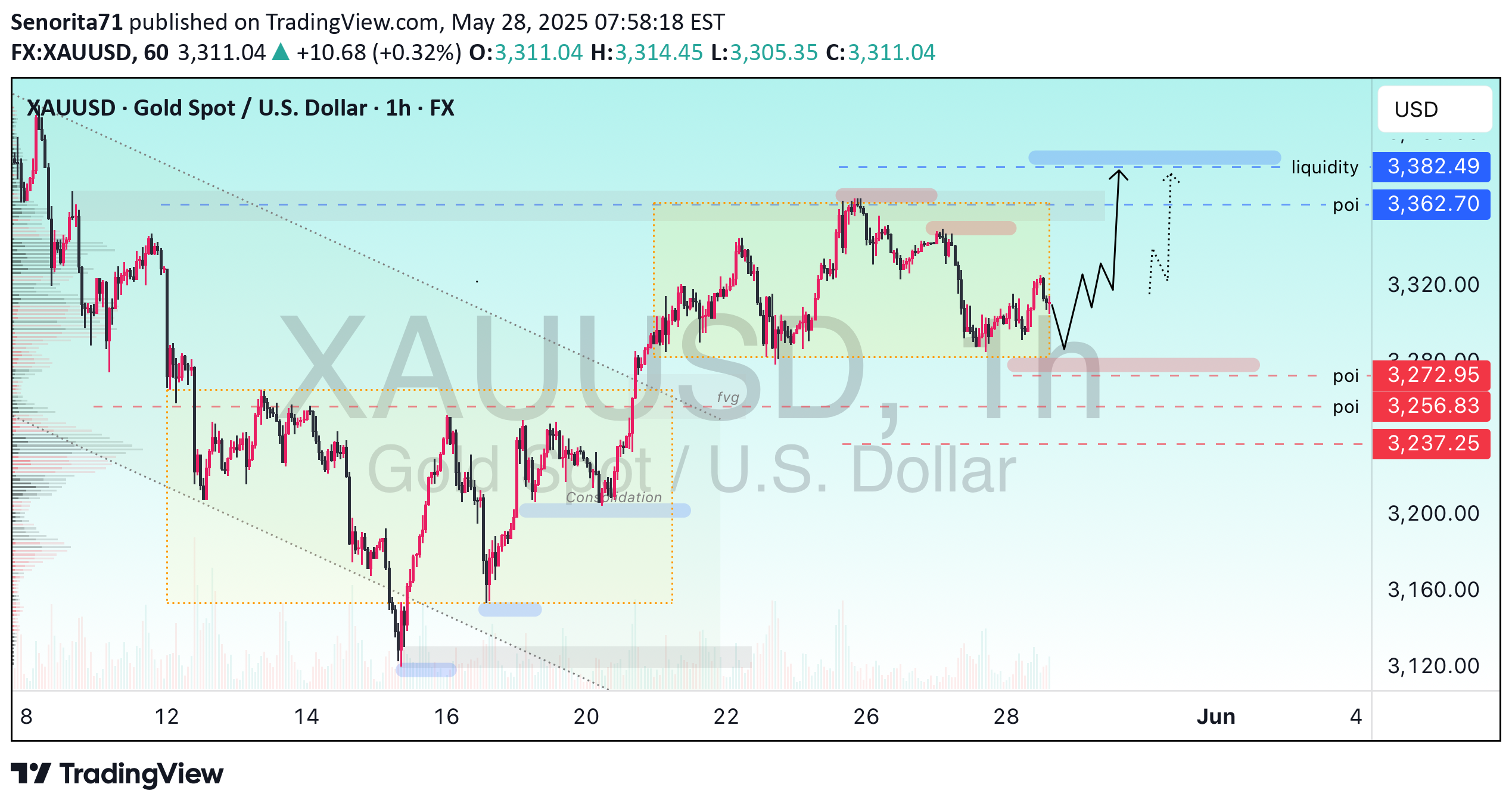

XAU/USD Upward Directions

Gold fails to gather directional momentum and stays in a consolidation phase above $3,300 midweek. The uncertainty surrounding the US trade relations and elevated geopolitical tensions help XAU/USD keep its footing as market focus shifts to FOMC Minutes.

XAU/USD Short Term Predictions

Gold price sticks to intraday gains above the $3,300 mark, or a one-and-a-half-week high touched during the Asian session on Wednesday, and looks to build on a three-week-old uptrend amid a combination of supporting factors. US fiscal concerns and a downgrade of the US government's sovereign credit rating last Friday continue to weigh on the USD.

