Natasha512

@t_Natasha512

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Natasha512

ریزش سنگین طلا در راه است: فرصت فروش XAUUSD با تحلیل تکنیکال قوی

Trading Idea: XAUUSD (Gold) Short Opportunity Pair: XAUUSD Time Frame: 4H Analysis: Gold broke a strong trend line, inducing previous higher highs, and hunting stop losses of sell swing traders. This liquidity sweep indicates potential for a significant drop. Trade: Short XAUUSD Target: 3830 Stop Loss: Above recent high Rationale: The hunted stop losses and broken trend line suggest a bearish continuation. Anticipate a sharp decline in gold prices. It's not the financial advise trade at your own risk.

Natasha512

پیشبینی سقوط طلا: فروش XAUUSD با اهداف مشخص در کانال صعودی!

XAUUSD Sell Setup Timeframe: 4H Gold is trading within a parallel channel in an uptrend, respecting both sides as support and resistance zones. After reaching the upper side of the channel and taking liquidity, a potential reversal is indicated. Trade Details: - Sell: 4150 - Stop Loss: 4170 - Targets: 4130, 4100, 4050 Rationale: The channel's upper boundary and liquidity pool suggest a high probability of a downward move. Tight stop loss and multiple targets provide flexibility.

Natasha512

تحلیل طلا (XAUUSD): سیگنال فروش در کانال صعودی 4 ساعته برای معاملات سوئینگ

Gold is currently trading within a parallel channel in an uptrend on the 4-hour timeframe, respecting both sides of the channel as support and resistance zones. Given its position at the upper side of the channel, a rejection is likely, and a pullback is expected due to overbought conditions. Consider selling gold at $3970_$3972, with a stop loss at $3978 and targets at $3950, $3900, and $3850. Trade At Your Own Risk It's Not The Financial Advice.

