PassivePips

@t_PassivePips

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

PassivePips

تحلیل بیدرنگ بیتکوین: آمادهسازی برای صعود تا ۱۲۲ هزار دلار از نقطه حمایت کلیدی

Caught the last 109k bullish OB to 124k, plus the rejection back to the original OB. Pattern happening again, I'm in buys from the bullish OB and target the bearish OB at 122k. I trade long ranges and layer entries, called the previous buys on an earlier mind. Trade active and running risk free.

PassivePips

سیگنال طلایی بیت کوین: ریسک بالا، سود خیرهکننده (۱:۱۰)

High risk simple OB set up, tight SL as still wants to push. Trigger for entry valid bearish OB and selling pressure, targeting the area to fill Fvg and bullish OB 1:10 RR, using 25% of normal risk. Due to high risk set up, will layer remaining entries if see reaction

PassivePips

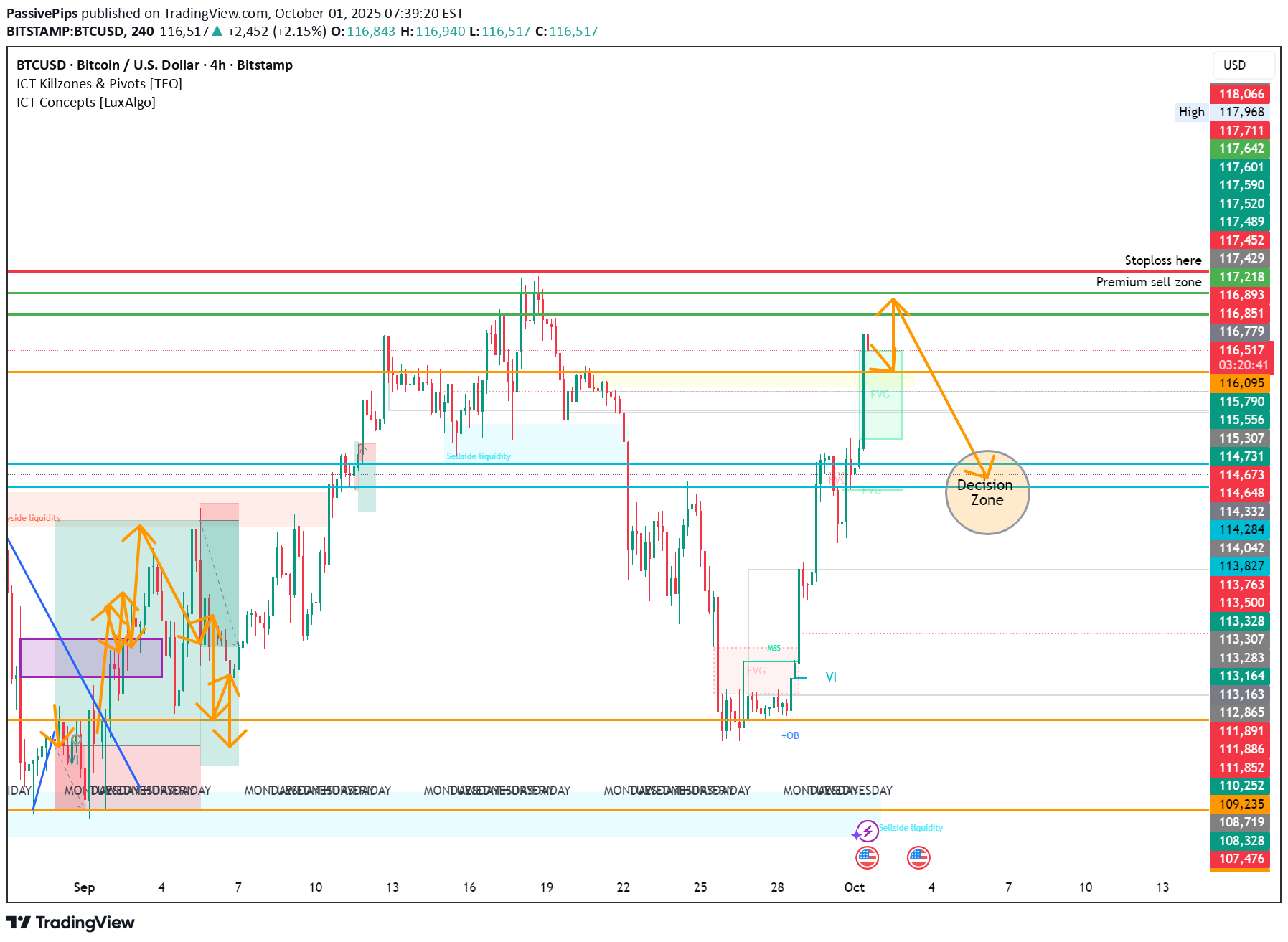

رمز ارز بیت کوین در آستانه چرخش بزرگ: آیا صعود ادامه دارد یا ریزش آغاز میشود؟

🚀 BTC Bulls Still in Control… but Watch This Zone 👀 I’m currently riding buys from 109.5K, targeting the 117.5K zone 🔥. That’s where I’ve marked a key sell zone. ⚡️ On the 4H chart, we’re pushing into a strong resistance area. Previous bearish OB + valid supply zones = high probability of a pullback here. My plan: Take profits at 117.5K ✅ Watch the sell zone closely 👀 If we see rejection, I’ll look to flip into sells. Watch decision zone closely I’ll switch back into buys for the next leg up. 👉 What’s your bias here — bulls 🐂 or bears 🐻?

PassivePips

Sells to buy reversal set up

XAUUSD Trade Update Currently in a sell position – tight stop, strong RR. Eyeing that 30-min order block & potential liquidity sweep for the next move. Price rejected key zones across multiple timeframes – confluence is stacking. Risk is higher as trade started against momentum, but gold is starting to mirror BTC again… interesting correlation! Risk will be managed as always – moving to break-even when possible. 📊 What’s your bias here – bullish or bearish? 💬 Drop your thoughts below & let’s discuss setups!