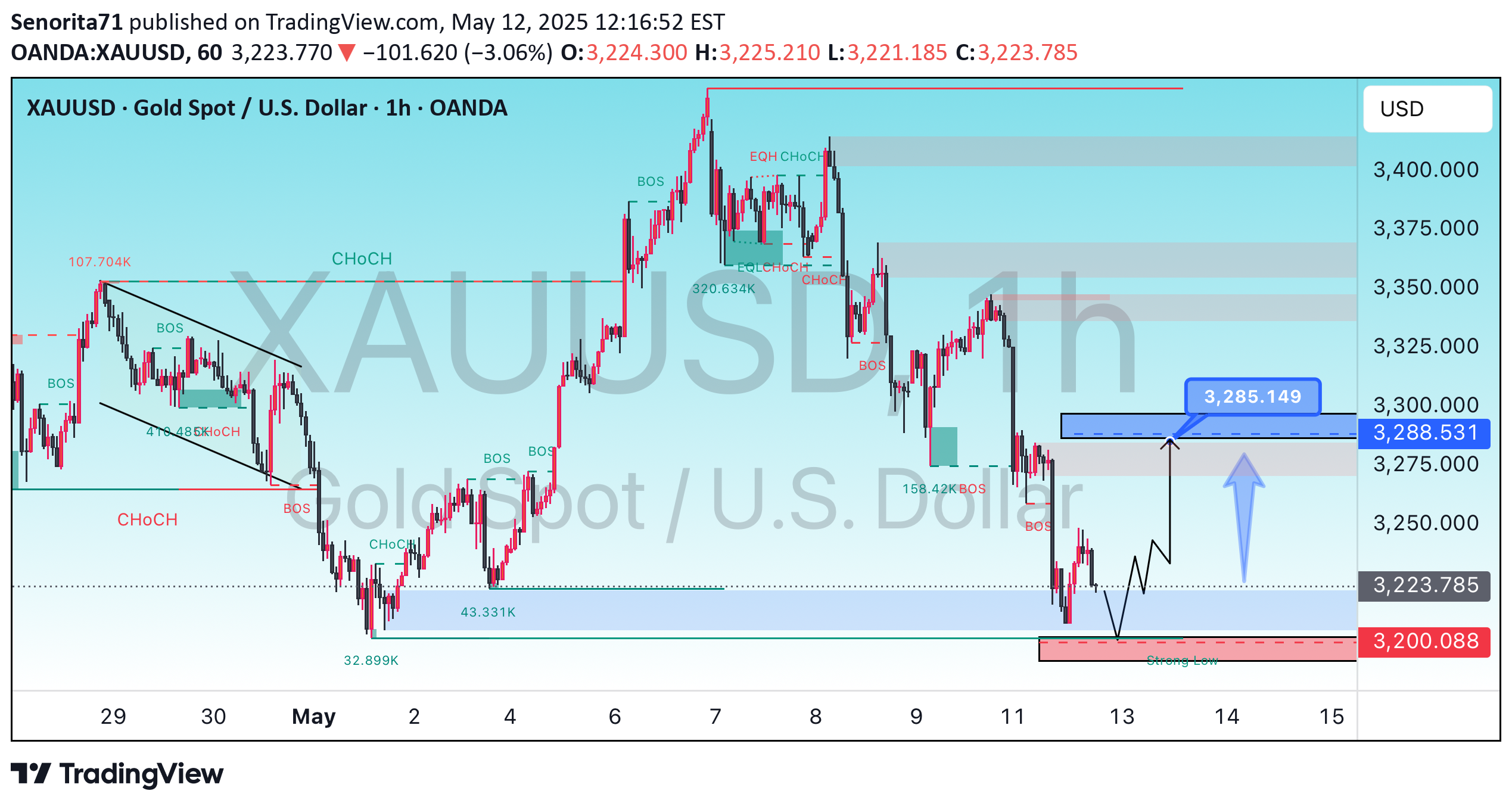

Gold Making Step In Buy

Gold began the week under pressure, retreating toward the $3,200 mark per troy ounce, where some support appeared to materialise. The decline followed a broader improvement in risk sentiment after encouraging developments emerged from US-China trade talks over the weekend.

Gold H1 Confirm Analysis

Gold adds to Friday’s advance, reclaiming the $3,300 mark per troy ounce and beyond on the back of rising safe-haven demand following heightened geopolitical tensions in the Middle East. In addition, a persistent uncertainty over US trade policy continues to linger, adding to the upside momentum in the precious metal.

Gold H1 Confirm Analysis

Gold adds to Friday’s advance, reclaiming the $3,300 mark per troy ounce and beyond on the back of rising safe-haven demand following heightened geopolitical tensions in the Middle East. In addition, a persistent uncertainty over US trade policy continues to linger, adding to the upside momentum in the precious metal.

Xauusd Prices To Fall Soon

Gold price struggles to lure buyers and trades below the $3,300 in the European session on Wednesday as signs of easing US-China trade tensions continue to undermine safe-haven assets. Key GDP and PCE inflation data releases from the US could trigger the next big action in XAU/USD.