Natasha512

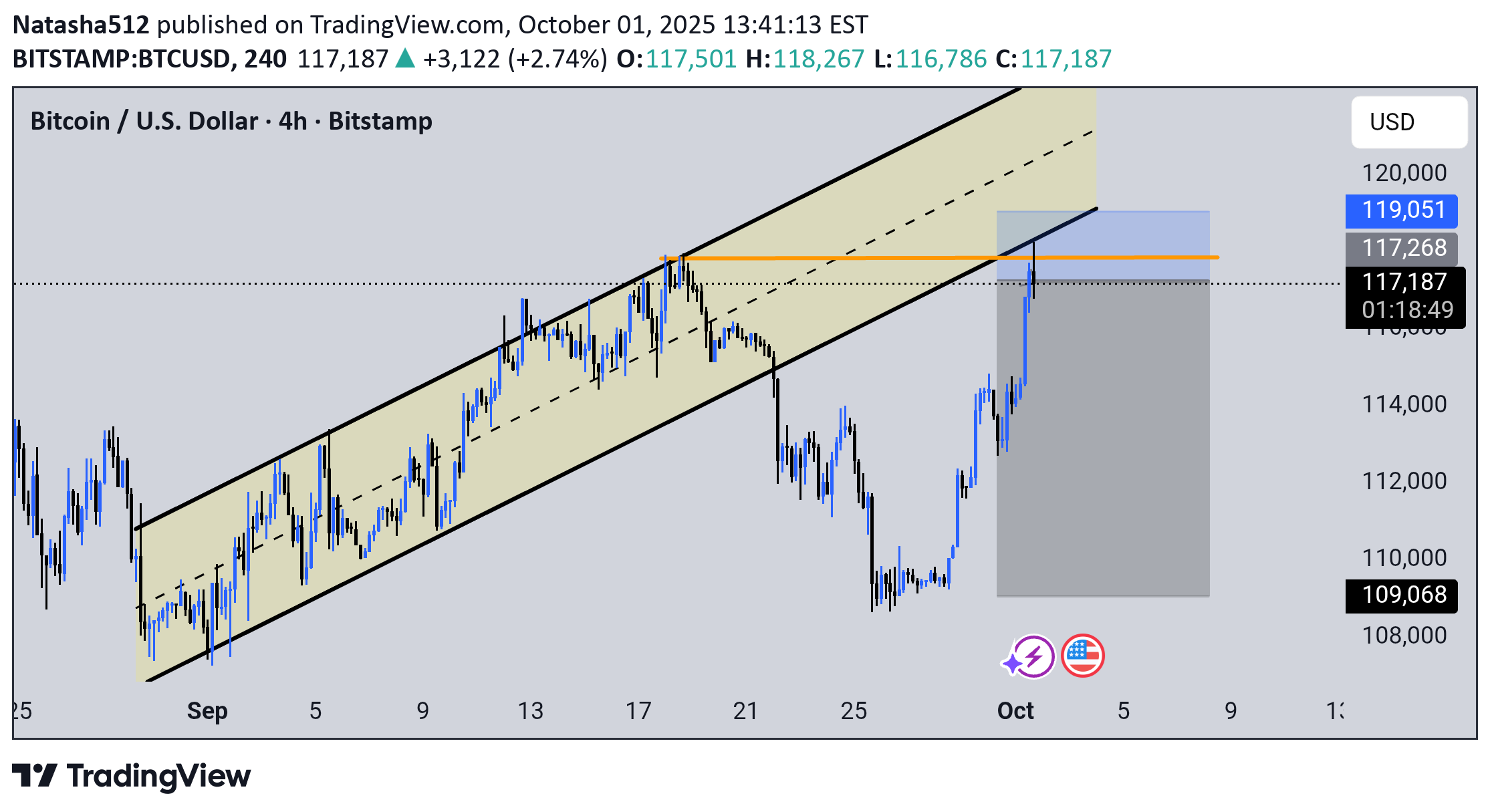

موج نزولی بیت کوین در راه است؟ فرصت فروش طلایی BTCUSD با تارگتهای مشخص

BTCUSD, 4H: Bitcoin navigates a parallel channel with a prevailing uptrend, respecting both channel boundaries on multiple occasions, yet punctuated by a prior significant breakdown. Currently, BTC approaches the inclined support line previously breached, coinciding with a sweep of prior leg's highs, effectively hunting stop losses of swing sellers. Anticipating a substantial bearish cascade, a sell opportunity emerges at 117,000-118,000, targeting 115,000, 113,000, 111,000, and 109,000, with a stop loss set at 119,000. It's not the financial advice trade at your own risk.

