SatoshiSacamoco

@t_SatoshiSacamoco

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

SatoshiSacamoco

That's it. Pack up and go home

Extremely unpopular opinion, I know. Great 2023, great 2024. That's it!

SatoshiSacamoco

Bitcoin to new highs

Una imagen dice mas que mil palabras. A picture is worth a thousand words.

SatoshiSacamoco

Ethereum to new highs

Una imagen dice mas que mil palabras. A picture is worth a thousand words.

SatoshiSacamoco

Elliott Wave Theory

I've been wanting to share this for a little while. As we heat up, the roadmap becomes super important. Elliott waves aren't perfect, and they never align perfectly with the price, but the theory certainly offers great insight into how the price moves when the euphoria comes. I'll leave details on how waves 1, 3, and 5 work and how they can shape the road for Bitcoin this cycle. Wave 1: In Elliott Wave Theory, wave one is rarely obvious at its inception. When the first wave of a new bull market begins, the fundamental news is almost universally negative. The previous trend is still considered to be strongly in force. Fundamental analysts continue to revise their earnings estimates lower; the economy probably does not look strong. Sentiment surveys are decidedly bearish, put options are in vogue, and implied volatility in the options market is high. Volume might increase a bit as prices rise, but not by enough to alert many technical analysts Wave 3 : In Elliott Wave Theory, wave three is usually the largest and most powerful wave in a trend (although some research suggests that in commodity markets, wave five is the largest). The news is positive, and fundamental analysts have started raising earnings estimates. Prices rise quickly; corrections are short-lived and shallow. Anyone looking to “get in on a pullback” will likely miss the boat. As wave three starts, the news is probably still bearish, and most market players remain negative, but by wave three’s midpoint, “the crowd” will often join the new bullish trend. Wave three often extends wave one by a ratio of 1.618:1 This is where we are in the cycle: Wave 3 . Trying to guess how far or how high this wave will go is impossible. It could be 80k, 100k, 120k. Who knows! LET IT RUN, AND DO NOT TRY TO TIME IT! Some key points of wave 3 are, retail tends to join the party when the wave is 70-80% completed or when the wave reaches key levels (Previous ATH) That last 20-30% of the movement is what provides the bulls with a false sense of security. Don't get trapped here. Wave 4 is around the corner. Wave 5 : In Elliott Wave Theory, wave five is the final leg in the direction of the dominant trend. The news is almost universally positive, and everyone is bullish. Unfortunately, this is when many average investors finally buy in, right before the top. Volume is often lower in wave five than in wave three, and many momentum indicators start to show divergences (prices reach a new high, but the indicators do not reach a new peak). At the end of a major bull market, bears may very well be ridiculed (recall how forecasts for a top in the stock market during 2000 were received) Wave 5 lacks the huge enthusiasm and strength in the Wave 3 rally. A small group of traders causes Wave 5 to advance. Although the prices reach a new high above the top of Wave 3, the rate of power or strength inside Wave five advance is very low when compared to Wave three advance. Sometimes, there is a failure in wave 5; be aware of this phenomenon, as it leads to a massive bull trap just before the price turns around. Clearly, the best wave to ride is wave 3. It's the longest, strongest and clearest impulse. This is where we are right now. ENJOY!

SatoshiSacamoco

Bitcoin path to new highs

Bitcoin weekly chart 2024 path: 1) I expect Q1 to be bearish to neutral. 2) I doubly speculate that the short-term ETF launch will be bearish. 3) HODLThe ETF launch was indeed bearish. HODL.

SatoshiSacamoco

FTM/USD Long 4h

5:1 Risk to Reward ratio. This trade is supported by BTC.D (51%) dropping quickly and BTC's last push to 48 before the ETF launch.

SatoshiSacamoco

Bitcoin cool down.

I'm going to throw out this very unpopular view. It's about time this cools down a bit.

SatoshiSacamoco

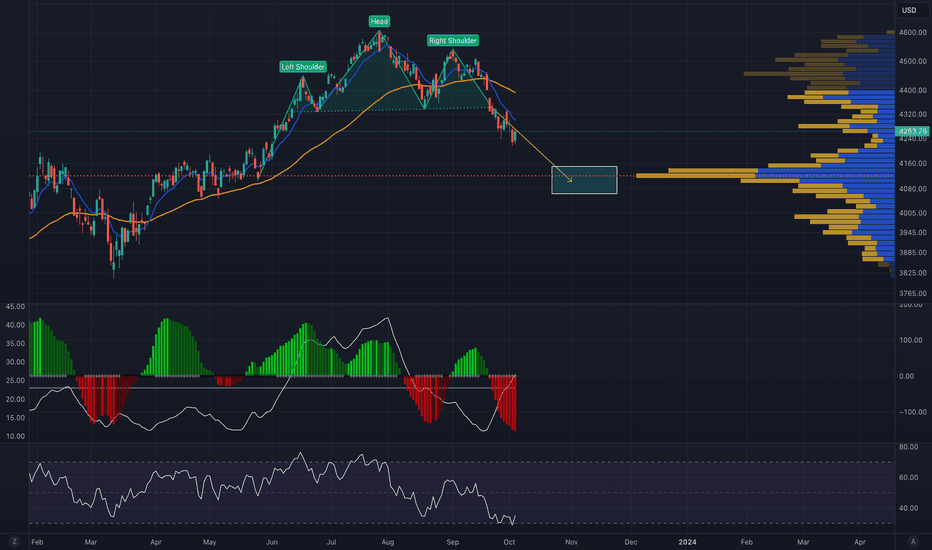

S&P500 H&S Target

S&P500 Head & Shoulder Target after seasonal correction.

SatoshiSacamoco

Head and shoulders pattern?

Possible H&S for Bitcoin. If this pattern ends up forming, the target would be around 20k.

SatoshiSacamoco

Break 30k and down

Deja Vu? So much liquidity above 30k. We got to grab that.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.