Gold Will Fly Soon Confirm

Following a bearish opening to the week, Gold gains traction and trades above $3,300 in the American session. Mixed headlines on the ongoing US-China trade war cause markets to remain risk-averse on Monday, allowing XAU/USD to turn north.

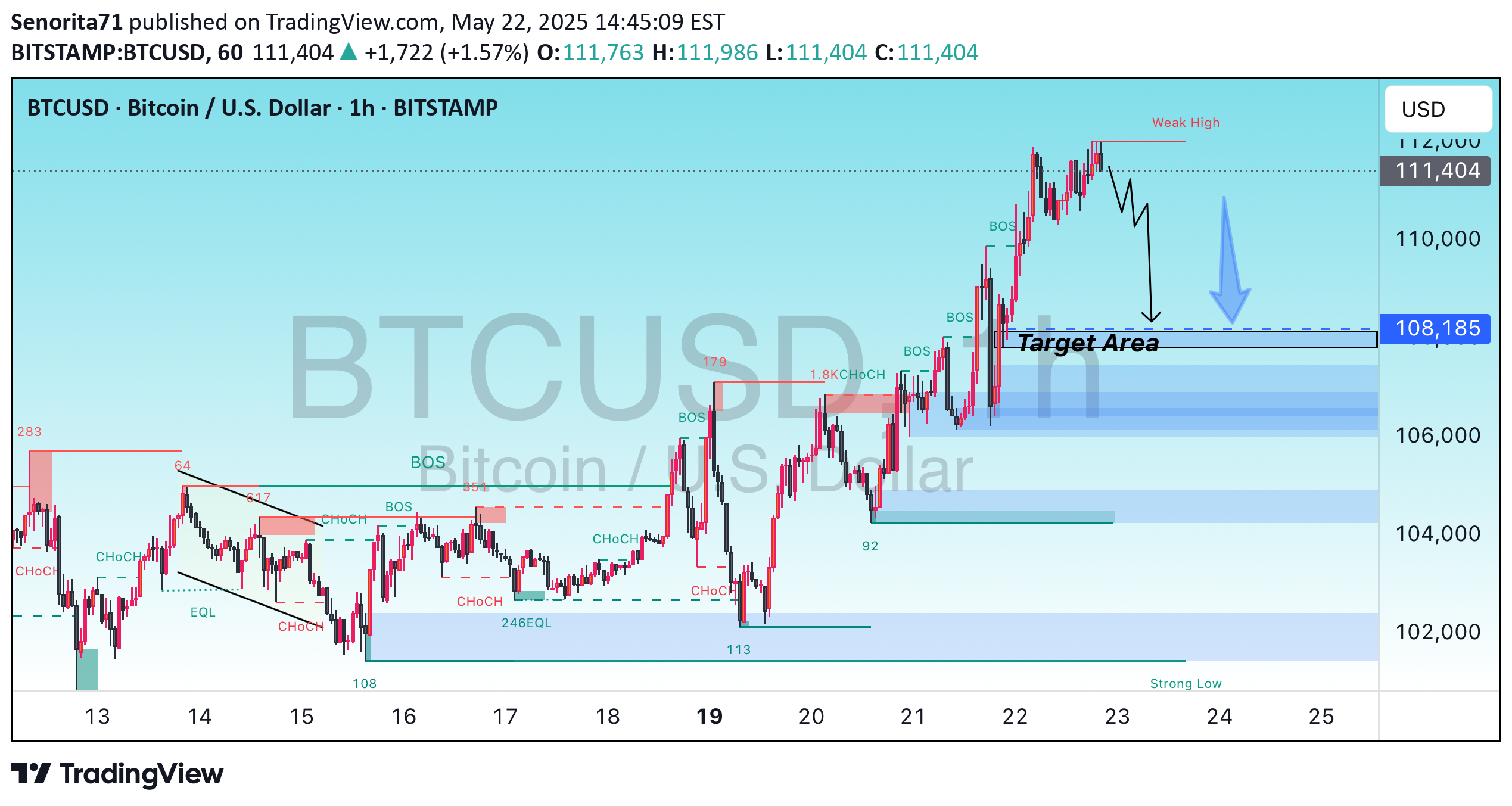

BTCUSD TO TOUCH 90000$ SOON!

Bitcoin (BTC) is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day Exponential Moving Average (EMA) at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Federal Reserve (Fed) on Wednesday, BTC remains relatively stable. Meanwhile, institutional demand shows weakness, as it recorded nearly $170 million outflow from Bitcoin spot Exchange Traded Funds (ETFs) on Wednesday.

Gold Moving In Buy

Gold clings to strong daily gains near $3,220 despite retreating slightly from the record-high it set touched at $3,237 on Friday. The precious metal benefits from safe-haven flows following China's decision to raise additional tariffs on US imports to 125% from 84%.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.