Rashid198622

@t_Rashid198622

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Rashid198622

IMX IS WINDING UP

Unique Features and Use Cases: IMX crypto may have unique features or use cases that differentiate it from other cryptocurrencies. For example, it might offer innovative technology, specialized functionalities, or targeted solutions for specific industries or communities. If IMX provides valuable solutions that address unmet needs or challenges, it could attract users and investors, leading to increased demand and potential price appreciation. Partnerships and Collaborations: Partnerships and collaborations with established companies, organizations, or platforms can enhance the credibility and visibility of IMX crypto. Strategic alliances may facilitate the integration of IMX into existing systems, increase adoption among users, and open up new opportunities for growth. Positive developments in partnerships could generate positive sentiment and drive investor interest in IMX. Growing Ecosystem: A vibrant and expanding ecosystem can contribute to the success of a cryptocurrency. If IMX crypto has a growing community of developers, users, merchants, and investors, it may benefit from network effects and ecosystem development. As the ecosystem matures and attracts more participants, it can create positive feedback loops that support the long-term growth and sustainability of IMX. Market Demand and Adoption: Market demand and adoption play a crucial role in determining the value of a cryptocurrency. If IMX crypto addresses real-world problems or fulfills specific needs in the market, it may gain traction and see increased adoption over time. Factors such as user-friendly interfaces, accessibility, security, and scalability can influence the ease of adoption and contribute to IMX's success. Market Sentiment and Speculation: Market sentiment and speculation can have a significant impact on cryptocurrency prices. Positive news, developments, or rumors about IMX crypto's potential can generate excitement and speculation among investors, leading to increased buying pressure and price appreciation. However, it's essential to differentiate between hype and substance and consider the long-term fundamentals of IMX when evaluating its potential for growth. Regulatory Environment: The regulatory environment can influence the adoption and value of cryptocurrencies. Favorable regulations that provide clarity, legitimacy, and investor protection may encourage more significant institutional participation and investment in IMX crypto. Conversely, unfavorable regulations or regulatory uncertainty could dampen investor confidence and hinder IMX's growth prospects. Technological Advancements: Technological advancements and improvements in the underlying infrastructure of IMX crypto can enhance its functionality, security, and efficiency. Upgrades such as scalability solutions, consensus mechanisms, privacy features, or interoperability with other blockchains can position IMX for broader adoption and utility, driving demand and value appreciation. Market Dynamics and Trends: Market dynamics, trends, and macroeconomic factors can influence cryptocurrency prices. Factors such as overall market sentiment, investor risk appetite, macroeconomic conditions, geopolitical events, and global financial trends may impact the value of IMX crypto along with other cryptocurrencies. Understanding these broader market dynamics can provide insights into potential price movements and trends.

Rashid198622

BITCOIN trend analysis LONG LONG LONG

Bitcoin's price not reaching zero can be attributed to several factors: Limited Supply: Bitcoin has a capped supply of 21 million coins. This scarcity is built into its protocol, making it similar to precious metals like gold. The finite supply creates inherent value and prevents Bitcoin from going to zero. Growing Adoption: Bitcoin adoption continues to increase globally, with more individuals, institutions, and companies accepting and investing in it. As adoption grows, demand increases, which supports its price. Network Security: Bitcoin operates on a decentralized network secured by miners who validate transactions and secure the network through proof-of-work consensus. The robustness of its network security adds to its value proposition. Store of Value: Bitcoin is often referred to as digital gold and considered a store of value by many investors. Its qualities as a hedge against inflation and economic uncertainty contribute to its resilience. Market Dynamics: Bitcoin's price is subject to market dynamics, including supply and demand, investor sentiment, macroeconomic factors, regulatory developments, and technological advancements. While it can be volatile in the short term, its long-term trajectory is influenced by its fundamentals. Community Support: Bitcoin has a strong and dedicated community of developers, enthusiasts, miners, and investors who contribute to its ecosystem's growth and resilience. While Bitcoin's price may experience fluctuations, its underlying technology, scarcity, growing adoption, and community support provide reasons why it is unlikely to go to zero. However, like any investment, it carries risks, and investors should conduct thorough research and exercise caution.

