NoFOMO_

@t_NoFOMO_

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

NoFOMO_

آیا این نشانه اوج بازار است؟ زمان خروج از سود یا صبر کردن؟

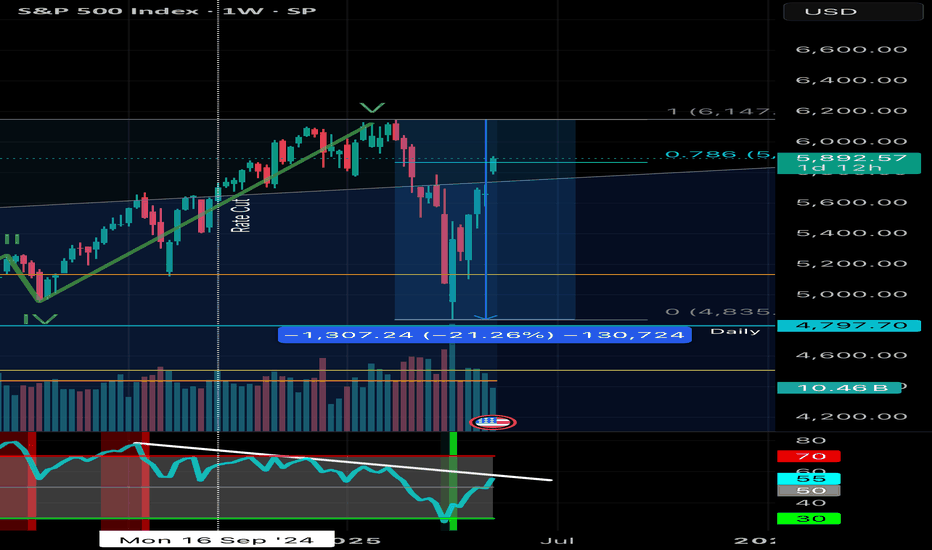

To me this looks like Wave 5 of the Elliott Wave supercycle in the stock market. We had a monster rally since the liberation day dump, now we are coming up against some strong resistance. Should we be concerned? So far I have taken a lot of chips of the table. I am still very much long, we don't fight the tape, but if you haven't already started booking profits; have a good hard think about how much higher we could go from here. The government shutdown will start to filter through the earnings reports next earnings season, especially if it persists over a month. Consumer stocks are showing weakness, whilst the AI trade continue to go vertical, but it will not go on forever - something will eventually give.

NoFOMO_

آیا سقوط بزرگ در راه است؟ هشدار کاهش ۷ تا ۱۲ درصدی بازارها!

The move up since the liberation day dump has been epic. I called the low on the markets at the time. I was long AppLovin, AMD, Reddit, Arm, Alab, REMX, amongst many other names that far outperformed the market. I warned you about the imminent dump before it happened, and then took positions on the long side as the market capitulated and we hit the golden ratio. Now it's time to zoom out and remind you that this will not grind up forever. My interpretation of the chart is the move is nearing the end, the risk of strong downside move (7-12% drop) is increasing significantly and greed will catch many people out. The inverse head and shoulders pattern is almost complete, we are grinding up in this channel and will start to come up against the resistance over these coming days/weeks. I had an upside target of 7000-7250 and we are almost there. The dips are getting brought up, so bulls may have more time to make gains but I am not convinced that the gains are worth the risk at this stage. I will start taking some chips off the table here. Not financial advice, do what's best for you.Just a reminder we caught the top here and booked profits on all of our long trades. Whilst I am still open to taking long trades when opportunities present themselves, these are far and few between. We took the bearish stance a few days before it was announced that Michael Burry shorted Palantir and Nvidia. Now it's time to sit back and chill

NoFOMO_

ریزش ناگهانی ارزهای دیجیتال: راز پامپ ۳۴۰,۰۰۰ درصدی و ترید نجاتبخش آربیتروم!

We had an absolute melt down in the crypto markets, classic manipulation by the market makers. If you were lucky enough, you could have longed Atom at $0.01 and be up over 340,000%. I was not that lucky, but managed to catch a trade on Arbitrum. If you follow my trades, you will know that I had my technicals on this chart already. We had a collapse to new lows, but technical support bounce. I took a long trade at $0.11 with some limit orders filled during the flash crash. I suspect we get a blast off in alts from here, a strong liquidity sweep was taken. Now I will remain patient in my long here, stop loss has been moved up - I am already up 212% on this trade. Not financial advice, do what's best for you

NoFOMO_

Altcoin Season loading?

