Riscora

@t_Riscora

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

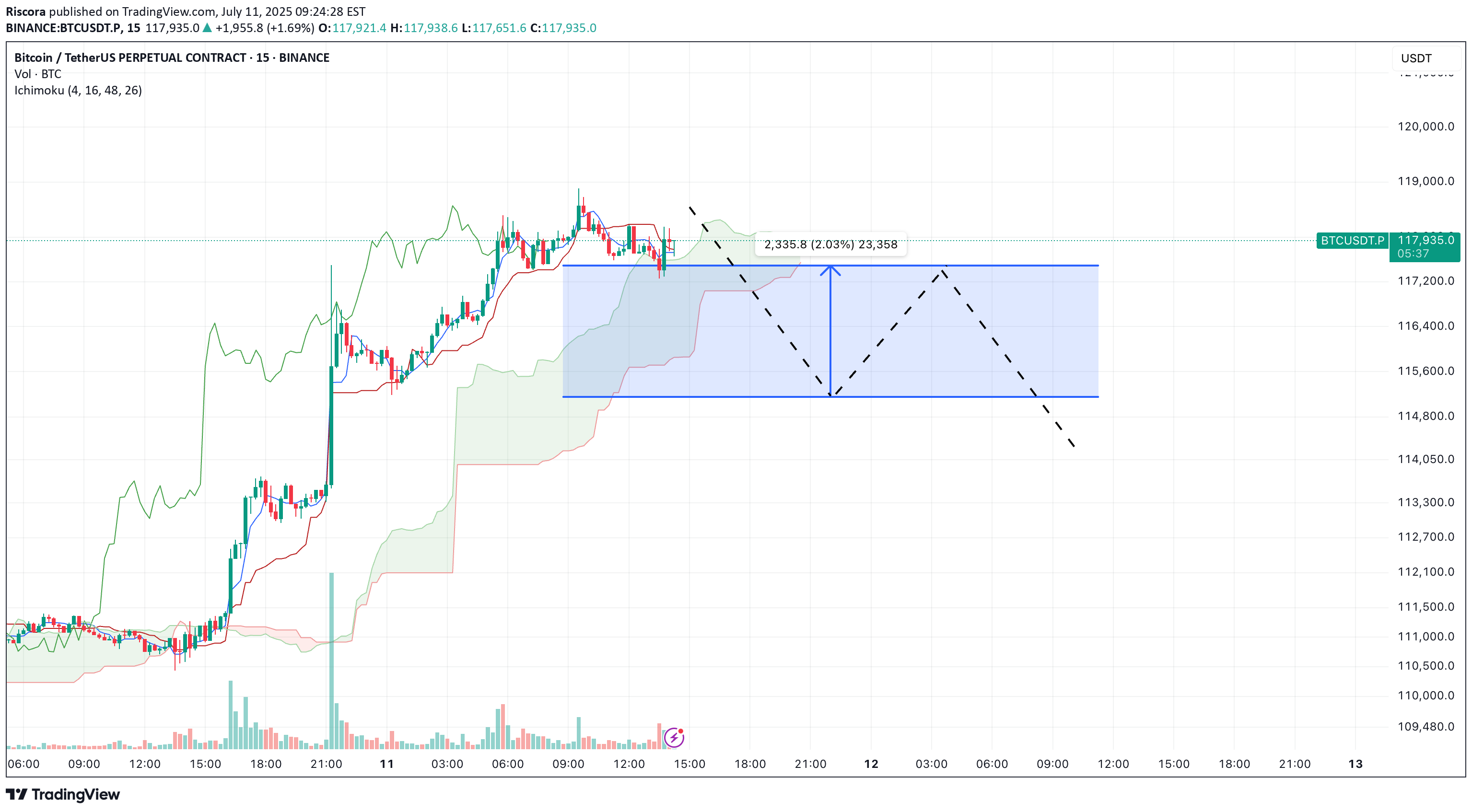

A new trading week begins after an exceptionally strong bullish close last week. Given the strength of that rally — and seeing how long/short ratios are now heavily skewed to the long side — I expect this week to open with a pullback. To me, the bullish impulse feels exhausted, so I’m watching for a short-term retracement. My initial target is a move toward 117,500, but if the correction accelerates, we could even see a deeper dip, possibly down to the 113,000 area. That said, the uptrend is still strong — any shorts here are high-risk, countertrend trades. I’ll treat all short setups as tactical reversals only, not as a full trend change. Caution is key in this environment! Let’s see how the structure develops as the week unfolds.

