Robert_MQL5

@t_Robert_MQL5

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Robert_MQL5

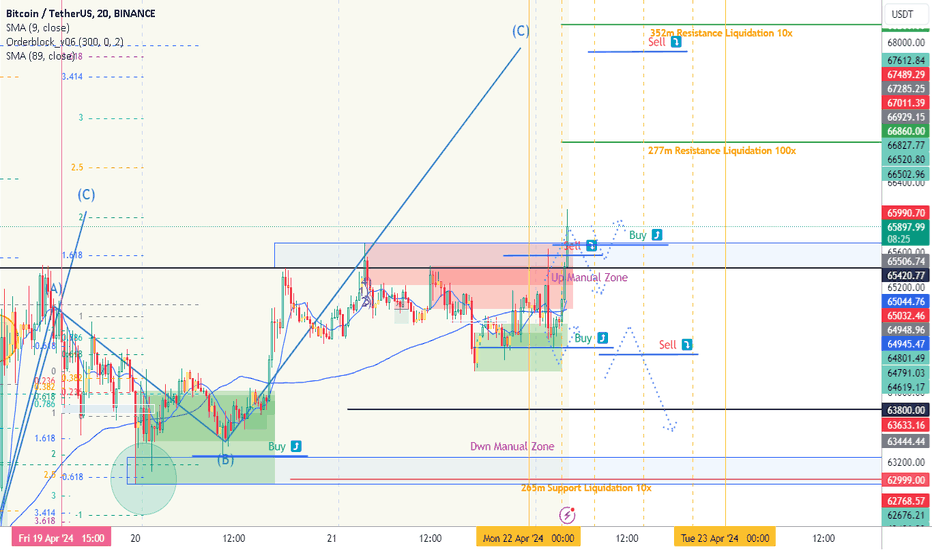

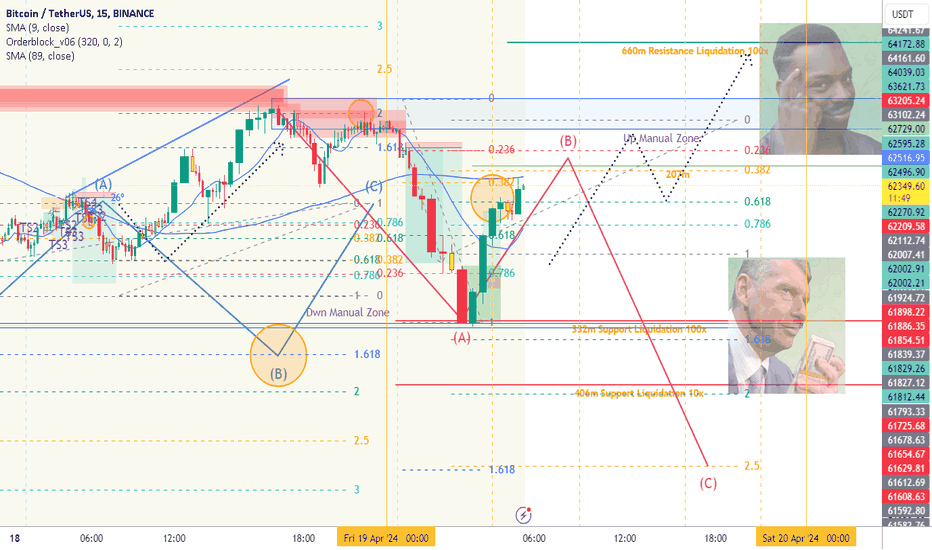

Hi traders! Who are we going to liquidated today? bulls or bears? I've started save liquidation levels every day at 4-6 o'clock. It seems may be helpful for trading. Yeasterday you see all Bulls was Liquidated, the market flashed through 3 bullish levels at once ). Trend is down. Today already I see that bull's trying to buy again and we have in total equal volume from up and down. In this case I'm expecting Range. As for me most interesting scenario for market maker DOWN then fast UP then DOWN again )) Try to guess what levels we will reach today.

