PouyanFa

@t_PouyanFa

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

PouyanFa

Is the entry trigger activating?

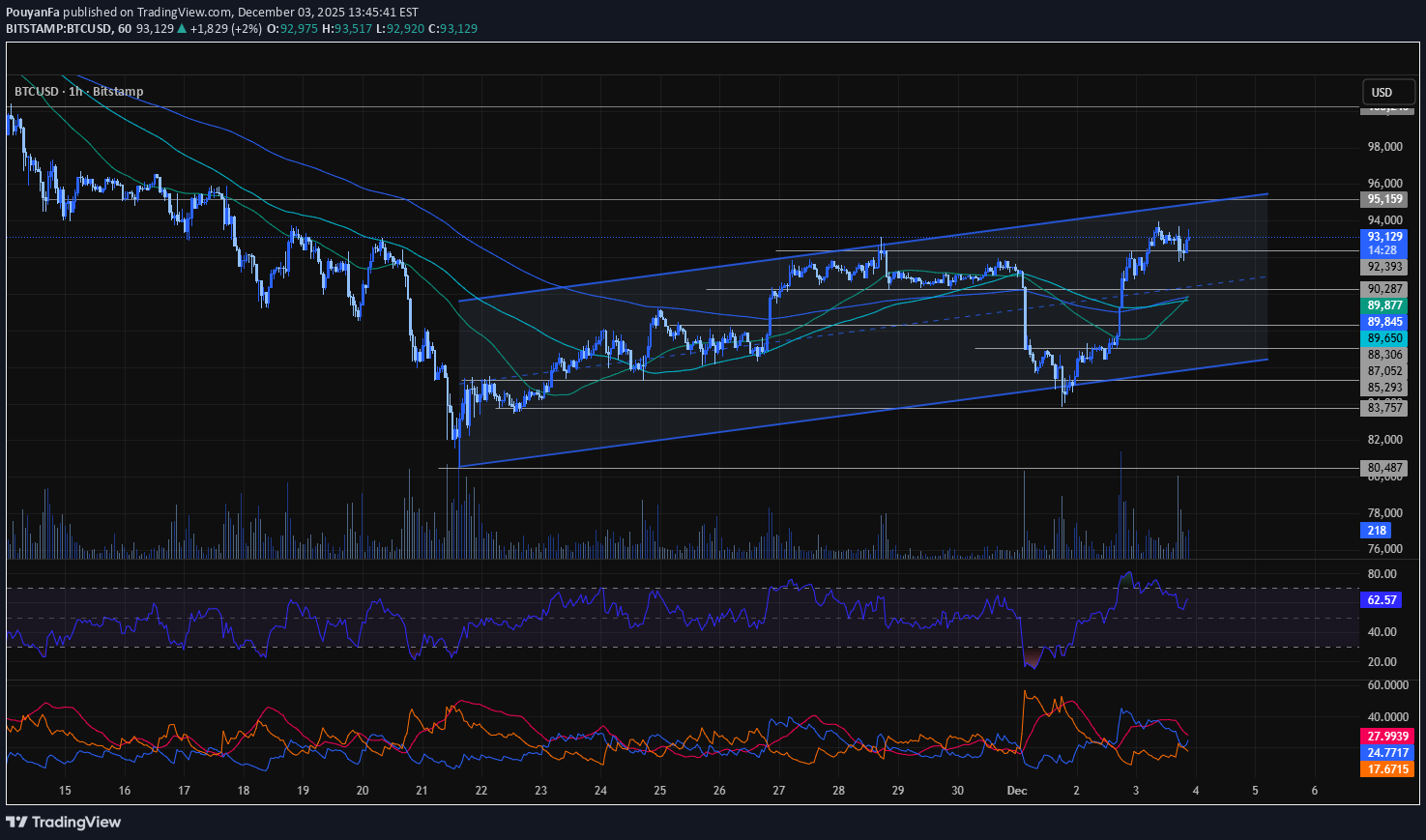

After news, Bitcoin has now entered a low-volume compression, which is giving signs of a potential sharp move. We can see that the second time it tried to reach the daily resistance, it couldn’t make a higher high and got rejected. We need to see whether the buyers take control and test the daily resistance again, or if the sellers are stronger. I personally will place a sell-stop at 91,860 so that if a sharp downward move occurs, I don’t miss the trend. I won’t set a very large target because, as we’ve seen in the past, the price has been moving up and down within a range box.