Yesterday was a fantastic bullish day, but price never reached my planned long entry block — buyers were too strong for a proper retest. At this stage, I believe the bullish impulse has run its course and we’re likely to see a sideways phase, as marked on my chart. I don’t expect new highs from here: the market is overcrowded with longs, and this rally needs to cool off. My base case is that BTC consolidates in this range for a while, with price chopping back and forth to unwind the excess leverage. I’ll be watching for signs of distribution: a rising wedge or a deeper pullback can’t be ruled out, but I’ll wait for clear signals from indicators and market positioning (especially long/short ratios). For now, I plan to range trade this zone, but shorts are very risky — that’s a strong countertrend play. If you must short, use minimal size, because the uptrend is still powerful and I could be wrong. Let’s watch how the structure develops. #BTC #Crypto #Trading #Ichimoku #Riscora

I see the green zone as an attractive area to look for long entries.After the strong move, I expect BTC to stay in a range for now. My main plan is to long from the green block and look to take profits at the upper boundary (yellow block), where liquidity is clustered.No interest in shorts at the moment — will monitor price action for changes.Range trading is the priority until further direction emerges.

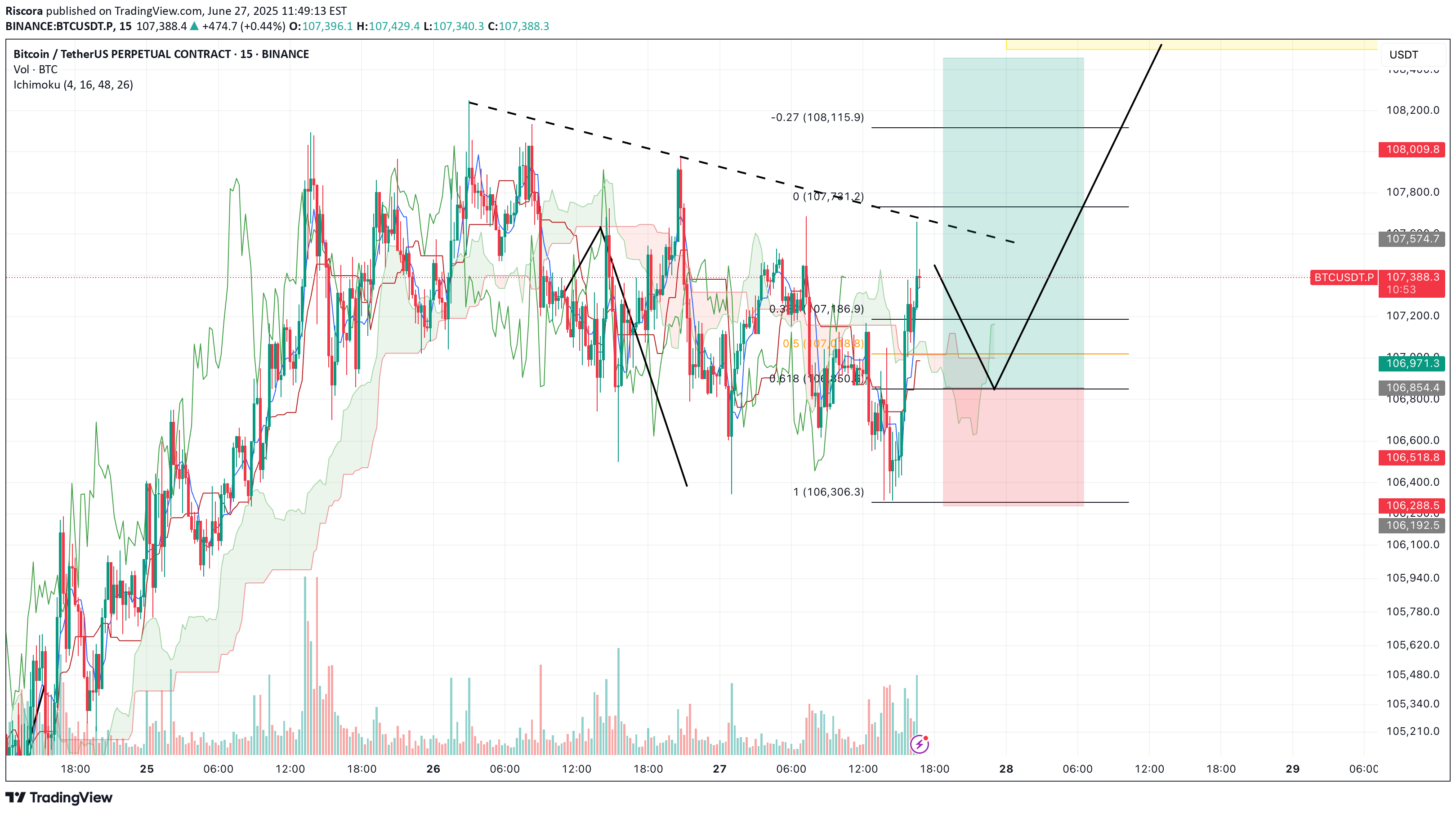

Reflections on the previous trade:Yesterday’s short setup played out: we reached the targeted downward block, as expected. However, price didn’t bounce to the 108000 level (untapped area), leaving a liquidity gap that isn’t great for bears. This means we might revisit and fill that zone in the future.Today’s context:A strong sell-off and the untapped 108,000 zone make things uncertain, especially when looking to avoid getting trapped in countertrend longs.Currently, I see two main short setups:Scenario 1: Short from 106,550 (correction entry)Entering on a pullback to 106,550 as a correction within the current bearish move.Targeting a drop towards the 1.618 retracement of the last impulse, aiming for the lower blue zone (bottom of the cloud on H4).This is the primary short if the correction materializes without breaking the highs.Scenario 2: Short from yellow block (liquidity grab fakeout)If price sweeps above and takes liquidity at the yellow block (marked by cluster of stop-losses), I’ll short from that fakeout.Stop-loss as shown on