Robert_MQL5

Sell from Hi Buy from Low There is more money from above, but DWN trend is triggered Ideally, have time to sell from above and buy from below So that the profit from one of the positions would cover the loss from another. Exit from range is 1.618 fib Aim

Robert_MQL5

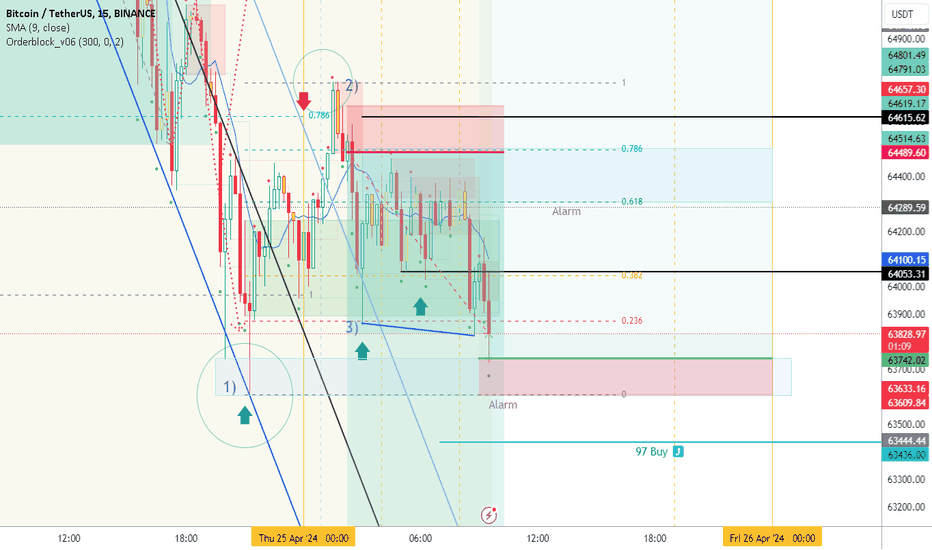

Still waiting for a BTC pullback, and trying to catch with a good RR ratioFirst deal is TP reached, Second waiting a price in zone 64Second TP reached. Looking for buy deals right now

Robert_MQL5

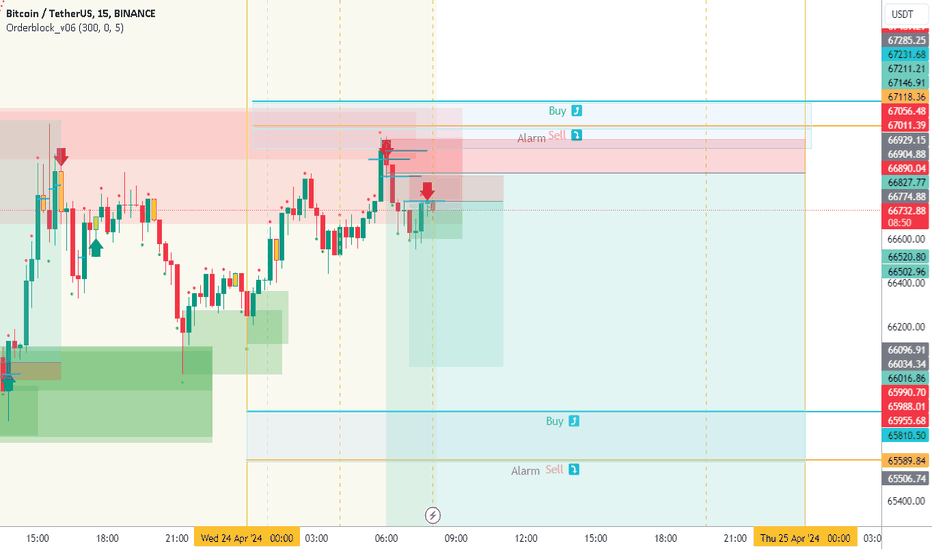

Hello traders. This is my simple BTC plan for the day. - volume at the bottom is greater than at the top - The American market met slight resistance yesterday and did not consolidate higher. - sales in priority

