QuinnReed_Charts

@t_QuinnReed_Charts

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

QuinnReed_Charts

تحلیل طلای امروز: فرصت خرید طلا (XAUUSD) در تراز کلیدی ۴۰۳۸ تا ۴۰۴۱!

📈 XAUUSD (GOLD) Analysis — 15M Timeframe Currently, Gold has shown a clean bullish market structure with a strong impulsive leg breaking above recent highs, confirming a Market Structure Shift (MSS) to the upside. The previous consolidation and liquidity grab below the 4018–4025 range acted as a demand zone, fueling this sharp rally. Now, price has reached a short-term premium zone and appears to be setting up for a retracement into discount before continuation higher. The 4038–4041 zone aligns perfectly with: A previous structure breakout level (role reversal zone). Fair Value Gap (FVG) and order block confluence. The equilibrium (50%) retracement of the recent impulse leg. This area represents a high-probability buy zone for continuation towards the next liquidity pool and target around 4084. 🎯 Trade Setup Idea (My View): Buy Zone: 4038–4041 Stop Loss: 4025 (below structural low and invalidation point) Take Profit: 4084 Risk/Reward: ≈ 1:3 🧭 Bias: Bullish continuation expected as long as price holds above 4025. A clean retracement into 4038–41 would provide an ideal long opportunity targeting liquidity above 4080 region.

QuinnReed_Charts

تحلیل طلا (XAUUSD) امروز: فرصت خرید در محدوده 4000 با هدف 4030!

The XAUUSD market is currently maintaining a bullish structure, respecting a clear ascending trendline from recent swing lows. Price is consolidating near the 4000–4005 zone, where multiple rejections indicate strong short-term support. My planned buy entry around 4000–4004 aligns well with this structure, supported by both the trendline and prior demand area. The stop loss at 3990 is reasonable, sitting below the last higher low and structural support. The first major resistance zone is seen near 4030, where previous liquidity grabs occurred, making it a logical target for a short-term bullish move. Overall, as long as the market sustains above 3990, bias remains bullish toward 4030, with the current price action showing healthy retracement behavior before another potential leg upward.

QuinnReed_Charts

تحلیل هفتگی طلا (XAUUSD): محدوده حیاتی 4000 دلار؛ خریداران کجا وارد میشوند؟

Weekly Analysis The XAUUSD market is currently consolidating after a sharp corrective move from its recent highs near 4,381. Price is hovering around the mid-range, showing signs of indecision. The first support area is seen between 4,042–4,062, where minor bullish reactions may occur; however, a deeper retracement toward the second and stronger support zone at 3,945–3,957 remains likely before any sustained bullish momentum emerges. This zone aligns with previous structure support and demand imbalance, making it a potential launch point for buyers. A convincing break and daily close above 4,126–4,141 would confirm a market structure shift to the upside, potentially fueling a rally toward the 4,381 resistance zone + liquidity, which aligns with prior swing highs. Until then, traders should monitor the lower support levels for bullish price action signals suggesting the start of the next impulsive leg upward.Going exactly I pointed out, now let's see how it goes further.

QuinnReed_Charts

طلا شکست؛ زنگ خطر برای ریزش بزرگ یا فرصت فروش طلایی؟

Gold has shown a clear break below its ascending trendline after a strong bullish run, indicating that bullish momentum has weakened and sellers are regaining control. Price has since pulled back to retest the broken trendline, which is now acting as resistance, forming a classic structure for a potential continuation move to the downside. The rejection around the 3860–3865 zone provides an ideal entry for short positions, with stop loss kept above the recent swing high at 3895–3900 to protect against false breakouts. From a technical perspective, the bearish bias remains valid as long as price holds below this resistance zone, and the expected target lies at the previous swing low around 3790–3800. A break below this level could even extend the decline further, but the first take-profit zone should be the prior low for a safer exit. Overall, this setup aligns with the shift in market structure and offers a favorable risk-to-reward ratio.

