Patrick2707

@t_Patrick2707

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Patrick2707

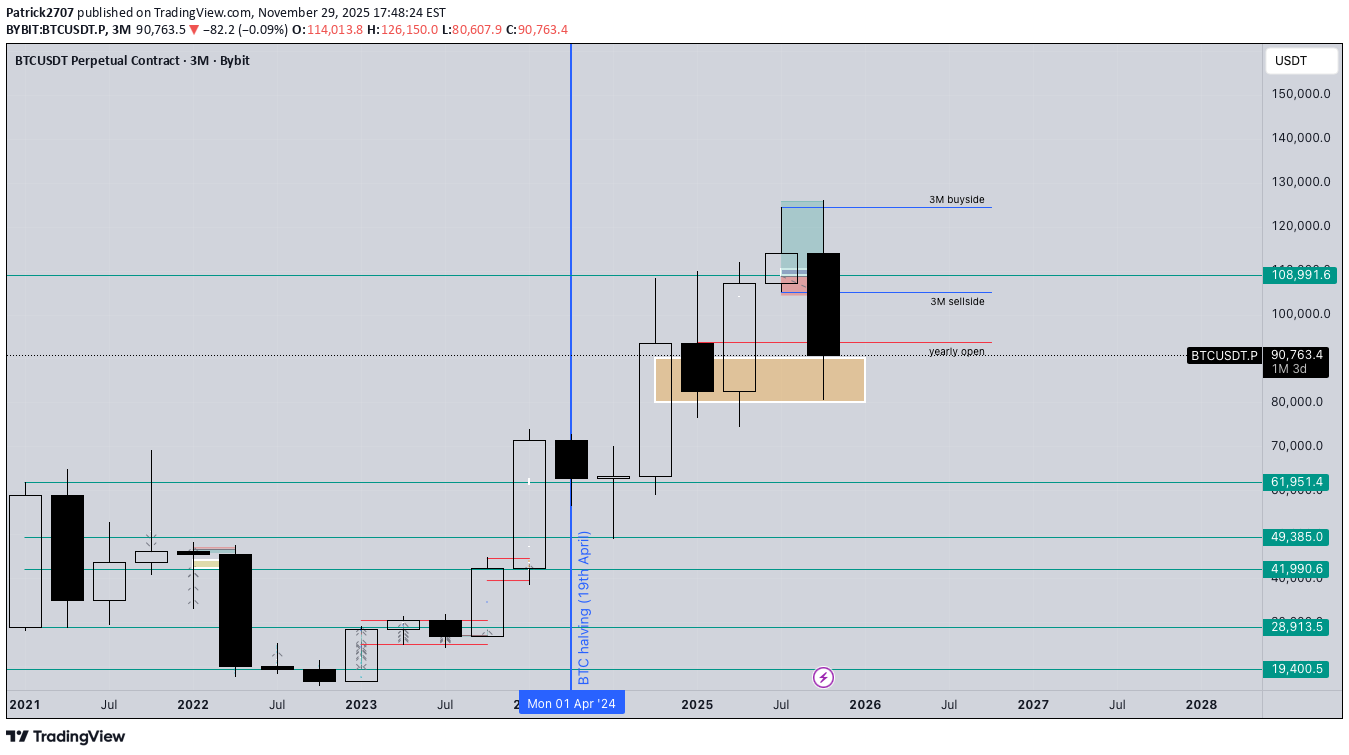

تحلیل هفتگی بیت کوین: سطوح کلیدی برای صعود یا سقوط به ۸۵ هزار دلار!

Let's have a look at the current PA on BTC. The weekly order block (yellow box) is reacting properly so let's see what we should expect from here. IF we fail to hold the weekly order box in the course of the coming weeks expect lower prices towards 85K. IF we regain the yearly open (red line) and hold , the lows will be in. We can then expect BTC to retrace back towards 100K and higher. As always no need to guess where the market wants to go...PLAN...BE PATIENT...and WAIT FOR THE MARKET TO SHOW YOU ITS HAND. Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action analysis and does not constitute financial advice in any form.

