Pierce_Bowers

@t_Pierce_Bowers

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Pierce_Bowers

XAUUSD : Testing Key Levels Amid Declining Momentum.

After a period of bullish momentum, gold prices are now showing signs of exhaustion as they retreat from the key resistance level at $2,718. This failed attempt to break higher has led to a noticeable shift in market sentiment, setting the stage for potential further declines.The chart highlights a double-top formation at the resistance zone, signaling a bearish reversal pattern. As prices edge lower, attention now shifts to the critical support range between $2,622 and $2,560, marked in blue. This area represents a consolidation zone where traders should watch for potential price reactions.If the price sustains below this support range, the next logical target lies near $2,542, aligning with the 1.618 Fibonacci extension. However, a bounce from this zone could provide short-term trading opportunities, depending on the broader market conditions.This interplay between resistance and support levels underscores the importance of strategic decision-making in navigating the current market dynamics. Where do you think gold is heading next?

Pierce_Bowers

Gold price today: Strongest increase in the past 9 weeks

Gold prices continued to rise sharply today and hit a 9-week high after the important US inflation report. Specifically, the US announced that the consumer price index (CPI) in November increased by 2.7% compared to the same period last year, in line with market expectations.Optimists in the gold market breathed a sigh of relief when the CPI stabilized. Because this factor could push the Federal Reserve (FED) to cut interest rates at the monetary policy meeting taking place next week, which would benefit gold prices.According to investors' assessment, there is a 96% chance that the FED will cut interest rates by another 0.25 percentage points at the meeting on December 17 and 18, 2024.Personally, I am expecting gold prices to reach a new high in 2025, when bond yields gradually decrease, geopolitical risks are still the driving force for investment sentiment in gold.And you, what do you think?

Pierce_Bowers

BTC/USDT Set to Break Higher: Targeting $101,000 and Beyond

Bitcoin (BTC) is firmly poised for a bullish breakout, currently trading around $97,500. After a steady recovery from the $94,960 support level, the price action shows clear signs of strength, supported by key technical levels and market momentum.The 4-hour EMA has provided solid support, indicating that buyers are firmly in control. The next critical resistance level lies at $101,050. A breakout above this threshold would signal the continuation of the bullish trend, with the price likely to target the $104,000-$106,000 range. This zone represents a key supply area, but the ongoing momentum suggests BTC has the potential to test and even breach this level.Market sentiment also favors a bullish outlook, as BTC has consistently respected its support zones, creating higher lows. This pattern reinforces the upward trajectory, making a move toward $101,000 and beyond a highly probable scenario in the short term.For traders, the strategy is clear: focus on buying opportunities during minor pullbacks. Any retest near $94,960 presents a favorable entry point, with a well-defined target at $101,050 and further extension to $106,000. Stop-loss levels can be placed below $94,000 to manage risk effectively.In my analysis, BTC is setting up for a decisive move higher, backed by strong technical indicators and market dynamics. The bullish trend is undeniable, and the current levels offer a compelling opportunity to ride the momentum. Stay focused, and prepare for Bitcoin to reclaim higher territory.

Pierce_Bowers

Gold Surges Toward Key Breakout

Gold prices continue their upward trend, currently trading near $2,702 after a significant rally. The 4-hour chart reveals a strong bullish structure, with the price breaking out of a consolidation zone between $2,666 and $2,651.Key Observations:Gold has reached the 0.618 Fibonacci retracement level at $2,678, confirming its bullish momentum.The next major resistance lies at $2,716. A successful breakout above this level could propel prices toward the 1.618 Fibonacci extension near $2,777.Potential Scenarios:Bullish Continuation: If gold breaks and holds above $2,716, the rally is likely to extend toward $2,777.Pullback Opportunity: A rejection near $2,716 may lead to a retest of the support zone around $2,666–$2,678, offering a potential buying opportunity for traders.Trading Strategy:Buy Zone: Near $2,666–$2,678 on a pullback.Take Profit: Around $2,716 for short-term positions and $2,777 for extended targets.Stop Loss: Below $2,651 to minimize risk.

