SalimiFinancee

@t_SalimiFinancee

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

SalimiFinancee

Based on Ichimoku, we expect short-term uptrend toward 3348 and after that we expect rejection from these levels and starting downward movement to support levels (3228-3179).we consider all these levels as valuable zones for our trading so be cautious about the reaction of XAUUSD.

SalimiFinancee

BTC overall trend is still bullish based on previous analysis. nowadays we see exact rejection of price from our resistance level. on higher time frame the trend is still bullish. important support levels are highlighted on the chart. The 93-94 zone is the most important one. this zone will determine the direction of BTC movement

SalimiFinancee

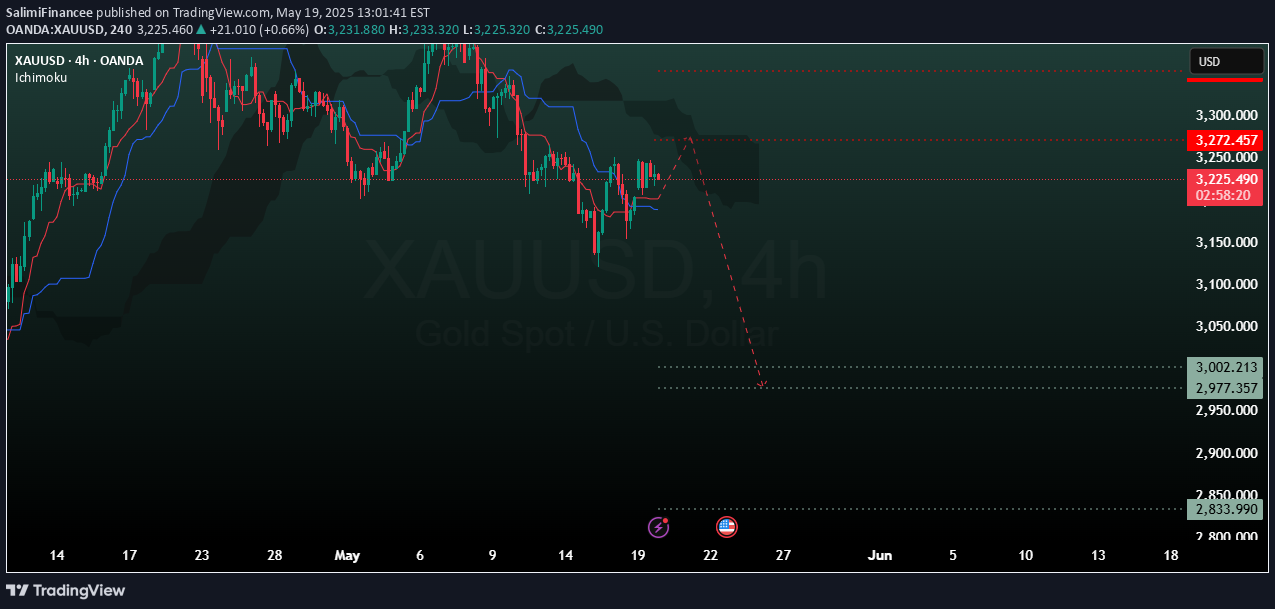

Gold is in its own correction wave.The important resistance levels for gold is 3272-3353.Based on ichimoku, we expect it to touch the support levels 3002-2977

SalimiFinancee

Ethereum is trying to reach its important resistance levels. We are monitoring its reaction in these areas(2749-3105). After reaching important support levels, it should be checked whether Ichimoku is showing an upward trend or not, then the analysis will be updated.

SalimiFinancee

In the previous analysis, the zone of 70 was determining level for us, whether it was a correction or a downward trend. BTC continued it's upward movement from near that area.Now Bitcoin is near it's historical resistance area, this time the zone of 110 to 114 plays this role for us.According to ICHIMOKU and according to previous analysis, Bitcoin tends to move to higher levels marked on the chart.

