Sa7en

@t_Sa7en

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Sa7en

سقوط آزاد MYX در راه است؟ ریزش ۶۹ درصدی محتمل پس از رد شدن از مقاومت!

Technicals first: MYX walked up to that giant spiral on the chart, knocked politely… and immediately got rejected. Zero breakout energy. That’s usually the market’s way of saying “nice pump, now get back down there.” With momentum dead, a slide to the $0.90 support looks likely — that’s about a 67% haircut from current levels. Fundamentals? Oh boy. FDV sitting at ~$2.79B while the protocol’s TVL chills around $30M. That’s a ~90× MC/TVL ratio, which in crypto is basically a neon sign flashing: “Speculation Only Zone.” Usage isn’t growing anywhere near fast enough to justify the sticker price; it’s all vibes and no volume. Bottom line: The chart rejected, the fundamentals don’t back the hype, and if gravity kicks in, MYX returning to ~$0.90 isn’t just possible — it’s the sober scenario after the party.

Sa7en

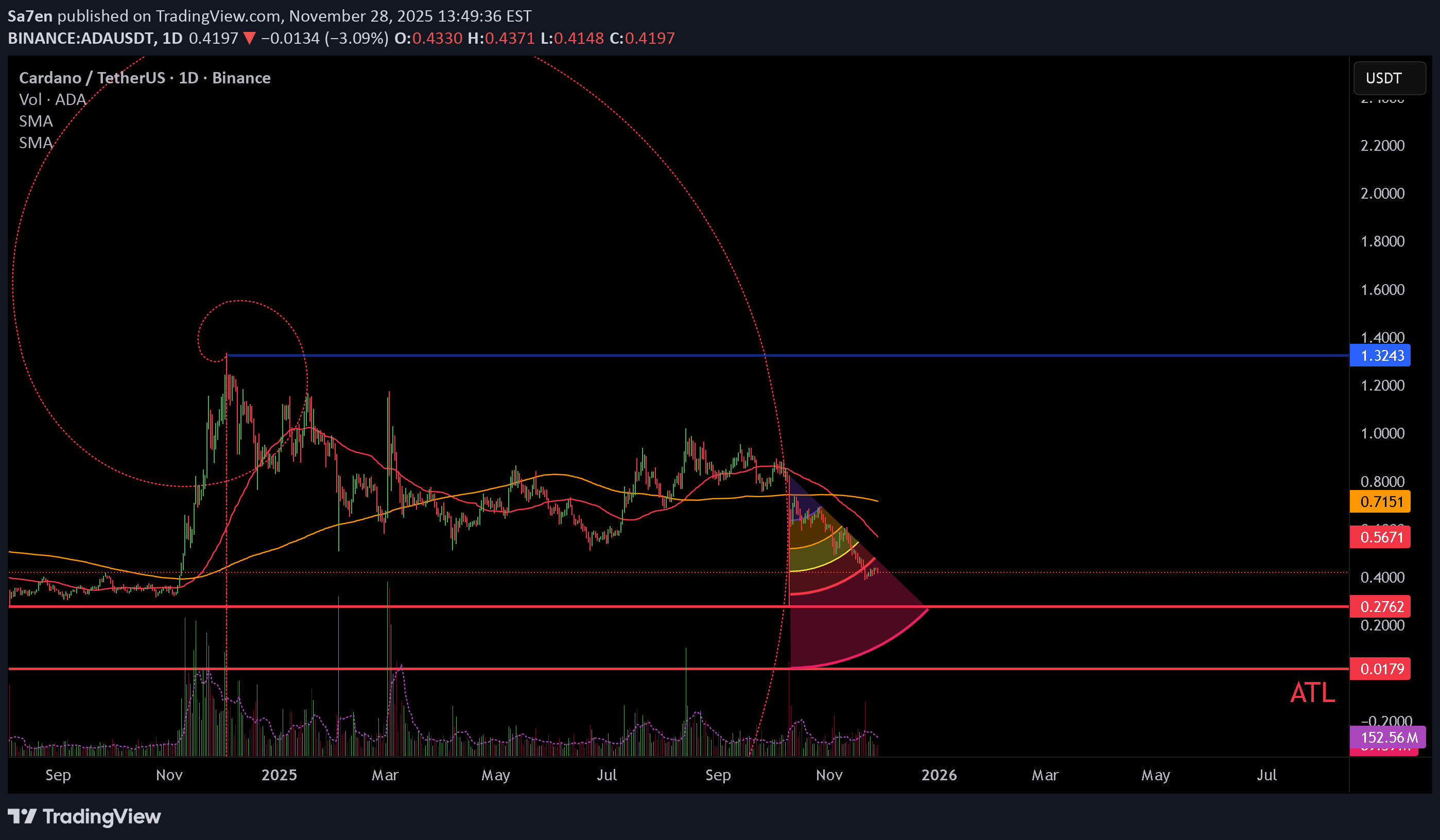

کاردانو در حال فروپاشی است: چرا باید هر چه سریعتر از این "کشتی ارواح" فرار کنید؟

Fun di Mental: ADA isn’t just breaking down on the chart — it’s breaking down everywhere. The death cross on the daily isn’t a signal anymore; it’s a eulogy. Price slippery under key supports because there’s simply no bid left; no more greater fools. Liquidity is thin, volume is fading, and the only thing rising is the number of people pretending they “were never really into Cardano anyway.” Cardano was always called a ghost chain, but now it has the metrics to prove it. Active addresses collapsed, DeFi TVL drained out, and the network’s economic engine is stalling so badly that SPOs are on the edge of shutting down because the rewards don’t justify the cost. When your validator base is contemplating mass rage-quitting, the trend isn’t your friend. On November 21, 2025, Cardano suffered a “chain split”: a single malformed delegation transaction exploited a long-existing (Peer reviewed??) bug in the node software and resulted in part of the network accepting a “poisoned” ledger while the rest stayed on the “healthy” chain. That split caused block production to slow or pause for over an hour. Some exchanges and wallets temporarily halted ADA deposits/withdrawals. Technical: ADA is in a confirmed macro downtrend — lower highs, lower lows, and a death cross already printed (50D < 200D). This is the classic “lights-out” pattern for L1s entering terminal decline. Moving Averages: ADA basically front-ran its own death cross — the price nuked before the bearish crossover even printed. The long-term SMA around $0.71 is now a ceiling of doom — a structural reminder of how far