PassivePips

Looking at a sell set up after some correction

BTC/USD – OB-to-OB Execution Previous short: delivered to TP. Previous long: liquidity grab via wick before displacement in intended direction. Current bias: bearish, yet observing a 1H market structure shift with clean FVG formation. Price has violated trendline, creating potential for a retracement into premium arrays. Setup: OB-to-OB, scalping between defined supply and demand blocks. Re-entered long post-liquidity sweep. Risk classified as mid-to-high; position sizing adjusted. Monitoring: price reaction at OBs and FVG to validate continuation or reversal narrative.Buy trade active after re-entry on retest of original buy zone, risk free now holding to full TPBest analysis in a while, perfect buy set up with counter sells entered the zone to the wick now heading straight to full take profit. TP is the entry for buys again to 114k areaBuy trade achieved full TP, now entered the sells at the zone. Running risk free

PassivePips

Gold high risk buy

📉 XAU/USD Setup 📉 Currently watching the 4H order block as price continues to face bearish pressure. We’ve seen multiple rejections here before, and so far the level has held. 🟡 Plan: Simple order block → order block play Entry: Midpoint of the range, layering positions up to my max risk profile High risk (counter-trend), but strong RR potential Trade fully risk managed ✅ ⏳ Still some movement required—no valid buy signal just yet. Patience is key. 📍 Premium Buy Entry: 3285 Let’s see if this zone holds. Discipline > chasing. 💪