the chart. Targeting the 0.27 fib of the previous impulse.For this trade, I want to see a sharp rejection and heavy sell-off from the yellow zone.If price consolidates above 107,200 (a couple of 1H closes), this is a red flag and I’ll exit manually.In that case, expecting a move to 108,000 to fill the previous imbalance, before looking for renewed downside.Key notes:Context is highly uncertain today, multiple possible outcomes.For now, I’m favoring the second scenario, but scenario one remains valid if the correction plays out as described.Watching price action and volume closely for clues.#BTC #Crypto #Trading #Ichimoku #Riscora

Yesterday’s short setup didn’t work out as planned — stop-loss was hit as bulls showed strong momentum. However, I still believe that a move to the yellow block (downside liquidity zone) is possible, and the idea remains valid.The main mistake was with the stop placement, not the scenario itself. After taking a loss, I’m more cautious: reducing risk, lowering position size, and entering with less conviction. Bulls were dominant yesterday, so I’m keeping my risk tight on this trade.I’ll take the setup again, but with a more conservative approach. If price breaks and holds above my stop-loss level, it will confirm a shift in sentiment to bullish, and I’ll look to flip my bias accordingly.Key points:Previous short was stopped out — reviewing riskStill see potential for a move to the yellow blockLower risk, smaller size after a lossIf price holds above stop, trend flips bullishLet’s see how this plays out.#BTC #Crypto #Trading #Ichimoku #Riscora

Today’s idea:I’m expecting a retracement to the 107,867 level as a pullback to the recent impulse. The move we observed earlier aligns with my prediction from last Friday — liquidity was taken out above the highs, and now I anticipate a deeper correction against the overall bullish move.My main scenario for the day is a move down into the 106,400 area at minimum, targeting the liquidity below.Ideally, I’d like to see a push to 107,870 first, as that would provide the best entry for a short setup. I’m willing to open a short in that scenario, but it’s important to remember the higher timeframe trend remains bullish, so any short should be approached with caution.Key levels:Retracement target: 107,867Main downside target: 106,400Cautious shorting only — trend still bullish overallLet’s see how the price develops. Will update if conditions change.#BTC #Crypto #Trading #Ichimoku #Riscora