Pierce_Bowers

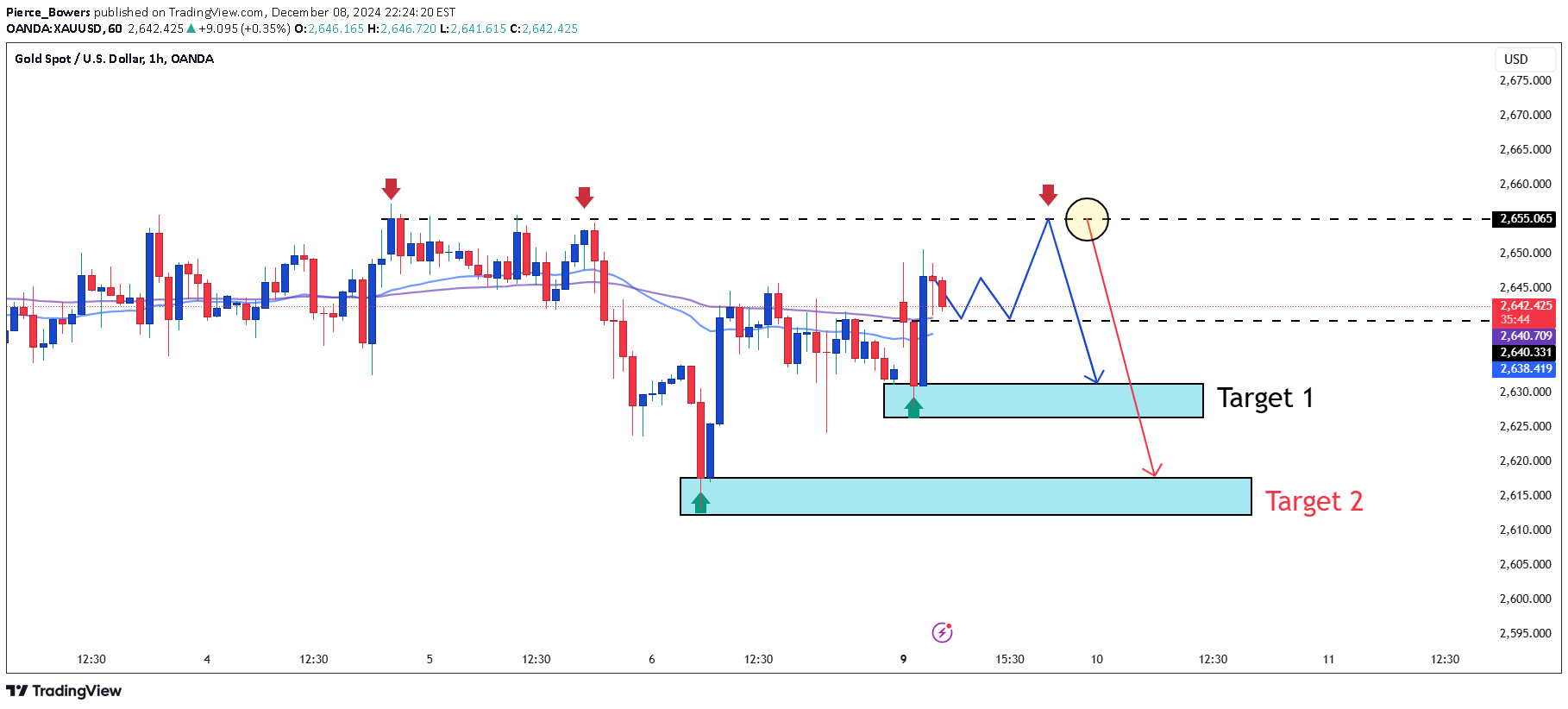

Gold Price Analysis: Poised for a Breakout

Gold prices are currently consolidating in a tight range, as shown on the 1-hour chart. Resistance at $2,655 has been tested multiple times (red arrows), but sellers remain strong, while buyers hold firm at $2,640 (green arrow), forming a key support zone. This balance signals a potential breakout in either direction.Key Scenarios-Bullish Breakout: A sustained move above $2,655 would confirm bullish momentum, opening the door for further gains.-Bearish Breakdown: A drop below $2,640 would pave the way for a move toward $2,630 (Target 2), with potential for further downside.