Natasha512

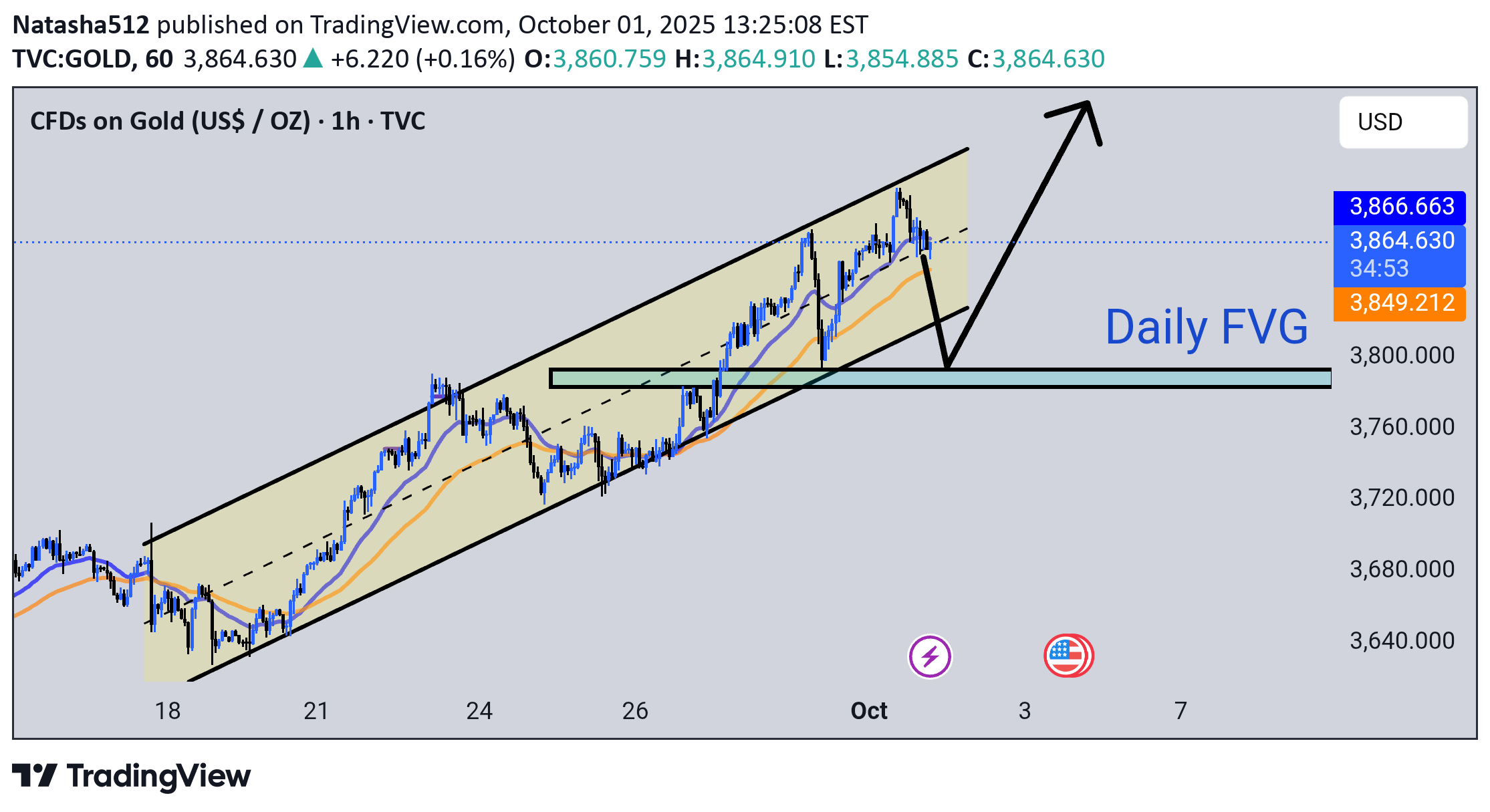

تحلیل طلا (XAUUSD) در تایم فریم 1 ساعته: فرصت خرید استراتژیک در محدوده 3795!

Gold progresses within a defined parallel channel, sustaining an upward trajectory characterized by the formation of minor liquidity pools. Reversals from the channel's trendlines underscore their efficacy as dynamic support and resistance levels. Having recently reversed from 3895, a robust resistance zone within the channel, gold is now converging towards the support region. Immediately beneath this support lies a Daily Fair Value Gap (FVG) zone, prompting the anticipation of potential liquidity pool creation to facilitate a sweep into this FVG, catalyzing further bullish momentum. Consequently, strategic buying opportunities are identified at 3795-3785. Notably, the prevailing bullish wave remains intact, corroborated by the 50 EMA's position above the 100 EMA, affirming the overarching buy trend and guiding informed long-entry decisions. It's not the financial advice trade at your own risk.

Natasha512

XAUUSD TECHNICAL ANALYSIS (4H TIMEFRAME)

Observed bearish Fair Value Gap (FVG) in the previous leg on the 4H timeframe. Inducement seen in previous candles. (Fundamental Considerations): Trump administration's policies potentially strengthening the USD. Talks between Zelensky and Putin may impact market sentiment, potentially pressuring gold downward. Inverse relationship between stocks and gold; with stocks in green, gold may see downward pressure. (Trade Idea) - Trade Direction: Sell XAUUSD - Entry: Current levels - Stop Loss: 3412 - Targets: 3380, 3350, 3320 Rationale The combination of a bearish FVG, inducement on the 4H timeframe, and fundamental factors suggesting downward pressure on gold support a bearish outlook for XAUUSD. Disclaimer This analysis is for educational purposes and should not be considered as investment advice. Always conduct your own research and consider multiple perspectives before making trading decisions.