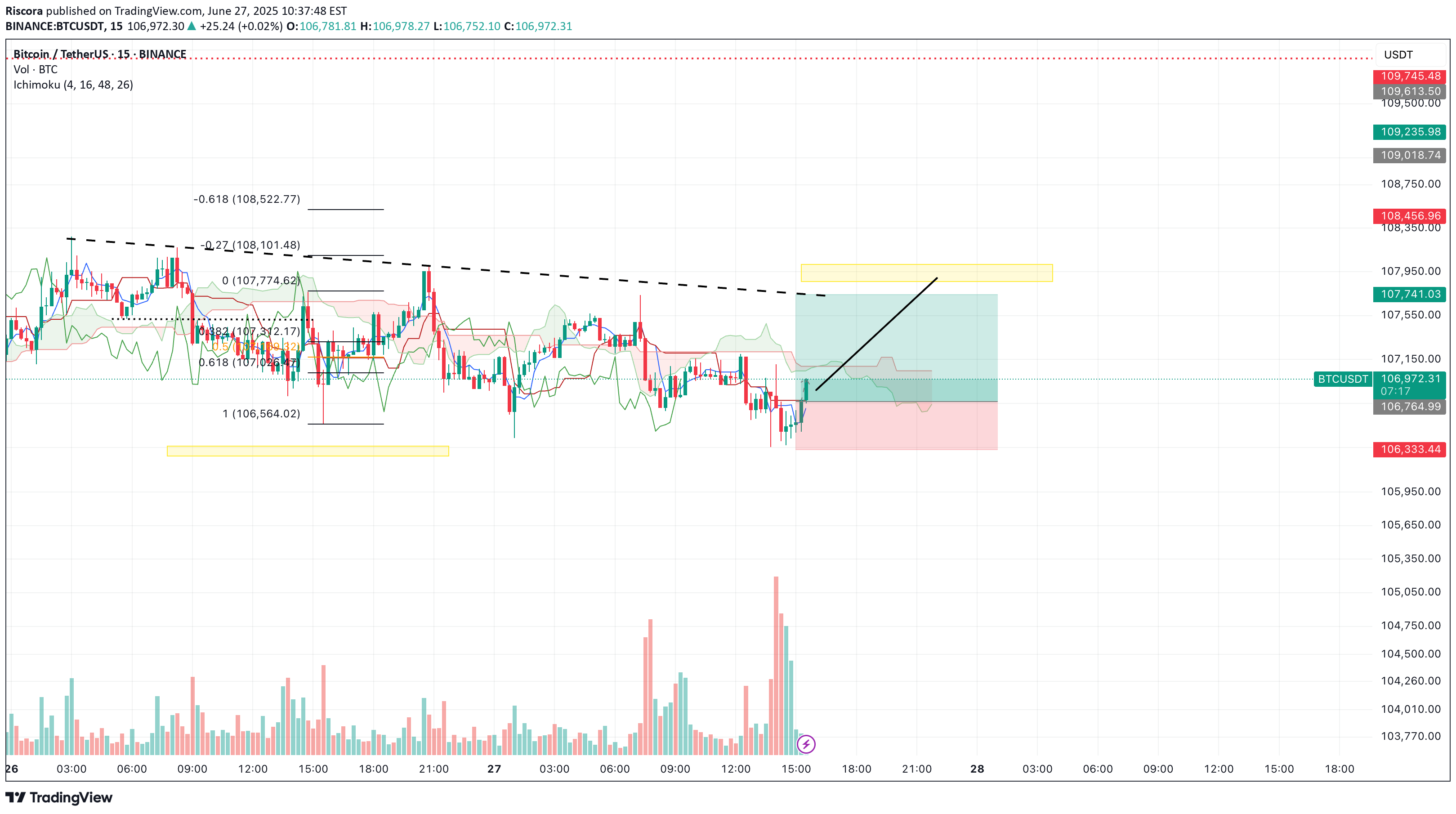

Previous idea played out. The last candle showed strong volume and a wick to the upside, signaling some liquidity has been taken.From here, I expect either a minor high above that wick or a correction down to the 0.618 area, then continuation of the bullish move towards the yellow liquidity block.If price breaks below recent lows, the 106,300 level has proven itself as solid support—buyers have stepped in there twice with strong volume, so I’m not expecting it to give way easily.Overall, I anticipate another push up to collect liquidity above and will reassess once price reaches the upper range.Watching price action closely for confirmation.#BTC #Crypto #Trading #Ichimoku #Riscora

Today’s idea:We’ve seen strong volume at the current support zone. My expectation is for a move upward towards the yellow block at 107,900, targeting liquidity that has accumulated above the dotted trendline.This is my main scenario for today: a range-bound session with a liquidity sweep to the upside. Watching for reaction as price approaches the yellow zone.#BTC #Crypto #Trading #Ichimoku #RiscoraStrong & quick trade but decided to close up because reversal is more likely happen from current price levels or a little bit higher. Will keep you posted

Yesterday’s plan worked out partially. For now, I believe the bullish move has run its course and today we should see a corrective phase. My main target for the correction is the yellow block at 106,300.Ideally, I’d like to see a pullback towards the entry area before the move continues.The scenario is invalidated if we break above the previous high — in that case, I’ll reconsider the outlook.Key levels:Correction target: 106,300 (yellow block)Entry retest preferredInvalidation: new local high above yesterday’s peakMonitoring price action and will update if the setup changes.