PassivePips

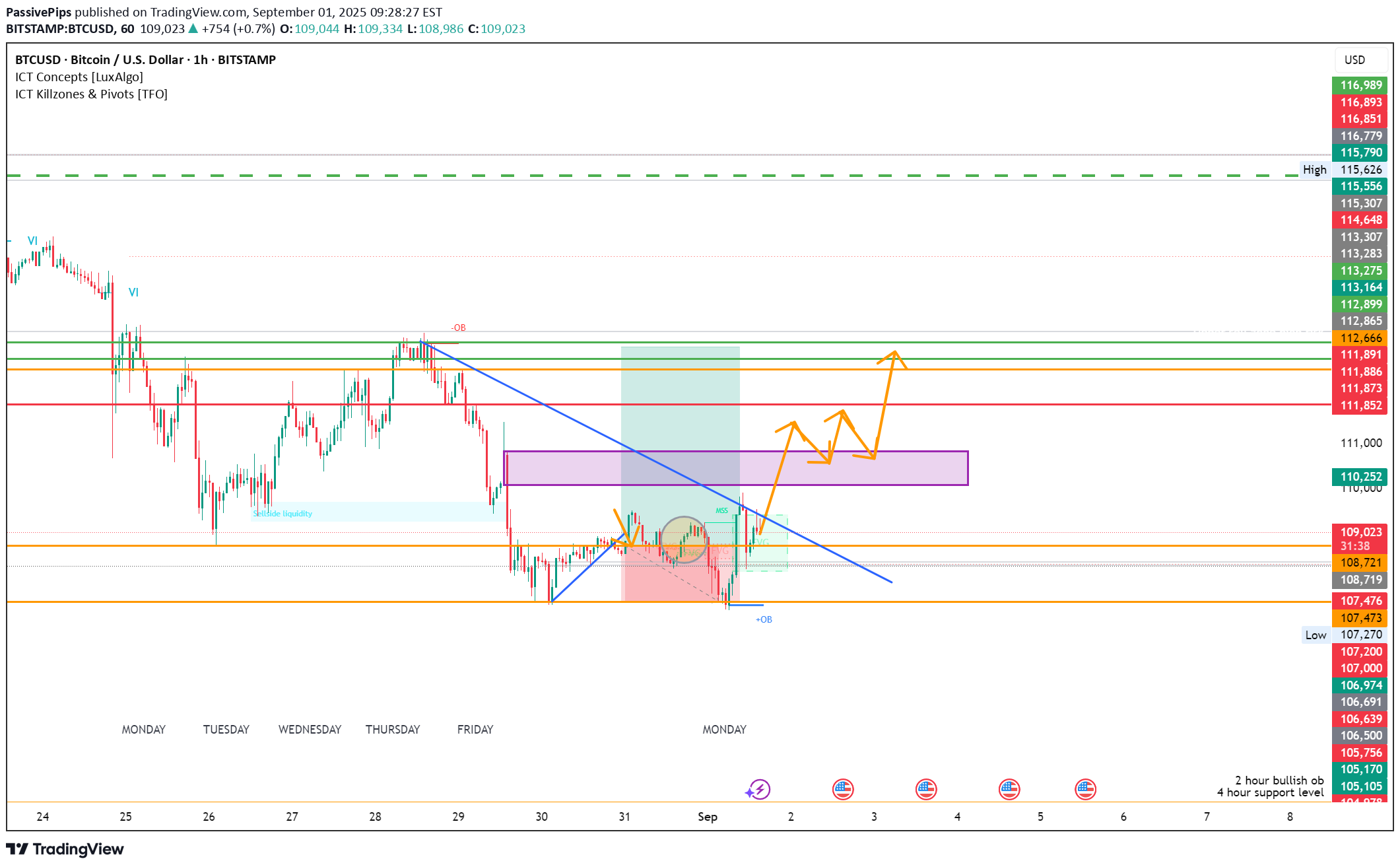

High Risk BTC trend reversal trade idea

🚀 BTC/USD Trade Setup 🚀 Looking at a counter-trend opportunity here 👀. Risk is fully managed according to my profile and spread across the buy zone. ⚡ High-Risk Setup Alert ⚡ Using previous 4H & 1H zones as entry points Targeting order blocks 🎯 First position: 1:1.75 RR 🎯 Second position: 1:12 RR (longer hold) As always: risk management first. I’ll look to secure breakeven as soon as possible. If SL gets hit—no stress, it’s just part of the game. ✅ Orders are placed → now it’s set and forget. Remember: 📌 If you’re glued to the charts, it usually means one of three things: You don’t trust your own analysis You’ve over-risked You’re just following a signal 👉 Any of those can blow an account. Patience & discipline win long-term. Let’s see how this plays out. 💪

PassivePips

Btc sell zone

Became liquidity last sell zone 0.5% loss. Stronger setup here,targetting tight entry and sl. Tp OB will secure BE due to high risk zone