SalimiFinancee

Gold long-term trend is still bullish. based on ICHIMOKU the Xauusd is in supposed correction. daily support level (3228) was touched. the price is near important support level (3188).For next weeks:Support levels:31883166Resistance levels:33513381After that waiting for Ichimoku to give us the exact road map.as you see XAUUSD continues its long term bullish trend, it couldn't touch 3188 but starts this big move from mentioned daily support level (3228). and look at that reaction of Xauusd on that valuable levels on the chart :)

SalimiFinancee

The long-term trend of gold is completely bullish according to previous analyses, which still shows a strong bullish trend on monthly time frames. We expect a correction in the chart during next week, but The long term trend of Gold is still bullish and we couldn't see any ICHIMOKU based divergence.important support and resistance levels on the chart is highlighted.

SalimiFinancee

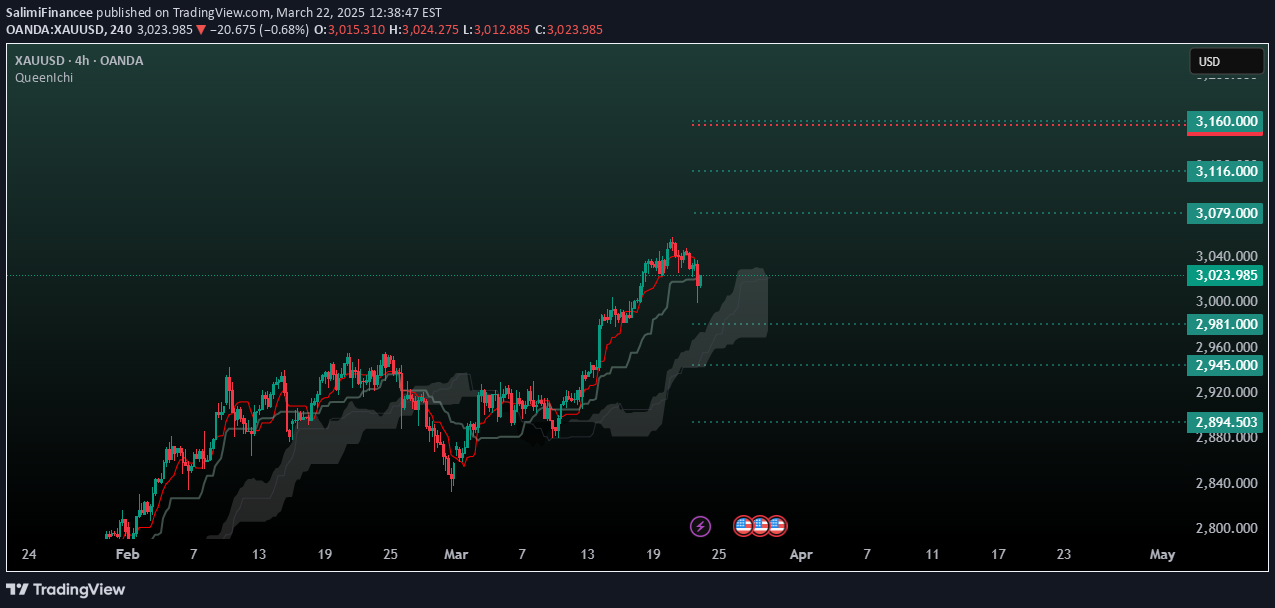

Xauusd Analysis Based on IchimokuGold maintains its bullish trend on higher time frames and has the potential to go to higher levels.According to Ichimoku data, there is a possibility of a price correction on the chart this week. The overt trend will remain bullish until the price goes below the $2,894 level.Key Levels:All important levels for probable trades have been identified. Monitor the price reaction to these levels.

SalimiFinancee

Gold is still in its important resistance zone (2947) and try to break this level.It tries to reach 3000 levels.Gold overall trend is still bullish based on our previous analysis.Consider all levels as a valuable SnR.As usual we trade on all these levels.

SalimiFinancee

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.