Natasha512

XAUUSD IS STILL BEARISH.

Gold has shown significant rejection from the resistance area (3435-3450) on the 1D timeframe, with approximately 3 rejections in the past. Currently, gold is respecting the support area (3242-3247) on the 1D timeframe, having been rejected twice previously. According to Smart Money concepts, gold is likely to sweep the liquidity at the support area (3242-3247). 4H Timeframe Analysis On the 4H timeframe, gold has respected the bearish Fair Value Gap (FVG) zone, indicating potential downward momentum. Trade Idea Given the analysis, a bearish outlook is anticipated, with potential strong support area (3242-3247). - Bearish Bias: Rejection at support area (3242-3247) expected - Target: Below current prices, with potential sweep of liquidity at support area Rationale The repeated rejections from the resistance area and respect for the support area, combined with the bearish FVG on the 4H timeframe, suggest a potential bearish move. Smart Money concepts indicate a likelihood of liquidity sweep at the support area. Disclaimer This analysis is for educational purposes and should not be considered as investment advice. Always conduct your own research and consider multiple perspectives before making trading decisions.

Natasha512

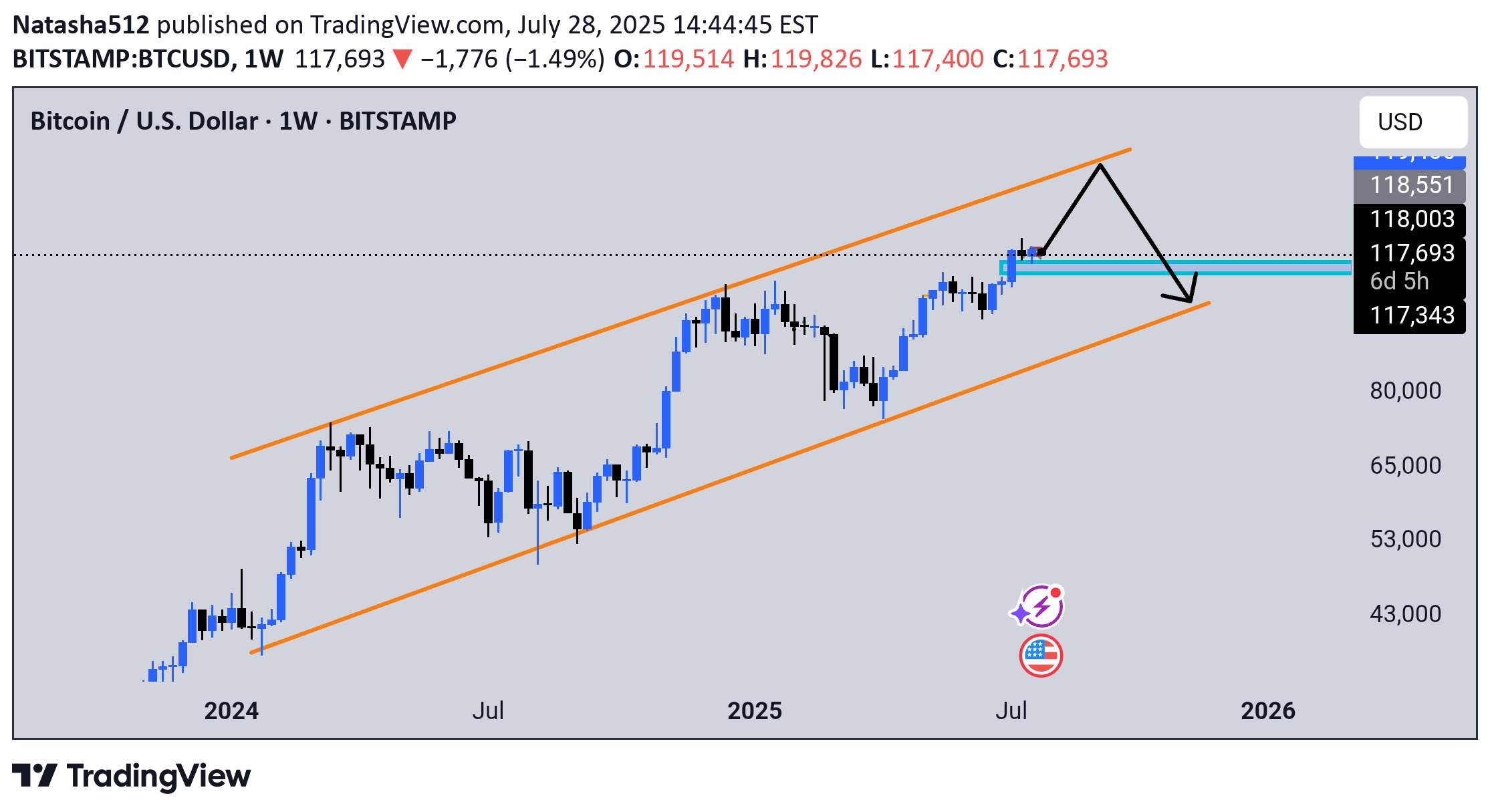

BTC Technical Analysis In Weekly Time Frame

Bitcoin (BTC) is currently trading within a parallel channel on the 1-week timeframe, consistently respecting the support and resistance zones. This movement is aligned with an uptrend. Additionally, a Bullish Fair Value Gap (FVG) has been identified, and the price has recently touched the zone. Trade Idea Given the observed bullish structure and the presence of the FVG, a continued bullish trend is anticipated. - Target: 152,000 Rationale The parallel channel and the respect for support and resistance levels suggest a strong trend. The Bullish FVG adds further evidence for potential upward movement. If the trend continues, Bitcoin could reach the specified target. Disclaimer This analysis is for educational purposes and should not be considered as investment advice. Always conduct your own research and consider multiple perspectives before making trading decisions.