Rashid198622

BTC trend

This is what I think BTC will do 150K max, Trend: Bitcoin's trend has historically been characterized by volatility, marked by rapid price fluctuations. In recent years, it has seen significant growth in adoption, institutional interest, and mainstream recognition. However, it remains susceptible to sudden price swings influenced by various factors, including investor sentiment, geopolitical events, and regulatory announcements. Projections: Projections for Bitcoin's future price vary widely among analysts and experts. Some bullish projections anticipate continued growth fueled by increasing institutional adoption, limited supply (due to Bitcoin's fixed maximum supply of 21 million coins), and growing interest as a hedge against inflation and currency devaluation. Conversely, bearish projections cite concerns over regulatory uncertainty, potential technological challenges, and competition from other cryptocurrencies. Factors Influencing Projections: Institutional Adoption: Continued institutional adoption, evidenced by investments from major companies and financial institutions, could drive further price appreciation. Regulatory Developments: Regulatory clarity or uncertainty in major markets can significantly impact Bitcoin's price and overall market sentiment. Technological Advancements: Technological improvements, such as scalability solutions and layer 2 protocols, could enhance Bitcoin's utility and scalability, potentially affecting its long-term value. Macroeconomic Conditions: Bitcoin's price dynamics are also influenced by macroeconomic factors like interest rates, inflation, and global economic instability. Market Sentiment: Market sentiment, including investor confidence and speculative behavior, plays a crucial role in short-term price movements. Long-Term Outlook: Bitcoin's long-term outlook remains a subject of debate. Some proponents view it as a revolutionary store of value and digital gold with the potential to disrupt traditional financial systems. Others remain cautious, citing scalability issues, environmental concerns, and regulatory risks.

Rashid198622

rule long

Rune Stones: Runes are characters or symbols that were historically used in ancient writing systems. Some people find the use of rune stones in divination or meditation practices intriguing. Each rune symbolizes specific meanings or energies, and people may use them for guidance or introspection. "Rune Long": If you meant something else by "rune long," it could be a term or idea specific to a particular context, culture, or subject. Without more information, it's challenging to provide a precise response.

Rashid198622

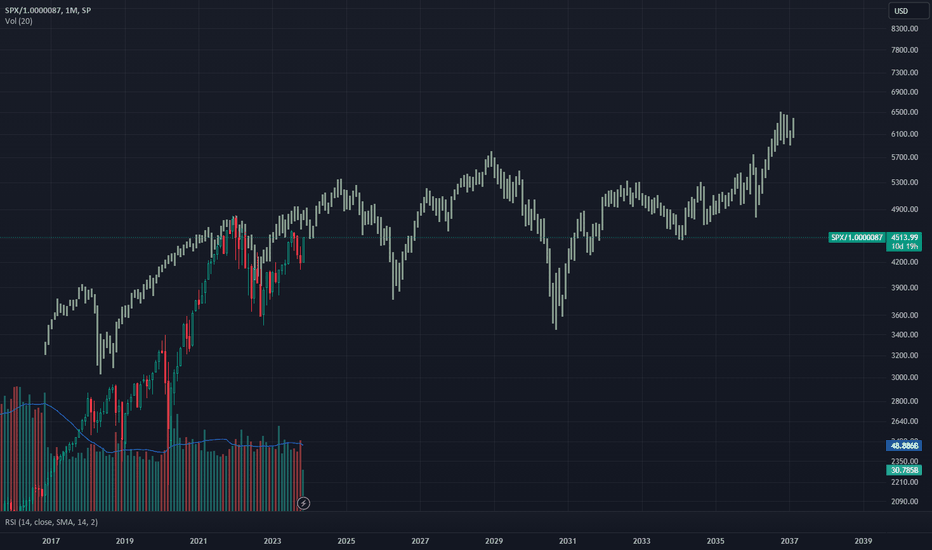

SPX LONG BORING SIDEWAYS MARKET

High inflation volatile rates SPX is going nowhere. Period.

Rashid198622

RUNE GOING TO HADES

RUNE is destine to go to hades thats a fact, take it to the bank.

Rashid198622

EOS TO THE FREAKING MOON

EOS is the best crypto out there and there is NO ONE who can stop its parabolic run now. See you at the freaking moon brav...

Rashid198622

ASTRUSDT, SHORT TAKE PROFIT AND NEXT RIP IDEA

I am short ASTR, looking to take profit at the highlighted area and will be adding more at the highlighted area.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.