MtICHI

@t_MtICHI

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

MtICHI

شانس ریزش بیتکوین: تحلیل چارت و نقطه ورود برای فروش استقراضی

as setup is seen on the chart we think of a short position to be opened upon pullback toward previous low look at the market to get the opportunity

MtICHI

sell on BTC

BTC is reacting to trendline and we proposed a short position toward specified tp a price action pattern for tp setting used let see market reaction

MtICHI

BNB is bearish

coin is probable to make a temporary bullish move before heading south .a reversal cup and handle pattern already formed with a pullback through the range of the pattern suggested that this pattern is solid one let's see what would happpen

MtICHI

bitcoin is bullish for a while

observing divergance on RSI and reaction to trendline is preparing a buy opportunity toward upper trandline let's see what would happen

MtICHI

BCH is ranging

the coin is in range bound like an abcde correction and we are observing inverse cup and handle pattern following downward fall indicating potential bearish toward specified fibo level .if the coin recovers itself from the fibo level we will see a short rally let's what the market will play outfirst leg completed waiting for bullish leg

MtICHI

buy position on Jasmy

based on price action patten coin now is trying to test once agina its upper level and then upon touching the level will decide for whichway to gowe prefer to open a long position as depicted on the chart

MtICHI

buy position

buy position with target at 107000entry 103300RR:1.34stop at 100200we place this position based on price aciton chart pattern

MtICHI

Solana is bullish

according to the pattern we are expecting solana to test once again its upper trendline ,then will decide which way to gopls see what would be the resulttarget reached

MtICHI

gold is bullish

Gold prices remain steady, straddling the $2,645.01 pivot, with market direction tied to U.S. dollar strength and Fed rate cuts.The U.S. dollar index has surged 2.5% since late September, nearing a two-month high, putting pressure on gold prices and limiting upward potential.Gold faces resistance from a strong dollar and higher Treasury yields but could rally if support holds above the $2,645 daily pivot.tp reached

MtICHI

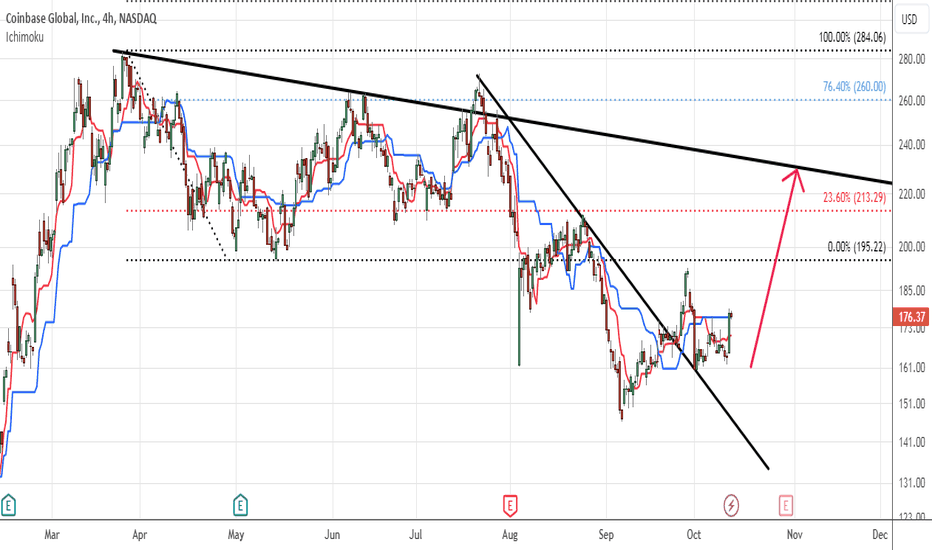

coinbase global stock is bullish

coin stock after breaking static trendline is trying to test once again its upper trendline according to the pattern, after trendline testing the stock price will decide which way to go wait to see the result

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.