SPYDERMARKET

@t_SPYDERMARKET

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

SPYDERMARKET

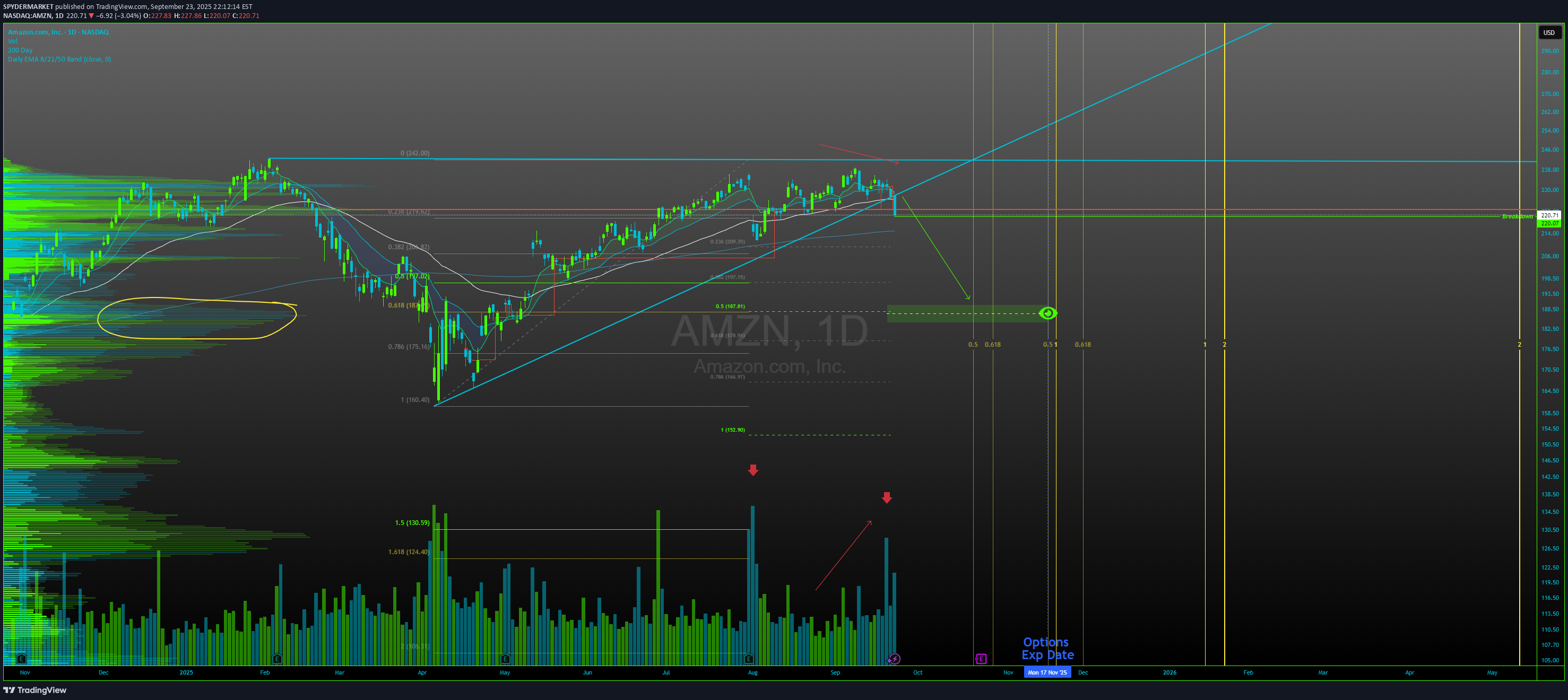

AMZN Sitting on a Cliff… Amazon’s hanging out right on a key trendline around $220. If it holds, cool maybe we bounce. But if it breaks… could get ugly. Price is testing support from the March uptrend. Not much volume below = could drop fast if it slips. Big support zone around $187–$184 (Fib levels). aggressive selling Volume’s been picking up lately — people are watching. What I’m Watching: Lose 220, we get $190 → $185

SPYDERMARKET

Apple is breaking out, supported by bullish accumulation volume patterns indicating strong buying pressure. Key bullish points: $100B U.S. investment strengthens domestic operations and tariff protection. Strategic supply chain shifts to U.S. and India reduce geopolitical risks. Leading tech sector rally amid AI growth potential. With momentum building, $275 is the next target.

SPYDERMARKET

Accumulating tesla shares - $300 is a very interesting area for TSLA, Looks like as long as we hold this area we should see $500 by end of year... much sooner.

SPYDERMARKET

The last few weeks flagging out of this Inverse H&S Fridays is already bullish, Fridays fakeout lead to a 4HR 2022 iFVG ICT model, Bullish, Not much more to say other than see you at 140k+. Riding sep OPEX IBIT $70 Calls.

SPYDERMARKET

Breakout setting up continuation, seeing a squeeze signal, BoS 647, ride to 670+.Squeeze signal is red, mBoS, Taking Puts. Spy heading south.

SPYDERMARKET

Consolidating nice here, Hodling this baby, $6 soon, based on fibs, Log, Wouldnt $32 be nice by Jan 2027!Did anyone expect the first pattern to get a full 100% extension! NOOOOOOOOOO.

SPYDERMARKET

SPYDERMARKET

I’m short QQQ 👇 based on NQ, obv... Anticipating a 2022-style ICT iFVG bearish model. Front-running the setup w/ GDP shrinkage narrative (real or not, price moves on perception). Targeting $420 → sub-$400, making macro lower lows. I have targets. Sounds nuts? Maybe. But when we get there… I’m very long. 📉📈

SPYDERMARKET

AAPL sweep of bullish O.B. internal liquidity - External liquidity (ATH) remains unmitigated, signaling potential upside. The macro orderflow remains bullish as there are no clear signs on CHoCH and good accumulation volume, with Apple’s dominance in both hardware and services like Apple TV+, Apple Music, and Apple News+ continuing to drive confidence. Analyst Aaron Rakers from Wells Fargo maintains a "Buy" rating with a target price of $275.00. I’m targeting $266.52 if $248.08 holds on lower timeframes, with the potential for further upside if these levels hold.

SPYDERMARKET

Bitcoin has already broken out of either a Cup and Handle or an Upside Down Head and Shoulders pattern (howevery you want to view it. It is now pushing through the red trendline resistance. With strong bullish order flow, the next target for more conservative traders is around the 165K mark. Adding to this bullish outlook, President Trump's recent Executive Order (EO) on January 23, "Strengthening American Leadership in Digital Financial Technology," signals a major shift in U.S. policy. This, along with the SEC's rescinding of previous guidance and increasing support for digital assets legislation from Congress, further boosts confidence in the crypto space. The Trump Administration's pro-crypto stance is a sharp contrast to the Biden Administration’s more hostile approach, making it clear that digital assets are now seen as a vital part of America's economic growth and innovation. Keep an eye on the red trendline for confirmation of further upside potential, i want a want a daily close and break of structure to add IBIT calls at the money and ride the wave.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.