Arbitrum has broken out of the descending wedge, reclaimed the POC and is headed to higher levels. We went long at the breakout and stop loss has been placed at break even. Not financial advice, do what’s best for youAs mentioned, long since $0.3406 reclaim of the POC. This move up looks great, bullish!

NoFOMO_

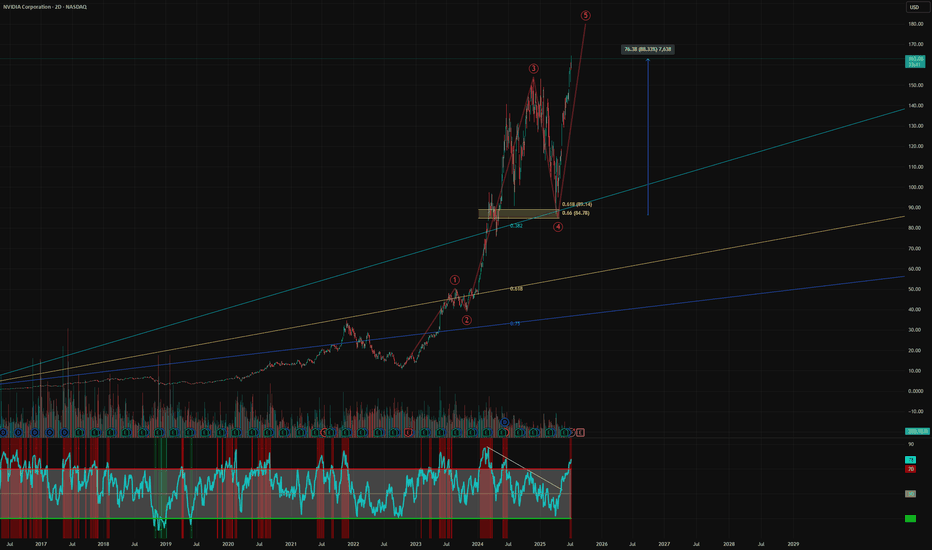

Nvidia - Blow off top?

Time to book some AI stock profits, I have exited ARM and today I am taking profits on Nvidia. We entered at the golden pocket, up over 88% since the recent lows. I am now scaling out of my position, starting with 50% of my total. I will use a trailing stop loss for the rest. We have hit a 4 trillion dollar market cap, more than the entire UK stock market combined. Am I bearish on Nvidia? Of course not, but the market is getting greedy and I like to book profits. I love the company, but I expect huge volatility going forward. Not financial advice, do what's best for you.Exited the remainder of my position. I'm also short SMH, as per my trade idea posted earlier.

