NOBSForex

@t_NOBSForex

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

NOBSForex

Is Amazon Forecasting Weak Holiday Sales?

Amazon looks very weak here and I wonder if this is a sign of how retail is going to pan out this holiday season. Regardless of the fundamental back drop my chart tells me all I need to know and right price is not screaming buy. We had the 8MA(226) cross below the 50MA(229) and it is now challenging the 100MA(226). All of the MA's are curling down and price is trying to test the 200MA(219) which will be an important spot if we get there. I would be looking to short bounces up to 227 until price can reclaim that 8MA. Selling Call Spreads above that level or selling Puts below 210 look like good options right now. If we see a break/hold below the 200MA I would be pressing shorts for 210, 208, 200. We all know how important 190ish was this year so bulls really don't want to see that level come back into play. AMZN

NOBSForex

TSLA Breakout Or Fakeout?

Yesterday I talked about Tesla breaking out of a long term range and price showed us some follow through up to my resistance level. Today is going to be all about how price reacts up here. Do we see continuation or a look above and fail? Watch 487/490 for your direction. Break/hold above is a long to target 500, 525, 560. A look above and fail is a short to target 480, 465, 461(8MA). If we do see weakness watch for any failures at the lower levels for good long entries. TSLA

NOBSForex

NVDA Testing the 100MA....Bulls Need To Step Up Soon

I know there are a lot of Nvidia bulls out there but this chart is not looking strong at the moment. Price is back in a range that it was stuck in from July - October and we also cracked the 100MA(177.9) today. If bulls can't reclaim 178 and if 175 breaks I would be short to test 170 and if price breaks and holds below 170 I would be pressing shorts for the 200MA(164). If price can reclaim 178 I would be long to test 180, 183 and if price can break/hold back above this range I would be pressing longs for 190, 195. Lots of weakness here just like you're seeing in the NQ so bulls need to step up soon or this will break down further.

NOBSForex

TSLA(Tesla) Breaking Out...Can The Break Hold This Time?

Tesla is trying to break out of my range once again. We have tried a couple of times and failed so we need to watch and see if this break holds. We do have a gap down to about 460 and then we have the 8MA(453) and the 21MA(441) sitting below for support. It's tough to chase this break so the safe entry would be to wait for a retest of the breakout around 470 or that gap at 460. Any weakness in that area that holds would be great long entries to target 487 and a hold above that level is where I would press longs for 500, 523, 560. A look above and fail at 487 would be a short to test 470, 460 and a hold below 450 is where I would press shorts for 441(21MA), 429(50MA), 415. I'm leaning long until bears show me something back inside the range. TSLA

NOBSForex

Bitcoin Bulls Need A Rally Soon or Price May Test 80-75k.

Bitcoin is looking pretty weak and is at an important spot on my charts. We were tracing out a bear flag and price broke down out of this flag today. We are also sitting below all of my important MA's with all of them curling down. Bulls are clinging on to the last lifeline short term which is a series of higher lows with support at 85k and 83450. I would definitely be leaning short here so selling any rallies up to 87.5k and the 8MA(89483) that fail would be good entries along with a break/hold below 85k to target 83.5, 80k. A hold below 80k is where I would press shorts for 76k, 72k. If you have to be long you could try right here (85880) with a stop below 85k but this is big time counter trend and not advised unless you're gambling for a bottom tick. A safer long is to wait for a look below and fail of 83k, 80k or a reclaim of the 8MA(89483).