Robert_MQL5

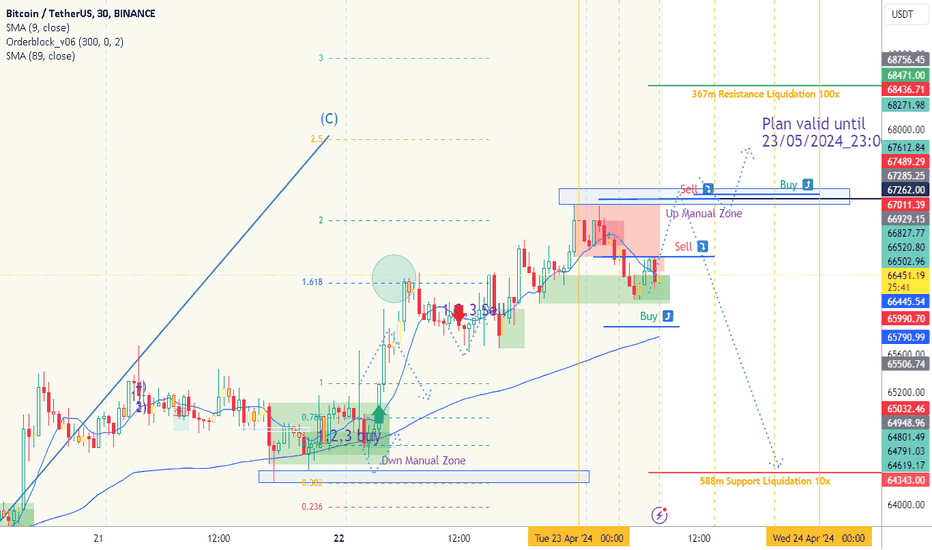

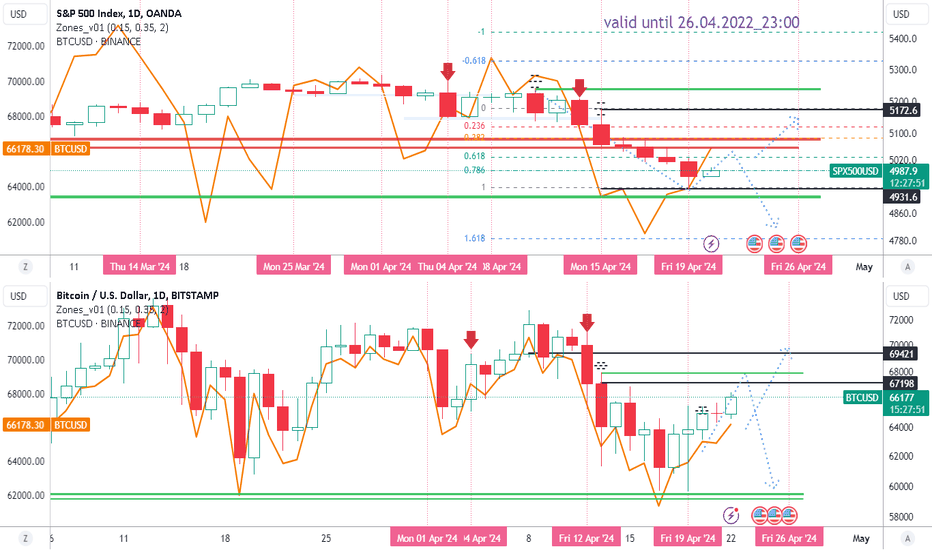

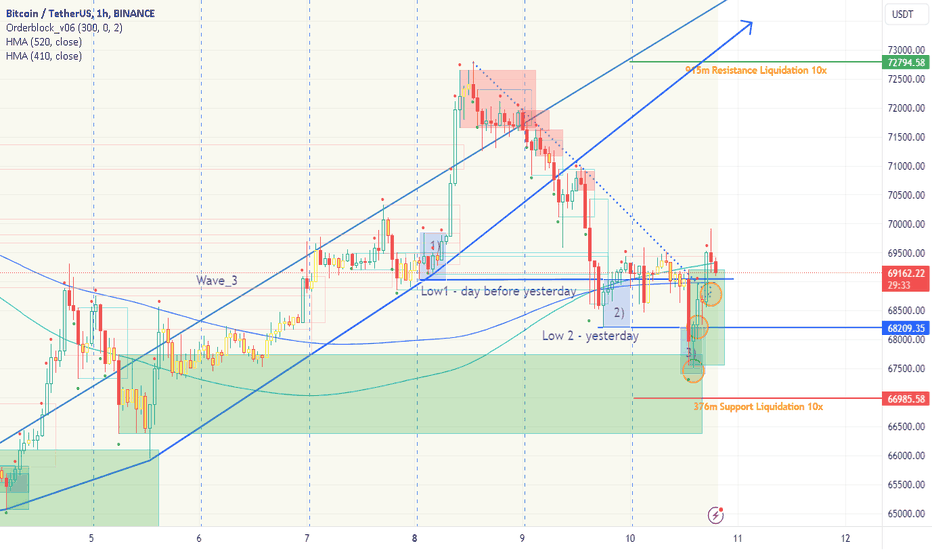

Hello traders. Here's my simple analysis for current week Only. Let's try to compare US market and BTC. - On the charts I see that BTC traders are more positive than US market. - It seems to me that they are trying to predict and overtake the movement of the stocks. For example, this Friday, the Index met good resistance and Monday morning showed a pullback. Over the weekend, BTC slightly pulled back ahead of the rollback and froze in anticipation of Sunday. On Monday, he also continued his journey upward. What am I talking about? - How is your Daddy? - US Market is your Daddy - I'm comparing D1 candle type on SPX500 and BTC and see that, trand candles on US market ultimately force BTC to move in the same direction. - At this point there may be a big trap here. While BTC tries to be faster than SPX500, and has more volatility. The SPX500 is steal in a down trend, this week there may not be a reversal, but just a pullback. And the US trend will continue to move downwards. Which will lead to a rapid drop in BTC and most likely an update of local LOWs. Well, in my opinion the best way to earn maximum money for MarketMaker is try to set BTC on local maximums (66.5-68.5), then drop it down acording US trend. If US continue pullback to local week hies. I think BTC can update 72. This plan is valid until 04/26/2022_23:00 Next week is new plan. Thanks for watching and sharing your opinion with me.SPX continues its growth, within two days it overcame the resistance of 1.6. and has already updated two local highs. Almost returned to the weekly maximum. -The trend is labeled as rising. BTC has already regained its position and made a weekly high, now waiting for SPX Today is X-day. I want to see how SPX reacts from the weekly high 5172. In case of SPX breakdown and consolidation above the weekly level, I think BTC will give a pump.Looks Like SPX is going down, BTC too