PassivePips

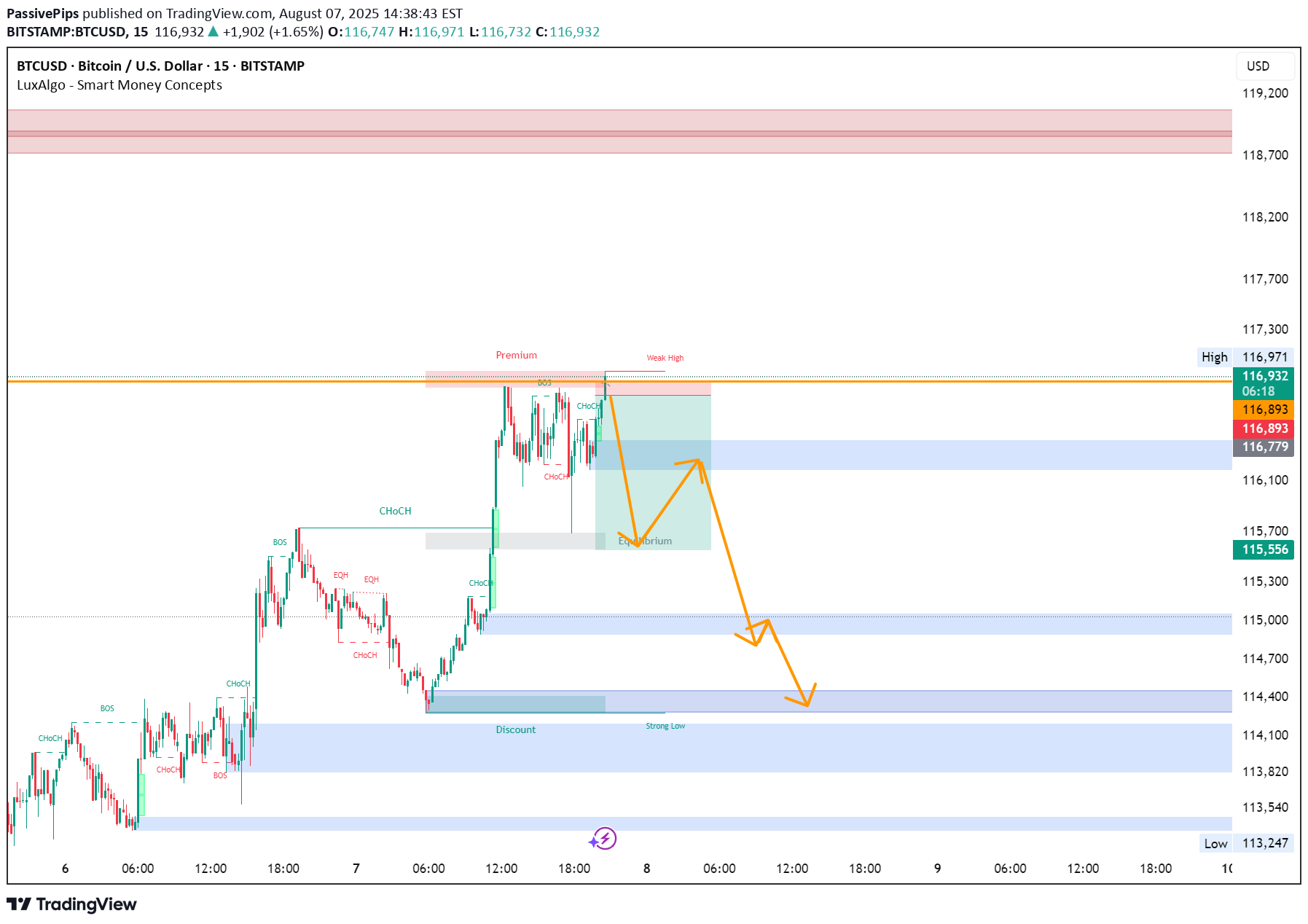

BTC sell set up

Back in the markets 🔥 Finally trading again after one of the toughest years personally — and what a start. 📈 Currently up +21% on the account today! Some quick BTC scalps + a longer hold on BTC buys doing the heavy lifting. 🛑 Running a high-risk setup against the trend, but it’s tightly managed with a well-defined stop and fully within my risk profile. 🎯 Targeting a lower order block based on imbalance/FVG from the previous move. Risk-to-reward sits at a juicy 1:21 if we reach TP. 📌 Will secure break-even ASAP — even if I get tapped out, the setup is managed and calculated. Let’s see how this plays out. Eyes on the chart 👀 #BTC #CryptoTrading #RiskManaged #BackAtIt #CryptoAnalysis #Scalping #OrderBlocks

PassivePips

Simple order block scalp

BTCUSD Trade Breakdown 🔍💰 Clean order block to order block move on BTCUSD. Took the entry on the retest of a key zone—low risk with a tight stop thanks to timing and volume conditions. ✅ Price needed to push through a bearish FVG, and now the trade is running risk-free. I'm holding for now and watching for more entries in line with the setup. 🎉 One of our members followed this trade on a £20 live learning account and is currently up 14%! Awesome to see the strategy working in real time for learners. Gold setup is looking ready too 👀 📈 Like, comment, and share your thoughts or questions. Got any recommendations or similar setups? Drop them below! Appreciate you checking it out 🙌 ---

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.