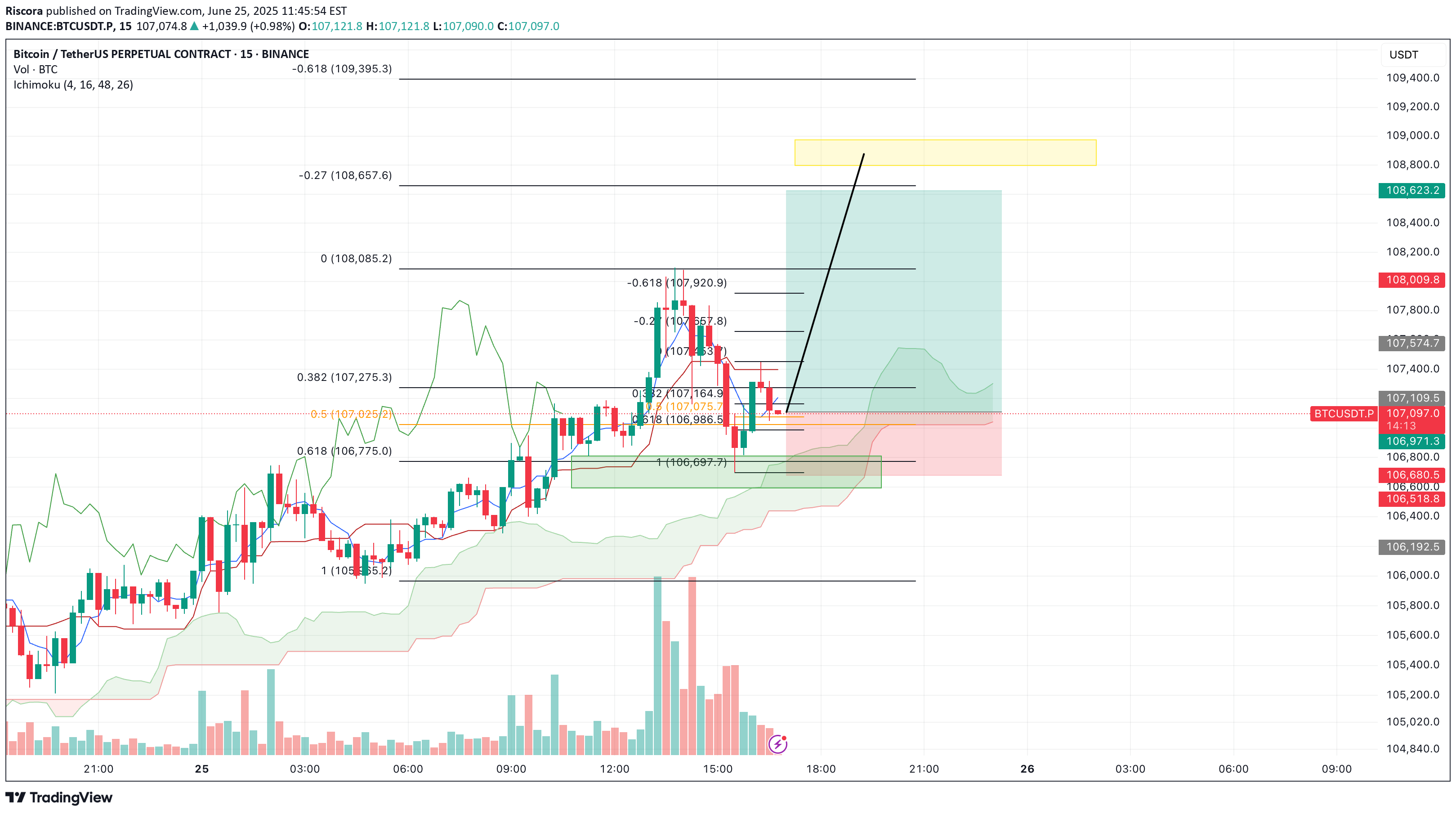

Yesterday’s idea worked out perfectly: price reached the target block and continued its upward move. Today, bulls remain firmly in control, and I expect the bullish trend to continue towards the 108,620 area.The recent pullback is viewed as a correction within the ongoing impulse. Buyers are clearly dominating the market, so my main scenario is further growth to the yellow block, where significant liquidity from short liquidations is clustered. I expect price to reach this range today, and I’m considering long setups on any corrective moves.Key levels:Main target: 108,620 (yellow liquidity zone)Critical support: 106,676If price closes below 106,676, or we see no bullish reaction for an extended period, I’ll consider that bulls may be losing control and a deeper reversal could follow. For now, the bias remains bullish.Watching price action closely and will update if conditions change.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.