Technical analysis by QuinnReed_Charts about Symbol PAXG on 9/28/2025

QuinnReed_Charts

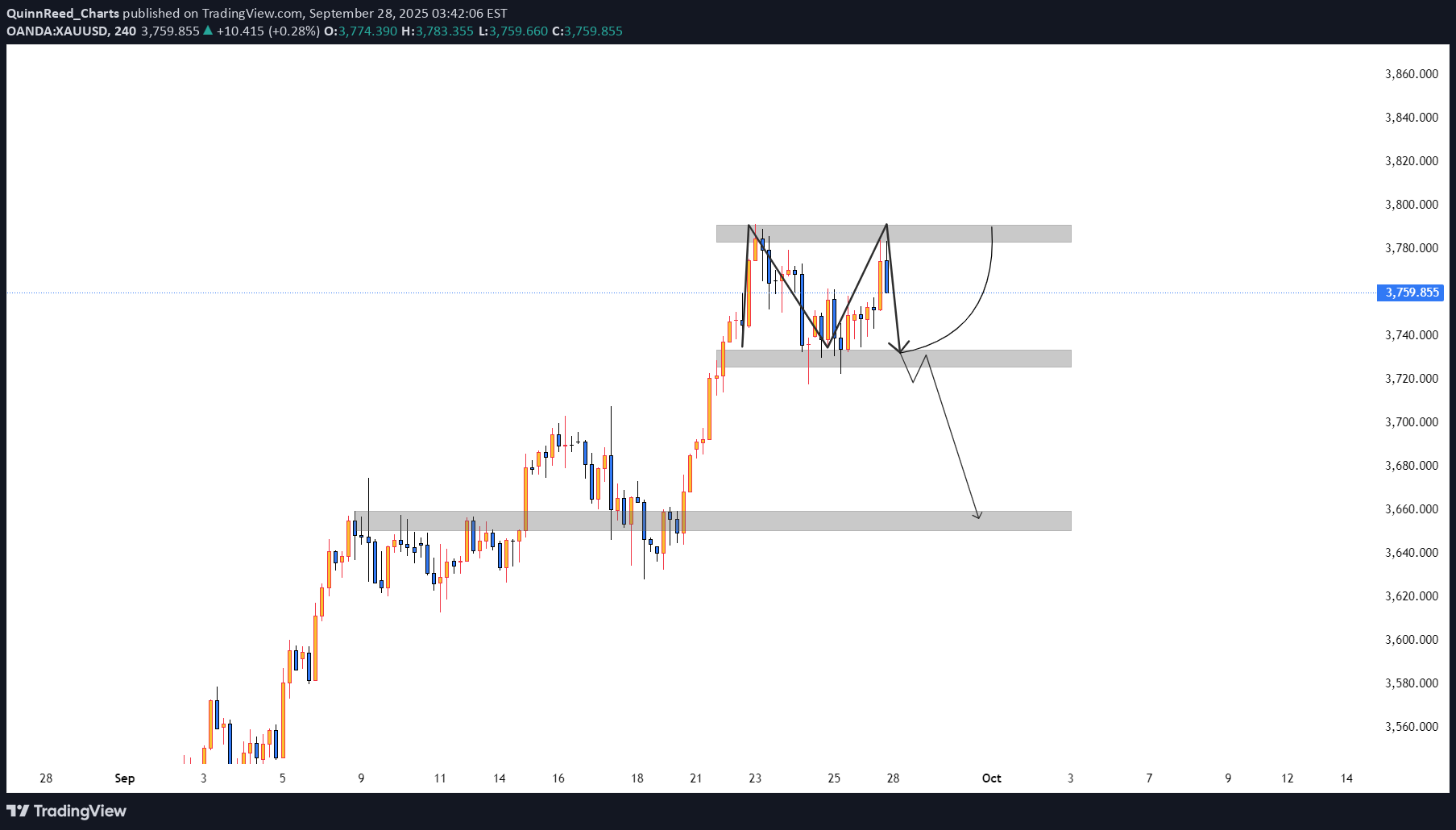

Gold XAUUSD Weekly Analysis 28 Sept to 2 Oct 2025

Gold is currently trading at a decisive level where the weekly structure is hinting at a potential shift. After a strong bullish run, price tested the 3785–3800 zone but failed to sustain, forming a double top/M pattern and rejecting strongly from this supply area. The rejection has now pushed gold back into the crucial support zone of 3725–3733, which is a make-or-break level for the next swing move. If this support holds firm and we get a strong H4 close above it, buyers could regain momentum, opening the door for a bullish continuation towards 3780–3800, where the previous rejection zone lies. This would keep the broader bullish structure intact. On the flip side, if the market fails to hold this level and breaks below 3725 decisively, we can expect further downside towards the next demand zone at 3650–3660, which served as an earlier accumulation area. Overall, swing traders should treat 3725/33 as the key inflection point: above it, gold looks poised to retest the highs, while a breakdown could trigger a deeper correction into lower support levels.