Pierce_Bowers

Gold Weakens Further as Market Awaits Fresh Catalysts

Good morning, traders! In the early hours of Friday's trading session, gold continues to weaken, losing over 12 pips.This decline reflects a temporary pause from bullish investors as they seek new drivers for upward momentum. From a technical perspective, the chart shows that while long-term bullish momentum remains intact, the current pullback appears to be nearing its conclusion. Support is forming around the $2,566 zone, followed by $2,630.In the short term, gold may experience further declines as the market awaits directional clarity from news expected later in the day. On the other hand, the long-term bullish trend remains a favored bet, with key upside targets marked clearly on the chart.Happy trading, and may your trades be profitable! Don’t forget to leave a like and share your thoughts about the outlook for this precious metal. Cheers!

Pierce_Bowers

Gold Awaits Breakout Amid Consolidation Phase

Gold prices continue to trade sideways within a familiar range, reflecting a phase of indecision as traders await fresh catalysts for the next directional move. Support for XAU/USD comes from geopolitical tensions, ongoing concerns about trade wars, and the recent decline in US Treasury yields, which bolster the safe-haven appeal of the precious metal.From a technical perspective, the recent sideways price action can still be categorized as a bearish consolidation phase, aligning with the broader downtrend from last week. The breakdown earlier this week below a four-day ascending channel has tilted the bias in favor of sellers. However, neutral oscillators on the daily chart suggest that any slide below the overnight low of $2,622-$2,621 could encounter support near the $2,600 mark, where buyers might reenter.On the upside, immediate resistance is seen around $2,655, with the next hurdle at $2,666. Should gold breach this level, it could target the $2,677-$2,678 zone, paving the way for a potential rally toward the psychological barrier of $2,700.In the current scenario, gold’s consolidation reflects the market's cautious stance. While bearish forces hold the upper hand, the $2,600 level remains a critical support zone, ensuring that the downward movement remains measured for now. A decisive breakout on either side of the range will likely set the tone for gold’s next move.

Pierce_Bowers

Gold Prices Slip as USD Strengthens

Global gold prices took a hit, shedding $13.1 to settle at $2,640 per ounce in early Tuesday trading. This drop marked the end of a four-day winning streak for the precious metal, as it faced headwinds from a strengthening US dollar.The US Dollar Index climbed 0.5%, poised for its best weekly performance in over a week. This surge made dollar-denominated gold more expensive for holders of other currencies, dampening demand for the metal.Investors are now turning their attention to upcoming economic data and comments from Federal Reserve officials, hoping to glean insights into the future direction of US interest rates. Adding to the dollar’s strength were recent remarks from President-elect Donald Trump, who emphasized the importance of BRICS nations maintaining ties with the USD, further pressuring gold prices as the week begins.

Pierce_Bowers

Gold Awaits Breakout Amid Consolidation

Gold prices are currently trading at $2,632.20, reflecting a slight recovery of +0.15%, but the market remains at a crossroads. The recent price action suggests that gold is consolidating within an ascending channel, yet the overall structure hints at underlying bearish pressure.The $2,644 level acts as a critical short-term resistance. This zone has repeatedly halted bullish attempts, signaling strong selling interest. On the downside, immediate support is found near $2,620, aligning with the lower boundary of the channel. If this level breaks, it could open the door to a deeper decline toward the $2,590 region or lower.Gold’s current movement showcases indecision among traders, as the market awaits a decisive breakout or breakdown. A break above $2,644 could signal a short-term bullish push, but without strong buying momentum, such a move may lack sustainability. On the other hand, a break below the channel would confirm a continuation of the broader downtrend.From a strategic perspective, traders should remain vigilant for signs of exhaustion near resistance or confirmation of a breakdown below support. The price trajectory in the coming sessions will likely define the next significant move for gold, whether it resumes its bearish trend or attempts a stronger rebound.