Patrick2707

تحلیل قیمت اتریوم (ETH): این سطوح کلیدی را از دست ندهید! (2.5K تا 4K)

Let's have a look at ETH and its current trading range. Similarly to BTC, ETH is currently trading towards its quarterly (3 months) sellside liquidity. Pretty simple plan on ETH. IF we fail to hold the current sellside liquidity expect us to trade lower towards the 2.8K-2.5K range. IF we reclaim the current lows expect us to trade back towards 4K. No need to frontrun the market. Let it come to you and trade with it. Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

Patrick2707

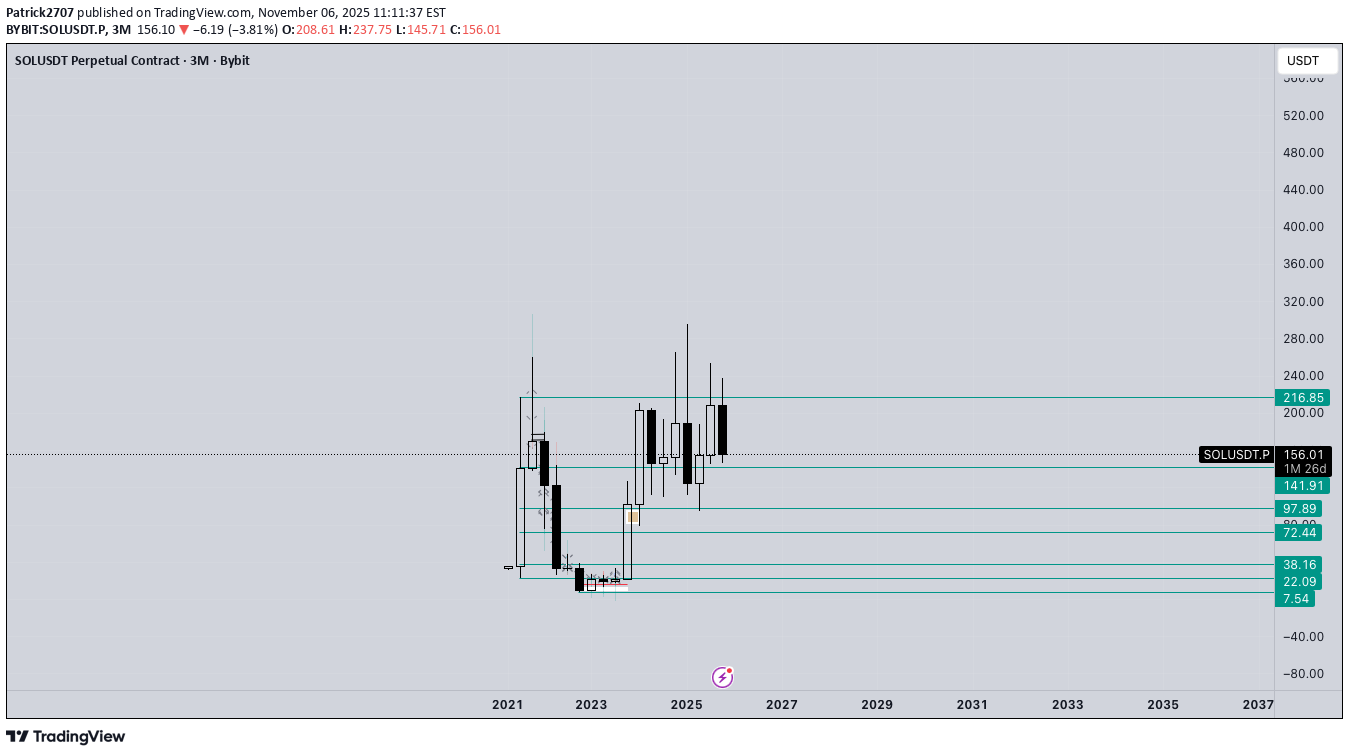

تحلیل دقیق و سطوح کلیدی قیمت سولانا (SOL): آیا سقف یا کف در پیش است؟

Let's have a look at SOL and its current trading range. I know a lot of you young traders are still hyped and enjoy trading SOL so I'll give you my take on it. Personally, I've never had a stake in it and don't plan on getting any merely based on the fact that since its inception a hyped fueled and based crypto - BUT for the sake of trading let's have a look at the chart. We are currently trading back towards the sellside liquidity sitting around 140$. IF we fail to hold it expect some more pullback towards 120-100$. IF we hold the 140$ sellside liquidity range (and BTC manages to reclaim 150K) expect SOL to aggressively retrace towards 216$. As always PATIENCE...PLAN AND EXECUTE. Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