Robert_MQL5

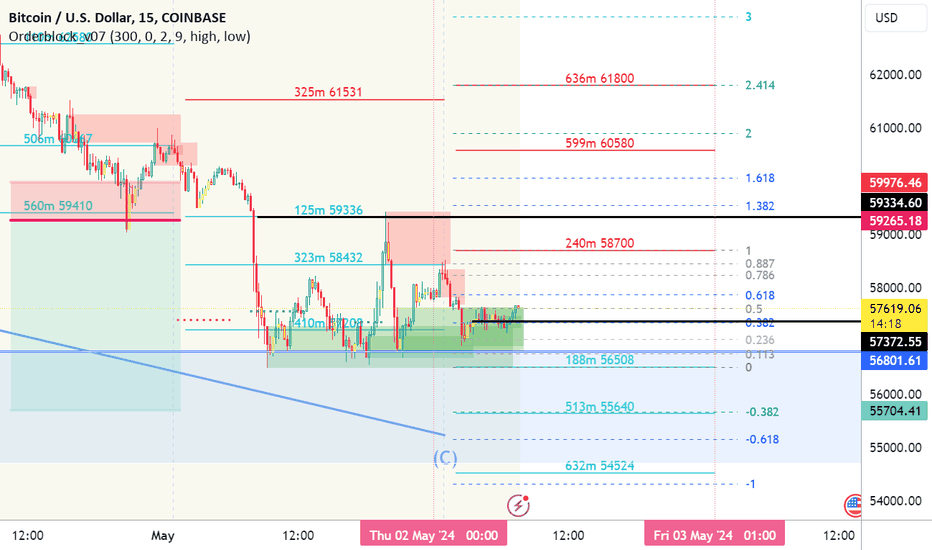

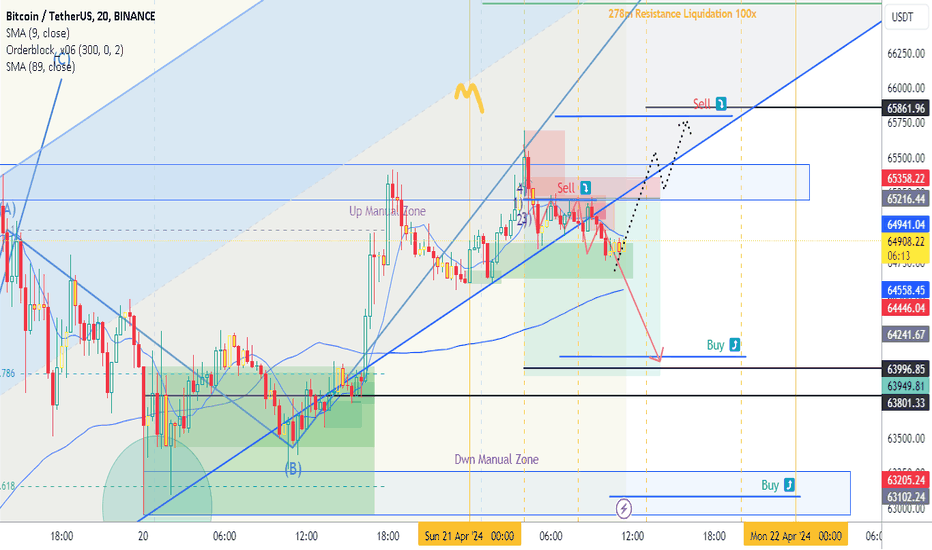

Hello traders. Here's my simple analysys. - I see the range continues - Priority up trend will remain for me - Today the American stock market is also rolling back upward, which I think will have a positive impact on the Bitcoin rate. With all this, I’m on guard, expecting a strong pullback - Bitcoin will crash down into zone 62 Well, the first priority is to buy from a pullbacks and second catch a sharp reversal to the bottom.

Robert_MQL5

Hello traders. Here's my simple analysys. - I see is range here - I see weak highs - Probability to broke a channel. - There is more money at the bottom than at the top Well, let's sell from Hi and Buy from low.

Robert_MQL5

Good morning traders and I wish you profit. I am sharing my views on the market. - Black Dotted Scenario against the crowd. - In blue are my classic thoughts. We updated two local highs yesterday, according to the idea here is an UP trend. In an alternative scenario, I see a range based on similar volumes of liquidations. No matter how much I really want to buy, I think the market maker has not made his final move yet.

Robert_MQL5

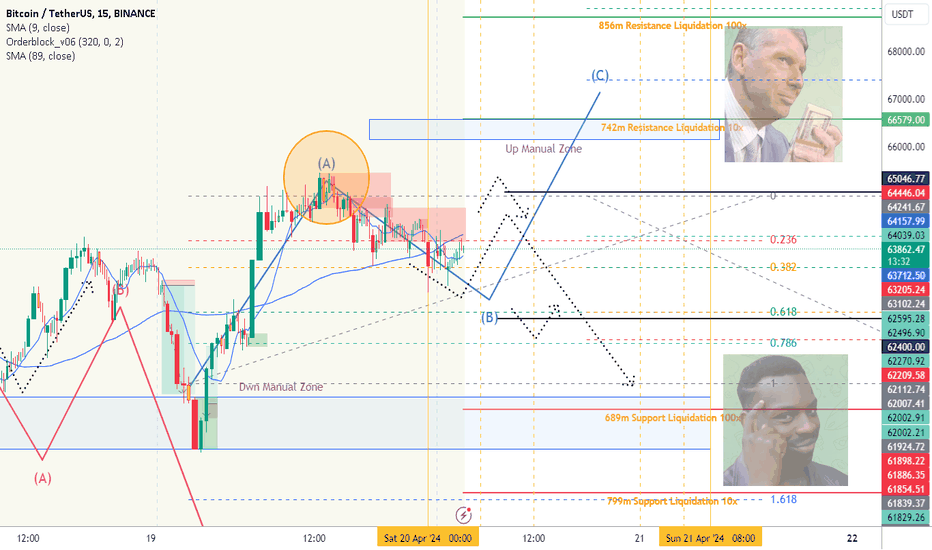