Pierce_Bowers

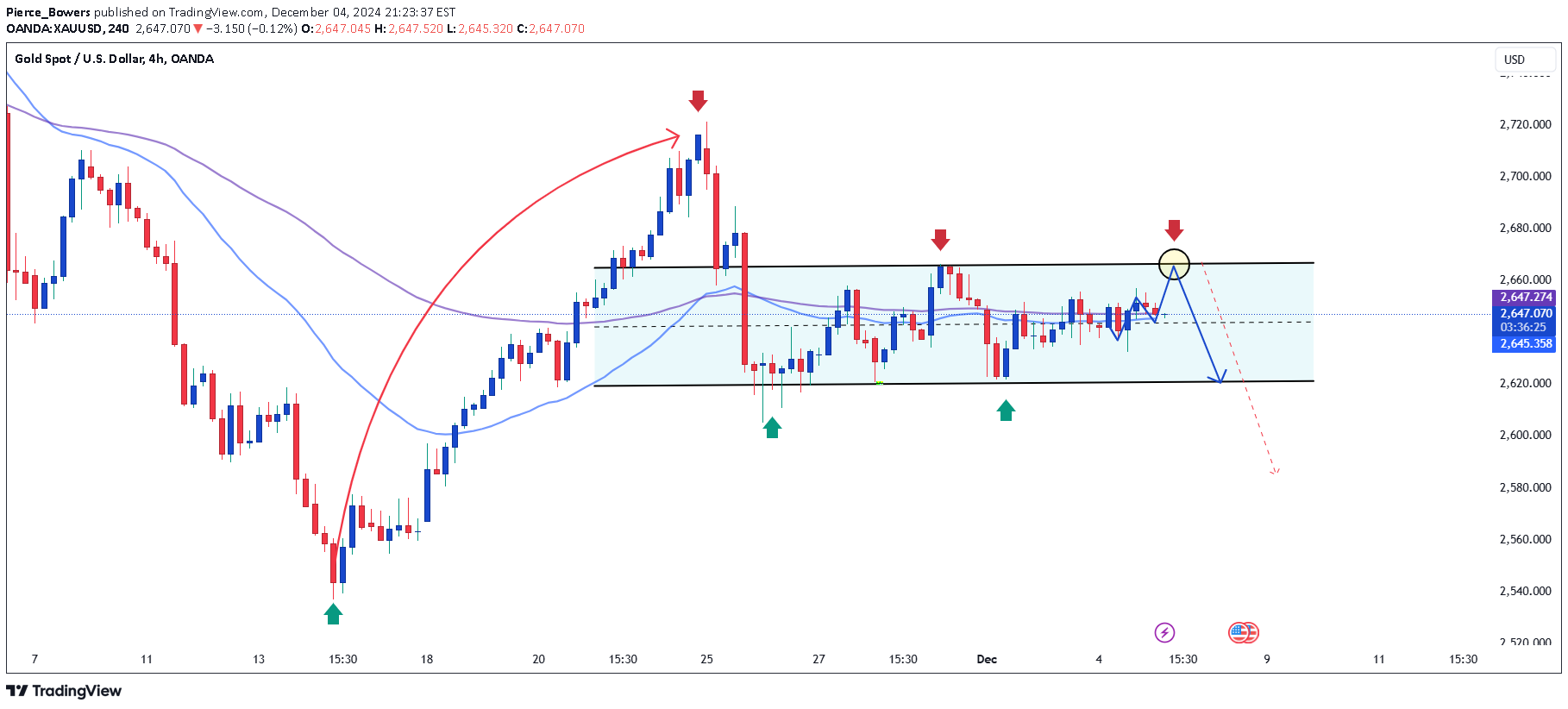

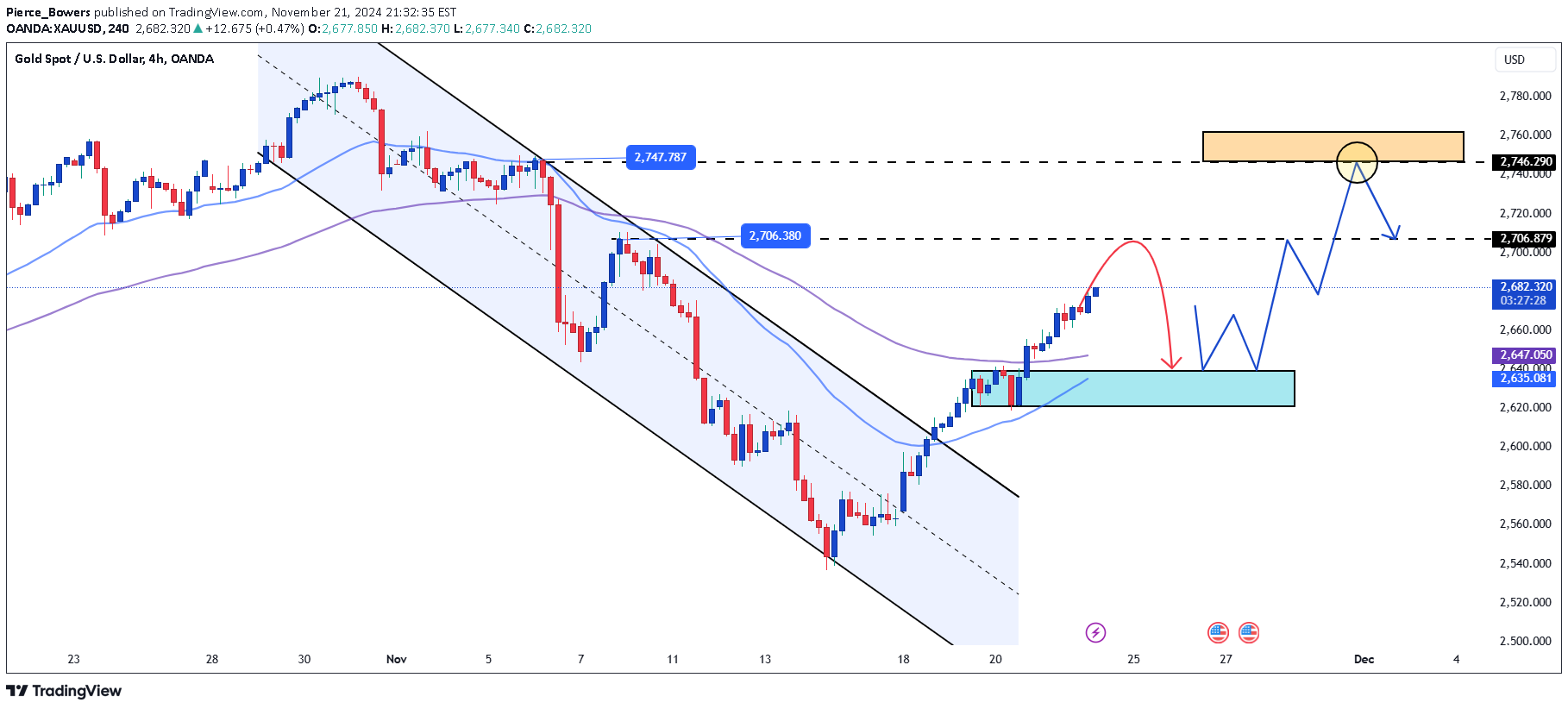

Gold Eyes $2,745 Amid Bullish Momentum

Gold (XAU/USD) continues to show bullish momentum, currently trading at $2,681.58, as it recovers strongly from the recent downward channel. The price is approaching the immediate resistance at $2,706, a key level that, if broken, could pave the way for further gains towards the major resistance zone at $2,746. This orange-marked zone is critical, as a breakout above it would confirm the continuation of the uptrend.In case of a pullback, the green support zone between $2,635-$2,647 offers a strong demand area where buyers may re-enter the market. A retracement to this level could provide a good buying opportunity before the price resumes its upward trajectory.Traders should monitor the price action around $2,706 closely. A successful breakout targets $2,746 and potentially higher, while a rejection might lead to a pullback to the support zone. Overall, the bullish structure remains intact, and gold appears poised for further gains in the coming sessions.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.