ADA has fallen and how far buyers have abandoned the asset. Key Levels: $0.576 – First major supply wall; not relevant unless ADA resurrects from the dead. $0.276 – The next real destination. A high-probability magnet. $0.017 (ATL) – Worst Case: The historical bottom (probably late 2026 - Early 2027). Fibonacci Spiral: ADA is pressed against the inner curvature — a classic “collapse spiral.” Fibonacci Speed Resistance Fan: Price is pinned under the steepest bands, confirming relentless seller control. Every bounce has been slapped down instantly. Volume & Momentum: Volume is anemic. Momentum candles are heavy red, with ADA showing the classic “ghost fade” — slow, steady suffocation with no bid support. Outlook: Structure points straight to $0.276 first, with the ATL absolutely on the table if fundamentals keep rotting. Always-Sunny Sometimes-Blockchain Visionary, Charles Hoskinson Meanwhile, Charles Hoskinson is busy building Midnight, a brand-new chain that just so happens to… replace most of what Cardano was supposed to become. When the founder starts eyeing the emergency exit, you don’t need on-chain analytics to know the vibz are B as F.

Sa7en

سوناتای مارپیچ بیت کوین: از ریزش تا کف قیمتی 87 هزار دلار (تحلیل دقیق)

Trend: Downtrend after topping near $109–110K. Price broke below mid-FBB (~$104K), confirming short-term bearish momentum. Fibonacci Bollinger Bands: - Resistance: $109K (0.618 band), $118–123K (0.786–1.0 bands). - Support: $95K (0.382 band), $87K (–0.236 band). - Structure suggests a correction toward the green FBB zone ($90–87K) before potential rebound. Fibonacci Spiral: Inner spiral apex = October top. Outer spiral = late November → early December, hinting at timed bottom window. Volume: Selling volume increasing; no clear capitulation yet. Outlook: Short-term: Bearish bias until reclaim above $107K. Medium-term: Watch $87–95K zone + outer spiral for reversal setup. Invalidation: Daily close > $110K flips trend bullish again. Summary: Correction phase within macro uptrend. Likely path: $100K → $95K → $87K support, then rebound toward $104–109K near December.

Sa7en

LONG: $BTC Laser focused on 138K (when you see it)

Bitcoin is riding a steady upward-sloping channel, keeping the bulls in control. The Golden Spiral—a mystical force of nature—marks the point where momentum exploded, and it hints that this rally might be far from over.Volume: Steady, but the calm before the storm? A breakout could ignite fireworks."Trust me bro" outlook:A clean breakout above the channel could push BTC toward 120K–140K, as the beyond-spacetime symmetries remain undeniable.

Sa7en

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.