QuinnReed_Charts

تحلیل تکنیکال طلا (XAUUSD): فرصت خرید طلا در محدوده حمایتی حیاتی و اهداف صعودی پیش رو

Gold continues to maintain its bullish momentum after breaking out of the previous resistance zone, which has now flipping into a support area around 3870–3875. Price is consolidating just above this demand zone, suggesting a healthy retracement before a potential continuation higher. As long as price respects this key support and does not close below 3850, the bullish market structure remains intact. Therefore, my plan is to buy from the 3870–3875 region, keeping a stop loss at 3850 to protect downside risk, while targeting the 3925 level, which aligns with the next target area and potential supply zone. This setup provides a strong risk-to-reward profile and aligns with the overall trend direction.

QuinnReed_Charts

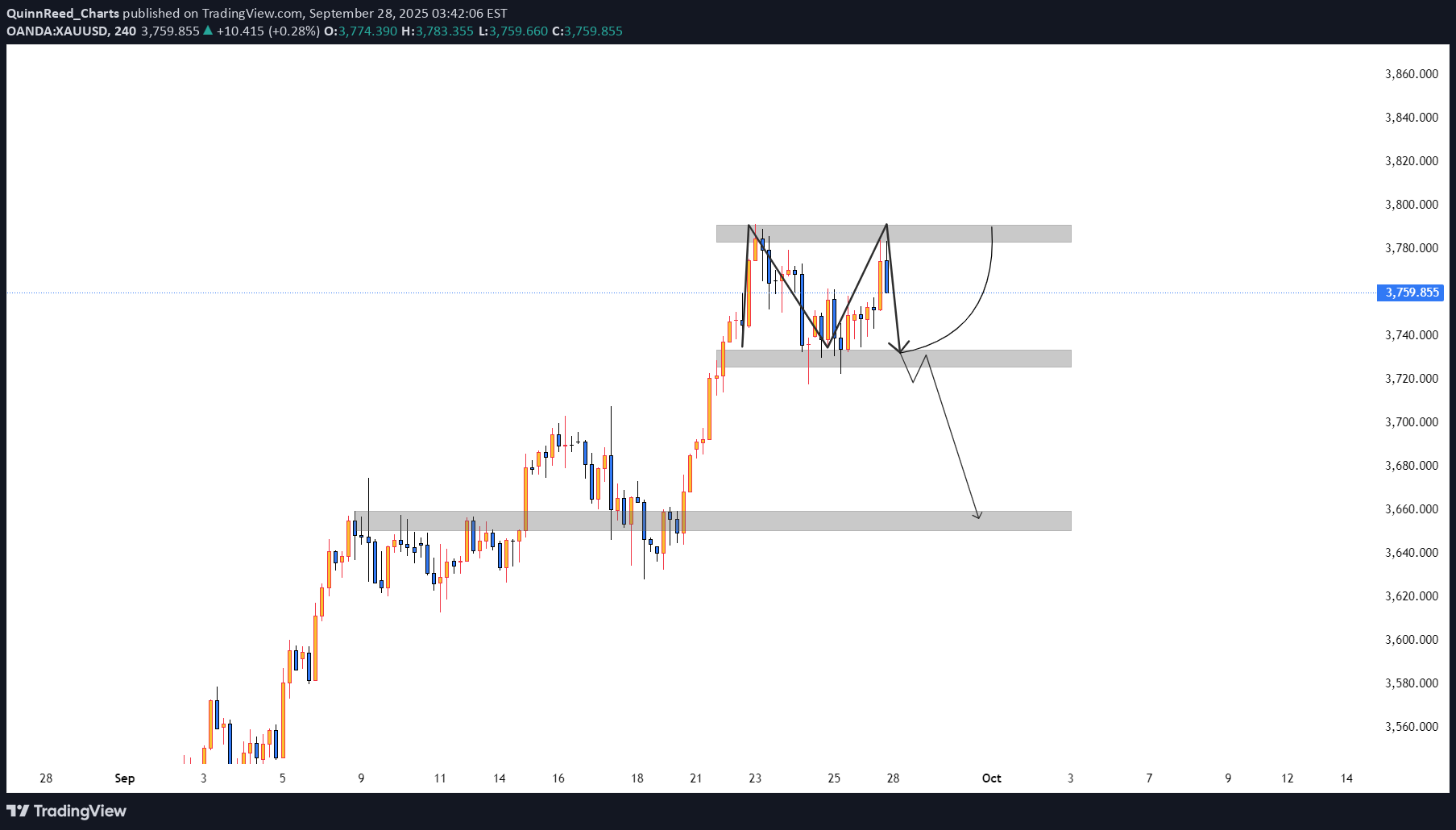

Gold XAUUSD Weekly Analysis 28 Sept to 2 Oct 2025

Gold is currently trading at a decisive level where the weekly structure is hinting at a potential shift. After a strong bullish run, price tested the 3785–3800 zone but failed to sustain, forming a double top/M pattern and rejecting strongly from this supply area. The rejection has now pushed gold back into the crucial support zone of 3725–3733, which is a make-or-break level for the next swing move. If this support holds firm and we get a strong H4 close above it, buyers could regain momentum, opening the door for a bullish continuation towards 3780–3800, where the previous rejection zone lies. This would keep the broader bullish structure intact. On the flip side, if the market fails to hold this level and breaks below 3725 decisively, we can expect further downside towards the next demand zone at 3650–3660, which served as an earlier accumulation area. Overall, swing traders should treat 3725/33 as the key inflection point: above it, gold looks poised to retest the highs, while a breakdown could trigger a deeper correction into lower support levels.

QuinnReed_Charts

Gold XAUUSD Intraday Setup 26.09.2025

Price is currently approaching the supply/resistance zone between 3757–3761, where multiple rejections and liquidity sweeps have previously occurred. The expectation is for sellers to step in within this region, making it a high-probability entry for shorts. The stop loss is set at 3774, just above the recent swing high and invalidation point, ensuring protection against a breakout scenario. The downside target is 3719, which aligns with the next significant support level and prior demand zone, offering a clean risk-to-reward structure. If price reacts as anticipated from the marked zone, we could see a sharp move down toward the target, making this setup attractive for traders looking to capitalize on bearish continuation.

QuinnReed_Charts

Gold XAUUSD Intraday Setup 23 Sept 2025