Patrick2707

تحلیل نمودار بیت کوین: مسیر بعدی BTC کجاست؟ (بالا یا پایین؟)

Let's have a look at BTC and its current trading range. As most are fearing and getting emotional about where BTC 'might be going next' - let's have a look at what the charts are actually telling us. We are currently trading below the quarterly (3 months) sellside liquidity sitting around 105K. IF we fail to reclaim it (clean close within the range) expect us to continue lower towards 98-95K. IF we manage to reclaim 105K expect us to trade back towards the quarterly (3 months) buyside liquidity sitting at 125K. For the 'bulls' and the 'bears' amongst you guys - the market is like an elevator. If you want it to eventually 'go up' the elevator first needs to 'go down' . Same logic if you expect the elevator to 'go down' it first needs to 'go up' . SET YOUR EMOTIONS ASIDE AND FOLLOW THE MARKET...PATIENCE...PLAN AND EXECUTE. Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

Patrick2707

ETH - Ranges overview

We’ve finally broken through 4K on ETH and we are currently trading around new highs. From here let’s see how we play out. IF we break through 5K and hold expect us to continue higher towards new all time highs at 6K and higher - on the longer term. IF we fail to hold the “support” (sellside liquidity) around 4K-3.5K expect us to trade back lower. As always when in new highs territories…do not BECOME A VICTIM OF EUPHORIA. Position yourself and be PATIENT. THE MARKET WILL SHOW YOU ITS HAND. Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

Patrick2707

BTC - Ranges overview (update)

BTC has been moving nicely lately so let's see where we go from here. As previously mentioned, we should expect an aggressive move upwards towards 110K and eventually new ATH. As expected we got the move and are now trading around 120K. IF we fail to hold the sellside at 115K expect us to trade back towards 110K. IF we hold our current levels expect further upside towards new ATH. No NEED TO FRONTRUN THE MARKET. BE PATIENT AND TRADE WITH IT. Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

Patrick2707

ETH - Ranges overview (update)

We've had some nice movements on ETH lately so let's have a look at where we are. As previously discussed IF we reclaimed 2.5K we should expect the market to aggressively trade towards the HTF buyside (3.4K and 4K). The buyside at 3.4K has been traded through already so no let's be PATIENT and see IF we get through 4K and higher. As always WAIT FOR THE MARKET TO SHOW YOU ITS HAND. Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

Patrick2707

BTC - Ranges overview

Let's have a look at BTC as we start this new week. From a weekly perspective you can see how we through around the weekly gap (blue box)and respected it. On the LTF we broke below it and failed to close below it. From here expect us to aggressively trade back towards 110K and eventually new ATH. IF we fail to hold the current sellside, we will revisit the weekly gap (blue box) and 105K. As always WAIT FOR THE MARKET TO SHOW YOU ITS HAND AND TRADE WITH IT. Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

Patrick2707

OP - Ranges overview

Let's have a quick look at OP. Market is pretty clean and setting up for some interesting moves in the coming weeks. Let's see how the market wants to move from here. IF we reclaim 0.70$ expect us aggressively trade back towards the HTF buyside liquidity at 1.70$.IF we fail to hold 0.60$ expect us to trade lower towards 0.50$ and eventually 0.40$. From a HTF perspective we are back into a weekly FVG from October 2022....if you pay attention you will notice it is the exact FVG which 'changed the bearish trend into a bullish trend' - to explain it in simple terms. WAIT FOR THE MARKET TO SHOW YOU ITS HAND AND TRADE WITH IT. Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

Patrick2707

ETH - Ranges overview (update)

We are currently holding pretty nicely and strongly on ETH so let's see how we play from here. Pretty simple plan and triggers as always. IF we break below 2.5K and hold expect us to trade back towards the sellside liquidity sitting around 1.8K. IF we reclaim 2.5K expect us to aggressively trade back towards the HTF buyside liquidity at 3.4K and 4K. Stay safe and never risk more than 1-5% of your capital per trade. The following analysis is merely a price action based analysis and does not constitute financial advice in any form.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.