Good morning and good luck to you. Here is my trading plan based on: - support & resistance based on liqidation levels - fib - my exclusive order blocks I can't predict price movements, but I'm learning think like a market maker. In this case, I assume that money-volumes are more important than indicators, patterns and other levels. The goal of MM is to remove maximum liquidity, so I try to think outside the box, against the crowd.

Robert_MQL5

Hello traders, here is my simple market vision - Upper you see new Bearish Orderblocks (beOB) formed during last two days - Lower we see rebound from old Bullish Order block (buOB) - Formed new one buOB today - Sperandeo TrendLine broken - The price was in lower part, not far from liquidation support . Liquidation Levels I'm building at 00-00, like a plan on this day. - I've added Blue boxes 1) 2) 3). First blue box i've buld by Lowest H2 candle of the day1. Second and third it's the same size box, and I've just moved them to low of day one and second day. What is the meaning and idea? The idea is to catch weak lows. Strong low - is low closed lower then blue box. Weak low is closed in or just tuched blue box. This concept can show us when trend becomes weak and also workong in range market and expanding triangles. The best entry points in my mind, when the price returnd from box №3 and closed in box №2. Also we can wait another confirmations like here. (Rebound from OldOB, TrendLine broken) In two words for remember: "Yesterday, the day befor yesterday. Return on third day. Weak lows. Reversal strategy" Books: Inner Circle Trader.First target second beOb

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.