NoFOMO_

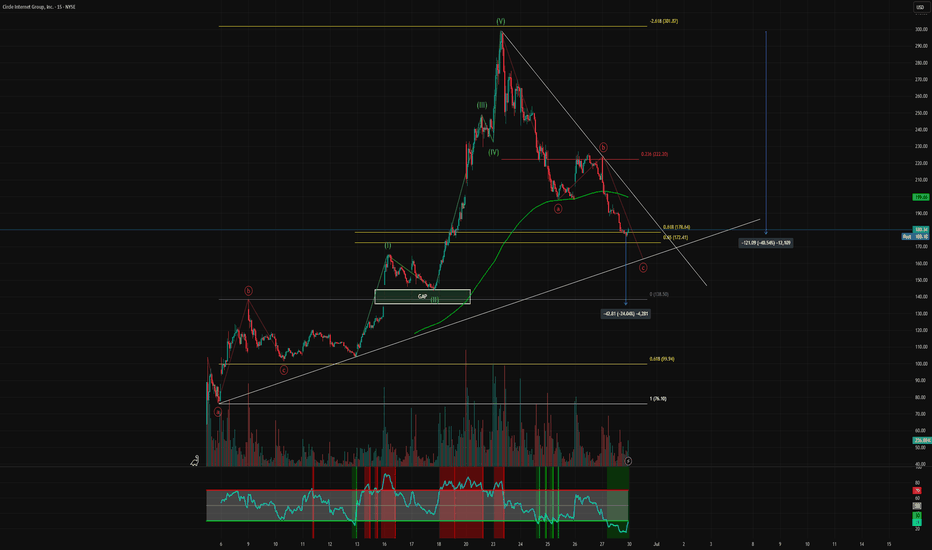

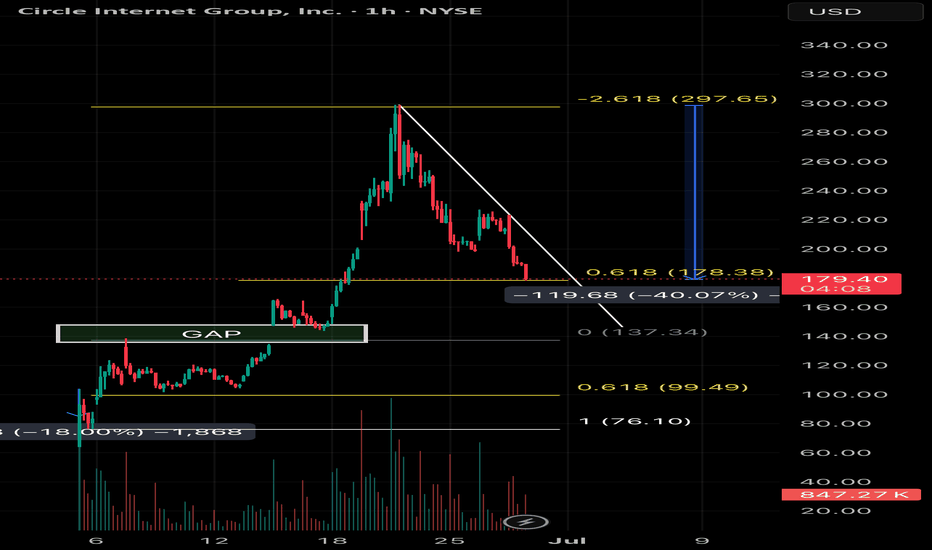

Circle - Buy the dip or short the hype?

The ideal short was way above, as I discussed in my prior post, at $300. Using my Fibonacci analysis I was able to determine what was a good entry (around $100) and a good exit ($300). I'd prefer not to short now. We are sitting on support but we need a meaningful bounce above $180 - I remain doubtful for now. At this stage I would prefer to look for another long, although I am not looking to catch a falling knife right here. What looks most probable to me is a failed pump and then a gap fill around $135, this could present a more compelling long. So far the golden pocket is holding up as support at $178. Monitoring this one closely and happy to go long if the volume supports the trade idea. Keep an eye on this, the volatility is great, it's a trader's dream!

NoFOMO_

Circle - A Story of Volatility

This stock is a traders dream. Huge volatility, good volume and respect of the technicals. I’m analysing this chart on the shorter term time frame. If you went long at the last golden pocket retracement, you made almost 350% gains in a short space of time. We have now pulled back approximately 40% from the highs of $300.22. Using Fibonacci analysis, it was an epic short at a key psychological level. If we see a bounce here in the golden pocket, around $178, we could have another solid run up. Watching this closely and trading it according to technicals, with stop losses. Not an investment or investment advice!

NoFOMO_

Double Top Pattern?

Are we about to smash past all time highs or will BTC put in a double top pattern? It’s too early to say, but what I’m looking for here on the bearish scenario is a break to all time highs to squeeze out the shorts, followed by a swing failure pattern, grabbing as much liquidity before the double top pattern is confirmed. If the bullish volume smashes past all time highs, I would be very careful trying to short. Not financial advice, do what’s best for you.New ATH, wicked past the previous high. Short entered at $109,800. Tight stop loss

NoFOMO_

Deadcat bounce?

We have pierced through the 0.786 fib retracement which is a sign of strength but it’s too early to call this the start of a bull run. We could quite easily fall back down if we fail to break the RSI resistance which is not too far away. I favour a break of the RSI as it will be the fourth attempt, but if we fail I intend to close out some of my positions to stay on the right side of risk. There’s a lot of greed and fomo entering the market again so I’m certainly not looking to fomo into more stocks here. Not financial advice, do what’s best for you.

NoFOMO_

High Risk, High Reward altcoin

Caught the low on the daily, beautiful reaction to the upside with plenty of room to rip. Possible end of the altcoin bear market, I think this altcoin is primed for a massive run.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.