PouyanFa

بیت کوین در دوراهی حساس: آیا حمایت 90 هزار دلار میشکند یا 95 هزار دلار فتح میشود؟

Bitcoin is consolidating after its strong rally toward the 126K all-time high, and price is now rotating inside the 90K–94K zone. The structure remains corrective, and BTC is currently retesting a major support area around 90K. If bulls fail to defend this zone, the next downside liquidity pockets sit at 88K–86K and then the heavier demand region at 83K–85K. Losing these levels would confirm a deeper corrective cycle. On the upside, BTC needs a clean break above the 94K–95K supply zone — which previously triggered a sharp rejection — to re-establish bullish momentum. A sustained breakout could open the path toward 100K and potentially higher mid-term targets. Overall, Bitcoin is in a ‘decision phase,’ and whichever side takes liquidity first (90K or 95K) will likely set the tone for the coming weeks.

PouyanFa

Key resistance ahead of tomorrow’s major news

**“Tomorrow, the most important news of 2025 will be released — the U.S. interest rate decision. This announcement is expected to determine the direction of many market trends, including Bitcoin’s. It will show whether the bearish phase is coming to an end or if we’re going to get rejected and continue the downward trend. In any case, high volatility is likely until tomorrow night, so be cautious with your positions.”**

PouyanFa

تحلیل شمع نهنگی دیشب: فعال شدن تریگر فروش و بررسی حمایت کلیدی 87,000 دلار!

In last night’s analysis, we mentioned that a whale candle was likely to appear. The signals were already there, and it was worth taking the risk by placing a sell-stop order. We saw that the sell-stop got triggered and even gave us an R:R of 5. Interestingly, the price showed strong support around the $87,000 level. Now we need to wait and see whether that reaction was just emotional volatility, or if the market is about to form a range there and continue the bearish move afterward.

PouyanFa

تحلیل بیت کوین: هشدار ریزش شارپی در تایم فریم ۱۵ دقیقهای و استراتژی فروش فوری!

Signals are showing a potential sharp bearish move. To avoid missing a whale candle, we can take a calculated risk and place a sell stop at 89.683.

PouyanFa

تحلیل جدید بیت کوین: آیا روند نزولی ادامه دارد؟ (زیر ۹۷ هزار دلار)

As long as the price is below 96–97K, we haven’t received any signal indicating a trend reversal, and we are still sellers. For now, I don’t have any new analysis because there hasn’t been any significant movement since yesterday. We’ll analyze it in more detail next week in the watchlist.

PouyanFa

بیت کوین در مرز حساس: منتظر شکست کانال یا ریزش دوباره؟

Bitcoin has formed a channel during the higher-cycle correction, and it has now reached the top of that channel. Buying volume has also decreased. We need to see whether it can break the top of the channel or if it will face resistance again and drop. For now, I don’t see any trigger for entry — we need to wait and see what new structure the chart gives us.

PouyanFa

بیت کوین در دوراهی حساس: آیا الگوی V شکل، مسیر صعود به ۹۲ هزار دلار را هموار میکند؟

After Bitcoin reached the price of 83,800, it found support and reversed the entire move, forming a V-pattern. We now have to see whether this pattern will actually play out or not. For it to activate, strong volume needs to enter the market — but so far it looks more emotional than logical. In any case, we need to wait and see how the price reacts to the 92,125 resistance level. Will it break through, or is this just profit-taking before sellers take control again?

PouyanFa

بیت کوین در آستانه ریزش؟ بهترین زمان برای فروش BTC کجاست؟

For a moment, Bitcoin made many traders panic with FOMO — afraid that the trend might have reversed and they might miss even a tiny piece of the move. But we do the opposite here. Until a trend reversal is fully confirmed, we open no long positions, even if it means missing a part of the upside. Right now our focus is only on short positions, and we’re analyzing the triggers for that. If you don’t have an active position, the 83,500 – 83,000 zone is a good area to wait for a confirmation candle before entering — or to place a sell stop. Personally, I prefer waiting for confirmation, because it lets us read the volume and the strength of the move. But of course, if a whale dumps the market, the sell-stop entry will catch it, while a confirmation entry might miss it. Since we stick to proper risk management, both methods are safe for us. Thank you for your support — boosting the post helps more traders see the analysis, grow our community, and learn from each other. 🙏📉

PouyanFa

تحلیل روزانه بیت کوین: منتظر سقوط بعدی یا تثبیت بالای ۹۷,۰۰۰؟

When we zoom out the chart a bit to have a more comprehensive view from the start of the downtrend, we can see a **strong bearish trend**. After each drop, the price has corrected and then continued to fall. Based on the chart’s history, it looks like we are currently in a **higher-level cycle correction**, after which the price could have another leg down. I still don’t see any signs of a bullish reversal **unless the price stabilizes above 97,000 with strong volume**. Otherwise, we are still looking for **short positions**. We monitor Bitcoin **daily** and analyze it every day to hunt for the best opportunities.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.