NOBSForex

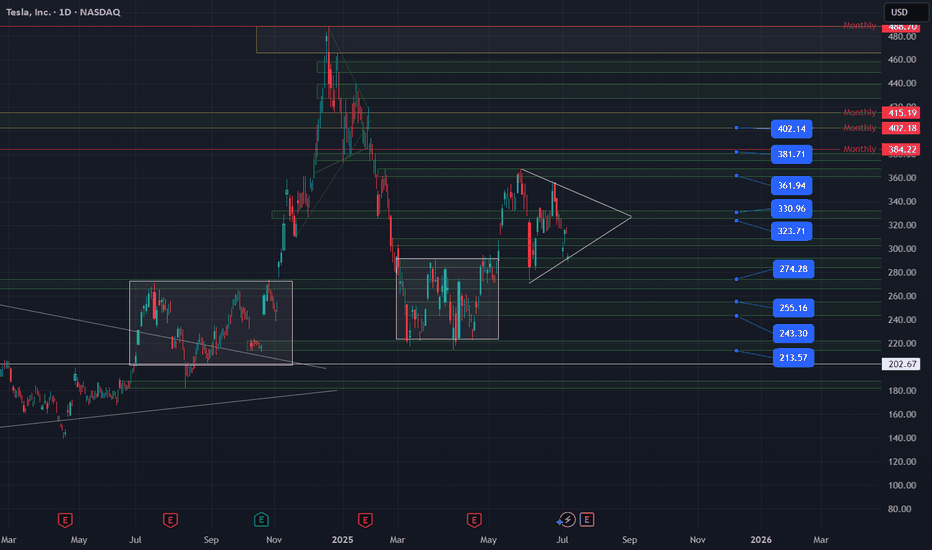

Long TSLA with a quick stop if we break back below 290.

I have followed TSLA for a while now and this 290 level has been huge. We have tried to test it a couple of times and failed, and you can see how price was stuck in a range below that level for almost 4 months earlier this year. The one thing that worries me is that there are a lot of people on social media calling for a pop here because of the drop we just saw and a lot of people are watching that 290 level. I think the market might punish the majority and dump this but the R:R is too great to ignore a trade here. I would stop out of this if price closes back below 290 (on the 1H or D timeframe depending on your risk). If we don't stop out I would target 300, 310, 325. Break/hold above 333/5 and I would press longs for 360, 400. If price does break/hold below 290 I would be short to target 280, 275. 275 should be another big support level as you can see the other white box/range on the chart has a top there. A look below and fail of 275 would be another good long entry and that would be the level I would watch if they decide to punish the 290 crowd. I will post again if we see 275 otherwise look for upside with a quick stop as detailed above.

NOBSForex

Long XAUUSD if...

I would like to get long XAUUSD if price can do one two things. Hold a test of the 50MA or show a look below and fail of the 50MA. Gold has been pretty weak the past couple of sessions and it looks like they are taking out stops and using the liquidity below that trendline to get long. Really good R:R here as a close back below the 50MA would be a stop. Let's see how this plays out because I would also be short if we see a break/hold below that 50MA. Two trade possibilities depending on the price action here.50MA is at 3290.

NOBSForex

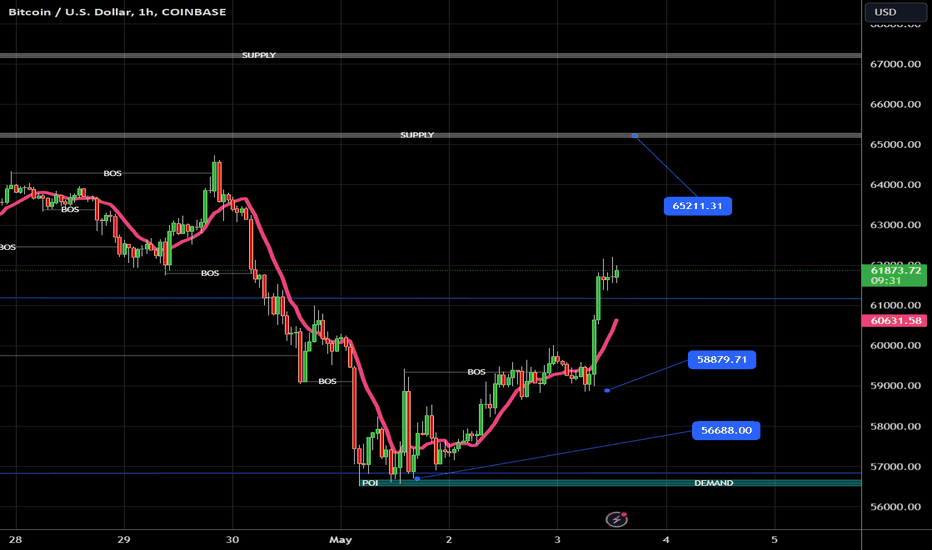

BTC bulls may have a nice setup short term

BTC is putting in some nice price action today on the 1H. Strong consecutive bullish candles and looks like it may have set up a short term low/base down at 56.8k. I like a long here with targets up at 63k, 64.6k, 65.2k.All targets hit within 3 days of call. Still like this long longer term but let's see how CPI plays out.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.