Gold has shown strong bullish momentum, breaking above multiple resistance zones and forming a clean rally on the 15-minute chart. After this impulsive move, price is currently retracing, and a key support area lies around 3757–3759, which was previously resistance and may now act as support. A potential long setup forms if price taps into this level, offering a buying opportunity with a target at 3800, aligning with the next psychological resistance, while maintaining a protective stop loss around 3747. This setup reflects a classic resistance-turned-support trade with favorable risk-to-reward.Gold dropped to exact entry and now up for 100 pips, trail with SL.

QuinnReed_Charts

Gold XAUUSD Intraday Setup 22.09.2025

Gold has recently broken its all-time high and is currently trading at 3711, signaling continued bullish momentum in the market. However, after such a strong breakout, a short-term retracement is likely as price action tends to revisit previous consolidation zones to gather liquidity. I'm now watching the 3693–3696 area closely—a key level where gold previously consolidated before the breakout. This zone is expected to act as a liquidity pocket, where the market may dip briefly to shake out early long positions and trap impatient sellers before resuming its upward trajectory. This kind of move is typical in strong trending markets, where price pulls back to retest former resistance turned support and collect orders before the next leg higher. My plan is to go long in the 3693–96 range, with a tight stop-loss placed at 3685, just below the liquidity sweep zone, minimizing downside risk. The target for this trade is 3725, anticipating that momentum will carry gold to fresh highs once the pullback completes and institutional buying steps back in.

QuinnReed_Charts

Gold XAUUSD Intraday Setup 19 Sept

Gold on the 15M timeframe is showing a short-term bullish structure after forming a series of higher lows, with the price now retesting the ascending trendline support near 3647–3650. This area also aligns with a minor demand zone, suggesting buyers are stepping in to defend it. If the trendline holds, momentum could push the market back toward recent highs, with the first target at 3674 (TP1) and extended target at 3685–3690 (TP2). However, if price closes below 3638, it would signal a break of structure and potential continuation of the bearish leg, so a stop loss below this level is crucial. Overall, the market is offering a favorable risk-to-reward long setup as long as the trendline is respected and no strong bearish candle closes below support.The trade activated instantly. And now up for about 100 pips. Keep trailing.That's it. Gold hit the target 1 3674 and still strong. Giving almost 300 pips within couple of hours. Take partials and trail with remaining portion.It's finally reached the TP 3685 at the end. Have a nice weekend.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.