Natasha512

XAUUSD Technical Analysis In 1D Time Frame.

Gold is currently positioned at a key trend line that has previously flipped the trend from bearish to bullish twice. Given the recent liquidity sweep of the previous leg and the current price action at the trend line, a bullish move is anticipated. Trade Idea - Buy Gold: 3308 - 3313 - Stop Loss: 3300 - Target: 3370 Rationale The trend line's historical significance and the recent liquidity sweep suggest potential buying interest, which could drive the price up towards the target. As with any trade, risk management is crucial, hence the specified stop loss. Disclaimer This analysis is for educational purposes and should not be considered as investment advice. Always conduct your own research and consider multiple perspectives before making trading decisions.

Natasha512

Liquidity Sweep Will Push Gold Up Or Not?

Gold is currently trading within a defined range, bounded by two trend lines acting as resistance and support. Recent price action indicates a liquidity sweep at the resistance line, potentially triggering stop losses for sellers. Notably, gold has also obtained liquidity at the support line currently. Trade Setup Observed the liquidity sweep at the support line and also of previous leg, a bullish move is anticipated. Buy Gold: 3334-3339 Stop Loss: 3323 Targets: 1. 3350 2. 3370 3. 3390 4. 3400 (Rationale) The trade is based on the assumption that gold will rebound from the support line, leveraging the liquidity sweep and potential buying interest at this level. The targets are set based on the recent price structure and potential resistance levels. (Disclaimer) This analysis is for educational purposes only and should not be considered as investment advice. Always do your own research and consider multiple perspectives before making trading decisions.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.